Summary:

- Southwest Airlines Co. faces challenges due to rising oil prices, labor costs, and uncertain travel demand.

- Despite setbacks, Southwest has shown resilience with strong Q2 results and a focus on strategic growth initiatives.

- The recovery in business travel remains slow, and caution is warranted in the current economic landscape.

Angel Di Bilio/iStock Editorial via Getty Images

Introduction

I do not own shares in Southwest Airlines Co. (NYSE:LUV). However, I care a lot about its business and what management has to say. That’s based on at least two reasons:

- Southwest Airlines is America’s largest regional airline, which means it tells us a lot about consumer health, business travel demand, and the development of aircraft demand. I have close to 20% aerospace exposure (albeit mainly defense-focused exposure) and need insider comments for my research.

- The aerospace industry is tricky and best used as a trading vehicle instead of a tool to generate long-term wealth. Right now, the major theme driving commercial airlines is poor consumer sentiment and elevated oil prices.

When I minored in Aerospace Management & Operations, one of the first things we learned was never to invest in airlines.

Airlines are subject to so many uncertainties and risks. This includes the weather, consumer sentiment, wages, labor availability, energy inflation, competition, and so much more.

The sweet spot is to invest in producers of aircraft and their suppliers. These companies have pricing power and benefit from the long-term uptrend in demand without the many shorter-term challenges.

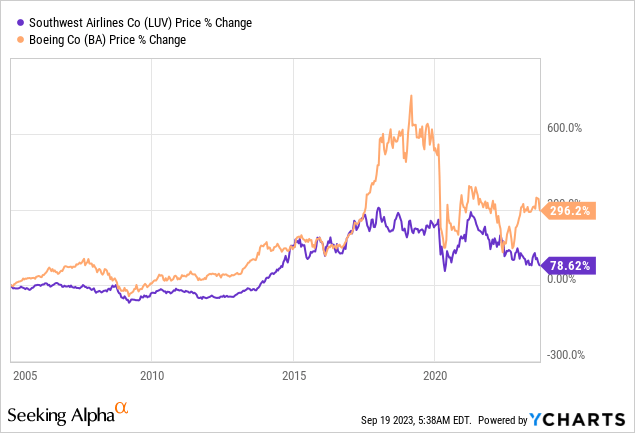

Since 2005, Boeing (BA) has outperformed Southwest by a wide margin despite having so many challenges. Also, bear in mind that Southwest is one of the best-managed airlines in the world. So many players have done worse.

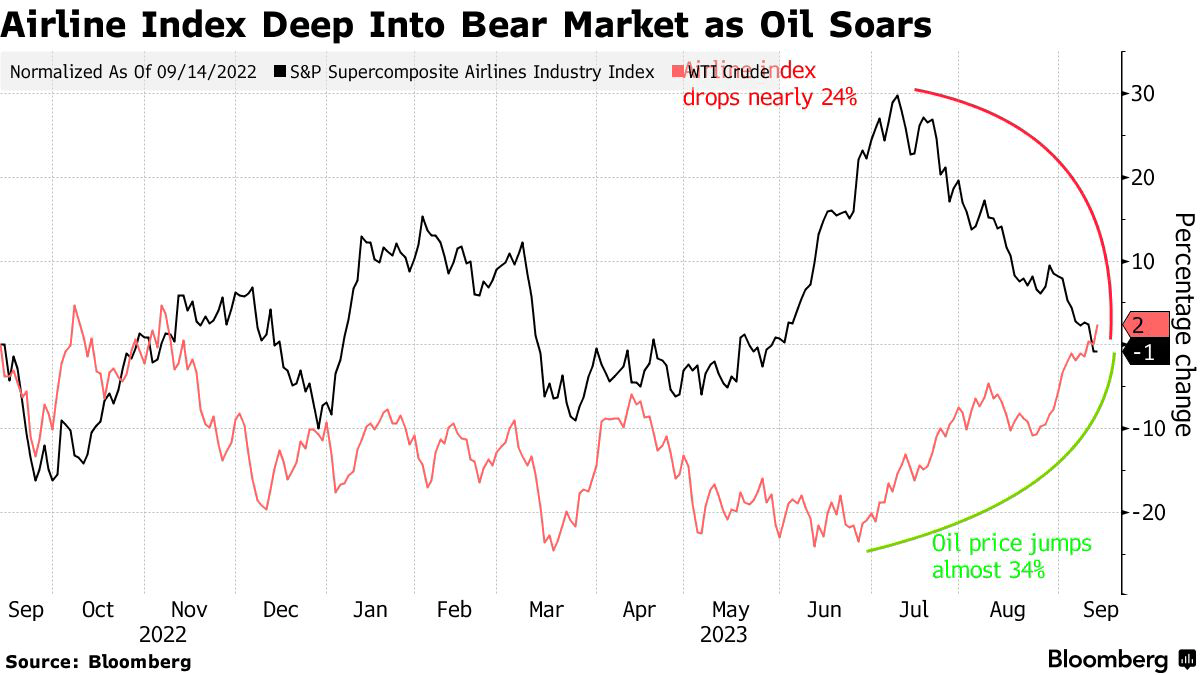

Having said that, new challenges are emerging. As reported by Bloomberg on September 15, airline stocks are tumbling as oil prices are rising rapidly.

