Summary:

- Southwest’s market share dipped in 2022 amid rising low-cost competition, while overall airline revenues continued growing.

- Southwest’s low-cost model and strategic decisions provide better margins compared to competitors.

- Best balance sheet in the U.S. airline industry.

- LUV’s projected 5-year stock price CAGR is 21%; dependent on stable economy.

Boarding1Now/iStock Editorial via Getty Images

INVESTMENT THESIS

I believe Southwest Airlines (NYSE:LUV) stock is a buy. Assessing the market dynamics over the last year, it’s clear that Southwest Airlines navigated a mix of challenges and resilience. The airline saw a reduction in market share, driven by the emergence of low-cost competitors, signaling a changing landscape in the aviation sector. Despite this hurdle, I opine that Southwest’s steadfast low-cost model and strategic choices like point-to-point routing and the exclusive operation of Boeing 737 aircraft have granted it a competitive advantage, leading to superior margins compared to competitors. This operational adeptness is further exemplified by boasting the best balance sheet in the U.S. airline industry, indicative of a solid financial base. As we look ahead, the projected 5-year stock price Compound Annual Growth Rate for LUV is an encouraging 21%, although this hinges on a stable economy.

COMPANY OVERVIEW

Southwest Airlines follows a low-cost model, mainly earning from ticket sales, extra services like baggage fees, and partnerships. Key to its model are low-cost operations, customer focus, and a strong corporate culture. It competes with major U.S. airlines like American Airlines (AAL), Delta Air Lines (DAL), and United Airlines (UAL), among others. In my view, Southwest’s distinct low-cost, customer-centric approach sets it apart in a competitive market.

SOUTHWEST’S LOW-COST MODEL

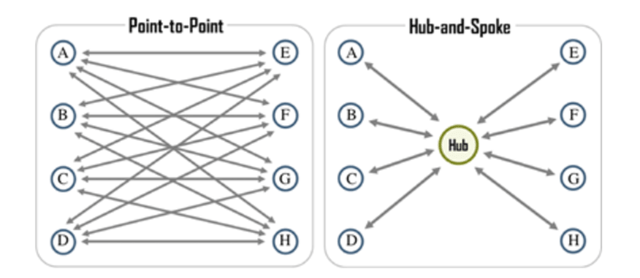

Southwest Airlines operates on a low-cost model, which proved resilient even during the pandemic. At the core of this model is a point-to-point structure, the exclusive use of Boeing 737 aircraft, and operations from secondary airports. Unlike the hub-and-spoke model used by many airlines, the point-to-point model aids operational efficiency by simplifying flight routes and minimizing delays. Additionally, using only Boeing 737 aircraft simplifies training, maintenance, and operations. A standardized fleet allows for easier training of cabin crews and support staff, streamlined maintenance, and a simplified inventory of spare parts. In case of a breakdown, an alternate aircraft can be arranged quickly. Southwest’s policy of not assigning seats is also beneficial. It speeds up the boarding process as customers can take any available seat, reducing boarding time. This policy is also helpful in situations where an alternate aircraft is used, reducing the turnaround time.

The Geography of Transport Systems

In my view, these strategic decisions lead to reduced operational costs, thereby improving margins. These strategies provide Southwest with a competitive edge in the aviation sector. Despite challenges like the pandemic, the low-cost model of Southwest ensures steady operational efficiency, supporting better margins and a sustainable operational setup.

INCREASED LOW-COST CARRIER COMPETITION BUT OVERALL MARKET IS GROWING

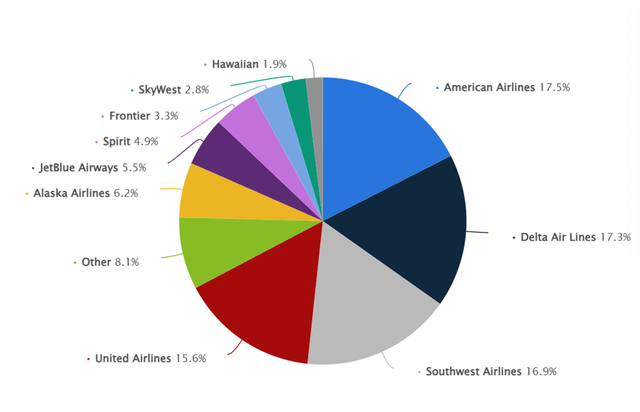

In 2022, Southwest Airlines faced a dip in market share, indicating a shift in the U.S. aviation sector. The market, largely held by four major players including Southwest, saw a shift as low-cost competitors began making inroads. This change was partly due to the pandemic’s aftermath which altered consumer behavior and market dynamics. Southwest’s market share decreased by over 3%, going from 20% in 2018 to 16.9% in 2022, amid growing low-cost competition. Meanwhile, American Airlines, Delta Air Lines, and United Airlines managed to expand their market shares during this period.

