Summary:

- Elliott Investment Management made a large investment in Southwest Airlines Co. due to underperformance, calling for a leadership upgrade and predicting a 77% upside potential.

- The airline faces revenue and cost performance issues, needing a vast operating improvement to justify the current price compared to legacy airlines.

- Legacy airlines like Delta and United are better deals, trading at lower P/E ratios and not requiring strategic turnarounds to perform well.

rypson

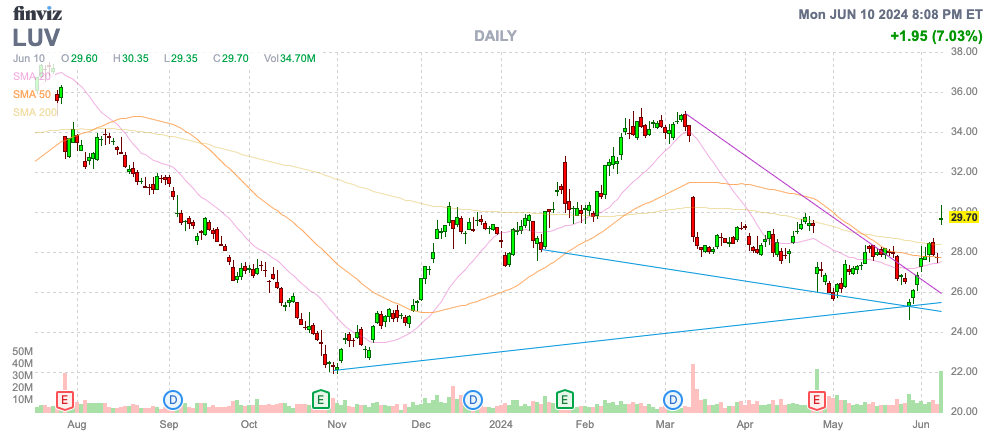

Elliott Investment Management made a large investment in Southwest Airlines Co. (NYSE:LUV) due to huge underperformance by the airline. The ironic part is that the better performing airline stocks are incredible bargains and don’t require strategic turnarounds to work. My investment thesis is Bullish on the stock due to expected higher margins and profits over time.

Source: Finviz

Big Upside Potential

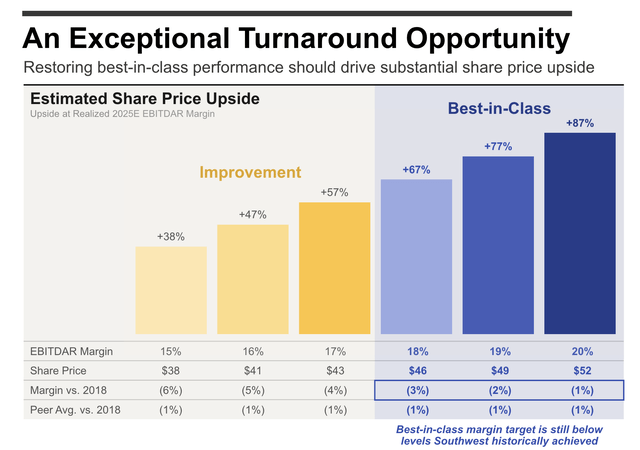

Elliott invested $1.9 billion in Southwest Airlines, calling for an upgrade in leadership to improve the performance of the airline. The investment firm predicts the stock can reach a target of $49 over the next 12 months for 77% upside.

By volumes, Southwest Airlines has the leading domestic market share at 22%, but the airline market has suddenly shifted to international demand. Both Delta Air Lines (DAL) and United Airlines (UAL) have highlighted strength in travel outside the U.S. while the domestic market is far more competitive.

Southwest Airlines recently reported a Q1 ’24 EBITDAR margin due solely to adding back larger depreciation expenses. As mentioned by Elliott, the airline has gone from best-in-class EBITDAR margins of 21% in 2018 to an estimate of only 8% for 2024. The legacy airlines are all close to the 2018 levels, with both Delta and United only 1 percentage point below the prior peak levels.

One of the issues likely facing Southwest is that the legacy airlines are far better operators now. These airlines are better segmenting flights with premium and non-premium offerings with more compelling prices to match the low-cost carriers.

As Elliott highlights, Southwest has issues with revenue underperformance and cost performance. The investment firm thinks the stock could top $40 based on just an EBITDAR margin of 16% with further upside to the target based on returning margins to prior levels.