As global oil prices surged, propelled further by supply cuts from Saudi Arabia and Russia and general weakness in supply growth, airlines experienced a substantial decline in their stock values.

The sudden spike in oil prices, alongside escalating labor expenses and subdued domestic travel demand, caused several major U.S. carriers to revise their profit projections for the third quarter.

Bloomberg

Analysts’ average profit estimates for U.S. airlines in 2023 and 2024 have also dipped significantly since July.

According to Bloomberg, fuel costs have emerged as a critical risk factor impacting airline profits.

Initially anticipating lower fuel expenses, airlines recalibrated ticket prices for the third quarter, only to face an unexpected and drastic surge in oil prices.

As fuel accounts for a considerable portion of major U.S. airlines’ annual operating costs, the recent oil price rise has increased concerns, pushing it to around 30% in the first quarter of 2023.

My view is that these uncertainties could last for many years, causing air traffic prices to remain high.

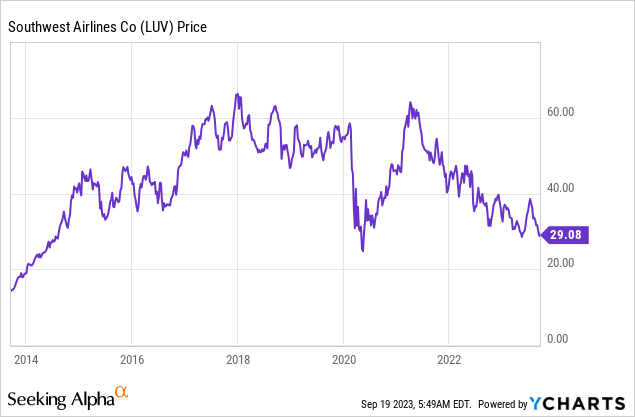

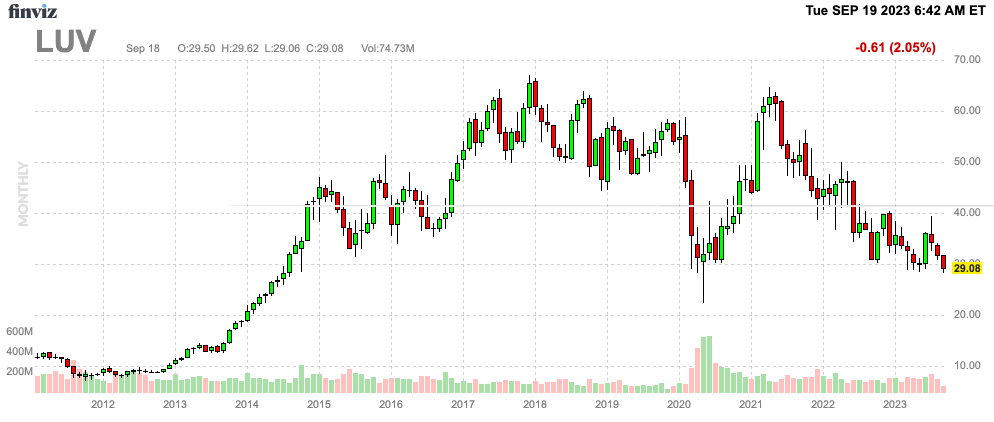

As a result, LUV shares are back at their 2020 lows, falling more than 50% from their 2021 highs.

Having said all of this, let’s dive into the details and see what the risk/reward is like at these levels.

Cautiously Optimistic?

The second quarter results of Southwest were very good – especially in light of its horrible stock price.

In the second quarter, the company achieved a net income of $693 million (excluding special items) and set an all-time record quarterly revenue of just over $7 billion.

During its earnings call, the company noted that the demand for leisure travel remained resilient, resulting in robust bookings throughout the busy summer travel season.

