Summary:

- Southwest Airlines announced hundreds of millions in costs due to the winter storm.

- Preliminary cost estimate matches my model outcome and is a considerable windfall.

- Buy rating has already shown results for investors.

Angel Di Bilio

Since the massive flight schedule disruptions at Southwest Airlines following a winter storm that unveiled a massive technological shortfall at the low-cost carrier, the airline has been under a magnifying glass. I have covered the reasons that explained why this became such a big issue for Southwest Airlines in particular in a separate report. So, in this report I will not revisit that particular part of the subject, but I will be discussing the costs as Southwest Airlines has disclosed preliminary cost estimates.

Winter Storm Blows Southwest Airlines In A Loss Position

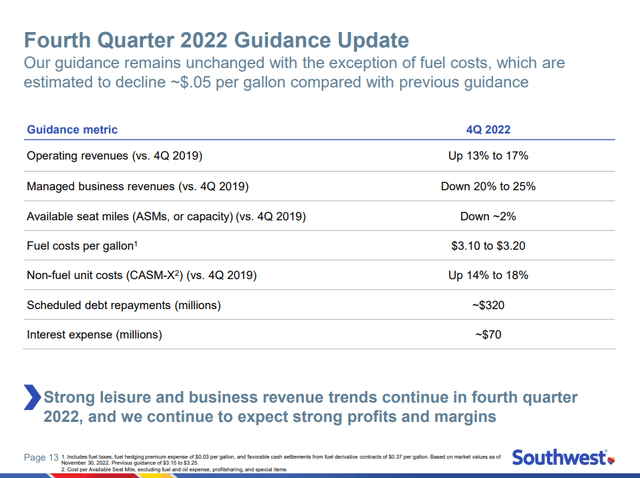

Southwest Airlines Q4 2022 guidance (Southwest Airlines )

Before the winter schedule wrecked the plans of Southwest Airlines and likely that of hundreds of thousands of passenger, the company expected revenues to be up 13 to 17 percent compared to the comparable pre-pandemic period. While no specific operating profit target or margin was communicated, it was clear that the airline was heading towards a strong end of the year. That was of course until the winter storm hit and Southwest Airlines was the only airline that could not stabilize and recover its operations in an acceptable way.

There is extremely little reference data available to quantify the financial impacts of non-recurring items like these. Having covered the Boeing 737 MAX crisis I can say that I have a bit of experience with quantifying the costs of one-off events. With the little data I did have, I estimated costs to be $450 million in a conservative estimate. Southwest Airlines did announce that the impact would be between $725 million and $825 million of which up to $425 million was driven by missed revenues. So, while the conservative number is far off from the total cost figure it does cover the revenue miss rather well and that is also why I already labeled the estimate as conservative at the time of writing. In an estimate that I had not published and planned to publish in the coming days one component of the estimate had already caused a rise to around $575 million.

|

Southwest Airlines Winter Storm Costs Estimate |

|

|

October 2021 disruptions |

$ 75.00 |

|

Frequency scaler |

8.35 |

|

Unit revenue scaler |

1.31 |

|

Cost Estimate |

$ 820.39 |

So, Southwest Airlines has now shared that until year-end more than 16,700 flights were cancelled. I was able to track 15,325 cancellations for Southwest Airlines. So, one difference in the cost estimates already comes from the total flights actually cancelled, contrary to the ones I was able to track down. Basically, all media outlets used the same platform, so none of the media outlets was able to track the full number of cancellations that Southwest Airlines has provided now. The cost estimate is actually rather simple and it uses the October 2021 disruptions and associated costs and scales for two elements. The first scaler corrects for the number of affected flights and the second scaler corrects for the significant increase in unit revenues. By doing so we obtain a cost estimate of $820.4 million. While I generally am wary of scaling in such a way with just one data point as a reference, this is the best we could work with in this case and given that the costs have been estimated to be $725 million to $825 million I would say that the result of this simple model is rather accurate. The result is that Southwest Airlines no longer expects to be profitable for the fourth quarter and that does not come as a surprise.

The Buy Opportunity Already Paid Off

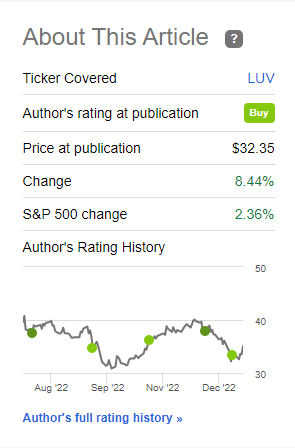

Price since publication (Seeking Alpha)

When I discussed the problems at Southwest Airlines, one thing I already pointed out was that the weakness was a buy opportunity and the results so far speak for themselves. The stock returned 8.4% compared to 2.4% for the stock market. Southwest Airlines partially got carried by the positive market, but I also believe that the costs were somewhat lower than anticipated by the market. I heard stories of passengers receiving compensations that were a tenfold of their ticket prices and that obviously would have meant a massive hit to earnings even bigger than what Southwest Airlines has disclosed now. So, part of the positive response in the share prices is likely the fact that much worse had been anticipated.

Furthermore, I did see a buying opportunity for the simple reason that long term negative impact from brand damage would likely be limited and to be completely fair, the disruptions on the scale we have seen them during the storm do not occur frequently. Most definitely Southwest Airlines has a troubled past with tech as also became clear last year and in 2019, but I believe that with the scale of the disruption faced now and the magnifying glass that Southwest Airlines is under they will accelerate the plans they already had to modernize their system. Assuming the airline will actually modernize in accelerate fashion now, it is somewhat of a de-risk to future operations. It is just too bad, the company was well aware of its technological shortfalls for the complex network they operate and instead of applying $825 million directly to solving that problem they now have to hand that cash or equivalents over to the customers they duped and the inefficiencies in the system that occurred.

Conclusion: Southwest Airlines Winter Storm Cost Are Bad But Not The Worst

I’d say that the costs without doubt are bad and certainly something that Southwest Airlines could have prevented if they would have put higher priority towards developing and injecting new technology into their system. However, the costs are not as bad as expected, the scale on which this has happened in December is something you are unlikely going to witness every year and if the airline has its priorities straight they will make the required technology changes. The company owes that to its passengers as well as its shareholders.

With that in mind, Southwest Airlines stock was a buy and remains a buy for me.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We’re about to raise our subscription prices. If you want full access to all our reports, data and investing ideas at the reduced rate, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.