Summary:

- Southwest Airlines Co. has faced numerous challenges, including an operational meltdown and self-inflicted internal issues.

- The airline has made efforts to fix its operational problems and improve its performance, but its complaint ratio remains elevated.

- Southwest is also dealing with higher fuel costs and labor cost challenges.

- Delivery delays for the Boeing 737 MAX 7 are negatively impacting Southwest’s growth.

Southwest Airlines Boeing 737 takes off from Las Vegas rypson

Southwest Airlines Co. (NYSE:LUV) continues to slog through a very challenging year, or annus horribilis as the great British Queen Elizabeth 2 referred to 1992 for the royal family. Southwest’s annus horribilis started not in calendar 2023, but well before 2022 came to an end. Like the great British monarch, Southwest has handled its travails with grace. It can’t be missed that some of the challenges facing Southwest, as was true with the head of the House of Windsor, are self-inflicted and internal even as other disasters couldn’t have been predicted or controlled.

Truth be told, the decade of the 2020s so far hasn’t exactly been great for Southwest Airlines. Its 50th anniversary fell squarely in the middle of the global covid pandemic which itself has resulted in a host of changes in societies and economies around the world, some of which remain unresolved and some of which have resulted in significant changes for business, including the airline industry. With earnings season approaching for the U.S. airline industry and as guidance comes in for the end of the year, a review of Southwest’s current challenges and how quickly they might start putting them in the rearview mirror will be helpful.

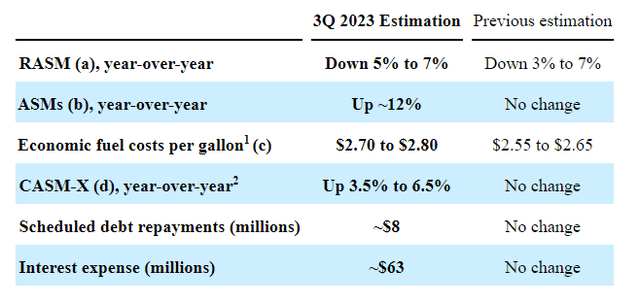

LUV guidance 3Q2023 as of 6Sep2023 (Seeking Alpha)

Moving Beyond the Christmas 2022 Meltdown

One of Southwest’s most negatively defining moments in history was its operational meltdown that took place between Christmas 2022 and New Years. The post-mortem has long since been completed and the conclusion is overwhelmingly that bad weather in multiple major Southwest bases – hardly a surprise given the time of the year – literally snowballed to the point that LUV lost control of its operation and ended up having to bring most of the remaining flights to a halt in order to restart their operation in a reliable manner, which finally happened by New Years 2023. Southwest blamed the operational meltdown on the massive number of crew schedule changes that pushed their systems beyond design capacity and left planes and crew members badly out of position. Throw in technology that is still well behind what other large airlines have – let alone the largest single airline operator in the Western world – and LUV’s operational meltdown was long overdue in many respects.

Thankfully, Southwest has worked hard to try to fix the causes of the operational meltdown. It has moved as quickly as it can to put automation fixes into place although the total rebuild of LUV’s operational systems will take years. In the meantime, the Dallas-based airline has been very conservative in pre-cancelling flights during expected bad weather to ensure it does not lose control of its operation. With the eyes of the U.S. Dept. of Transportation casting a caustic eye on Southwest, the airline has recorded some of the best operational performance in its history.

