Summary:

- Southwest Airlines has faced challenges in recent years, including a revenue guidance revision and Elliott Investment Management’s purchase of a significant stake in the company.

- The airline is transitioning to a new revenue management system, which has impacted revenue performance, and is also dealing with delays in Boeing’s delivery of the MAX 7 aircraft.

- Despite Southwest’s strong track record and balance sheet, uncertainties surrounding revenue growth even as it remains committed to its key stakeholders.

Southwest Airlines Tails

Jon Tetzlaff/iStock Editorial via Getty Images

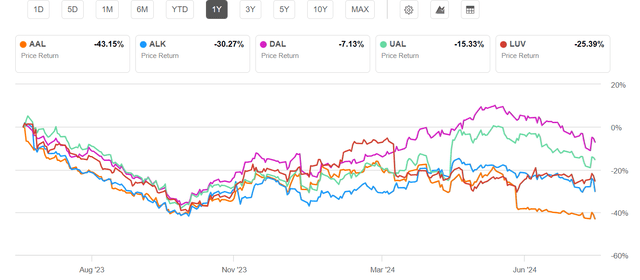

Southwest Airlines (NYSE:LUV) has had a difficult couple of years and yet I have written on several occasions, most recently just three months ago, that “Southwest Airlines is Set to Soar Again” and gave the stock a BUY rating. A number of events have taken place both in the industry and at LUV over the past three months and yet Seeking Alpha analysts have maintained a collective buy rating on the stock in a disconnect from both Seeking Alpha’s highly regarded quant system as well as Wall Street analysts, both of which now rate the stock as a hold. In fact, the SA Quant system has rated LUV a hold for most of 2024 with a few brief stretches of a buy rating. Collectively, Wall Street analysts have not had a buy rating on LUV for almost a year. In light of industry and company-specific updates and events over the past three months, it is worth evaluating if LUV still merits a buy rating from me.

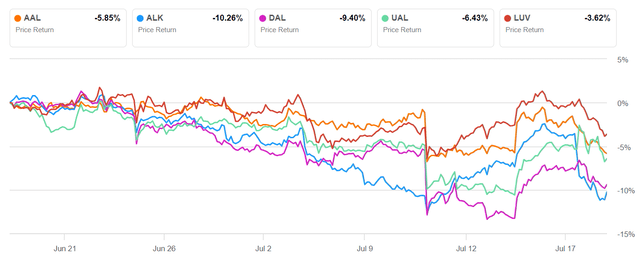

big 5 1 yr chart (Seeking Alpha)

An Eventful Quarter for Southwest

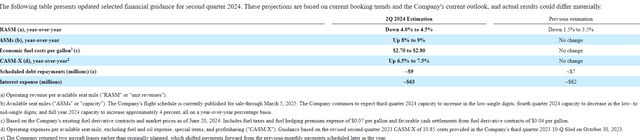

The most notable recent event that has taken place is that Southwest revised its investor guidance on June 26, 2024 to reduce its revenue expectations. The company previously guided for its revenue per available seat mile, or unit revenue – a standard measure of airline revenue generating efficiency – to be down 1.5% to 3.5% in the 2nd quarter but its revised guidance narrows the range while lowering its RASM decline to 4.0 to 4.5%. All of LUV’s fuel cost, non-fuel unit cost, and non-operating financial metrics were unchanged. Southwest noted that the reason for the RASM decline “was driven primarily by complexities in adapting its revenue management to current booking patterns in this dynamic environment.” Adding that “Despite lowered expectations, the Company continues to expect an all-time quarterly record for operating revenue in second quarter 2024.”

LUV revised 2Q2024 guidance (southwest.com)

As part of upgrading its information systems, Southwest announced several years ago that it would be moving from a decades-old computer reservations system to the Amadeus (OTCPK:AMADF) platform for its reservations and other back-office systems. Amadeus operates one of the world’s largest travel distribution systems in the world or the computer systems that airlines and other travel providers use to sell their products and to manage reservations for the travel service provider. LUV also chose Amadeus not just for a new generation revenue management system but for an origin and destination revenue management system – a substantial technological jump from LUV’s previous revenue management system. Revenue management systems are the back-office programs that airlines and some other travel providers use to optimize revenue by selling the best number of seats on each flight at the best price points given that most airlines have multiple fares in every market. By using extensive history of demand for flights in the past and with human input, revenue management systems are able to improve revenue performance by optimizing the number of seats that are sold at each fare level.

