Summary:

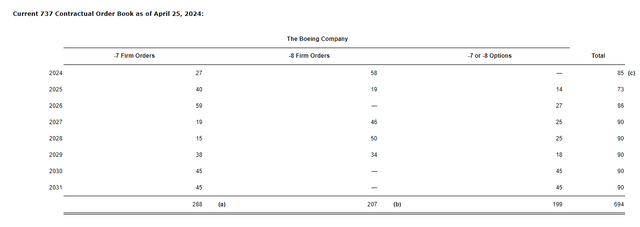

- Southwest Airlines joined a number of U.S. airlines in reporting a first quarter 2024 loss with concern around labor and maintenance expenses.

- Southwest’s loyalty to Boeing has been extraordinarily costly, with 2024 MAX deliveries expected to be a fraction of contractual levels.

- Southwest is implementing long-planned strategies and considering operational and customer service changes to grow its profits.

chanceb737

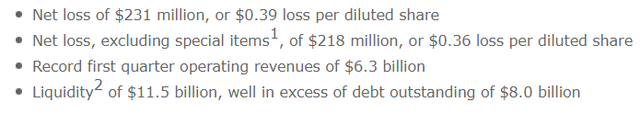

The past week was yet another difficult one for Southwest Airlines (NYSE:LUV). Southwest reported on Thursday, April 25, after Delta (DAL) which reported a small net profit and United Airlines (UAL) which reported a small loss which it said would not have occurred were it not for the grounding of the Boeing (BA) 737 MAX 9, of which UAL is the largest operator. LUV reported an operating loss of $393 million, a net loss of $231 million or 39 cents/share, and a net loss excluding special items of $218 million. The stock shed 7% on the day it released its first quarter financials.

Earlier in the week, UAL surpassed LUV with the second highest market cap among U.S. airlines. At the end of last week, UAL’s market cap reached almost $17.4 billion while LUV sunk to just under $16.2 B, both eclipsed by DAL’s $32.2 B, the highest of any airline in the world. Before covid, DAL and LUV traded places for the top spot, and now LUV as a company is worth just over half of DAL. What has happened to the scrappy Texas airline that was long considered the best-run airline in the world, and which spawned a series of copycat airlines around the world?

Not only has Southwest faced a plethora of issues that are common to mid-life companies – some of which LUV has not handled well – but Southwest has been subject to a bevy of external factors which have weighed more heavily on LUV than perhaps any other airline. A review of LUV’s first quarter 2024 financial statement highlights some of the issues that are confronting Southwest.

Southwest’s First Quarter Report Highlights Strategic Concerns

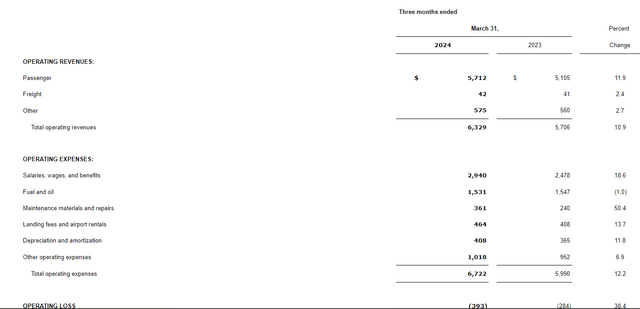

Southwest saw total revenues grow almost 11%, slightly less than the 12% increase in passenger revenue. On the surface, that increase in revenue would seem to be pretty good. But a look at expenses shows that labor costs were up 18%, LUV’s largest, making up 43% of total expenses. Not only is Southwest a mature airline with many senior employees, but it is not growing much because of Boeing production problems (more below). LUV’s 1Q2024 labor cost increase is in line with what it reported for all of 2023 with its revenue performance slightly better in the most recent quarter than in 2023 as a whole.

LUV 1Q2024 financial summary (LUV Investor Relations)

The second item that grabs the eye’s attention is maintenance expenses, which were up 50% in the MRQ, an even higher rate of increase than in all of 2023. The blame for the addition of hundreds of millions of dollars in unwanted extra maintenance expense comes from having to keep older aircraft in service longer due to the inability of Boeing to deliver new aircraft.

LUV 1Q2024 PnL (LUV Investor Relations)

It is in putting LUV’s first quarter earnings and guidance next to other airlines that have reported to begin to understand not just the issues which are impacting Southwest but the entire industry. Southwest is one of the big 4 of the U.S. airline industry alongside legacy/global carriers American, Delta and United because the four carry roughly 80% of U.S. airline passengers and revenue split somewhat between the four. The primary difference between LUV and the big 3 global carriers is not that LUV is half the age, but that LUV has stuck to its almost entirely domestic strategy using a single aircraft type – the Boeing 737. The big 3 all endured much longer lockdowns on their international systems during the covid era but have emerged stronger than their foreign competitors in the international market. At the same time, international travel is becoming more premium with the big 3 better able to sell up to higher classes of service, something Southwest cannot do because it has an egalitarian approach to travel. LUV is forced to compete with a growing number of weak domestic airlines. While Southwest’s presence in many markets gives it the ability to compete for business passengers, its bundled pricing – including check bags and change fees – leaves LUV with very few extra revenue opportunities above basic fare revenue. There seems to be a growing realization at Southwest’s Dallas headquarters that their business model is too simple and too generous.