On the other side, smaller low-cost carriers like JetBlue, Alaska Airlines, Spirit, and Frontier saw a rise in their market shares. Their growth hints at a potential shift in market preference towards budget-friendly travel options, perhaps influenced by the economic strains from the pandemic. The competition from these lower-cost players indicates a more diversified and competitive market, which has affected the market share of Southwest.

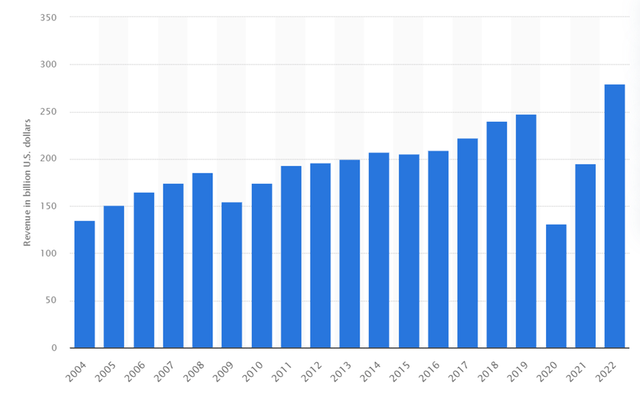

While the competition is reshaping market shares, overall airline operating revenues have been increasing over time, indicating a growing market. From 2004 to 2022, total operating revenue streams of U.S. airlines went from 134 billion to 280 billion (see below). In my opinion, this trend is likely to continue, benefiting the whole industry. The increasing revenues show a recovering and expanding industry, where airlines are partaking in a larger revenue pool, despite new challenges and competitors in the field.

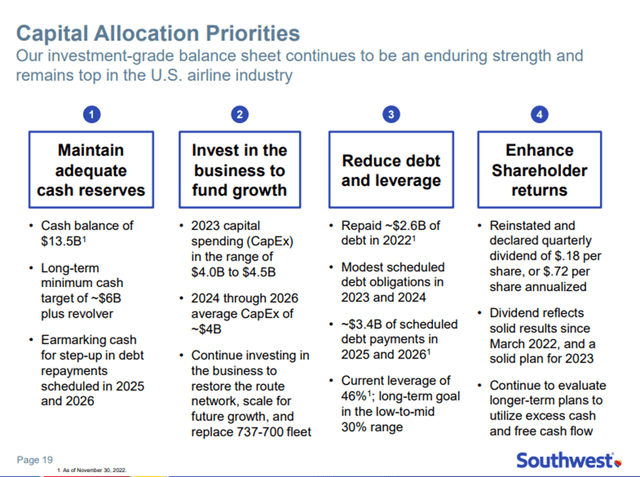

INDUSTRY LEADING BALANCE SHEET & CAPITAL ALLOCATION

Southwest Airlines, showcases a robust balance sheet, which is a rarity in the airline industry. One of the primary focal points of LUV’s capital allocation strategy is to maintain adequate cash reserves. The current ratio for Southwest Airlines stands at 1.25. This figure suggests that for every dollar of liabilities, LUV has $1.25 in assets. Essentially, it indicates that the company can comfortably cover all its short-term liabilities over the next 12 months. With a cash balance of $13.5 billion and a long-term minimum cash target of approximately $6 billion, this in my view demonstrates management commitment to financial stability and preparedness for unforeseen challenges, unlike most of their competitors. This is further underlined by their strategy of earmarking cash for step-up debt repayments scheduled for 2025 and 2026. Simultaneously, LUV is investing in its business to fuel growth, with a projected capital expenditure ranging from $4.0 billion to $4.5 billion by 2026. Debt management also forms a crucial part of their capital allocation, evidenced by the repayment of $2.6 billion in 2022 and planned payments in the subsequent years. Last but not least, LUV is taking significant steps to enhance shareholder returns. The reinstatement of a quarterly dividend at $0.18 per share signifies the airline’s robust financial performance and its commitment to rewarding shareholders. In sum, Southwest Airlines’ capital allocation priorities reflect a risk-adverse approach.

