Summary:

- Southwest Airlines updates guidance for Q1 2024, disappointing investors.

- Fuel costs per gallon expected to increase, unit costs excluding fuel expected to be up.

- Southwest Airlines reevaluates full year 2024 guidance due to lower deliveries of Boeing 737 MAX, freezes hiring.

Boarding1Now

On the 12th of March, low-cost carrier Southwest Airlines (NYSE:LUV) updated its guidance for the first quarter of 2024 and provided some updates regarding its capacity expansion plan for the full year. The market has responded negatively to the Southwest Airlines guidance update and LUV stock is now down 15%. In this report, I will be discussing the guidance update and re-evaluate my rating for Southwest Airlines.

Southwest Airlines Guidance Disappoints Investors

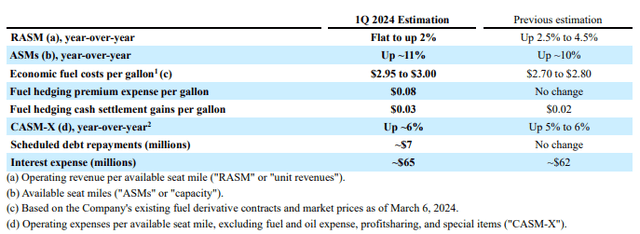

The guidance update for the first quarter was mostly negative. The company expects capacity to be up 11% compared to a prior expectation of a 10% increase in capacity. That was about the only positive in the guidance update and was driven by higher-than-expected completion factor. On all other metrics, the guidance was in the negative direction. Fuel costs per gallon are expected to be in the $2.95 to $3.00 range, which is up 20 to 25 cents on the gallon compared to the prior guidance. Furthermore, despite the higher-than-expected capacity the unit costs excluding fuel are expected to be up six percent, ending up at the higher end of the five to six percent range guided for earlier due to timing of costs.

Revenue per available seat-mile is expected to be flat to up to two percent, whereas Southwest Airlines guided for an increase of 2.5 to 4.5 percent earlier. The change was driven by higher completion factors which increases the overall revenues but does change the RASM mix for Q1 compared to earlier projections. Furthermore, close-in leisure volumes while business travel is tracking as expected.

With seasonality in mind, sequentially Southwest Airlines sees stronger RASM compared to historical patterns, but putting it altogether we see elevated costs both on non-fuel and fuel costs and higher interest expenses leading to a loss-making first quarter driven by losses in January and February partially offset in March.

Southwest Airlines Reevaluates Full Year 2024 Guidance

Initially, Southwest Airlines expected capacity expansion of 6% for the year as well as $2.55-$2.65 in fuel costs per gallon with 5.5 to 7 percent growth in non-fuel unit costs indicating that costs continue to be inflated despite more seats to amortize costs over driven by higher cost items such as labor costs and benefits. The company is now reevaluating that guidance and that is driven by lower deliveries of the Boeing 737 MAX. The number of deliveries expected has now been reduced to 46 from 58 MAX 8 causing a one-point headwind to the capacity expansion plan. The company has 27 Boeing 737 MAX 7 airplanes in the delivery schedule, but from those jets delivery was already deemed unlikely at an earlier stage. Nevertheless, the total deviation from the delivery plan provides a significant headwind to capacity expansion and the ability to benefit from demand and efficiently amortize costs. As a result, Southwest Airlines has also decided to freeze hiring for various roles, including pilots and cabin crew.

The elevated cost in Q1 2024 will be neutral for the full year, and the company continues to expect positive RASM development year-over-year. Southwest Airlines has not provided any official guidance update for all metrics for FY2024, but the fact that the company has hinted it is reevaluating the 2024 guidance has been reason enough for investors to sell. The main culprit of course is the reduction in expected deliveries, and it shows how the issues at Boeing are affecting Southwest Airlines and seeing this in the bigger sphere of things, we are seeing how Boeing’s issues are affecting an entire industry.

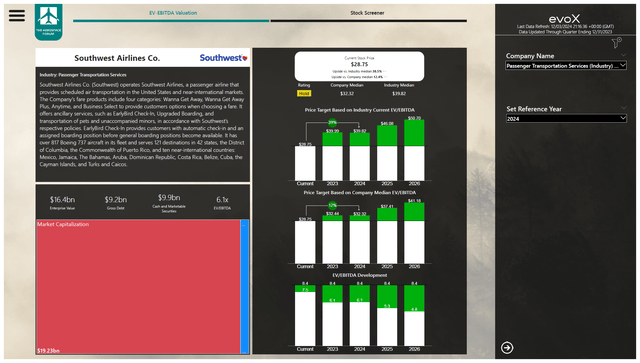

Southwest Airlines Stock Remains A Hold

I previously had a Hold rating on Southwest Airlines stock and after implementing the most recent balance sheet data and forward projections, I am maintaining that rating. My price target for 2024 implies 12% upside, but given the uncertainty regarding fleet expansion, rising fuel prices and inflationary pressures remaining elevated, I believe that a hold rating is appropriate. Coming out of the pandemic, many airlines tried to operate from a lower cost base. However, as demand for air travel was strong, we saw more bargaining power for unions to demand higher pay that was in many instances long overdue. The result could very well be that airlines are facing higher labor costs and higher fuel costs, which might become harder and harder to pass through. Absent of capacity growth allowing for better cost amortization, the risk-reward profile has become somewhat less attractive.

Conclusion: Southwest Airlines Faces A Challenging Cost And Expansion Path

While I am certainly not bearish on the prospects of Southwest Airlines, I do believe that the company will be seeing some pressures as airlines in general have significantly increased their cost basis and if we layer rising fuel costs on top of that as well as lower RASM growth the much needed fleet expansion that is not coming through due to issues at Boeing might become more and more problematic. As a result, I do believe that a Hold rating at this point in time is appropriate.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.