Up until this past year, Southwest’s revenue management system worked by optimizing the performance of each individual flight the company operates – over 3000 flights/day that are available for sale months in advance, meaning that Southwest needed a system that could manage over one million flights that are for sale in its reservation system at any one time. As part of the switch to the Amadeus platform, Southwest also made the decision to upgrade its technology to an origin and destination revenue management system; in that type of system, the demand is forecast and inventory levels in the reservation system are managed at the origin and destination level – rather than at the specific leg or segment level. For instance, if a passenger buys a ticket from Orlando MCO to Phoenix PHX, his origin and destination is MCO-PHX regardless of the routing he takes. That MCO-PHX passenger could fly on one of LUV’s nonstop flights in that market (so the leg or segment would be MCO-PHX) but they could also make a connection in a number of cities such as Nashville (BNA) or Dallas DAL or Houston (HOU); if the passenger makes a connection, their origin and destination is still MCO-PHX but the system has to decide the value of taking a passenger from Orlando to Phoenix along with the value of taking passengers from Orlando to Nashville as well as Nashville to Phoenix in addition to all of the connections that could also be carried on each of those flight segments. An Orlando-Phoenix passenger on a nonstop flight between those two cities might be connecting in Phoenix to Burbank or San Francisco or Seattle while a passenger from Nashville to Phoenix might have originated their trip in Baltimore or Boston or Pittsburgh and merely changed planes in Nashville. An origin and destination revenue management system has to consider all of those hundreds of thousands of combinations that can fly on every one of LUV’s flights and make the best decision to maximize revenue.

Although Southwest made the decision to switch to the new Amadeus origin and destination revenue management system several years ago, it is common in the airline industry to run two revenue systems in parallel during a transition with only the older system controlling the inventory in the reservation system while the new system monitors the network and booking patterns and begins to build forecasts. While Southwest did not say when the new revenue management system cutover took place, their commentary indicates that it has taken place during the last few months. It also did not say the specific problem but said that both the revenue management system itself and the human inputs were not accurate and were responsible for the revenue miss.

It should be clear that modern revenue management systems at airlines as large as Southwest are extraordinarily complex and they have to manage huge amounts of data with the input of humans that have updated and current information that differs from what happened in the past. For instance, if a competitor added significant amounts of capacity into a market and fares are now weaker than they were before, it may be necessary for an analyst to provide inputs to the system so that the current reality is forecast rather than an older reality which no longer exists. Humans have to provide any number of market specific inputs while system administrators might input macroeconomic factors such as interest rates which an airline knows will affect ticket sales. Changes to revenue management systems are highly risky and many other airlines have reported revenue shortfalls during transition from one system to a newer, more sophisticated system with much worse results than LUV is reporting for the 2nd quarter. Revenue management systems and the humans that operate them learn from forecast errors and the impact is typically minimized within one year and often in a much shorter timeframe. While reduced revenue because of the transition to a new revenue management system is not helpful for Southwest right now, it is not likely to be repeated at the same degree – if at all – and the new system is an investment that will increase LUV’s ability to optimize its revenue in the future.

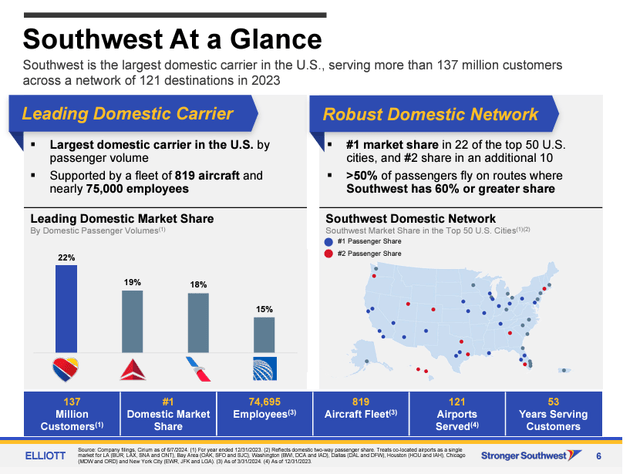

Southwest at a Glance (strongersouthwest.com)