LUV 2022 Investor Day Presentation

FINANCIAL ANALYSIS

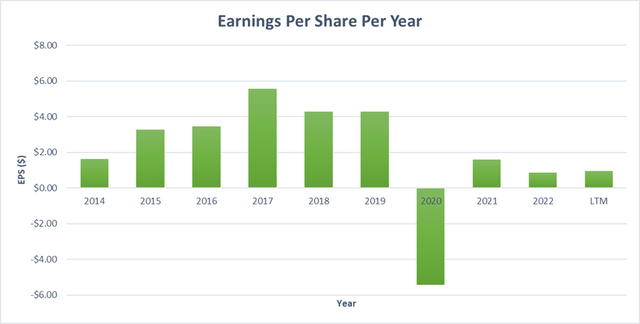

Over the last five years, LUV has faced financial hurdles. Revenue has been erratic, swinging from $21,965.00 million in 2018 to $9,048.00 million in 2020 to $25,135.00 million in the trailing 12 months of 2023. In my view, the Earnings Per Share (EPS) is very inconsistent given the cyclical nature of the airline industry. We can see that in reasonable good conditions, LUV is profitable where in 2018 EPS was $4.29, though in 2020 it was -$5.44 and in the last twelve months it was $0.94.

Looking ahead, if the economy remains resilient and travel demand is steady, LUV as a business will perform well, however as soon as a downturn approaches due to the high fixed costs and low margins (even though LUV has the best in the industry), LUV will suffer losses. However, unlike most airlines, LUV has a strong balance sheet that should be able to handle a moderate economic downturn. Therefore, as an investor, if you want to own an U.S. airline, I believe LUV is your best option.

VALUATION

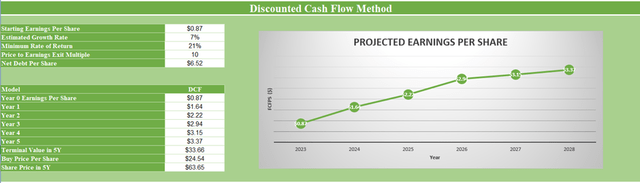

In my opinion, valuation should be a comparison between the market capitalization and the underlying business fundamentals, including future earnings. One method I find useful for this is a discounted cash flow (DCF) analysis. As of Q2, 2023, LUV’s current TTM earnings per share is $0.87. Using analyst EPS estimates for the next 3 years, then a growth rate of 7% for the following two years, the projected earnings per share for LUV by Q2 2028 would be $3.37.

Using an exit multiple of 10, which is based on what is reasonable for an airline in a stable economic environment over the past decade, the estimated price target for the stock in five years would be $63.65. Therefore, if you invest in LUV at its current share price, the expected Compound Annual Growth Rate would be about 21% over the next five years, based on these calculations. It should be noted that this 21% stock price CAGR assumes that the consensus analyst estimate plays out and that we face no economic headwinds that would affect travel demand for the next 5 years. Obviously, the return will be worse if something unforeseen happens to the economy.

CONCLUSION

In light of the market dynamics in the last year, it’s evident that Southwest Airlines faced a blend of challenges and resilience. The airline experienced a dip in market share due to the rise of low-cost competitors, reflecting a shifting landscape in the aviation sector. Despite this challenge, I believe Southwest’s enduring low-cost model and strategic decisions like point-to-point routing and exclusive use of Boeing 737 aircraft have endowed it with a competitive edge, contributing to better margins compared to competitors. This operational efficiency is further epitomized by having the best balance sheet in the U.S. airline industry, showcasing a solid financial foundation. Looking ahead, the projected 5-year stock price Compound Annual Growth Rate for LUV is an optimistic 21%, although this is dependent on a stable economy. I interpret this growth projection as an indicator of Southwest’s potential for sustained profitability and market position, underpinned by its low-cost model and robust balance sheet. As the overall airline revenues continue on an upward trajectory, I believe Southwest’s strategic approach places it in good stead for navigating market competition and economic fluctuations, maintaining its reputation and financial stability in the long term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.