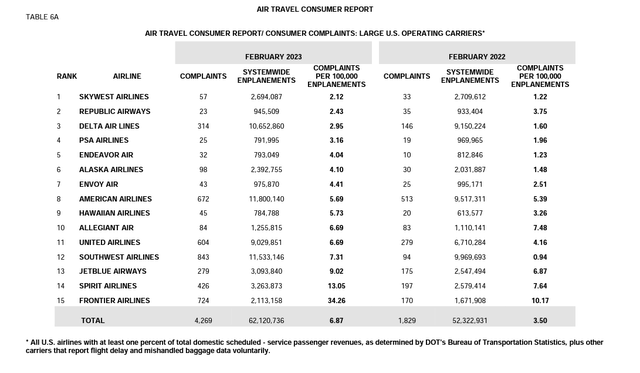

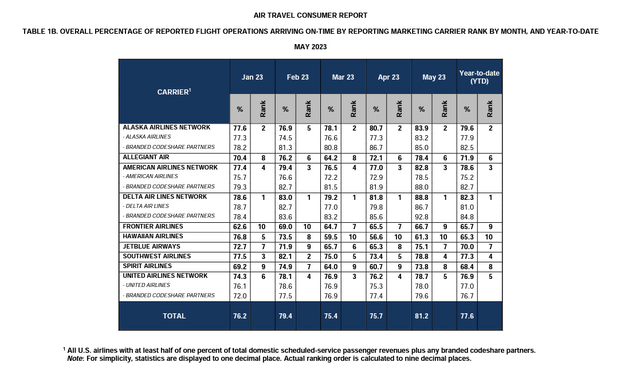

The DOT has been very slow to release its Air Travel Consumer Report, but its data through May 2023 shows Southwest in fourth place out of 10 U.S. airlines, behind perennial leader Delta (DAL) and consistent runner-up Alaska Air (ALK) and right behind American (AAL) – which has focused on improving its own operational reliability. Southwest’s position puts it ahead of United (UAL)- which had an operationally challenging summer (not yet in released DOT data) and the entire rest of the low-cost carrier segment of the industry. DOT data on consumer complaints, updated only through February 2023, shows that Southwest’s complaint ratio is still elevated compared to historic levels.

DOT airline consumer complaints Feb 2023 (DOT Air Travel Consumer Report) DOT airline on-time May 2023 (Air Travel Consumer Report)

Southwest recognized that its operation wasn’t sufficiently prepared for winter and it is certain to face the reality that its operations can no longer represent its namesake geography given that it has major operations in cities including Baltimore, Chicago and Denver. Operationally, the chances of another repeat of its billion dollar operational mess are very remote. Southwest spent months stimulating traffic that it lost and convincing some of its previously loyal travelers that it was safe to trust their travels to LUV again. By summer, it appeared that Southwest had regained its revenue position among U.S. domestic airlines. We’ll get to the weakening revenue environment which is weighing on Southwest later in this article.

Higher fuel costs

The increase in higher fuel costs is not helping Southwest, even if it is in the best position among U.S. airlines to weather higher fuel prices. LUV is the only U.S. airline that has consistently hedged a significant amount of crude oil in order to manage its jet fuel costs. While LUV’s fuel cost reduction strategies via hedging have been the most successful over time, LUV has lost money on its hedges but is able to carefully balance hedge losses with gains.

Crude Oil Futures 26sep2023 (Seeking Alpha)

Part of the current increase in jet fuel costs is related to the jet fuel crack spread, the cost to refine oil into jet fuel. Historically, the jet fuel crack spread has been around $10/bbl but is running near $40/bbl which is driving a significant portion of the increase in LUV’s fuel costs. Hedging cannot offset refinery-related costs while Delta’s refinery strategy has been very effective in managing crack spreads. DAL has the second most effective fuel cost reduction strategy, but both LUV and DAL enjoy competitive advantages in an industry that gives up tens of millions of dollars in profit with every dollar increase in the cost of a barrel of oil.

Labor cost challenges

Southwest’s annus horribilis started long before its operational mess. Airline labor groups had been trying to regain what they lost during the pandemic since most airline labor contracts came up for renewal during the pandemic; since airline labor contracts don’t expire, pilot unions took the strategy of keeping a running tab of the pay they had forfeited because of not having their pay lifted as the industry recovered and handed the tab to airline managements during negotiations. United and then American each came up with tentative proposal settlements early in 2022 but both were shot down by union leadership or the pilots themselves.

The breakthrough for pilots came when Delta reached agreement in early December 2022 with its pilots for the then-largest airline contract improvements that would cost that airline more than $7 billion including retro pay; American and United have come to agreements with their pilots, largely copying the financial components of the Delta contract. Southwest has to come to agreement with its pilots who have vote to authorize a strike, but that can only happen when federal labor leaders agree that the negotiation process is no longer working and they have specifically said that the process needs to continue to work. Authorization to strike votes are common in the airline industry but often help lead to accelerating an agreement.