Enter Elliott

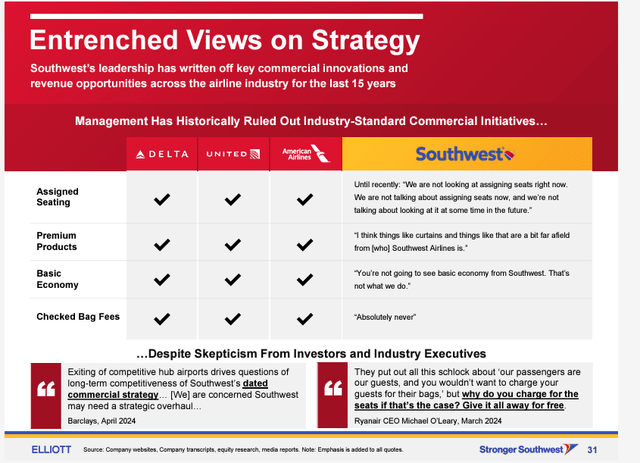

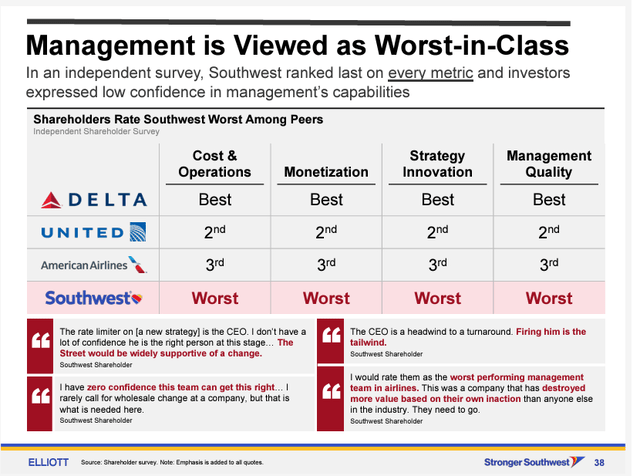

The second major event that happened was Elliott Investment Management’s purchase of a low double digit percentage of LUV shares in early June. Elliott accompanied its purchase of LUV shares with a biting commentary on LUV’s financial and stock performance compared to LUV’s competitors with accusations of an inbred board and management and assertions that LUV’s product is no longer viable in the current market. Southwest management had said prior to Elliott’s involvement that the Dallas-based airline was looking at its product offering and intended to provide more details on enhancements at Southwest’s investor conference in September. Elliott’s point about Southwest’s underperformance relative to its peers cannot be overshadowed even if its management understands the need for LUV’s legendary service to evolve. Elliott stated that it surveyed a number of stakeholders including other shareholders even though the largest U.S. airlines are largely held by the same institutional investors.

LUV product Elliott (strongersouthwest.com)

Southwest management says it intends to stay the course and adopted shareholder rights plan that it believes will ensure that negative impact to Southwest will not occur. The airline’s management said it has been willing to work productively with Elliott but the investment company has not been satisfied with Southwest’s appointment of a new outside director or LUV’s explanation for degraded 2nd quarter revenue performance.

LUV mgmt comparison (strongersouthwest.com)

The root of LUV’s underperformance is in considerable dispute. Elliott believes that LUV has underperformed because of its product offering while the company believes that delivery delays from Boeing (BA), the sole supplier of the 737 jets which make up the entirety of Southwest’s fleet, has had a significant negative impact on its revenues. Boeing was supposed to deliver the first MAX 7 aircraft, the smallest version of the MAX family, in 2019 but the certification process for that model is now expected to happen in 2026 with earliest deliveries at least one year from now. Southwest has been very careful not to badmouth Boeing but has repeatedly said that it is having to hold onto older aircraft for longer periods of time than it planned which increases maintenance costs and decreases planned fuel savings. It is also pushing its entire fleet harder, starting its schedule earlier in the day and ending it later at night which diminishes revenue performance and increases labor costs as airport personnel work longer. In addition, LUV has had to take delivery of the larger MAX 8s which puts even more pressure on fares since LUV has to fill up to 17% more seats on the larger aircraft than it would have to fill with the MAX 7.

