Summary:

- Southwest Airlines’ aggressive expansion into new airports has backfired, leading to unprofitable routes and loss of cost edge, necessitating a scale-back for improved efficiency.

- The airline’s core operations remain strong, but uneconomic routes and poor ground service utilization have significantly impacted profitability.

- Management’s failure to adapt to market changes and rising costs has led to over-staffing and declining load factors, further hurting financial performance.

- Despite potential operational improvements, the airline sector’s low valuation multiples limit Southwest’s upside, making a profitable growth turnaround challenging.

Ryan Fletcher

Southwest Airlines (NYSE:LUV) has overextended itself in pursuit of growth. The company made a bald bet to expand while others were pulling back, this bet has backfired. Over the last 5 years, the airline has entered ~20 new airports most of which are still sub-scale and unprofitable.

The company was hoping to capitalise on the post-COVID aviation industry pull-back and push competitors out. The problem is that Southwest was too aggressive and seems to have lost its cost edge. The aggressive expansion is costing them dearly.

As it stands today, the best course of action for Southwest would be to scale down its growth ambitions for now and exit the airports where it is underperforming. Improved efficiency would also enable the business to return to gradual growth.

The main issue that we see is the valuation of airline stocks in general. The sector has disappointed investors for decades and even the best airlines seem to be trading at modest valuations. Value upside is therefore limited even if the turnaround is successful.

The main issue is uneconomic routes

Southwest was the darling of the sector for years due to rapid profitable growth but has lost its mojo as of late. It is now the least profitable major airline in the U.S.

It is important to point out that Southwest is primarily a point-to-point airline and their competitiveness relies on local economies of scale. The overall size of its network does not impact the cost competitiveness of Southwest. For this reason, the overall consolidated group operating numbers are not that useful in determining the efficiency of a point-to-point airline.

What matters is the market share at core airports and routes. Airlines want to keep their ground-based staff busy all day long and their aeroplanes flying in order to utilise their fixed cost base to the largest degree.

The consolidated operating metrics might have deteriorated, but Southwest still flies more than half of its passengers out of airports where it accounts for more than half of the volume. The operations of Southwest out of Dallas Lowe Field, Chicago Midway or Houston Hobby are still very profitable and very competitive.

The core business of Southwest is as strong as ever. The problem is that many new airports that Southwest has recently entered are still not generating profits and the business is having to use aggressive pricing to gain scale.

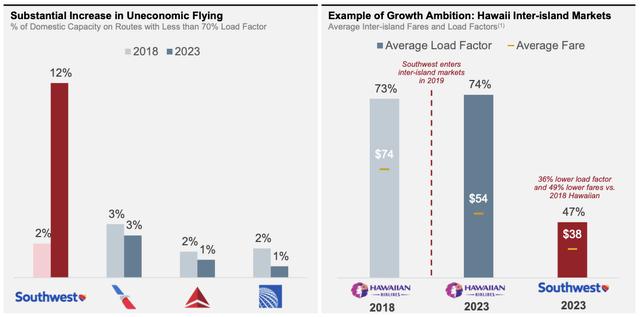

According to findings by Elliott, Southwest has increased its share of non-economic routes considerably. The negative effects of uneconomic flying are further compounded by poor ground services utilisation.

Uneconomic Flying (Elliott Investment Management)

We support the view of Elliott Investment Management and believe that Southwest needs to take a step back before it can continue moving forward.

Southwest went on the offensive in 2020, but this risky bet backfired

As most airlines were reeling after the COVID lockdowns, Southwest made a bold bet to go on the offensive. The management did have good reasons for this, as Southwest had an industry-leading balance sheet. With the benefit of hindsight, it seems that management has moved too aggressively and ignored structural market changes.

