Summary:

- Elliott Investment Management is pushing for significant changes at Southwest Airlines Co., including a new board, to improve shareholder returns.

- Southwest Airlines’ new strategy of assigned seating and premium options is considered incremental and insufficient compared to legacy airlines.

- Elliott’s plan could take 2–3 years to implement, with uncertain returns, while other airlines offer easier paths to stock gains.

Boarding1Now

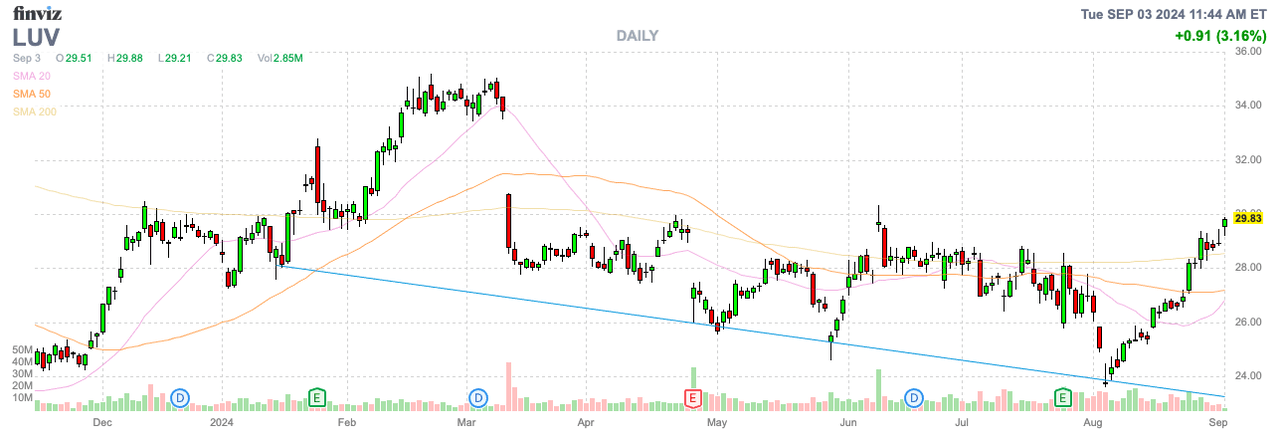

Elliott Investment Management has pushed Southwest Airlines Co. (NYSE:LUV) to make corporate changes to drive improved shareholder returns. The airline struggled in the last decade as legacy airlines have improved operations and the business became stale. My investment thesis remains Bullish on the stock due to the cheap valuation, but the activist investor has simpler paths to solid returns in the sector.

Special Meeting

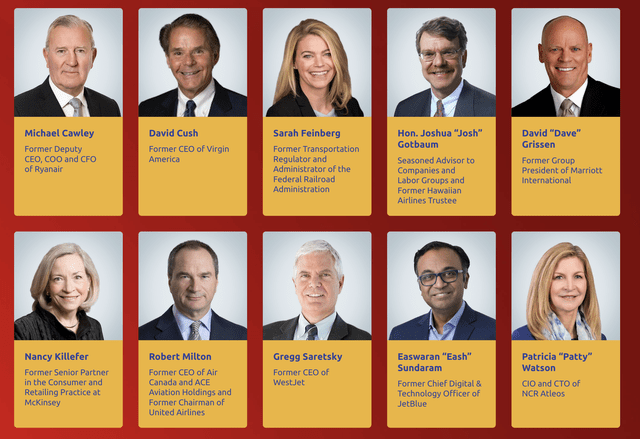

According to Reuters, Elliott now owns 11% of the outstanding shares, allowing the activist firm to call for a special meeting to replace BoD members. The company plans to meet with Southwest Airlines management on September 9 and has already proposed a new slate of 10 board members.

Elliott has a whole list of nominees for the board with relative airline industry experience. The major problem is the suggestion that a 10% owner should replace 67% of the board with new members, possibly loyal to the investment firm and not all shareholders.

The simple solution is to place a couple of these new members on the board, such as Michael Cawley, former Deputy CEO of Ryanair, and David Cush, former CEO of Virgin America. Without vetting each board nominee from Elliott, Southwest Airlines definitely has some solid choices to enhance the current board that has mostly overseen a decade of disappointment.

Elliott originally sought changes at Southwest Airlines back in June after making an initial $1.9 billion investment in the airline, leading to the ~11% economic interest. The airline has already announced major plans to shift the corporate performance with a move to assigned seats and premium seating options on all flights to capture more revenue per flight segment.

The investment firm has hinted at these changes being only half measures, but Elliott hasn’t provided any details on what else to change. The company wants a comprehensive review with new leadership, but investors need to understand the installation of new leadership and a review could take 6-12 months to develop.

The airline would need another 1 to 2 years to implement any changes. Investors would not see any returns for 2 to 3 years, at the earliest.

