Summary:

- Airline stocks remain below pre-COVID levels despite some recovery in 2021, mainly due to significant debt growth and rising labor costs.

- Southwest Airlines has seen a significant decline in enterprise value as it faces challenges in revenue growth, labor negotiations, and infrastructure needs.

- Southwest’s operational advantages are diminishing, and it may lose its valuation premium to peers, potentially leading to further stock price deterioration.

- Major airlines face considerable risks today due to a potential rebound in fuel costs combined with a growing decline in consumer discretionary spending capacity.

Brandon Bell/Getty Images News

Most airline stocks remain considerably below their pre-COVID levels. The Airline ETF (JETS) is roughly 40% below its January 2020 price despite retracing much of its 2020 losses through 2021. TSA checkpoint travel numbers imply that 2023 volume levels are equal to or even slightly better than those seen in 2019. Jet fuel prices are also much lower than last year, improving ticket pricing margins for most airlines.

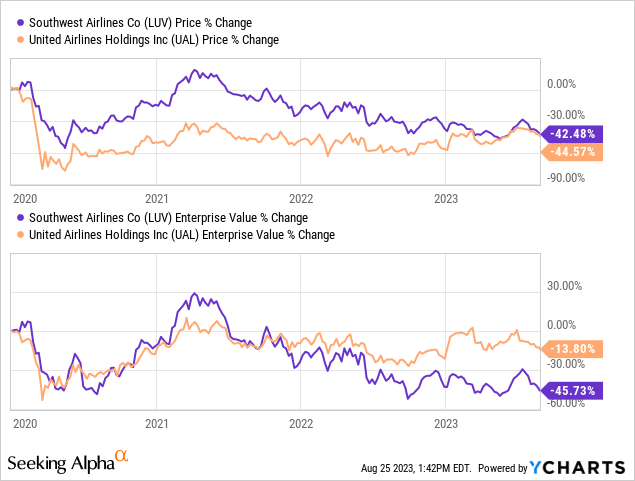

The airline industry faces different headwinds today than it has in recent years. For one, the pilot shortage has led to soaring prices as experienced aviators now earn up to $700K annually and are expected to rise further after a series of recent contracts. Secondly, airlines have significantly increased their debt levels since 2020; However, most airline equities are much lower, and their enterprise values are not since equity losses were made up for in debt expansion. However, not all airlines have seen enterprise value recoveries; Southwest (NYSE:LUV), a historical outperformer, has seen much more significant EV declines since 2020. See Southwest’s data vs. United Airlines below (UAL):

United Airlines’ total enterprise value (market capitalization plus debt) is in the range it was before the COVID-19 shock. While both have seen nearly equal equity value drawdowns, Southwest stands out more because its enterprise value has declined by ~42%, indicating the company has become much smaller. On the other hand, United Airline’s equity has become smaller, but the company is nearly the same size since its debt has risen.

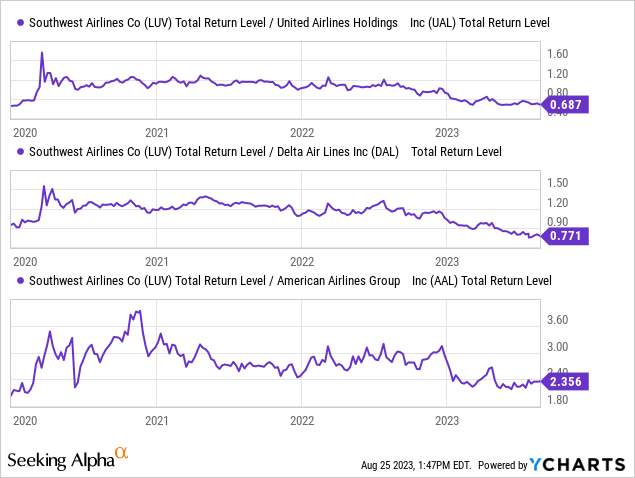

Southwest is facing some trouble today, mainly because it has underperformed its weaker peers recently. See LUV’s price ratio to its primary competitors:

In 2023, LUV has contracted significantly, while most of its peers have risen to varying degrees. Notably, the price ratios of LUV to its larger peers have fallen back to pre-COVID levels, indicating that Southwest is simply losing its “defensive premium” received in 2020. Further, Southwest’s ability to reduce risk compared to peers may be more limited as risks shift from demand to supply. In other words, the airline’s most significant risks today have more to do with labor and materials costs than a lack of customers. Of course, if consumer spending power continues to wane, Southwest and other airlines may face significant issues on both fronts.