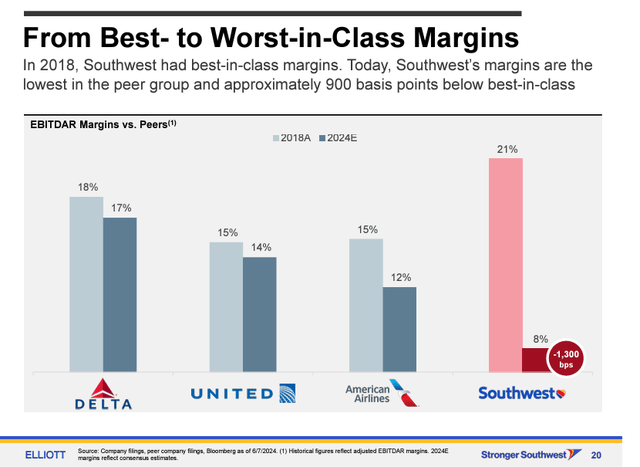

LUV margin comparison (strongersouthwest.com)

Southwest has faced repeated promises that certification for the MAX 7 would come soon and yet deliveries of that model have been repeatedly pushed back with some aircraft already built but unable to be delivered. It has been hard for LUV to know how to adapt its business plan due to the changing delivery timelines from Boeing. Low-cost carriers count on the ability to grow in order to keep costs in check as lower paid new workers are added to the payroll. Thus, it is impossible to separate Southwest’s revenue underperformance from Boeing’s production and certification issues – but Southwest management has no choice but to improve its revenue performance, something it seemed prepared to do even before Elliott became involved with the airline.

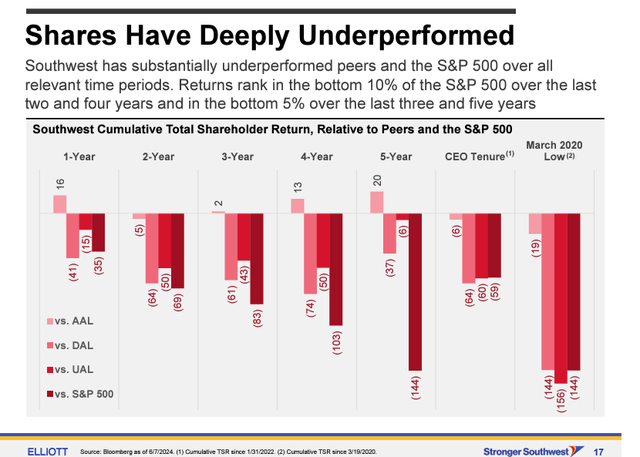

LUV stock underperformance Elliott (strongersouthwest.com)

A Challenging Airline Environment

Southwest’s underperformance has to be seen within the context of the large economy and of the performance and commentary of other airlines. Although the U.S. economy is generally considered to be in good shape, there are growing indications that high interest rates and higher prices that have persisted even as inflation has calmed are negatively impacting middle to lower income Americans more than those in higher income tiers. As an all coach/economy airline and with no longhaul international routes, Southwest is being hit harder with the weakness in the lower tiers of the U.S. economy than global carriers including Delta (DAL) and United (UAL) both of which are seeing strong performance on their international networks and also with premium passengers.

The second quarter earnings season is underway. Last week, Delta reported weaker year over year earnings despite strong revenues but noted that there is overcapacity in the domestic economy market. United reported its earnings on Wednesday and had similar performance and commentary with strength noted in international and premium markets – where those two carriers typically see comparable performance. United also expected weaker third quarter earnings than analysts expected due to the same domestic overcapacity that Delta noted although United said that capacity should become more balanced midway through the quarter. Finally, Spirit (SAVE) revised down its 2nd quarter investor guidance based on lower non-transportation or ancillary revenue.