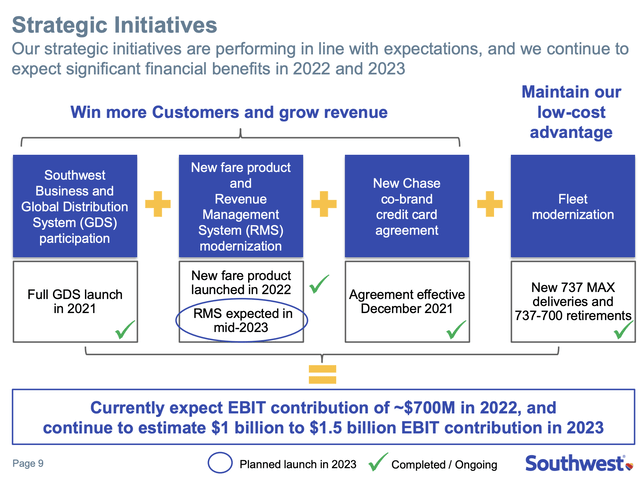

On a full-year basis, the company expects a pre-tax profit contribution of $1.0 to $1.5 billion from strategic initiatives, which were outlined during the previous year’s Investor Day.

Furthermore, despite operational challenges related to weather and other factors, Southwest Airlines achieved the lowest second-quarter flight cancellation rate in the past decade.

Adding to that, in light of challenges since 2018, including the grounding of the MAX aircraft, COVID-19 impacts, supply chain disruptions, and uncertainties in Boeing aircraft deliveries, the company emphasized the need for smooth and predictable capacity growth during its earnings call.

The company plans to finalize details with Boeing for orderly growth, targeting 70 deliveries in 2023 and stabilizing the 2024 plan.

For 2023, the capacity is expected to remain unchanged, with a year-over-year growth of 14% to 15%.

Looking ahead to 2024, the company anticipates adjustments to the network and flight schedules to generate an incremental $500 million in pre-tax profit and a reduction in system capacity development to pre-pandemic levels.

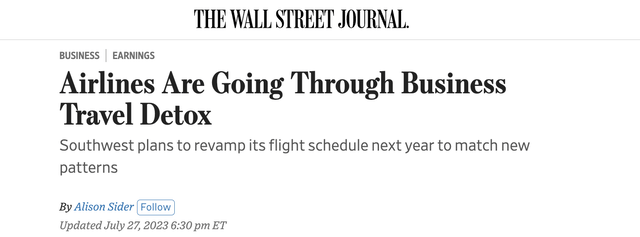

Network adjustments were also highlighted by the Wall Street Journal on July 27.

According to the Journal (emphasis added):

Appetite for travel has roared back in the past two years as pandemic-era restrictions began to fall away, and airline executives have reported soaring demand. But carriers are still navigating what they say might be long-term shifts in who is traveling, when and why.

The big companies whose employees once filled weekday flights, often paying top dollar for last-minute tickets and premium seats, aren’t back in full force. Leisure travel, and an emerging type of trip combining pleasure and work, have taken on more importance.

In its 2Q23 earnings, the company confirmed this, as it reported that leisure travel had broken pre-pandemic levels, while corporate travel requires optimization.

At the September Morgan Stanley Annual Laguna Conference, the company further elaborated on these trends. For example, the company mentioned sequential improvement in business travel from 2Q23 to 3Q23 on a year-over-year basis.

[…] business is just not fully restored. I think the last 10 to 15 points or so of business restoration are going to be stubborn. That’s not unusual. It happened post 9/11. I wouldn’t be surprised. So business obviously drives close-in strength, especially on the fare side. So that may be a piece of it that is not unique to Southwest and that may persist for a while. But even that aside, we’re seeing close-in strength. – LUV (emphasis added).

The good news is that the Global Distribution System (a part of the aforementioned 2022 Investor Day) is paying off nicely. The company noted that its investments since the 2022 Investor Day have led to market share.

Adding to that, the RMS (revenue management system) is working as expected.

We’ve also put in a new revenue management system and very, very pleased with the performance of the system. And one of the things that it does, it has a bias to take a close-in — to see and manage close-in strength. So I think you’ll see performance there. We saw it during the testing. So no, but cut to the chase, I think the close-in strength softness, if you want to call it, that issue really is isolated to August. We’re just not seeing that forward. Now things can change, but we’re not seeing that in September forward. – LUV (emphasis added).

In December, the company will give us more details regarding its strategic progress.

The company acknowledged increased fuel costs but highlighted successful yield performance. Despite rising costs, Southwest maintained strong yields, with fares up YoY.

This brings me to the valuation.