Why is Southwest Losing Value?

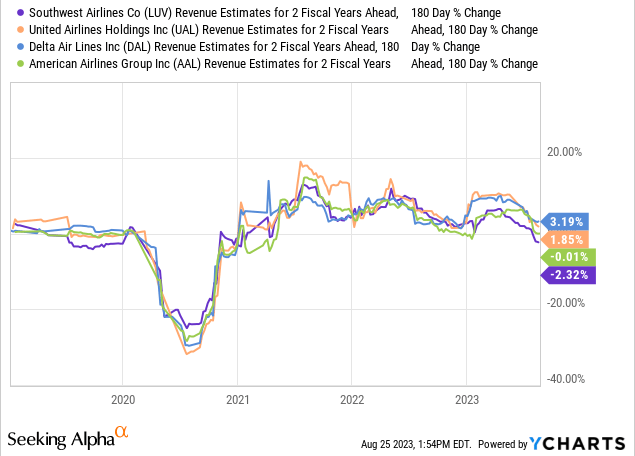

For one, Southwest has had more significant adverse changes to its revenue growth estimates than its larger peers. This includes the firm’s current, following, and two fiscal year sales outlook. Southwest’s changes to its sales outlook two years ahead are shown below:

Airline Forward Sales Estimate Changes (YCharts)

Over the past three months, all four major airlines have seen their sales growth outlooks slow. However, Southwest is the only one with a negative trend in its sales outlook over the past six months. Thus far, its 2-year-ahead sales estimate has only declined by 2.3%; however, that is an initial indication that the company is facing some demand-side pressure compared to its peers. This change may be partly due to immense negative publicity surrounding its December 2022 operational meltdown, indicating the company’s technical infrastructure or labor levels were not up to par, causing it to lose many would-be customers.

The stock’s recent decline of around 10% in the past month may be partly attributable to the Maui fires, which will temporarily shut down one significant sales avenue for the firm; however, it should not be a major long-term issue. Hawaiian Airlines (HA), down 16% over the past month, will likely face the most significant impact among airlines, with Southwest second.

Southwest is also stuck in a standstill with its pilots union, which is prepared to strike. American Airlines (AAL) recently ratified a new contract that will increase pilot compensation by 46% over the next four years, immediately increasing pay by 21%. As such, Southwest will likely need to offer a similar deal or risk facing a strike. The company’s union also expects an overhaul of its scheduling system, which has been blamed for pilot fatigue and flight delays, indicating the company may need to increase its CapEx spending to improve outdated systems.

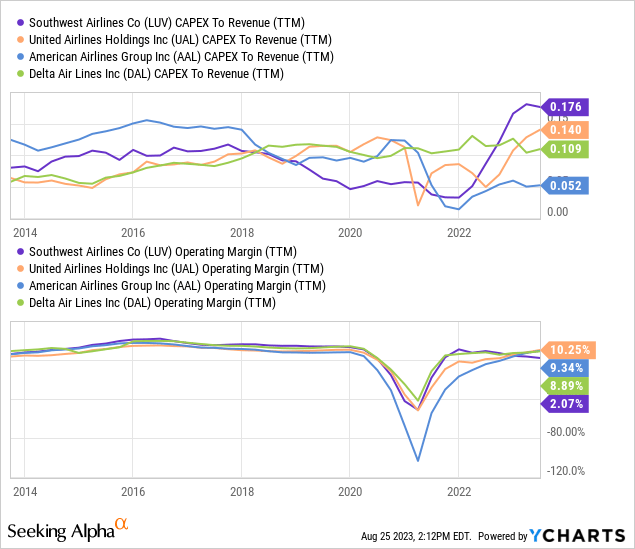

Accordingly, Southwest is seeing a massive increase in capital costs and a significant decrease in its operating profit margin. While its operating margins are historically stronger than its peers, it lost tremendous ground this year as its operating margin fell to 2% while its peers rose to over 9%. See below:

Lower operating margins and higher CapEx equals much lower free cash flow. All three of its peers have positive free cash flow. However, Southwest’s FCF has fallen to ~-$1.5B over the past year, nearly equal to its 2020 minimum level. Thus far, it has not needed to raise debt or sell significant equity to raise cash to offset negative free-cash-flow; however, its nearly $9B positive working capital in early 2022 has dwindled to ~$2.9B in Q2, indicating a considerable deterioration in liquidity. Still, its liquidity position is healthier than before 2020 as the company took advantage of 2020’s attractive borrowing conditions.

