Summary:

- SolarEdge Technologies continues to be impacted by adverse market conditions, as very much evidenced by disclosures made in connection with Monday’s $300 million convertible notes offering.

- While the company reaffirmed projections for Q2 top- and bottom-line results, SolarEdge now expects negative free cash flow of approximately $150 million.

- Over the past 18 months, the company has recorded negative free cash flow of almost $750 million.

- With net cash declining rapidly and a $632.5 million debt maturity approaching next year, the company decided to proactively access the capital markets.

- Given renewed uncertainty regarding the timing and potential extent of the eagerly-awaited industry recovery, investors should consider moving to the sidelines until the dust has cleared.

romaset/iStock via Getty Images

SolarEdge Technologies or “SolarEdge” (NASDAQ:SEDG) continues to be impacted by adverse market conditions, as very much evidenced by disclosures made in connection with Monday’s $300 million convertible notes offering.

While the company reaffirmed the guidance provided in the Q1/2024 earnings release, SolarEdge now expects negative free cash flow of approximately $150 million due to a number of factors:

- certain discretionary minority investments

- extensions of credit provided to certain customers

- higher than expected working capital requirements related to the ramp of the company’s U.S. manufacturing efforts

- slower than expected collections of receivables

In addition, the company warned of a potential $11.4 million loss following the recent chapter 7 filing of customer PM&M Electric:

SolarEdge Technologies (…) intends to disclose today to certain investors that PM&M Electric, Inc., a customer that owes the Company approximately $11.4 million under a secured promissory note recently filed for Chapter 7 bankruptcy.

While the Company is closely monitoring the proceedings, it cannot guarantee the outcome of the proceedings and may fail to collect the amounts due to the Company or collect such amounts only after significant delay.

Please note that on the Q1 conference call six weeks ago, management projected SolarEdge to generate cash in the current quarter (emphasis added by author):

The main reason for the position that we’re in right now is the fact that while we did see the revenues declining already when we guided for Q4 and then for Q1, you still have commitments for inventory procurement and also for manufacturing towards your contract manufacturers. And that means that during the first quarter we still manufactured more than we actually sold. And this, of course, results in the fact that we had to pay for the inventory and we had to pay our vendors.

What happens in the second quarter is that this phenomenon is actually reversing. We are going to start selling more than our actual manufacturing and actually, we’re going to utilize the inventory that is just $1.55 billion of cash sitting in the form of products.

And once we’re going to start reversing those, we expect the cash to start to be generated again. So we already expect to see cash generation in Q2, and we’re going to see intensified generation into Q3 and Q4, where not just that we will have higher revenues, we will also have higher utilization of the inventory.

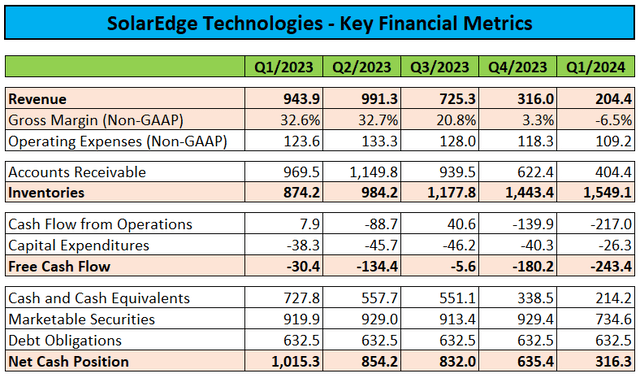

Over the past 18 months, the company has experienced close to $750 million in cash outflows.

Negative Q2 free cash flow of $150 million would reduce SolarEdge’s net cash position to approximately $165 million:

Company Press Releases / Regulatory Filings

Clearly, the industry recovery is taking longer than expected as also evidenced by German competitor SMA Solar’s (OTCPK:SMTGY, OTCPK:SMTGF) ugly warning last week (emphasis added by author):

SMA Solar Technology AG (…) is adjusting its guidance for the fiscal year 2024. The Managing Board now expects sales of between 1,550 million euros and 1,700 million euros (previously: 1,950 million euros and 2,220 million euros) and operating earnings before interest, taxes, depreciation and amortization (EBITDA) of between 80 million euros and 130 million euros (previously: 220 million euros and 290 million euros).(…) The reason for adjusting the guidance is a persistently volatile market as well as delayed increase of incoming orders resulting from continued high inventories at distributors and installers.

This results in a sales and earnings development in the Home Solutions and Commercial & Industrial Solutions segments below expectations. Furthermore, there is new uncertainty in the market due to the recent outcome of the European elections and the upcoming elections in the USA on November 5th.

With $632.5 million in convertible bonds scheduled to mature in September 2025, further cash outflows could have left SolarEdge with insufficient funds to address the debt.

Given this issue, Monday’s $300 million convertible notes offering can hardly be considered a surprise:

SolarEdge Technologies (…) today announced its intention to offer, subject to market conditions and other factors, $300 million aggregate principal amount of Convertible Senior Notes due 2029 in a private offering to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended.

In connection with the Offering, SolarEdge expects to grant the initial purchasers of the Notes a 13-day option to purchase up to an additional $45 million aggregate principal amount of the Notes on the same terms and conditions.

SolarEdge intends to use the net proceeds from the Offering to pay the cost of the capped call transactions, redeem a portion of its outstanding 0.000% Convertible Notes due 2025 and for general corporate purposes. If the initial purchasers exercise their option to purchase additional Notes, SolarEdge expects to use a portion of the net proceeds from the sale of the additional Notes to enter into additional capped call transactions with the option counterparties and the remainder to redeem an additional portion of its outstanding 2025 Notes and for general corporate purposes.

In layman’s terms: The company is looking to raise up to $345 million in gross proceeds which will be used for:

- Entering into derivative transactions in an effort to reduce potential dilution.

- Redeeming a portion of the company’s existing convertible notes.

- General corporate purposes.

For my part, I would expect the new convertible notes to result in annual cash interest obligations of approximately $20 million.

Effectively, SolarEdge is trying to refinance a portion of its 2025 convertible notes well ahead of maturity.

To be perfectly honest, the move is not exactly suited to instill confidence in the company’s second half outlook.

In addition, the massive cash flow miss is raising further questions regarding management’s ability to accurately forecast the business, particularly after SolarEdge utilized $33.2 million in cash to repurchase approximately 0.5 million shares at an average price of $65.67 in the first quarter.

Given renewed uncertainty regarding the timing and potential extent of the eagerly-awaited industry recovery, investors should consider moving to the sidelines until the dust has cleared.

Bottom Line

SolarEdge Technologies continues to struggle with weak industry conditions as evidenced by a massive cash flow miss in Q2.

Even worse, the company appears to have little confidence in a near-term recovery as otherwise management would have likely abstained from offering equity-linked debt with the stock trading at multi-year lows.

Given renewed uncertainty regarding the timing and potential extent of the eagerly-awaited industry recovery, investors should consider moving to the sidelines until the dust has cleared.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.