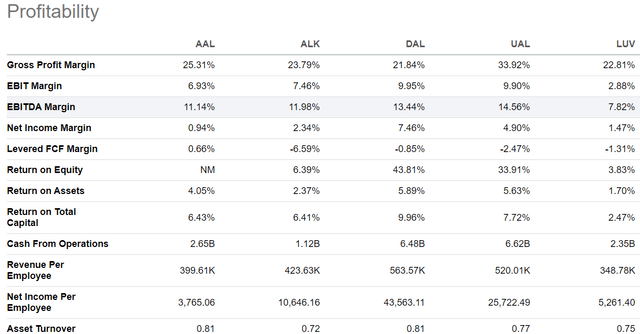

The implications for Southwest from all of these other airline earnings reports is clear. The market that Southwest caters to – domestic coach travel – is having the hardest time and is populated by airlines that are struggling the most. It can’t be lost that American, the weakest of the big 3 global carriers, is the least global carrier of the big three while Southwest competes in the domestic market with multiple low cost and low-cost carriers that do poorly. In fact, Alaska Airlines (ALK) is the only primarily domestic airline that is reporting strong financials – in line with my expectations that their return to being a top-tier carrier is underway. Notably, ALK is adding premium cabin domestic seats in line with findings from AAL, DAL and UAL that there is strength even at the front of domestic aircraft.

Elliott has made a lot of noise about the amount of revenue that Southwest leaves on the table because of their egalitarian philosophy of selling a ticket with all of the same components for everyone. Indeed, the legacy carriers generate considerable amounts of revenue from all sorts of ancillary services – baggage, various levels of seat assignments, and loyalty program tiers that incentify upselling which increases revenue. It is very likely that Southwest will address some of Elliott’s concerns which are echoed by some LUV customers; on the other hand, Southwest has a very loyal following for whom the airline’s product as it exists now is what keeps them loyal. Southwest has to figure out how to improve its revenue performance while incorporating whatever changes it feels it can implement without alienating its most loyal customers – and, if the root issue of LUV’s revenue underperformance is related to Boeing’s issues with the MAX 7, Southwest has no choice but to develop strategies that will overcome Boeing’s issues which are not going to be resolved for at least a year.

big 5 profitability 18jul2024 (Seeking Alpha)

Let’s also not forget that there is considerably fragility among some of Southwest’s competitors. Ultra discounter airline Spirit’s downward revision of its guidance raises further doubt about SAVE’s viability. That airline is in the midst of delicate negotiations with creditors who are deciding whether to push back the due date on a significant amount of debt that SAVE cannot afford to pay on its current schedule. Even though SAVE is suffering from durability problems with the Pratt and Whitney (RTX) Geared Turbofan engine that has grounded scores of planes, creditor decisions could limit SAVE’s ability to wait for those engines to be fixed – with the potential that some of the capacity that multiple carriers say needs to be removed from service might be removed from the ultra-low-cost carrier model for the long-term. JetBlue (JBLU) also is struggling to restructure its business. Southwest could benefit from restructuring among smaller low-cost carriers.

A Strong and Proven Business Model

Regardless of the current situation in which Southwest finds itself, investors flocked to LUV as one of the best airline investments ever because the company fundamentally has a solid track record. While LUV has to navigate its current turbulence, it has demonstrated in the past that it can adapt to changing markets. While Southwest started service with a quick 20 minutes on the ground between flights on aircraft that seated around 100 passengers, LUV has adapted to larger aircraft – necessary to improve efficiency – and longer ground time between flights. The increase in the “airport hassle factor” has made short haul flights less desirable and yet LUV has adapted to offer more medium and longhaul flights. LUV’s workforce has become more senior and other airlines are becoming more efficient, narrowing the efficiency gains between Southwest and legacy airlines, and yet Southwest continues to be the most efficient of the big 4. LUV started as a predominantly point to point airline (did not offer connections) and yet its network now supports large percentages of connections in some cities, sometimes as much as legacy airlines offer in their hubs.

