Southwest Airlines Gets Neutral Rating As Earnings Turbulence Roars Over Soaring Revenue

Summary:

- Southwest Airlines rated Neutral / Hold today, in line with the consensus from analysts and the quant system.

- Tailwinds to this stock include an above-average dividend yield, and YoY positive revenue growth as well as future revenue outlook.

- Headwinds and storm clouds include profitability growth struggles, underperforming the S&P500 index, and the aftermath of an industry still somewhat in post-pandemic recovery mode.

- The risk of the current Middle East conflict, and rising oil prices, has been addressed.

Boarding1Now/iStock Editorial via Getty Images

Research Note Summary

Are you thinking of snatching up an airline stock before it flies away?

Not so fast!

Today, I will do a deep dive with my research note on Southwest Airlines (NYSE:LUV), the Texas-based company known for its iconic tri-color livery and its fleet of short and mid-haul aircraft hopping around many airports around the US.

In today’s note I gave it a hold/neutral rating, from a holistic perspective not being bullish or bearish on this stock right now.

This rating is fueled by positive revenue growth and an above-average dividend yield.

Turbulence faced by this company includes YoY earnings declines, underperformance vs the S&P500, 0% dividend growth in 3 years, and an industry still at least somewhat in recovery mode after the global pandemic years.

A risk identified is rising fuel costs affected by geopolitical situations in the Middle East in particular, and this has been discussed.

Methodology Used

I will utilize my WholeScore Rating methodology which looks at this stock holistically across 6 categories including potential downside risks, and assigns a rating score.

Some data used in today’s note comes from the company-released Q2 earnings results on July 27. Forward outlook relates to the upcoming earnings results that the company will release Q3 on Oct 26.

Industry Outlook

To understand being an investor in the airlines industry, one should understand all the challenges this segment has to face: weather delays / cancellations, technical issues, fare competition from rivals on same routes, spikes in fuel costs, the cost of acquiring new aircraft, airport terrorism risk, and so on.

As someone who once worked in support for an airline website’s contact center, I know firsthand that an airline is one of the most difficult businesses to be in, both for staff as well as the traveling customer. Today, as an investor / analyst, in my opinion it is also one of the most challenging segments to try and invest in.

Much like retail /malls, this segment took a major hit just a few years ago from the global pandemic and resulting travel restrictions. I learned long ago that if an airline is not keeping its planes in the air whenever possible, they are losing money for the company. To say it is a turbulent industry would be an understatement, I think.

Now, those travel restrictions are generally behind us, and we have seen a rebound in this sector, I would call it.

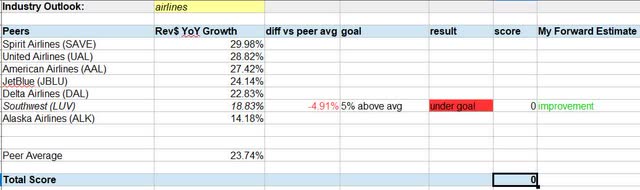

To compare Southwest and its YoY revenue growth against a peer group, I put together the following peer group of 7 airlines, all US-based.

Against the peer group, Southwest’s revenue growth was weaker and it was almost 5% below the peer group average of 23.7% YoY growth, so it missed my target and earned a score of 0 here.

Southwest – industry outlook (author analysis)

However, my forward sentiment expects improvement going into Q3.

This positive outlook is based on commentary from CEO Bob Jordan in his Q2 remarks:

Based on current revenue and cost trends, we expect record operating revenue and a profitable outlook again for third quarter 2023 and continue to expect year-over-year margin expansion for full year 2023.

Financial Statements

The financial statements paint a mixed picture for this company, but slightly more on the negative side.

My target for this stock was a 5% YoY growth in revenue, net income, free cashflow per share, and equity. The company did not hit my target on any of them.

From the income statement, we can see that their YoY profitability actually declined by just over 10%. Revenue, however, rose around 4.5% on a YoY basis, just barely missing my 5% goal.

Southwest – financial statements (author analysis)

From the cash flow statement, we see that free cash flow per share declined over 47% on a YoY basis, while from the balance sheet the story is that positive equity declined almost 3%.