LUV 1Q2024 op stats (LUV Investor Relations)

Southwest’s Business Model is Going to Change – for the better

Southwest’s first quarter earnings call provided the greatest insight into not just some of the thinking that is going on regarding LUV’s product, but also the timeline to roll out changes. Southwest has long prided itself in not charging for the first two bags for all passengers. Southwest’s shorter flight times provide even more incentive to keep boarding and deplaning times to the minimum. Southwest says that they know some customers choose Southwest because of the two free checked bags component of their product, and so they have no intention of eliminating that benefit, which seems like a wise move considering the revenue pressure the company is under.

The boarding process for passengers has also long been unique at Southwest with essentially a first-come, first-served system of finding a seat on the plane rather than the use of electronic seat selection in advance of boarding. Some have referred to Southwest’s boarding process as a cattle call, but it serves to get passengers on the plane quickly – with a limited amount of luggage – and disincentivizes waiting until the last minute to board. In addition, the first come first served process is highly prone to abuse; many Southwest passengers report that large numbers of passengers request early boarding due to disabilities or physical needs, requiring a wheelchair to board, but which is miraculously not needed on arrival. There are a significant number of passengers that will not fly Southwest because of the boarding process, and the chances are those objections are growing as abuse of the boarding process grows.

Southwest says a decision on changes to its boarding process could come by the fall at its investor conference. All of the seats on Southwest aircraft are available for any passenger other than exclusions at exit rows due to disability or for children, as is true for any U.S. airline. While Southwest could add extra legroom sections of the aircraft which would be monetized as other airlines do, LUV could implement policies restricting seats in certain parts of the cabin to passengers of certain fares would reduce the incentive to abuse the system, but it might not generate the revenue that would come from monetizing seats. The chances are probably fairly high that LUV will implement policies that will allow them to price discriminate on seating. LUV could create differentiated seats, but it would be very costly for them to implement a plan that would require taking aircraft out of service for reconfiguration, making policy changes more likely than physical changes to aircraft.

Loyalty to Boeing has been Extremely Costly

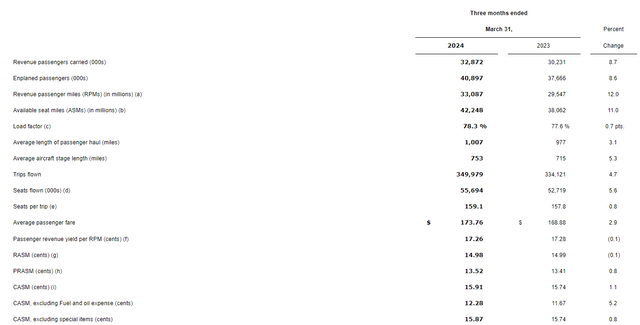

The root of most of these problems is Boeing’s inability to get the MAX 7 certified and to deliver the contracted amount of MAX aircraft to Southwest, which was the launch customer for the MAX 7, the smallest member of the MAX family which will seat slightly more than the earlier generation 737-700s which form the largest portion of Southwest’s fleet. LUV was the launch customer for the MAX 7 and expected to receive its first MAX 7s in 2019, but certification has still not taken place in the wake of the FAA’s increased oversight in the aftermath of the two foreign carrier pre-covid MAX accidents and, more recently, Boeing’s production quality issues. Certification of the MAX 7 is not likely until late in 2025 at the earliest.

Southwest has been converting its MAX 7 orders into the larger MAX 8, but that aircraft seats 25 more passengers than the MAX 7 and even more than the -700, making it more difficult for LUV to increase fares and also adding ground time for every flight because of the increased number of passengers.

Boeing recently advised Southwest that it will only deliver 20 MAX 8s to LUV in 2024, down from the contractual 85 aircraft that LUV reported on January 25, 2024 with its 4th quarter 2023 earnings; even then, just weeks after the Alaska Airlines MAX 9 door plug accident, LUV expected to receive 79 aircraft.