Source: Stronger Southwest presentation

The EBITDAR calculation is utilized by many analysts, but the calculation excludes actual charges. Also, the valuation portion of the metric is based solely on financial assets (cash and debt) and doesn’t factor in aircraft value where Delta and United Airlines have vastly higher PP&E balances contributing to the net debt levels.

Southwest has ~$1.5 billion in annual depreciation charges excluded from income, while the vastly larger revenue base of Delta only gets hits with $2.3 billion in such charges. Naturally, Southwest would produce better numbers when excluding these charges.

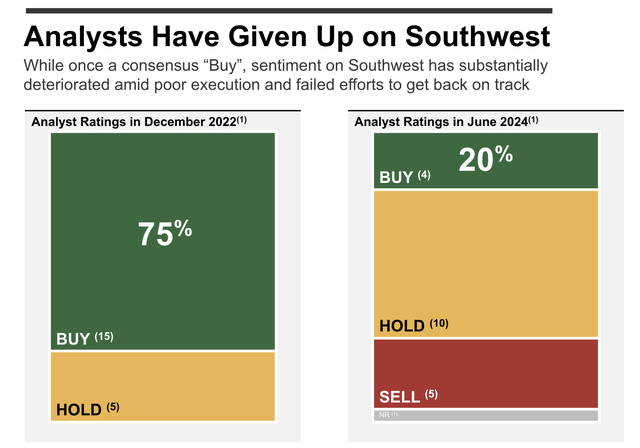

Besides, the bigger issue is that Southwest Airlines is no longer seen as the leading airline operator and management changes would take years of seamless operations to overcome. The airline famously had the Christmas outage in 2022 that caused over 16,000 flight cancellations and disrupted travel plans for 2 million passengers.

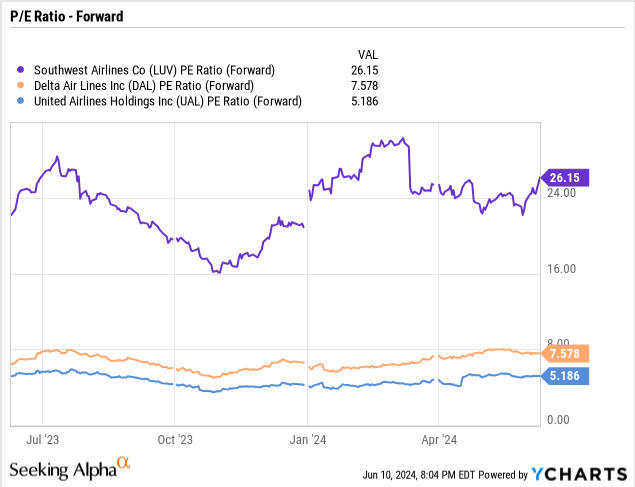

Stick To Legacy Airlines

While Southwest Airlines could potentially turn around the business and produce higher margins, the big question is whether the stock is more compelling than other airlines. Southwest Airlines already trades at 26x forward EPS targets, while Delta Air Lines trades at below 8x EPS targets and United Airlines is at 5x EPS targets.

In essence, Southwest already trades as if a turnaround is going to take place. If the airline doubled EPS estimates of $1.14 for 2024, Southwest would generate a $2.28 EPS and the stock already trades at 13x such an EPS target. Analysts already forecast the company surpasses this EPS target by 2026 anyway.

Remember, though, Delta Air Lines doesn’t need to improve operations to produce higher earnings to warrant a higher stock prices. The stock would actually need to rise 77% to reach the same P/E ratio as Southwest Airlines after doubling margins and earnings.

United Airlines already needs to double to just obtain a P/E ratio of 10x. Elliott Management doesn’t need to turn around the business, and management just confirmed the 2024 EPS target of $10 to $12 after maintaining a Q2 EPS target of $4.

In our view, Elliott is correct about Southwest needing better leadership to boost the performance of the airline, but the logic behind the stock price appears misplaced. The stock isn’t a Buy due to valuation, not whether management is delivering fantastic results.

Source: Stronger Southwest presentation

Southwest Airlines needs a vast operating improvement to just warrant the current price. The legacy airlines just need a rational stock market to value the stocks at higher levels.

Elliott wants to value Southwest Airlines based on the current multiple assigned to the legacy airlines of 4.8x TEV/EBITDAR. This valuation method favors a balance sheet like Southwest without debt and high depreciation costs, versus just valuing the stocks based on their earnings streams.

Takeaway

The key investor takeaway is that the legacy airlines are far better deals than Southwest Airlines Co. stock and don’t require turnarounds to perform. Southwest Airlines likely has solid upside from better performance over time, but the company needs to resolve the operating issues before this will occur.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start June, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.