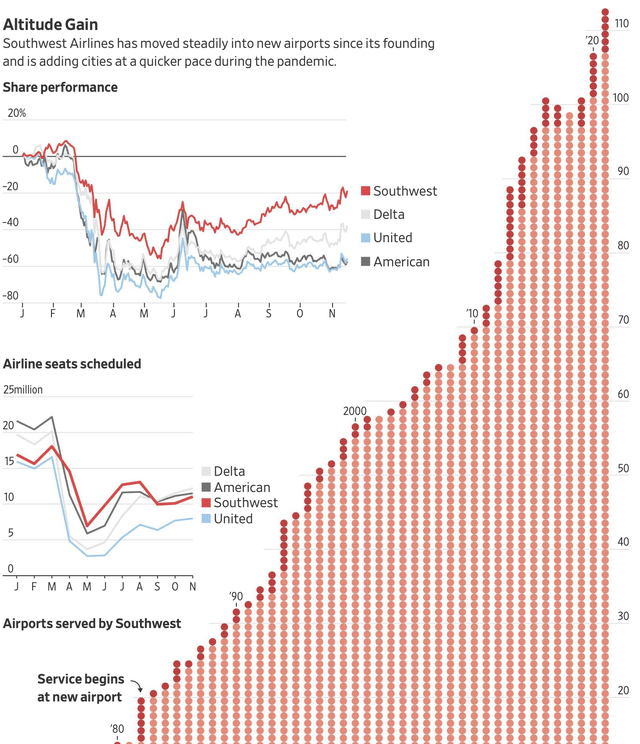

Southwest has been adding airports to its service network throughout its existence and has grown from a scrappy upstart to the largest domestic carrier in the U.S. Unfortunately, it now is the least profitable major carrier in the U.S.

The growth of Southwest accelerated from about 2008 when Garry Kelly took the helm over from Herb Kelleher.

Airports Served (The Wall Street Journal)

The new management team had decided to take advantage of the market pullback and went on the offensive. During the first decade of Keller’s reign, the aggressive growth strategy has done wonders for Southwest investors, as the share price has accumulated at an average of 31% per annum.

But something has changed thereafter. From 2018, the share price of Southwest is down by over 50%, even as the network has expanded by a further 70%. Over the last decade, growth did not create value, quite the contrary, – it has destroyed value.

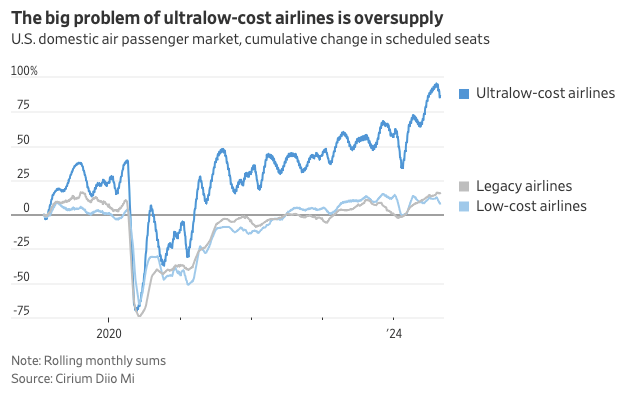

It appears that the impressive Southwest run has attracted a number of copycats into the budget airline market. Over the last decade, Southwest has started facing stiffer price-based competition, especially in markets where it does not have a strong market share and scale advantages.

Ultralow-Cost Oversupply (The Wall Street Journal)

Some observers also claim that the legacy carriers have upped their game, while the leisure travellers have increasingly started demanding premium economy service.

Another issue that the budget airline industry has faced as of late is the rising cost of fuel. Budget airlines attract the most price-sensitive customers and in some cases they even create additional demand by offering considerably lower fares.

Fuel makes up a considerable share of the cost of flying. As oil prices rise, airlines have to pass on the higher cost, and as they do, they push the most price-sensitive customers out. As oil prices rise, the number of budget-conscious fliers declines. This negative effect is most pronounced for budget airlines as most of their customers are budget-conscious.

Overall, it would appear that network expansion did not improve profits over the last 5 years as low-cost seat capacity increased while the overall market has contracted due to premiumisation and the rising cost of fuel. The budget flying market seems to be oversupplied and Southwest has been expanding into it, no wonder that the profitability has plummeted.

Southwest operates a cost structure that does not match demand

The management of Southwest failed to foresee these new developments and went on to grow the business in a weak market. The fixed costs of the business have expanded considerably, but demand did not come and is not likely to come any time soon.