Southwest’s loyalty to Boeing has been extraordinarily costly, and the costs will continue to mount in 2024. LUV is planning to end 2024 with fewer aircraft than it started the year because it is too expensive to continue to overhaul older aircraft and keep them in service. Remarkably, Southwest plans to increase capacity by flying their fleet harder. When Boeing finally gets certification of new aircraft moving again, Southwest should be the first beneficiary, since the MAX 7 will be certified first. United is one of the launch customers for the MAX 10 but has rescheduled its MAX orders for the next several years to smaller MAX 8s and 9s. The MAX 10 is expected to follow the MAX 7 in the certification process. Boeing has MAX 7s and 10s that have been built but cannot be delivered to airline customers. UAL also has been informed of dramatic reductions in the number of MAX aircraft that Boeing will deliver in 2024, but United also has Airbus (OTCPK:EADSY) A321NEO aircraft on order for delivery in 2024 that will supplement its MAX deliveries, a luxury that Southwest does not have.

Southwest has repeatedly said it has evaluated adding a second aircraft model but that their analysis shows that adding a second fleet type besides the 737 would be very costly because of the way Southwest flows its aircraft through its network throughout the day with pilots capable of flying any aircraft in the fleet. In retrospect, if LUV knew that it would face a six-year delay in getting the MAX 7, it might have considered alternative aircraft, but the repeated certification delays at Boeing have not provided sufficient time to seek alternative aircraft models and obtain sufficient numbers of aircraft even if Southwest was able to modify its operations to adjust to two aircraft types. Ultimately, Southwest will have to transition to a second fleet type since it is certain that no further derivatives of the 737 will be offered; the MAX does not meet a number of standards for modern aircraft and Boeing has been relying on exemptions to aircraft rules in order to keep offering new models. For now, Southwest has decided to get as many MAX aircraft as it can as soon as it can and optimize its operation in order to use the resources it has.

LUV order book 25Apr2024 (LUV Investor Relations)

Southwest’s Turnaround Strategies Will Deliver

As with any company that is financially struggling, the first steps in executing a turnaround are to get rid of the underperforming or money-losing functions that a company does. LUV tipped its hand regarding its weaknesses with its most recent schedule changes. Along with its earnings report, LUV shared that it would discontinue service to four airports – Syracuse, NY; Bellingham, WA; Houston Bush airport; and Cozumel, Mexico. The story behind the decision to end service at each of those cities is different. At Syracuse, LUV barely broke into double-digit passenger share, with American and Delta splitting half of the airport’s boardings – as those two often do in medium and small cities. Bellingham’s primary attraction is that it is within an hour of the Canadian border, allowing passengers who want to avoid the high taxes on transborder airline travel. Cozumel is a major tourist location, but the market is very competitive with service by the big 3 plus several Mexican carriers.

The most notable airport cut was Houston Bush airport because it is symbolic of a larger issue which Southwest faces. Houston is served by two airports; LUV is the largest airline with 95% share at Houston Hobby airport, which is south of downtown. UAL has one of its hubs at Houston Bush airport, which handles more than three times more traffic than Hobby airport; UAL carries almost twice as many passengers at Bush as Southwest does at Hobby. Southwest has been the fifth largest carrier at Bush airport, indicating its overall Houston strength has not translated into consumer preference at Bush airport.

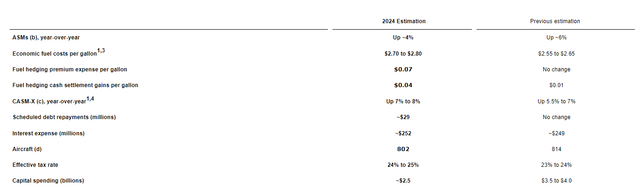

LUV 2Q2024 guidance (LUV Investor Relations) LUV 2024 guidance 25Apr2024 (LUV Investor Relations)

Southwest was founded as part of a lengthy legal battle for it to serve Dallas Love Field, which was the primary airport for Dallas but which was replaced by DFW airport. Through decades of legal machinations, lawsuits, and federal intervention, LUV has remained at Love Field, where it also enjoys a 95% market share. Southwest’s DNA has long been to serve airports which other airlines could not or did not want to serve and then to dominate those airports, something it does at Chicago Midway, Dallas Love and Houston Hobby. The primary airports in each of those three cities are hubs for one or more of the big 3 global carriers. Southwest management has tried to build its presence in other airline hubs, most recently with service to LUV’s other “hubs”, but that has been with limited success. Southwest has started and ended service to Houston Bush airport three times; absent a significant strategic change at LUV or a major competitive change, it is doubtful that LUV will return to Houston Bush airport.