Southwest Is Losing Its Defensive Premium

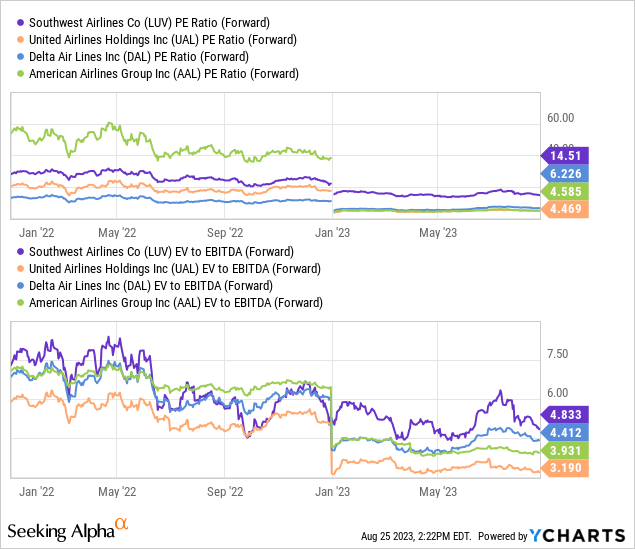

Southwest’s fundamental position is problematic, but not excessively so. Southwest may be behind on infrastructure compared to its larger peers, increasing the need for more significant CapEx expansions. Additionally, although it traditionally has stronger labor retention, it appears to be losing its edge as pilots and other workers fall into severe shortages, causing immense pay increases across the industry. So far, Southwest has seen the most notable decrease in operating margins associated with rising employee costs. However, the company continues to trade at a significant valuation premium to its peer group. See below:

Southwest’s forward “P/E’ is over twice as high as its peers at 14.5X. Of course, the company’s financial debt-to-EBITDA ratio is nearly half that of American and United, giving it far lower bankruptcy risk than those companies. Still, even on an “EV/EBITDA” basis, which accounts for the huge leverage discrepancy, LUV trades at a roughly 19% premium. If Southwest also traded at a 3.9X “EV/EBITDA,” its market capitalization would need to be about $11B, or ~24% below its current level.

In my view, this is the most significant negative factor facing LUV compared to its peer group today. The stock’s equity value is trading at roughly 31% premium (or a decline by ~24% to fair value) to its peer group on an “EV/EBITDA” basis. Its premium on a “P/E” basis is much larger, though it is generally justified by the substantial debt differences between Southwest and its older peers. Aside from the debt difference, the stock would need to decline by ~24% to trade at a similar “EV/EBITDA” to the others.

Southwest’s “operational premium” was justified in the past by its comparative popularity among airline employees and customers. However, as supply-side strains mount, Southwest’s differences to other large airlines are becoming ever smaller. As it competes for a small supply of pilots, more of its sales are going to labor, meaning it must cut costs in other categories or risk more considerable operating margin losses. Combined with its potential infrastructure upgrade needs, Southwest is clearly not in a desirable position. At this point, there is no reason the company should trade at a discount to its peers. However, its “EV/EBITDA” premium is far less justifiable than years ago, as it faces equal or more significant operational pressures than its peers.

The Bottom Line

Overall, I am bearish on LUV and believe it will likely lose value over the coming year. Further, I anticipate that LUV will continue to underperform other airlines as it loses its valuation premium to its larger peers, potentially implying another ~24% decline. On top of that, Southwest may face additional issues due to risks facing all airlines. This includes notable ongoing declines in consumer spending power and a potential return to significant shortages in the fuel market. Should travel demand decline again, Southwest and its peers are in a much worse financial position than in 2020 due to the vast balance sheet deterioration and cost growth factors that have occurred since.

In a best-case scenario where air travel demand remains near peak levels, I still believe LUV could face some losses due to its loss of operational advantages. In a worst-case scenario, it will face that risk plus demand-driven drawdowns due to macroeconomic strain, potentially including fuel cost growth and recession-driven consumer demand declines. Of course, it is also possible that a fuel cost rebound upsets consumer demand without a recession occurring. Thus, a wide array of potential factors could influence LUV’s value over the coming year; however, at this point, I believe most catalysts are negative for LUV.

Although I am bearish on LUV, I would not bet against it today because it is not so overvalued compared to stocks in general. It is likely overestimated compared to peers and faces potentially significant macroeconomic headwinds; however, I only expect LUV to decline by 10% to 35% over the next year unless extreme changes occur. In my opinion, other sectors, such as technology and growth stocks, seem to be much better short opportunities today due to extreme overvaluation and stronger technical positioning.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.