Summary:

- Southwest Airlines has released an action plan to prevent a new operational meltdown.

- Southwest Airlines stock has underperformed, but Wall Street sees significant upside.

- CEO Bob Jordan is a Southwest Airlines veteran, but his responses to the problems have been tone-deaf.

Angel Di Bilio

Southwest Airlines (NYSE:LUV) is one of the airlines that I have been fairly positive about in the past. However, the flight disruptions that occurred in Q4 2022 and primarily hit Southwest Airlines makes me doubt whether CEO Bob Jordan is the right man at the top for Southwest Airlines as I explain in this report.

Southwest Airlines Stock Underperforms After Meltdown

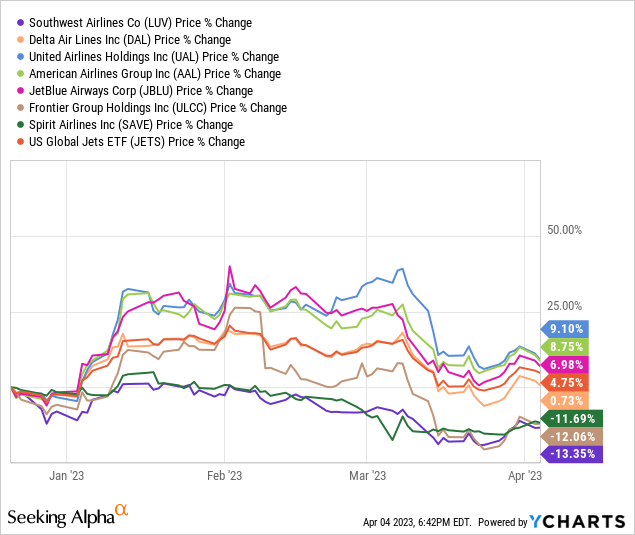

What we can see is that Southwest Airlines significantly underperformed peers and the US Global Jets ETF (JETS) since the December 2022 flight disruptions and I believe that underperformance is not solely driven by the $725 million to $825 million that the flight disruptions has cost Southwest Airlines.

Why A Tone Deaf Southwest Airlines CEO Needs To Go

Some months ago when I analyzed the flight disruptions at Southwest Airlines, a reader said the CEO had to depart and I responded that I believe that sending out leadership often is the easy way out, but it no way solves the issue and they should be forced to fix the mess they made before departing. However, at this point I do think that the CEO has to go. Quite often, the way you manage a crisis can make it either worse or better or dent your reputation. The latter happened in the case of Southwest Airlines.

What I found striking about Southwest Airlines and its CEO is that at the moment hundreds of thousands and likely millions of passengers saw their holiday travel plans evaporate, Southwest Airlines sent a spokesperson to address the media. They are trained for this, it is their job. I didn’t expect a someone with a suit appearing in front of the camera to provide details. PR departments know extremely well that in such cases it might be more worthwhile to appear as a common man and address the media. Still, they sent the wrong person to do it. The issues were so big that at least someone from management had to be put on the stand to take the heat. It would have shown real sense of duty and failure. Instead they sent a spokesperson.

The easy thing to say of course is that the CEO was behind the scenes working hard with management to fix things. Reality is that the issues at Southwest Airlines are not new and the company waiting with modernizing its outdated system until it would go wrong horribly one day. If they didn’t fix that in the days, weeks, months and years before the meltdown, don’t expect the CEO to be Superman and fix it all in a day or two. The CEO appeared in a pre-recorded video days later apologizing, it didn’t make him look approachable. If there is an issue and you don’t hear from management for days, it gives you very much the feeling that the CEO is not in control of things as he should. In the summer, the CEO of the Schiphol Group was sacked as Schiphol Airport melted down, leaving passengers in long queues of hundreds of meters before security checks and he was ultimately blamed for not being visible in those days. So, being visible during a crisis is of utmost importance, but that is something Bob Jordan hasn’t understood.

When the CEO appeared in a CNBC interview in January, he was simply tone deaf saying that the software did what it was supposed to do. If your software runs in such a way that it leaves you in a meltdown, then in the bigger sphere of technology you are running behind and that was clearly visible as the meltdown did not happen with other carriers. The reality is that Southwest Airlines runs an old system that cannot handle its complex operations. That the software does what it is supposed to do means nothing, because somewhere the bigger system is not doing what it is supposed to do which is living up to the commitments to passengers. The interview just didn’t seem right, when the reporter asked about whether the CEO understood how mad customers were, he started off by welcoming him in the “terrific Dallas maintenance facility”. If your customers are not happy with your company, that is not the way to start off.

