Summary:

- The entire airline industry is forecasting a strong demand environment for 2023.

- Southwest Airlines has a stronger balance sheet than legacy carriers allowing more flexibility to improve operations.

- It is unlikely that Southwest will repeat its operational meltdown in December due to the reasonable and achievable investment goal to prevent a future meltdown.

Boarding1Now

Introduction

The combination of Southwest Airlines (NYSE:LUV) operational troubles in December of 2022 and recent macroeconomic concerns have led to the overall downward trajectory of Southwest Airlines stock. There are fears of repercussions of the operational trouble, such as, consumers turning their back on the company if any form of this trouble occurs again in the future. Also, as the macroeconomic conditions continue to be choppy, concerns regarding the future travel demand persist. However, because I believe Southwest Airlines’ plan to boost operational resiliency is both reasonable and achievable while the demand environment for the airline industry stands strong, I am bullish on Southwest Airlines. Especially as the company’s exceptionally strong balance sheet offers investors dividends, future growth, and some levels of shield from future calamity. Therefore, I believe Southwest Airlines is a buy.

Overall Demand Environment

As I have mentioned in my Delta Air Lines (DAL) report, all the major airlines in the United States are seeing a positive demand environment in 2023 showcasing a consensus among airlines that 2023 will likely show a great demand environment for the airline industry. Delta Air Lines have stated that the “demand is getting stronger” while American Airlines (AAL) said that there “continue[s] to be decent pricing” environment. United Airlines (UAL) gave a positive comment for the full year 2023 as well by saying that “the outlook looks really strong.” Although United Airlines downgraded its first-quarter forecast, the company maintained its 2023 forecast. Then, Southwest Airlines, apart from the losses incurred due to the operational failure in December, says that “March revenue trends are encouraging.” Further, the company ensured that the “bookings for the second quarter appear solid” as the “overall booking curve [is] now generally in line with pre-pandemic trends.” As such, I believe it is reasonable to argue that the airline industry, including Southwest Airlines, is seeing a positive demand environment for 2023.

Southwest Airlines’ environment surrounding fuel costs is shaping to be positive for the company as well. The company’s management team has said that “based on the current forward curve for jet fuel, [the company’s] improved fuel cost outlook has more than offset [the company’s] 2023 CASM-ex outlook.” This outlook, in my opinion, is credible as the International Energy Agency’s view is that there will be a surplus in supply for the first half of 2023. While a supply deficit is mentioned as a possibility in the second half of 2023, the agency mentions that it is reliant on recovering demand from China.

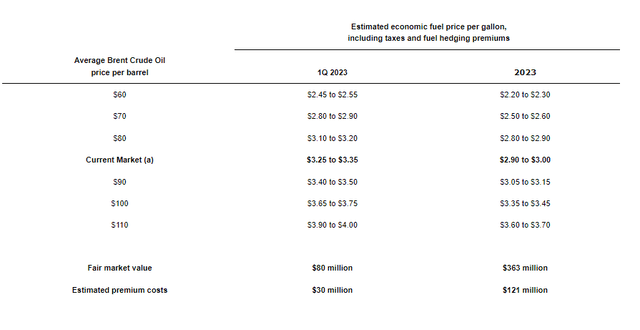

Digging deeper into the details, as the picture below shows, during Southwest’s most recent earnings report, the company’s fuel cost estimates were at around $85 dollars per barrel; however, as the current market rate sits significantly below this level at about $70 per barrel with an expectation for this trend to continue throughout the first half of 2023, the overall oil pricing environment for Southwest Airlines is positive.

Strong Balance Sheet

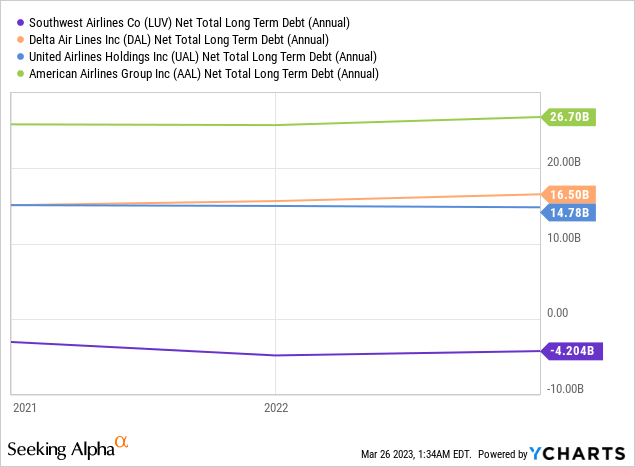

Beyond the strong air travel demand environment that applies to all airlines, Southwest has its unique strength in the balance sheet as the company’s balance sheet is stronger than other major airlines including Delta, United, and American Airlines.