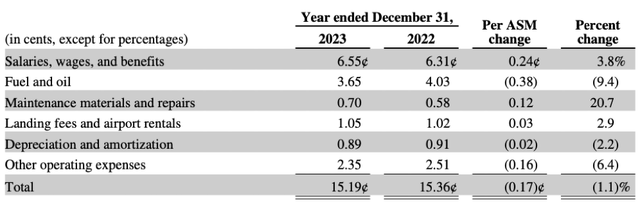

Salaries and wages are by far the most important cost item for Southwest. Labour efficiency is a key operating metric of any airline and when an airline over-hires, it becomes very difficult to maintain profit margins.

Operating Expenses (Southwest Airways)

Over the last 5 years Southwest staff count has increased by 27% while seats flown have only grown by 12% and passengers flown by only 5%. It is quite clear that Southwest has too many employees. On top of this, the load factors have declined as Southwest is now flying more empty seats.

|

FY2017 |

FY2018 |

FY2022 |

FY2023 |

|

|

ASM |

159,795 |

170,323 |

||

|

Change, % |

7% |

|||

|

Trips flown |

1,375,030 |

1,459,427 |

||

|

Change, % |

6% |

|||

|

Seats flown |

207,223 |

231,409 |

||

|

Change, % |

12% |

|||

|

Enplaned passengers |

163,606 |

171,817 |

||

|

Change, % |

5% |

|||

|

Seats per trip |

150 |

158 |

||

|

Change, % |

5% |

|||

|

Aircraft at end of period |

706 |

750 |

770 |

817 |

|

Change, % |

9% |

|||

|

Trips per plane |

1,889 |

1,839 |

||

|

Change, % |

-3% |

|||

|

Active fulltime equivalent Employees |

58,803 |

74,806 |

||

|

Change, % |

27% |

|||

|

Average aircraft stage length |

757 |

730 |

||

|

Change, % |

-4% |

|||

|

Operating expenses per ASM, excluding fuel and profit sharing (cents) |

8.5 |

11.5 |

||

|

Change, % |

35% |

|||

|

Operating revenues per ASM |

14 |

15 |

||

|

Change, % |

11% |

Financial statements and our estimates

What is more astounding is that load factors have declined even as pricing has stayed very competitive. Over the past 5 years pricing has increased by only 11% on average while the cost has grown by 35%.

As we mentioned before, the budget airline sector is quite price-elastic. If the airline is pricing aggressively by not passing on cost increases, we would expect them to attract additional travellers and grow market share. It was not the case this time round, as the market appears to be weak.

The ultra-low-cost airline sector in particular is struggling at the moment. Players are merging to optimise capacity and improve operating performance. Spirit Airlines (SAVE) is now facing potential insolvency after its merger with JetBlue (JBLU) was blocked. In a weak market that is not expected to improve soon, management should take action and start scaling down the cost base.

Free-ride with Elliott Investment Management

If you thought that it would be impossible for any executive to survive after delivering double-digit negative shareholder returns over a period of 6 years, you are mistaken, Garry Kelly is still the Chairman of Southwest.

To be frank, this executive did deliver extraordinary returns during his first decade at the helm and did deserve some credit from investors. However, 6 years is a long period of underperformance and if the old playbook is not working any more, new plays have to be drawn up. As the market has changed, maybe a fresh set of eyes is needed to guide the business.

As investors with a value bias, we encounter many businesses trading at low valuation multiples. Most of these are cyclical businesses with poor competitive positions, however, when a good business is cheap, management is usually the issue.

The management is not always easy to replace, however, especially the long-serving one. Independent directors usually do not have the willingness or the resources to engage in a battle with entrenched executives.

Activist investment funds are often needed to shake things up and Elliot Investment Management is one of the best in breed. The fund stands to gain when the performance of the company improves. Therefore, minority shareholders can free-ride on their efforts.

Activist campaigns do not succeed all the time, as performance attribution can be too vague, and the strategies suggested too aggressive. This is not the case with Elliott and Southwest. The airline has very clear issues, reflected in operating data, and the performance improvement can be tracked easily. The turnaround also mainly relates to underperforming airports, and the core operations will stay intact. We believe there is a good chance that Elliott will succeed.

