Summary:

- As Spirit Airlines faces challenges, it is an excellent time to look at the airline industry, particularly given its failure to recover since 2020.

- Southwest Airlines has seen a decline in its EPS outlook, but that trend has slowed as it looks toward more moderate cost growth.

- The entire airline industry has faced a consistent decline in profit margins since 2020. Southwest’s margin pressures may slow unless fuel costs rise.

- Southwest may find itself paying more for pilots over the coming years, even if the pilot shortage ends due to a recession.

- Southwest’s valuation is reasonable if we adjust for debt and compare it to peers; however, its low and falling profit margins remain a significant concern.

DaveAlan/iStock Unreleased via Getty Images

The recent wave of volatility surrounding the Spirit Airlines, Inc. (SAVE) JetBlue Airways Corporation (JBLU) merger deal has triggered another increase in speculation surrounding airlines. Spirit Airlines is currently expected to potentially go bankrupt if the merger deal fails. For the most part, airline stocks have never recovered from 2020 due to the extreme debt growth that period caused, followed by a wave of cost-growth factors such as labor and fuel. To some extent, airlines are struggling with excessive volume, as TSA screening numbers indicate air travel is currently around record-high levels. As a result, pilots, flight attendants, and other key personnel are becoming far more expensive, pricing out the lowest-cost airlines.

Combined with higher interest rates on most airline’s leveraged balance sheets, it is difficult to make a steady profit in the travel industry. One interesting example is Southwest Airlines Co. (NYSE:LUV), which I covered in August with a bearish outlook due to its valuation and cost growth concerns. The stock lost around a quarter of its value over the following months as its EPS outlook declined as expected. However, around the end of the fall, it erased most of those losses as its outlook improved slightly. Now, it is just 5% lower than when I covered it last, indicating the need for an updated analysis.

Industry Profit Margin Erosion Continues

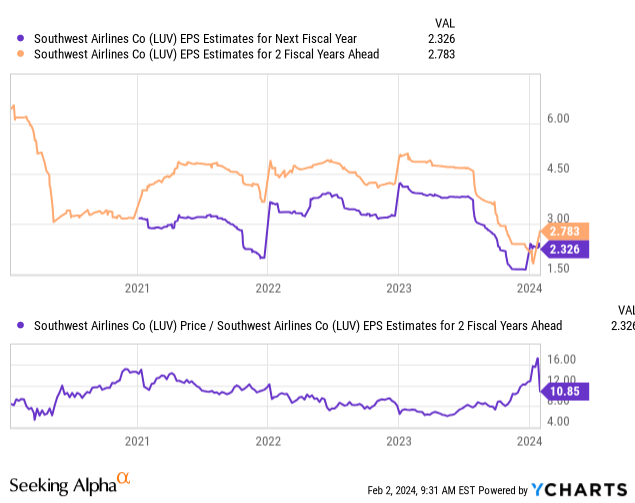

Southwest Airlines had seen a significant decline in its EPS outlook throughout the latter half of 2023. The consensus EPS target for 2024 dropped all the way to about $1.7 but is now back up in the mid-to-upper $2 range as it looks toward cost growth reduction measures. The improvement to its income outlook has resulted in a notable improvement to its forward “P/E” valuation based on its 2-year income outlook. See below:

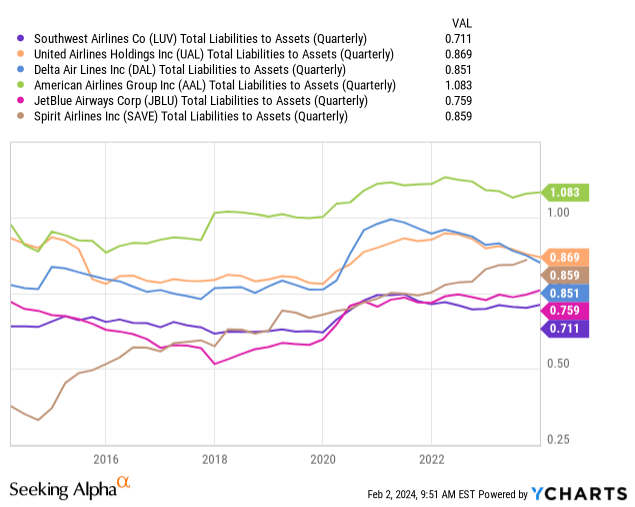

Of course, Southwest continues to trade at a significant valuation premium to most of its peers. LUV’s three-year ahead forward “P/E” is currently 10.8X, but United Airlines Holdings, Inc. (UAL) is 2.9X, Delta Air Lines, Inc.’s (DAL) is 4.85X, and American Airlines Group Inc.’s (AAL) is 3.25X. However, LUV’s forward “EV/EBITDA” is 5.8X, with the other three ranging from 4.5X (United) to 6.8X (American). Thus, although it has a “P/E” premium, it largely stems from its lower debt leverage burden. Though that may be best seen in the “debt-to-EBITDA” ratio, all airlines have had extreme EBITDA volatility in recent years. However, the discrepancy is still apparent in the balance sheet leverage level. See below:

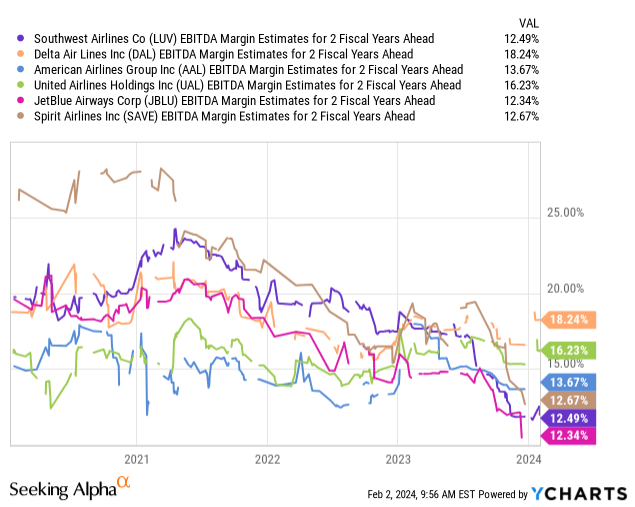

Spirit sticks out like a sore thumb with massive leverage expansion over the past decade, an issue considering its operating margins are naturally lower. Southwest has the lowest leverage of this group and, unlike most, has avoided significant debt growth in recent years, rising less than most in 2020. If we account for that fact, Southwest is valued along a similar level to its peer group if we assume stable profits. Problematically, the entire airline industry has faced a consistent decline in profit margins since 2020. See below:

This figure relates to expected EBITDA margins for two years ahead, meaning it does not account for short-term fluctuations or the impact of interest rates. Southwest is one of the lowest in the group, near the discount airlines, as its ability to keep up with rising costs appears limited. Like many others, Southwest is looking to slow hiring to avoid excess cost growth. As with the other smaller airlines, many pilots appear to be “resume washing,” meaning they’re joining Southwest but leaving within months to join the larger high-salary airlines. The company recently agreed to a 50% pay raise over the next five years, pointing to continued cost growth.

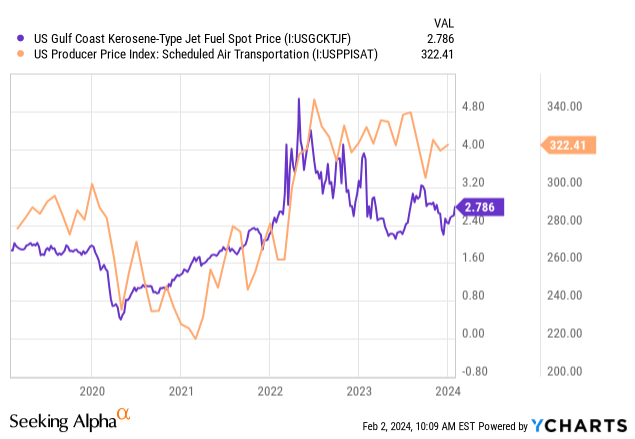

At the same time, airlines such as Southwest face margin pressures despite declining jet fuel prices. Jet fuel was in short supply in 2020, leading to rapid ticket price growth. Ticket prices generally remain around the same level, but fuel has become more expensive, meaning airlines’ labor cost growth has more than offset the declines in fuel prices. See below:

Given geopolitical issues involving the oil market, we must consider how the industry may react if jet fuel prices rise, even to the same levels in 2022. Given the growth in labor costs, the airline industry likely cannot handle any prolonged increases in fuel costs. Overall, I do not believe that Southwest’s margin pressures will end, but it does appear they should slow unless we see a rise in fuel costs.

Hoping For A Recession?

Interestingly, the one thing that could benefit Southwest may be a small and contained recession. It is a lower-cost carrier but does not suffer from debt and quality issues, as do most “discount” airlines. Thus, it has a more significant margin of safety than most other airlines. If the US economy slows and people gravitate toward lower-cost carriers, Southwest would likely benefit as its revenue may be more stable, and any declines in air travel would slow or end the pilot shortage.

Of course, while Southwest needs a shock to slow excess labor shortages, the airline industry is too likely to fluctuate between the extremes. In “good times” like today (for air travel volumes), the labor shortage has become so large that airline margins are collapsing. However, a decline in travel demand could cause the opposite, as airlines would still likely pay higher costs with lower sales until they pursue layoffs. Thus, high debt combined with cyclicality will likely mean that only the airlines that can hire and fire quickly will fare well. Since Southwest has agreed to substantially increase pilot pay over the coming year, it is ill-positioned for a more significant recession as it may be paying more for pilots when the shortage ends.

The Bottom Line

If we adjust for debt differences, LUV is reasonably valued compared to its peer group. It is also cheaper than usual, although its falling margin trend offsets that. Given its financial situation and trend, I believe its valuation remains too high. However, although I am bearish on the stock, I am not excessively so, nor would I bet against it today.

To me, its most significant risk is that, as the air travel cycle continues, it will move from one extreme to the other. It is on one “high demand” extreme today, driving labor shortages and higher wages. By the end of the year, particularly if fuel prices rise, I expect air travel demand will fall, leading to lower revenues that fail to offset the high wage growth. Then, the company could struggle to choose between layoffs and struggling with the union to lower the wage growth it set forth at the end of 2023. Still, the larger airlines likely have more negative exposure to that risk, while the discount ones may struggle more than Southwest with continuing labor cost growth. To me, Southwest has the “worst of both,” but its mid-level pricing may also be a diversification benefit.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.