As the chart above shows, when comparing American, United, Delta, and Southwest Airlines’ net total long-term debt, Southwest is the only company with a negative figure, which means that the company does not have a net debt. Southwest’s cash position is $4.2 billion greater than its total debt unlike United, Delta, and American Airlines showcasing the strength of Southwest’s balance sheet.

This strength in the company’s balance sheet, in my opinion, drives additional value for investors that other airlines may lack. First of many is dividends, with Southwest’s strong balance sheet and operational margins, the company is the only airline to offer dividends. Second, the company, to some extent, will likely be shielded from future calamities, but most importantly, the company’s strong balance sheet allows Southwest to drive future growth opportunities. The company, even with the youngest fleet among the US carriers, continues to actively replace its old and less efficient aircraft with more efficient Boeing 737 MAX series. In 2023, the company is expected to take the delivery of about 90 aircraft while retiring 27 aircraft. Considering that Southwest’s old Boeing 737-700 is about 18% more efficient, the company’s operational efficiency will continue to tick upwards. Overall, I believe that Southwest can be more active in replacing its old fleet compared to its peers continuing to keep the youngest fleet due to the company’s strength in the balance sheet. Southwest Airlines does not have a significant amount of debt that urgently needs to be paid back or refinanced. Therefore, I believe Southwest Airlines’ strong balance sheet offers unique strengths.

Future Proofing Systems

Southwest had an operational meltdown in its systems in December 2022. The company stated that the “impact continues to be largely isolated to January and February.” However, the bigger risk, in my opinion, comes not from temporary losses but from customers starting to doubt Southwest’s operational ability. If there are any more operational meltdowns such as the one of 2022, the damage that comes from customers’ preferences will be astronomical; thus, I believe it is paramount that investors assess Southwest’s plan to enhance its operational resiliency.

Looking at the three-point plan the company released, I believe the company’s goal of enhancing its operational resiliency is both reasonable and achievable. First, Southwest will be accelerating operational investments for the next five years to modernize its system. The airline plans to spend more than $1.3 billion to upgrade and maintain information technology systems in 2023. Crew optimization, scheduling, and customer phone system have been a priority. Considering that this particular step directly addresses the problem from the December operational meltdown, with an ample budget, I believe the company is taking an initial reasonable step toward modernizing its systems. Second, to prepare for winter operations, the company is investing in infrastructure and equipment including deicing trucks, deicing pads, deicing fluids, engine covers, and engine heaters, and preparing winter staff. Finally, the company is investing to make cross-team collaboration more efficient and effective by aligning network planning and operations control teams under one senior leader. I believe these solutions to be both reasonable and achievable to prevent a future meltdown in winter operations. As such, I believe it is reasonable to argue that the risk of future operational meltdown and the following change in consumer preference is an unlikely event.

Risk to Thesis

Macroeconomic concerns pose ample threat to Southwest Airlines’ positive 2023 forecast. Even if the company has one of the strongest balance sheets in the airline industry or even if the company works toward future-proofing its operational systems, major macroeconomic events can potentially derail Southwest Airlines’ 2023 estimates. Investors should be cautious of the current financial sector risks after the fall of Silicon Valley Bank and routs regarding Deutsche Bank (DB) and First Republic Bank (FRC).

Summary

Even after the operational meltdown in December, I believe Southwest is an attractive stock. Not only are multiple airlines projecting a strong demand environment for 2023, but the oil price is also showing a declining trend. Further, Southwest Airlines has the strongest balance sheet compared to United, American, and Delta Air Lines, which gives the company more freedom to continue focusing on upgrading its fleet to a new and efficient model instead of paying down high-interest rate debt. Finally, as the company laid out a reasonable and achievable goal not to repeat its operational meltdown in 2022, the potential future risk of consumers’ preference turning against the company became an unlikely scenario. Therefore, I believe Southwest Airlines is a buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DAL, LUV over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.