Pilots aren’t the only labor group that was looking for improvements in pay and benefits in the midst of a period of high inflation. Delta moved fairly quickly to extend pay raises to the remainder of its workforce, which is largely non-union. While not as rich as what pilots received, the increased labor costs for the big 4 airlines will amount to billions of dollars per year for all labor groups. Delta gave boarding pay to its flight attendants for the first time among large U.S. airlines; historically, U.S. airline crewmembers in both the cockpit and cabin were not paid for time boarding the aircraft or preparing it for flight but only when the door is closed. Delta’s move to add boarding pay will particularly impact Southwest which operates more flights on its own aircraft than any other airline; Delta operates slightly more flights in total but some are on regional jets and the operators of those regional jets negotiate their own labor agreements.

Southwest’s large number of short and medium haul flights means that LUV flight attendants will receive hefty pay raises just by including boarding pay. LUV reached an agreement with its flight attendant union earlier this year but union leadership rejected the proposal before it was sent for a membership vote.

The sheer size of these labor cost increases comes with many asking why airline labor costs are increasing so much and how airlines can afford them. Delta’s contract proposal with its pilots came fairly early in the post-COVID labor environment and, besides other airlines, railroad and UPS employees won substantial increases in pay, even if less than what some union leaders wanted. Autoworkers are pushing the envelope even further with the likelihood that sticky inflation will persist even as the Fed tries to slow inflation.

Delta, quite simply, was in the best position in the airline industry to reach agreement with its pilots and then to quickly move to pass raises along to its non-pilot personnel. DAL has long been able to generate more revenue per unit of production than other airlines and that revenue premium is accelerating post-COVID because of the airline’s investment in its products and services, supplemented by its industry-leading loyalty program and credit card arrangement with American Express AXP.

Southwest’s egalitarian approach to travel has opened air travel to millions of passengers that otherwise would not fly, but the LUV model is not generating the amount of revenue that the full-service global carrier model is delivering due to a growing desire among some segments of the population to distinguish themselves with higher quality and distinctive travel services and experiences. It certainly wasn’t lost on Delta executives that other airlines could not support high labor costs as well as Delta could; the low-cost carrier segment has struggled to deal with soaring costs and tight supply chains.

The compound effect of pilot and flight attendant pay increases will add greatly to LUV’s expenses when settlements are eventually reached and voted in by membership. In the meantime, many Southwest employees are becoming increasingly impatient with the pace of pay raises, a significant development for a company that, although highly unionized, has had great employee relations due to its above-average employee compensation.

It is highly notable how much the times have changed. LUV’s current pilot contract limits the ability of the airline to attract pilots compared to the big 3 and is leading to grounding of aircraft in addition to the time limits that many of Southwest’s older aircraft face; regardless of whether fleet age or pilot contract related, LUV has dozens of aircraft out of service, and that is resulting in hundreds of millions of dollars per year in lost revenue.

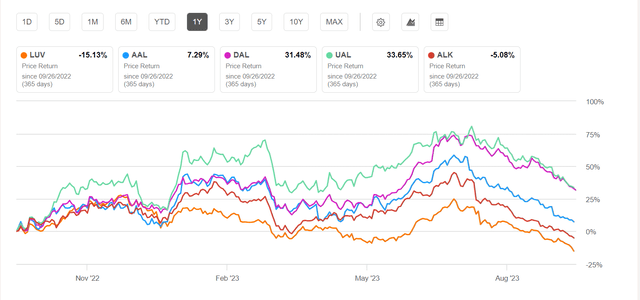

LUV vs industry 1 year chart 26sep2023 (Seeking Alpha)

MAX 7 delays, stalled growth

Increasing revenues is essential if LUV is going to be able to support new labor contracts and yet Southwest has faced a five-year battle in getting its Boeing 737 MAX 7 aircraft delivered due to certification issues on Boeing’s side. The MAX’s grounding due to two fatal foreign crashes forced the airframe manufacturer to rework the electronic systems on the MAX that allowed the aircraft to handle the heavier and differently placed engines compared to former versions of the 737. The crashes also highlighted the unhealthy certification process by the FAA, which heavily relied on Boeing to test and self-certify many of its aircraft’s systems.

