Summary:

- SolarEdge Technologies, Inc. shocked the market with signs of creating extra demand via aggressive financing, leading to a collapse in stock price.

- The company faces challenges with excessive inventory levels and additional customer financings.

- SolarEdge issues a $300 million convertible debt offering in a sign the inventory issue will remain a long-term problem.

- The stock should be avoided until the red flags are cleared up.

acilo/E+ via Getty Images

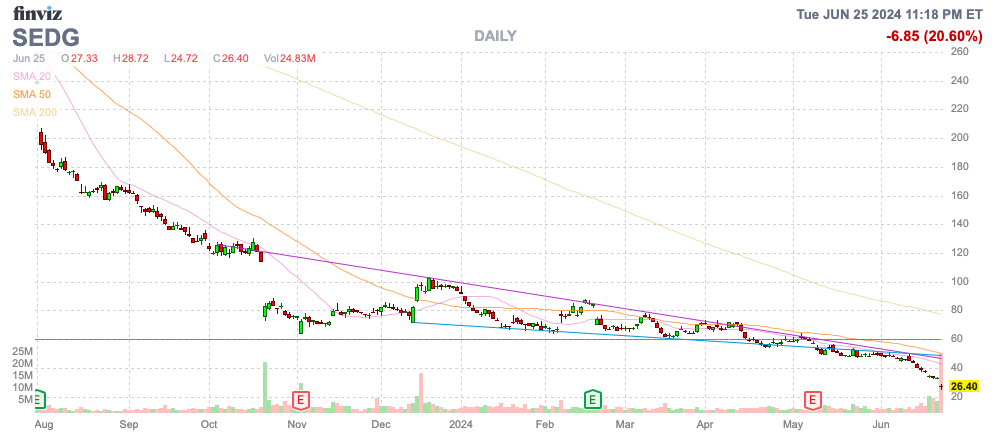

While SolarEdge Technologies, Inc. (NASDAQ:SEDG) was a promising turnaround story due to under shipping demand, the company just shocked the market with signs of creating extra demand via aggressive financing. Moreover, the solar energy company had to raise additional capital, crushing the stock. My investment thesis remains Neutral on the stock after the collapse to new lows due to an expected sales rebound.

Source: Finviz

Double Whammy

SolarEdge dumped a whammy on the market with the announcement of a customer filing for Chapter 7 bankruptcy. The company has an $11.4 million secured promissory note with the customer with an unknown recovery.

The news is another shocking sign of how SolarEdge was potentially dumping solar equipment sales on customers lacking the financial resources or the end customers to warrant the sales. The company was already under shipping demand by over $200 million per quarter due to dumping too much inventory on customers during the peak sales last year.

SolarEdge ended Q1 with an A/R balance of $404 million with allowances of $19 million and becomes one of the few scenarios where credit policies potentially became too lax. Our prior research actually pointed out questions on A/R balances since customers with too much inventory turn into financial headaches.

The company still has to deliver those sales levels via the new production launches, which include growth of ~$125 million in revenues per quarter above the current sell through rate. The sell through rates support SolarEdge holding closer to the current price levels, but investors do need to watch inventory levels and A/R balances before the stock is completely safe.

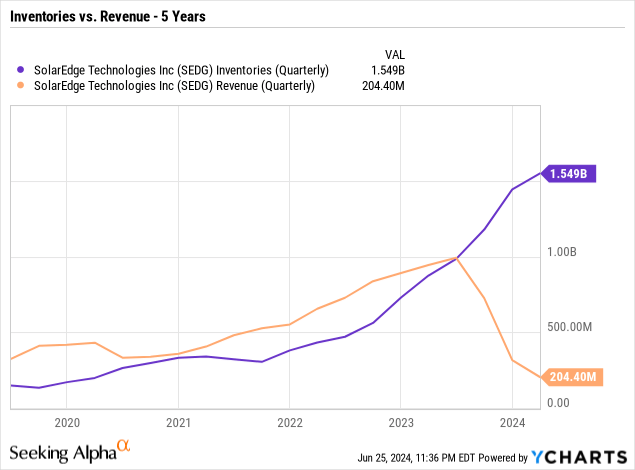

In this manner, the A/R balances did dip by $218 million from the end of 2023 balance of $622 million. Now, the bigger issue is SolarEdge building up a massive inventory balance of $1.5 billion, up another $100 million sequentially.

As evident by the quarterly data, SolarEdge previously kept inventory levels solidly below sales. The inventory levels now match about 6x the forecasted Q2 revenues of $250+ million.

These issues lead up to the other problem with investing in SolarEdge. The balance sheet wasn’t strong enough to support the ongoing losses and mismanagement of the business. The company only had cash of $681 million, and management now forecasts a Q1 cash burn of $150 million.

SolarEdge just dumped the double whammy on existing shareholders with a $300 million convertible debt plus the potential of investors to buy an additional $45 million worth of debt. In essence, SolarEdge adds $345 million in cash to a balance sheet quickly becoming deplete when cash generation would naturally occur by monetizing the inventory and A/R balances. The big problem was the SEC filing pointing out the Q2 ’24 cash burn rate elevated due to the ongoing concerns: extended customer credit, manufacturing ramp leading to higher inventory and slower pace of A/R balances.

Though the net cash position was only $316 million, SolarEdge has plenty of cash and assets to handle the $150 million cash burn during Q2. If the inventory and A/R balances were under control, the company should quickly monetize these assets to provide additional cash, but the convertible debt deal signals otherwise.

No Clear Bottom

The stock slumped 20% to only $26 due to the convertible debt and the signal from rushing out the offering. The issue is figuring out where the stock bottoms and whether an investor can trust the financial decisions of management.

After all, management repurchased $33 million worth of shares at $65.67 per share back during Q1 when the operating cash burn rate was $217 million. Also, the company extended credit to a customer that quickly filed Chapter 7, leading to a potential loss of cash, but also the loss of a sizable customer whose sales may not repeat.

SolarEdge did reconfirm the Q2 sales target of between $250 to $280 million. The biggest worry is whether the market can actually normalize and grow in the 2H towards the sell-through rate of $500 million, with the company producing the following quarterly numbers:

- Q2’24E: ~$250M, $250M+ under shipped

- Q1’24A: $200M, $250M+ under shipped

- Q4’23A: $316M, ~$200M under shipped.

If management can show that revenues will rebound to the $450 to $500 million quarterly range and the inventory and A/R issues start resolving themselves, the stock could definitely hit bottom here and rebound.

Takeaway

The key investor takeaway is that the SolarEdge Technologies, Inc. market cap has dipped below $2 billion in what would be a compelling valuation. The stock has too many red flags now to pounce on the dip.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end Q2, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.