A couple of weeks ago it was announced that Garry Kelly will retire next year and six directors will leave the board in November. The current CEO plans to remain in place.

Next week, on September 26th Southwest will host an investor day where it plans to put forward an operational improvement plan. This is probably the last-ditch effort by the current CEO Robert Jordan to keep his seat.

It remains to be seen if the plan proposed is aggressive enough and if it can put Southwest back on track. The pressure from Elliott could have been enough to enforce change. We will be waiting eagerly for the upcoming presentation.

The value upside of scale-back is limited

Southwest is currently significantly less profitable than before the pandemic. It can return to higher profitability, but some revenues will be lost. We believe that Southwest needs to exit unprofitable markets and the profits will improve as loss-making routes are closed.

On top of this, some planes will be freed up, allowing the company to monetise some of their property, plant and equipment. Southwest is a well-capitalised airline, and most of its planes are unencumbered.

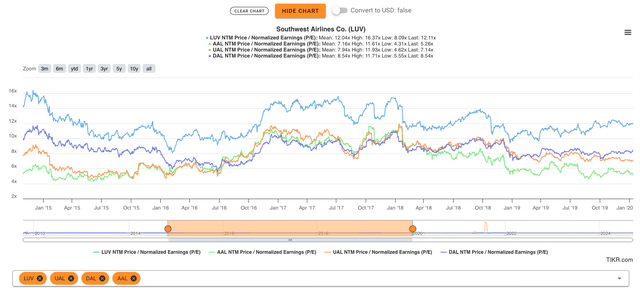

The problem is that airlines do not command high valuations multiples in general. Before the pandemic, major U.S. airlines were trading at an average PE multiple of only 8x. Southwest was a notable exception, commanding a 12x PE due to its profitable growth in the past. The airline is now facing issues and probably should not trade at a premium to peers.

Airline valuation multiples (TIKR terminal)

The capacity expansion since 2018 has yielded little value. Assuming that Southwest returns to the revenue and profit margin level of that year, the company should be able to deliver $2.5 billion of annual earnings. Assuming a rather conservative 8X earnings multiple, the equity would then be worth $20 billion. The equity value is only 15% higher than the market cap today, but there is one more value driver.

Throughout its operational history, Southwest has ploughed most of its earnings back into additional plane purchases to facilitate network expansion. Since 2018, the book value of Southwest has increased by close to $2 billion and the company has added 67 new planes to its fleet. Southwest is currently cycling out its older 737-700 aircraft, and a potential network scale-back would accelerate these efforts.

However, many airlines are currently trying to get rid of older and less fuel-efficient aircraft, therefore the value of these planes is not high. It is estimated that the older 700s probably cost about $5-$10 million a piece, therefore the spare planes of Southwest could be worth about $500 million.

Southwest cannot dispose of newer aircraft to remain competitive and the older planes are not worth much. Even after including the value of the spare planes, the upside potential appears to be rather small.

The success of Southwest’s turnaround depends on the ability of the business to convince markets that it deserves an above-industry average valuation multiple again. This would only be possible if the company was able to grow while operating profitably. In a competitive airline industry, this will not be easy.

For Southwest investors to yield attractive returns from this turnaround, a broader operational and strategic realignment is needed. Lower oil prices would also come in handy.

The bottom line

Southwest Airlines has made a bold bet that did not work out and is now suffering from the consequences. The company did grow to become the largest airline in the U.S. however, it has struggled to maintain profitability compared to other major carriers.

The company has overextended into an increasingly crowded and contracting budget market. It is now time to scale back the operations in unprofitable airports and return to higher levels of profitability. This will not be difficult to do.

It appears though that the markets are also seeing this as a sure bet and have already priced in higher margins going forward. There is not much upside left at the current share price.

Attractive shareholder returns would only be unlocked if Southwest was able to convince the markets that it could grow profitably again. This will be a lot more difficult than just cutting back on unprofitable routes.

At this point, we see no easy profits with Southwest’s turnaround.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.