The FAA has been extraordinarily rigid in its oversight of Boeing and has ground certification of the MAX 7 and MAX 10 models, the smallest and largest models, respectively, of the MAX family. Congress stepped in to provide Boeing with some wiggle room to avoid costly redesigns because the MAX does not meet current design requirements but Boeing continues to struggle to complete all of the tests and documentation to certify the MAX 7, of which LUV is the largest and launch customer, and the MAX 10, of which UAL is the largest and launch customer.

Delivery delays for the MAX 7, which is very similar in size to the 737-700 from the previous generation of the 737 family, has forced LUV to keep scores of 737-700s in service that the airline would like to retire. As MAX 7 delays stretch on, Southwest is being forced to squeeze its 737-700 fleet much harder to get the last remaining time out of its – 700 fleet since aircraft have required maintenance at designated flight and time intervals and many of its -700s are nearing the end of their lives unless costly overhauls are performed.

Throughout the MAX 7 delays, LUV has been substituting larger MAX 8 aircraft but the MAX 8 seats about 30 more passengers and requires one additional flight attendant so the economics of flying the larger model are unfavorable esp. for an airline that has built its route system on point-to-point flights with high percentages of local passengers (those that fly just one segment with an airline) rather than those that connect at a “hub” or stay on a flight for several segments. The larger aircraft has diminished LUV’s ability to optimize revenue performance.

Since the lead time for delivering a narrowbody (single aisle) aircraft is about one year after order commitment, LUV has been forced to convert MAX 7 orders to MAX 8s based on Boeing’s expectations for MAX 7 certification, resulting not only in a lag time in getting the right size aircraft into LUV’s fleet when the MAX 7 is finally certified but also reducing the total number of aircraft that LUV can receive since a number of MAX 7s are already built and being stored by Boeing awaiting certification. Once the MAX 7 is certified, LUV could receive large numbers of aircraft in a fairly short period of time.

LUV vs industry growth 26Sep2023 (Seeking Alpha)

Delays in fixing LUV’s revenue problem

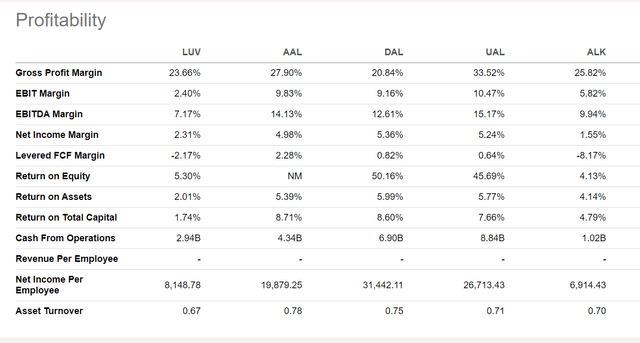

The greatest benefit of getting the MAX 7 into LUV’s fleet will be that it starts to correct LUV’s revenue problem. All of the low-cost and ultra low-cost sector is struggling with supply chain issues and have had to dramatically slow their growth. Since low-cost carriers grow capacity in order to keep unit costs from growing, the delay of the MAX 7 is part of what is slowing LUV’s revenue growth which has been below the big 3 global carriers, American, Delta, and United.

There are significant competitive considerations if LUV is able to get the MAX into service. A number of low-cost carriers have other supply chain or manufacturer issues that they are dealing with, including the Pratt and Whitney (RTX) Geared Turbofan defects which are taking A321NEO aircraft out of service for inspections or rebuilds at several low-cost carriers. If LUV is able to put the MAX 7 into service before those engine issues are resolve, LUV could be able to regain market share in a number of markets including Florida. And the reduced low-cost carrier capacity will help push up industry yields, esp. during the winter as macroeconomic concerns in the U.S. domestic market pressure travel demand.

