Summary:

- After the close of Wednesday’s regular session, leading solar inverter system supplier SolarEdge Technologies reported another set of disappointing quarterly results.

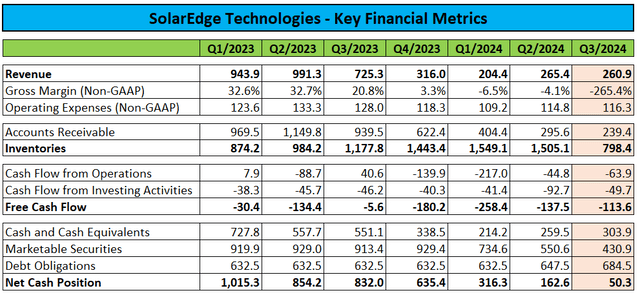

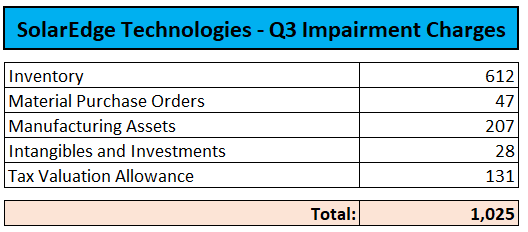

- While revenues came in at the very low end of the previously provided guidance range, margins and inventory levels were impacted by an eye-catching $1.025 billion in impairment charges.

- Elevated cash usage continued during the quarter, thus resulting in an additional $100+ million reduction of the company’s net cash position.

- Going forward, I would expect concerns regarding SEDG’s financial condition to weigh on SolarEdge Technologies’ shares.

- With anticipated negative near-term catalysts having played out, I am raising my rating on the stock from “Strong Sell” to “Sell”.

suravikin/iStock via Getty Images

Note:

I have covered SolarEdge Technologies, Inc. (NASDAQ:SEDG) or “SolarEdge” previously, so investors should view this as an update to my earlier articles on the company.

After the close of Wednesday’s regular session, leading solar inverter system supplier SolarEdge Technologies reported another set of disappointing quarterly results:

Regulatory Filings / Company Press Releases

While revenues of $260.9 million came in at the very low end of the previously provided $260 million to $290 million guidance range, margins and inventory levels were impacted by an eye-catching $1.025 billion in impairment charges:

Conference Call Transcript

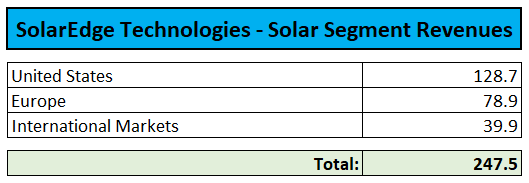

Sell-through for the quarter was approximately $450 million, down 13% sequentially, mostly as a result of price reductions.

While sales in the United States were up, persistent weakness in the European market resulted in sell-through declining by approximately 30% quarter-over-quarter.

Conference Call Transcript

Elevated cash usage continued during the quarter, thus resulting in an additional $100+ million reduction of the company’s net cash position.

Please note that SolarEdge will have to address $347.5 million in convertible notes by the end of Q3/2025.

On the conference call, management stated its intent to repay the notes at maturity with cash on hand rather than pursue refinancing based on expectations for cash inflows from the sale of tax credits as well as aggressive inventory reductions.

However, with revenues expected to pick up in H2/2025, increased working capital requirements might become an issue.

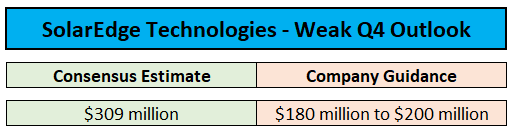

Adding insult to injury, SolarEdge issued Q4 revenue guidance well below analyst expectations:

Yahoo Finance / Q3 Earnings Release

On the conference call, management stated that Q3 revenues benefited from large battery shipments that won’t repeat in Q4. In addition, lower pricing will impact revenues going forward.

However, the company still projects to return to free cash flow generation in the first half of 2025 with price reductions expected to positively impact inventory levels:

Last week, we rolled out price reductions and promotions in Europe and international markets which will allow us to better compete and reduce the pricing gap with our low-cost competitors. We believe that these price levels in conjunction of the 45x manufacturing credits and the rollout of next-generation product which will carry significantly improved cost structures will enable us to return to our historic gross margin levels of over 30% once existing inventory is consumed.

These price actions are taking a toll in the short term by requiring us to take inventory write-down and also by generating lower revenues and gross margins for the next two quarters. We expect this period will be defined by continued inventory clearing from our distribution channels, lower seasonal installations and lower shipments due to their move towards the policy of higher inventory turns. As such, we believe that we will see a pickup in the demand as a result of our price reductions and promotion campaigns starting in the second quarter and more meaningfully in the second half of 2025.

During the questions and answers session of the conference call, a number of analysts appeared to be uncomfortable with the company’s stated intent to repay the 2025 convertible notes at maturity rather than raising additional capital in the near-term:

Joseph Osha

And then my second question, this has been asked about a couple of times already. So you’ve got this convert coming up. Yes, you have the money theoretically to pay it back if you continue liquidating inventory and so forth. But it’s happening right at the same time where you’re planning to spool your business back up and where presumably it will become user of working capital rather than a generator of working capital again. So my question to you is why on earth do you want to take that risk of ending up short on cash in the second half of next year versus placing the business on a firmer footing financially now?

Analysts also scrutinized the decision to finally lower prices as too late and asked for higher operating expense reductions.

In sum, the conference call didn’t go too well for interim management. At least, the company expects to select a new CEO before year-end.

Considering the substantial impact of recently implemented price reductions on revenues going forward as well as concerns regarding the company’s financial condition, I would expect analysts to revise their models and lower price targets even further with additional rating downgrades likely being in the cards.

Bottom Line

SolarEdge Technologies reported another set of weak quarterly results and provided highly disappointing forward guidance.

With the core European market not likely to recover in the near term, the company’s 2025 results won’t be anywhere close to current analyst expectations.

In addition, I would expect concerns regarding the company’s financial condition to weigh on SolarEdge Technologies’ shares going forward.

However, with the anticipated negative near-term catalyst having played out, I am raising my rating on the stock from “Strong Sell” to “Sell“.

I would become more constructive on SolarEdge Technologies’ shares should the company manage to generate substantial free cash flow ahead of next year’s convertible debt maturity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.