My forward-looking outlook:

I think revenue and earnings will be positive, based on the CEO commentary and FY23 outlook. I am neutral about cashflow on this company, since the history shows some quarters have positive cash flow some do not. Not a lot of consistency there, and it is a very capital-intensive business. For instance, in Q1 they had a $1.05B net capital expenditure.

In their Q2 commentary, the company had the following to say on this:

The Company’s second quarter 2023 capital expenditures were $925 million, driven primarily by aircraft-related capital spending, as well as technology, facilities, and operational investments. The Company continues to estimate its 2023 capital spending to be roughly $3.5 billion.

In terms of positive equity, I believe it will improve because the balance sheet shows a declining trend in long-term debt and total liabilities.

Dividends

More disappointment in the dividends department. My target is a stock paying at least $0.25 per share, which pays $100 in annual dividend income for 100 shares held. This stock comes short, at $0.18 per share.

It also had 0% dividend growth when comparing Sept 2023 with Sept 2020. Keep in mind that it, like other airlines, had to preserve cash during the pandemic travel slowdown.

Southwest – dividends (author analysis)

In terms of dividend yield, it beat the sector by 81%, and beat my own target.

Looking forward, I don’t see any growth to the dividend amount just yet. The yield may decrease somewhat as I expect the share price to be near its bottom and should start rebounding, fueled by the positive FY23 earnings outlook. This could cause the yield to go down.

Share Price

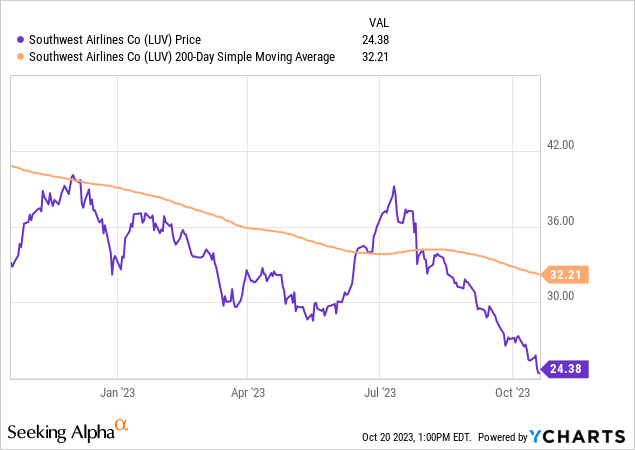

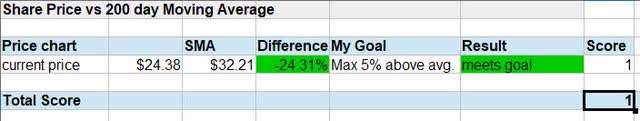

My portfolio strategy / investing idea this month is to track the 200-day simple moving average, and look for stocks trading below it or no more than 5% above it.

This is to reduce downside risk and maximize upside potential.

When looking at the YChart below, we see the current share price (as of this article writing) of $24.38, which is over 24% below the moving average!

A crossover below the average occurred around August and it kept sinking.

In my table, I determined that the current share price presents a buy opportunity at this super cheap price range.

Southwest – share price (author analysis)

This begs the question, will the price sink even further?

It could, of course. However, I think it is less likely to sink too much further after the positive fiscal year outlook.

Performance vs S&P500

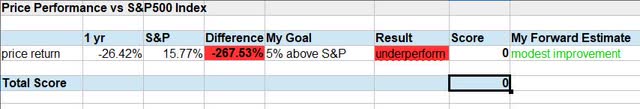

Another negative for this company was underperformance vs the S&P500 index, a major index that is tracked.

The market momentum is just not there for this stock, which underperformed the index by a whopping 268%.

Southwest – price vs S&P500 (author analysis)

However, again due to the positive earnings outlook going forward I think the market will begin to reverse course on its sentiment about this stock due to the revenue growth potential but it will take a little while to have a few quarters of solid revenue growth data to go by.

There is also the busy holiday travel season starting next month, and Thanksgiving week is one of the busiest travel weeks in the US.