Only after that he apologized to customers and employees and said the people had his full commitment on fixing the issues. He then went on convincing the reporter the loyal customers stayed with the airline, but still not addressing the frustration caused by the airline.

The CEO claimed that they are reviewing de-icing procedures as well as staffing to get to the root cause, while not talking to the same detail on the technology shortfall. When asked about the shortfall in technology investments, the CEO mentioned two parts where they did invest which is maintenance and human capital management system and then said it is not correct Southwest does not invest in technology. But those are not issues that focus on the outdated flight and crew scheduling technology use, so you could say the company focused its investments in the wrong areas, betting that what happened in December would not happen and didn’t require investment.

Making it worse, the CEO mentioned that the crew scheduling component worked as designed. If your system is working as designed and you still have a meltdown, then you have to ask yourself whether the system design is fitting for your business or whether you are missing a critical component in your technology solutions that prevents a cascading effect of issues or that perhaps more padding in the flight schedule should be adopted. The CEO did mention that GE Digital got a fix for it, which makes one wonder if things are not broken, what are you fixing. I think the reality is that while the CEO did not want to state it uses an old system that gets patched here and there and that GE Digital provided a new patch to handle things which is basically the cheapest solution. The other solution would be a costly design of a new system that would fully meet Southwest Airlines’ complex network.

So, I found the response from the CEO disheartening, especially since he has a background as a programmer. To me it comes across as finding the cheapest solution for a complex issue with a lot of corporate fancy in it. In the days of the meltdown at Southwest, I’ve seen pictures of crews getting message on their flight management computer receiving ACARS messages asking who is flying the airplane because it is a mess on the ground. That doesn’t rhyme at all with a statement implying the system is working. To make things worse, in the Congress hearings while the CEO said he was fully committed and this was on him, Southwest Airlines sent in the COO to testify.

The reality is that the flight disruptions were not just caused by the technological shortfall, but it was a combination of ground crews calling in sick during the adverse weather conditions and the subsequent mess it created that tiled the tech side that keeps the airline running. However, if I look at what the CEO did, I have significant reservations about this man being the company that by itself is a good company. The CEO was not visible for days and when he appeared it was in a pre-recorded video followed by appearing to simply being ignorant on the lacking technology. So, I don’t feel Bob Jordan is the man for Southwest Airlines. He has spent a lot of time at Southwest Airlines and in none of his roles the technology shortfalls were labelled as requiring urgent attention and he simply downplayed the technology shortfall. If you don’t admit to issues, then I am pretty sure you are not the man in the right spot to fix those issues.

Is Southwest Airlines Stock A Buy?

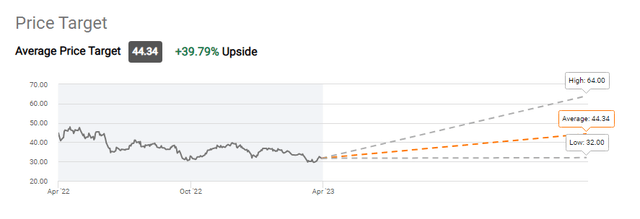

I believe the stock is a buy despite the mess the company made, and if we look at the Wall Street price target, we see that Wall Street has a Buy rating on the stock with a $44.34 price target, representing 40% upside.

Conclusion: Southwest Airlines Remains A Buy, Despite Tech Shortfalls

I do believe that Southwest Airlines remains a buy. The company has been underperforming, which itself also creates an opportunity. There are issues that need to be addressed, and from the Investor Day that I followed, I did see that modernizing technology is on the road map, and by the end of March, an action plan which includes what was to be expected was released. What happened is that the shortfall in critical technology investments hit Southwest Airlines before they invested in replacing or adapting the system to serve the complex and huge operations the airline runs.

So, I do believe they will get there, and when looking at the day-to-day performance, Southwest Airlines is one of the companies that credit rating agencies like which is rare for an airline, and they are in a net cash position which also allows the company to really invest in tech and return value to shareholders. As a result, I am bullish on the stock but I still do believe that this CEO needs to go.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.