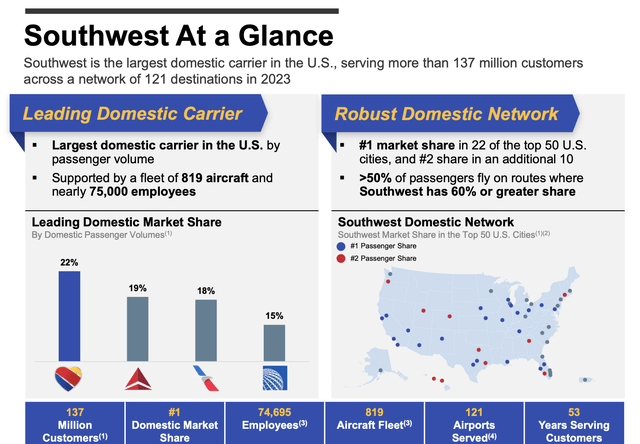

Southwest has the largest market share by passenger volumes, but the airline has a lot of low-fare tickets. Southwest might have 22% of the domestic passenger volumes, but the airline only has ~$27 billion in annual revenues, roughly half the legacy airlines.

Source: StrongerSouthwest.com presentation

The biggest problem facing Southwest Airlines is that the legacy airlines have figured out how to segment flights. Delta Air Lines, Inc. (DAL) and United Airlines Holdings, Inc. (UAL) now have more premium products in the front of the plane while leaving a section in the back with low-cost fares to match Southwest.

As Elliott mentions, the new plan for assigned seating and premium seats appears incremental and rushed versus a comprehensive view that keeps the low-cost airline unique in the sector. Southwest Airlines appears headed to joining the legacy airlines in similar domestic flight options.

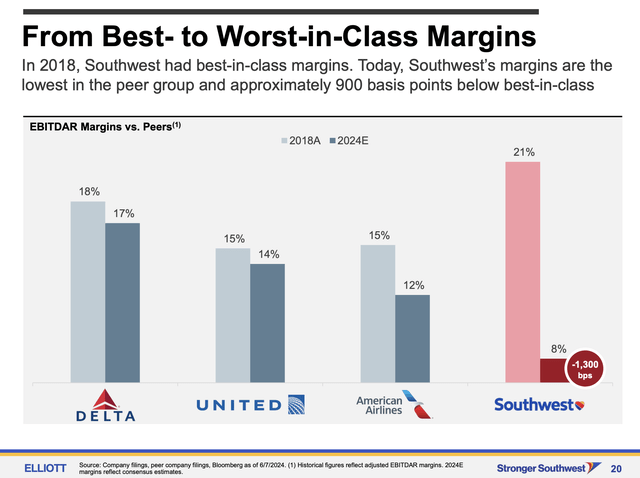

Elliott Is Focused On Margins

The major issue with the Elliott report is that legacy airlines are now better operators. Outside the recent CrowdStrike Holdings, Inc. (CRWD) outage, Delta Air Lines has been the leading domestic airline for years now.

Elliott makes the assumption Southwest Airlines can just return to 20% EBITDAR margins like in 2018 while the legacy airlines aren’t donating market share anymore. Southwest could just offer low-cost fares with strong operations and mint money, but other low-cost carriers are even more competitive in prices.

If 86% of potential customers truly want assigned seating, Southwest is in no man’s land with the legacy airlines offering similar pricing with those options. Even worse, the major outage back during the last Christmas holidays questioned the operational ability of the airline.

If Southwest Airlines returned to 20% EBITDAR margins, the airline would produce somewhere slightly under $6 billion in 2025. The airline has a current market cap of $18 billion and Elliott forecasts the stock reaching $49 for a market cap of nearly $30 billion, or ~5x EBITDAR.

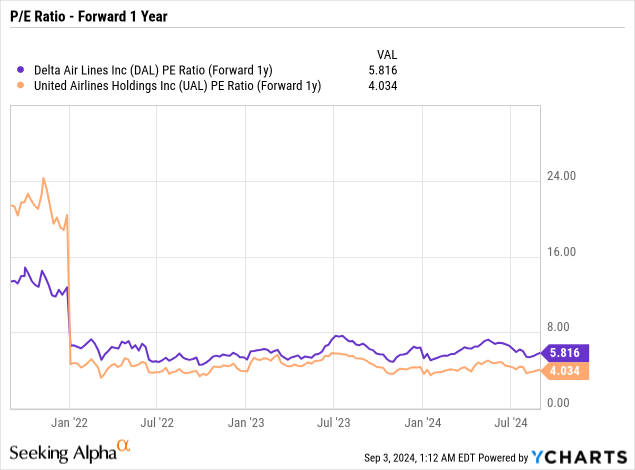

The projection is for the stock to rise 63% from here, but the legacy airlines could double on just the stocks hitting reasonable valuation multiples on already strong earnings. Both Delta Air Lines and United Airlines traded at only 4x to 5x EPS targets, and Elliott could have simply soaked up share supply and boosted the stocks in the process while advocating for higher valuations.

Southwest Airlines has to undertake a battle with an activist investor, find a more viable business solution than replicating the strategies of peers, and implement this plan. Elliott continues to take the hard path and a business solution might not even exist to return EBITDAR margins to prior levels.

Elliott estimates Southwest Airlines is only $38 with EBITDAR margins of 15%. The legacy airlines average around 15% margins, so the upside in the stock is limited to return to industry average margins. The real upside in the sector is the re-rating of the stocks.

Takeaway

The key investor takeaway is that Elliott Investment Management continues taking the hard path with Southwest Airlines. The investment firm is undertaking a lengthy process requiring a reshuffling of the BoD and a comprehensive business plan update that could take 2 to 3 years to implement. The airline stock is cheap, but investors have easier paths to stock returns via other airlines that don’t need to alter their business plans.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start September, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.