Southwest will also gain relative to United; the two compete more against each other than any other combination of the big 4 airlines. LUV and UAL are both aggressively trying to grow in Denver where the airport is opening dozens of new gates. Both airlines are also competing in major Texas markets. Most importantly, United has committed to large numbers of the MAX 10 as part of the Chicago-based airlines’ massive fleet expansion and replacement program. The MAX 7 will be certified before the MAX 10; while UAL has been changing its MAX 10 orders to MAX 8s and 9s, they are facing the same challenge as LUV in having to make model conversions a year or more in advance and will face a period when the supply of newly certified MAX aircraft will not be able to catch up with promised deliveries.

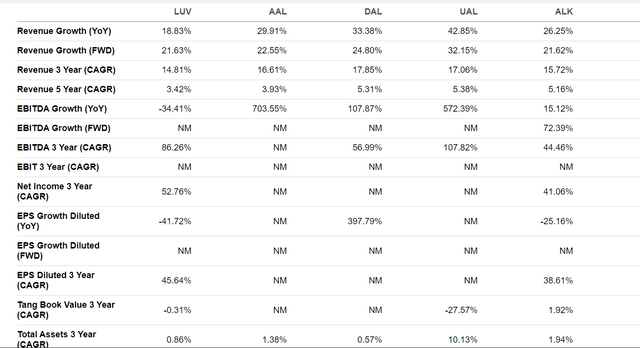

LUV vs industry profitability 26Sep2023 (Seeking Alpha)

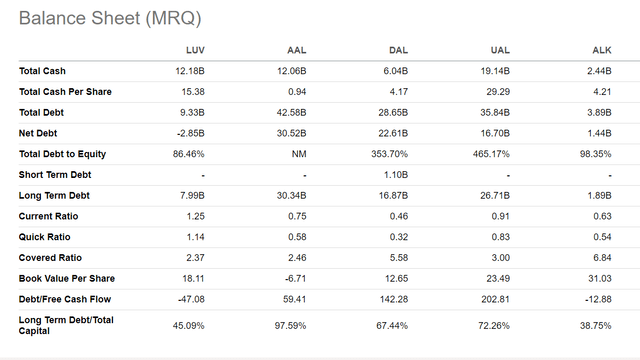

Balance sheet built to weather transition

Southwest’s greatest competitive advantage is its balance sheet, which is simply the best in the business, built through years of consistent profitability. LUV is in a positive liquid asset position compared to debt which has buoyed its stock value despite low or absent profitability. Ironically, the Boeing MAX delivery delays are helping improve LUV’s balance sheet, since Boeing continues to credit Southwest with customer compensation which is being used to reduce the cost of future 737s. It is LUV’s balance sheet that will give it the bandwidth to endure the current period of higher costs and reduced revenue. LUV pays a dividend with a FWD yield of 2.62%.

LUV vs industry balance sheet 26Sep2023 (Seeking Alpha)

Southwest has proven over nearly 50 years of being very capable of adapting to changing market dynamics and I believe they will do the same this time as well. Their egalitarian product is, in many ways, less attractive than it has ever been. The air travelers that are less subject to macroeconomic factors are spending more of their travel money for premium and long-haul travel experiences; while those dynamics could change, LUV for now is at a disadvantage to the global legacy carriers.

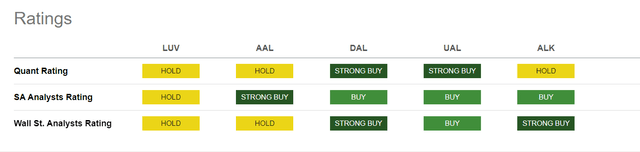

LUV vs industry ratings 26Sep2023 (Seeking Alpha)

Southwest is paying a very high price for its loyalty to Boeing and for its refusal to consider a second aircraft type which would complicate operations and increase costs. This would not have left LUV in the very slow growth position it is currently in as a result of its reliance on the 737.

LUV stock has been hammered more than it should have been, but improvement is closely tied to the resolution of the MAX 7 certification issues. I believe Boeing will get the MAX 7 certified in the next few months and Southwest Airlines Co. will be able to address its financial performance and its most significant strategic issues.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LUV over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.