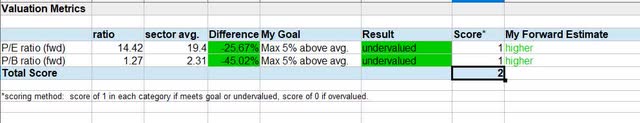

Valuation

An undervaluation opportunity exists with this stock, both in forward price-to-earnings and forward price-to-book ratios, as my table below shoes.

Its valuation metrics make it an interesting opportunity because I think the valuation may go higher from a forward-looking view, driven by more positive investor sentiment on earnings and also improved equity as debt continues to decrease. So, now may be the time to snatch up this undervaluation opportunity.

Southwest – valuation (author analysis)

Consider, for example, that long-term debts and total liabilities have been on a declining trend as the tables below show. Long-term debt, for example, went from a high of $10.3B in March 2022 down to $7.99B in June 2023. In my opinion, that is a positive trend.

Southwest – long term debt (Seeking Alpha) Southwest – total liabilities (Seeking Alpha)

On the asset side, total assets have also shown an improvement trend since December:

Southwest – total assets (Seeking Alpha)

Although the company posted a net loss in December 2022, it appears that earnings are also on an improvement trend, in relation to that quarter:

Southwest – net income since dec 2022 (Seeking Alpha)

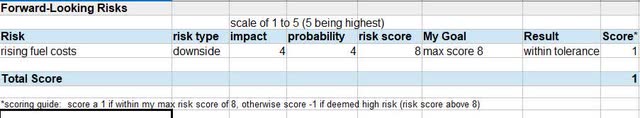

Forward-Looking Risks

A major risk to this type of business right now is the ongoing geopolitical conflict in the Middle East, and its impact on global oil/gas prices. We already mentioned how much the airline industry can be impacted by the cost of gas, but also by any potential rising wave of terrorist incidents, which could cause disruption to an already battered industry.

Those of us old enough to remember 9/11 and the aftermath also remember the impact it had to travel, particularly airlines. In terms of the current situation in the middle east, an Oct 20th article in The Guardian brought to light the risk of regional contagion:

The Middle East’s oil and gas exports could still emerge as collateral damage if the ongoing conflict engulfs the region.

Could this scenario spell higher airline ticket prices? It has already started, and here is why.

Just this September an article in The Financial Times pointed to how the oil price rally already has impacted airlines:

Topi Manner, the chief executive of Finnair, said he expected ticket prices to rise further in response to airlines facing historically ‘very high levels’ of fuel costs. ‘In a high fuel environment fares obviously would need to reflect that … short term volatility points towards increasing fares,’ he said.

I believe that this could impact this airline on the cost side, but at the same time it has a lot of tailwind on the revenue growth side so this could be an offsetting factor.

Consider its commentary from Q2 earnings results:

The Company’s second quarter 2023 revenue performance was an all-time quarterly record driven primarily by strong leisure demand.

Second quarter 2023 managed business revenues also improved sequentially compared with first quarter 2023, which was attributable to growth in corporate accounts and passengers as the Company continued to see gains in business travel market share.

So, in my table below I determined that the risk is within my tolerance levels.

Southwest Airlines – risk score (author analysis)

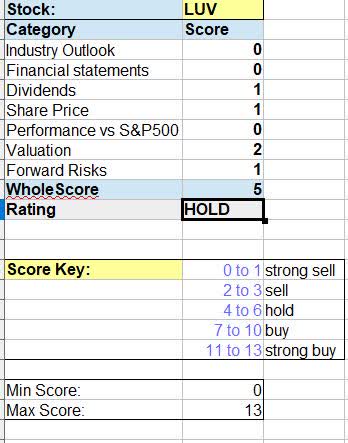

WholeScore Rating

In today’s note, this airline got a WholeScore of 5, earning a hold / neutral rating from me.

Southwest – WholeScore rating (author analysis)

In comparison to the consensus from SA analysts, Wall Street, and the quant system, it turns out my rating today agrees with all of them who also have a “hold” consensus on this stock:

Southwest – rating consensus (Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.