Southwest also announced that it would be reducing its service at Chicago O’Hare and Atlanta airports, both of which are hubs for one or more of the big 3 carriers. LUV’s service to Atlanta began when it acquired AirTran Airways in 2014; Atlanta has only one commercial airport and ATL was the largest city which LUV did not serve at the time of the merger. AirTran offered over 250 flights/day, some of which were on smaller aircraft that Southwest’s 737s, but LUV will be reducing flights below 100 flights/day. O’Hare service was added as part of LUV’s strategy to have a presence in legacy carrier hubs. The takeaway is that the original philosophy on which Southwest was built remains true; the company does best in markets which it can dominate and where no carrier is significantly larger than Southwest. LUV’s business model makes it particularly vulnerable where it has to compete against carriers that offer a broader product offering. LUV is likely to pull back in highly competitive markets esp. with legacy carriers. In addition, Southwest is opening its booking window to 300 days in advance, much more in line with legacy carriers and the longest booking window that LUV has ever offered. Not only will Southwest become a choice for travelers that plan up to a year in advance, but the carrier will also see improved cash flow during the transition which will include 2024.

While a revamp of LUV’s serving offering could help it compete more effectively against other carriers, one of Southwest’s strategies to increase aircraft utilization is likely to be to add redeye or overnight flights. For its entire existence, LUV has always ended its operation at the end of the day, although flights may arrive late into the night. In contrast, many airlines operate redeye flights, or those that depart at night, travel all night, and arrive in the destination city in the morning or later. Southwest did not need to worry about redeye flights when its network was entirely focused in the Central Time Zone and flight lengths were under 500 miles on average. Now that LUV’s network spans from Hawaii to the East Coast, LUV has a fairly small window of time to carry passengers from one end of its network to the other. In addition, operating redeye flights increases aircraft utilization. While most airlines only operate a small percentage of their fleet around the clock, adding a number of long domestic flights can significantly improve aircraft utilization. Southwest execs have said that redeye flights would come, but the ongoing and deepening Boeing delivery delays make it likely that Southwest will add redeye flights sooner rather than later. In fact, the capacity increases that the company is guiding to for 2024 seem hard to achieve without using redeyes. Early morning and late-night flights often do not generate the best yields but redeye flights often generate better yields than very early or late evening departures. Adding redeye flights could be a significant component of LUV’s financial turnaround.

One of the prerequisites for Southwest to add redeye flights was to amend its labor contracts. LUV has now completed that process, with its flight attendants voting to approve their latest contract proposal. Agreeing to costly new labor contracts when the company is financially underperforming seems counterintuitive, but Southwest was the last of the big 4 to settle with its pilots and needed to not be in that position with its flight attendants. Delta has led the industry in post-covid pay raises, not only avoiding labor discontent but also putting pressure on smaller carriers for whom the large pay increases are much more difficult. Southwest employees have traditionally been well-paid and have enjoyed healthy profit-sharing payouts, so the current situation in which the company finds itself has taken a toll on its employees. Delta and Southwest both have learned that keeping employees happy and well-compensated does wonders in incentivizing employees to take care of customers; both airlines rank high in customer satisfaction metrics. Southwest appears ready to make the investment in its employees not only as part of its restructuring, but also because it is confident that its financial turnaround will justify those higher salaries.

On the revenue front, Southwest reported the strongest growth in business travel revenue in the first quarter of 2024, up 25% on a year-over-year basis. LUV committed several years ago to distribute its fares via travel agent automated systems in order to reach business travelers; it has also built its corporate sales force. Its industry-leading business travel revenue growth not only matches an overall return of business travel but the fruit of concerted efforts by Southwest, which will pay disproportionate benefits for Southwest.

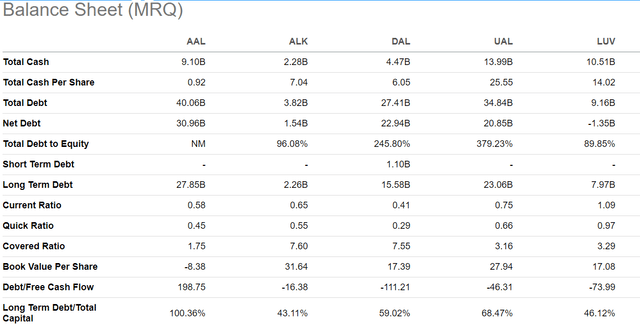

An Enviable Balance Sheet Supports the Turnaround

Southwest has long led the U.S. airline industry with its balance sheet. While the company is having to lean on that balance sheet to support its transition, LUV remains in an enviable financial position with hundreds of unencumbered aircraft and being paid for the cash it keeps on hand. LUV is one of only a couple U.S. airlines that pays a dividend, and LUV’s ratio is the best.

LUV vs Big 5 Balance Sheet (Seeking Alpha)

Southwest has been incredibly slow in addressing its deteriorating performance in part because of the repeated delays from Boeing that have made it impossible for Southwest to find alternatives. The good news is that Southwest is not confronted with rethinking its business model and appears set to make substantial changes to the way it operates in order to overcome the external factors over which it has little control.

I expect LUV stock to appreciate throughout 2024 with particular inflection points coming as it lays out changes to its business model.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LUV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.