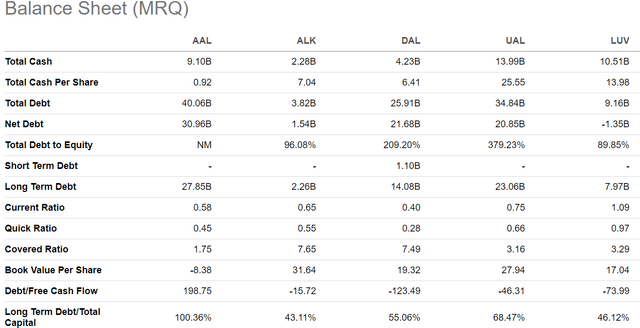

Southwest’s greatest advantage is its strong balance sheet which could support years of weak revenue growth – and yet that is highly unlikely to happen. Few other airlines in the world have a balance sheet as pristine as LUV’s.

big 5 balance sheet 18jul2024 (Seeking Alpha)

And Southwest is working hard to re-engage its employees who have been not only disheartened by the decline of Southwest’s industry leadership but have been financially harmed as profit sharing has been dramatically reduced, impacting Southwest employee pensions – facts that Elliott has been only too keen to highlight. However, Southwest followed a contract settlement with its pilots with a settlement with its flight attendants. While the labor market for pilots and mechanics is different from cabin crew and passenger contact employees, Southwest, like most airlines, is careful not to upset the historic salary relationships between workgroups. LUV’s settlement with its flight attendants came on the second attempt but was still the first of the big 4’s unionized flight attendant workforces to see salary increases; Delta’s flight attendants are not unionized and that company moved early after the pandemic to increase salaries. LUV has long had good relationships with its employees who have delivered above average levels of service to Southwest customers. As the company struggles to find the right revenue formula, it is committed to keeping its employees on its side and will certainly do all it can to increase the profits that will further cement the good relationship with its employees.

As Southwest evaluates its revenue model, it is likely to look for growth markets including its home market of N. Texas – the Dallas/Ft. Worth metro area. Since the day Southwest began service, it has been involved in legal battles to freely serve N. Texas – rooted in the area’s decision 50 years ago to require all airlines to serve the newly opened Dallas/Ft. Worth International Airport. Southwest fought to serve Dallas Love Field, the previous primary airport for the City of Dallas, since LUV wasn’t in existence when the agreements for other airlines to move to DFW were signed. American Airlines operates a massive hub at DFW and the two N. Texas airlines have fought endless legal battles which have resulted for the past ten years in a truce which has kept American at DFW (also as a result of American’s merger with USAirways) while Southwest only serves Love Field. The final restrictions other than capping the size of Love Field’s operations and limiting Southwest’s home airport to domestic flights end next year and it is certain that LUV will expand to other N. Texas airports – possibly including nearby DFW or possibly including other N. Texas airports.

And the final piece of good news that Southwest wants to hear in 2025 – and which will likely come – is Boeing’s certification of the MAX 7. Boeing has very likely come to the bottom of its production and certification issues and will come up with the final fixes to the MAX engine anti-ice system which will allow certification of the MAX 7 and then the MAX 10 after that with the latter model ordered by all other U.S. MAX customers. Certification of the MAX 7 and beginning of deliveries of the MAX 7 will be a key part of LUV’s efforts to fix its revenue problems as it puts the right size aircraft on the right routes. In addition, LUV’s fuel efficiency will improve and maintenance expenses will fall as it retires older 737-700 aircraft that it has had to keep in service. Finally, LUV’s flight schedule will be retimed to minimize very early and very late flights.

But all of those improvements will not come until MAX 7 deliveries begin which will not likely happen for at least a year and likely into 2026. In the meantime, Southwest needs to focus on reworking its product offerings in order to close the revenue gap with the big 3 global carriers – and esp. Delta and United which are generating substantial amounts of premium revenue including on their domestic networks.

big 5 1 mo chart 18jul2024 (Seeking Alpha)

Finally, we have to consider LUV stock relative to the rest of the industry. Investors have soured on airline stocks over the past month as domestic revenue weakness has become apparent throughout the industry. Given that international revenues will be soft through the winter, airline stocks as a group are not likely to see substantial appreciation for the next six months until airlines give insight into their 2025 revenue outlook and esp. for Spring Break and summer. Further, while airlines performed well relative to other sectors for various periods of time in the post-covid era, they are settling back because of the strength of other sectors esp. tech-related sectors. While there will be some airlines that will outperform their sector, in general, airlines as a group will be less competitive as investments.

LUV Stock Appreciation is Stuck at the Gate

It is therefore appropriate to downgrade Southwest Airlines to “hold” pending further clarity about its plans to improve revenue and of Boeing’s efforts to get the MAX 7 certified and into Southwest’s operations.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.