Valuation

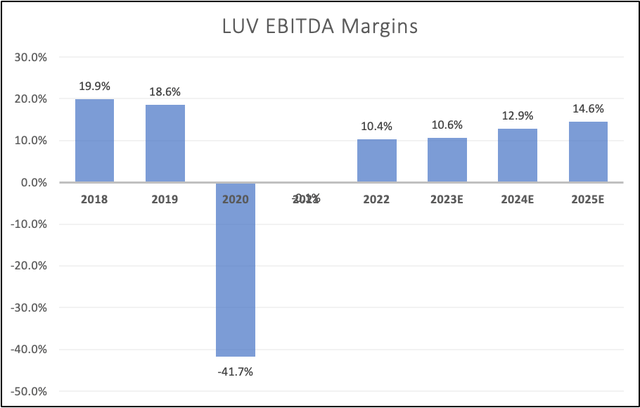

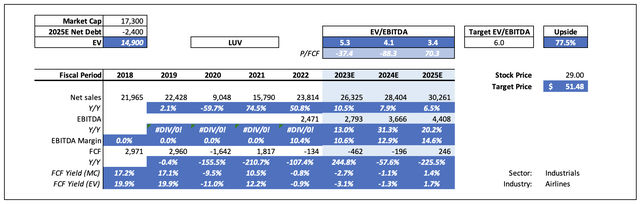

Analysts agree with Southwest’s comments. While the company is far from pre-pandemic margins, EBITDA margins are expected to gradually rise to 15%.

Leo Nelissen (Based on analyst estimates)

Moreover, the company has a healthy balance sheet. It has more cash than gross debt. Next year, the company is expected to end up with $2.4 billion in net cash.

The company has an investment-grade BBB+ credit rating, which is one step below the A-range.

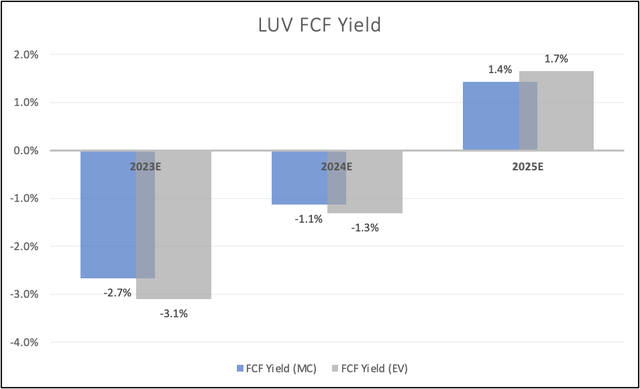

That’s despite close to $4 billion in annual capital spending requirements.

As a result, the company’s free cash flow is not expected to enter positive territory until 2025.

Leo Nelissen (Based on analyst estimates)

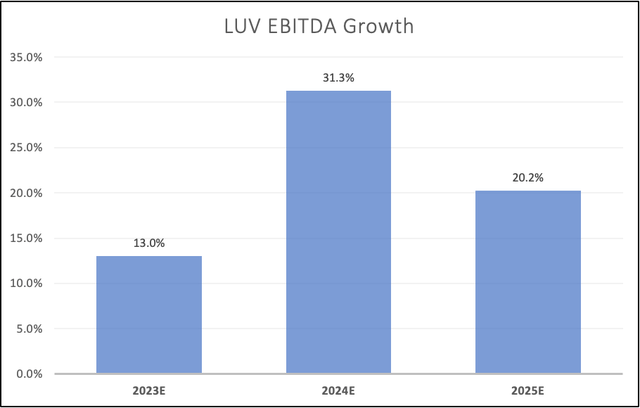

Having said that, consensus expectations are that EBITDA growth will remain strong.

- This year, the company is expected to grow its EBITDA by 13%.

- Next year, that number is expected to be 31% before dropping to 20% in 2025, which is still strong.

Leo Nelissen (Based on analyst estimates)

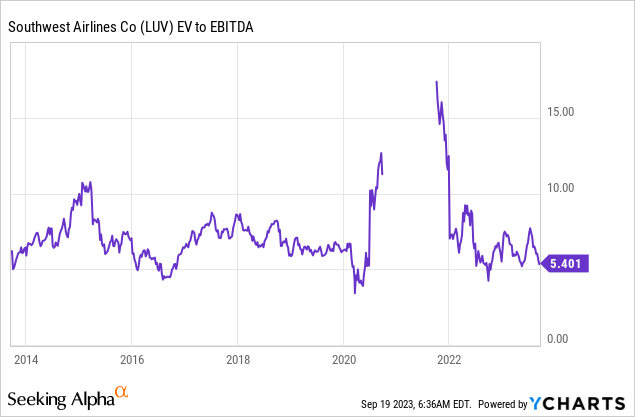

Based on that context, the company usually trades close to 6x EBITDA with major outliers. In 2015, the multiple rose to 10x as investors rushed into airlines to capitalize on falling oil prices.

If we apply a 6x multiple to the company’s 2025E EBITDA, we get a target stock price of $51.50, which is 78% above the current price!

Leo Nelissen (Based on analyst estimates)

The current consensus stock price is $35, as nobody seems to be willing to bet on a recovery this steep. Given the emergence of new macroeconomic challenges, I cannot disagree.

At this point, I wouldn’t even bet against a further decline to $20 if we get a toxic mix of sticky inflation, >$100 oil, and worsening economic conditions.

These are the worst possible circumstances to own airlines – besides pandemics and terror-related headwinds.

FINVIZ

Unfortunately, investors are merciless, as even the best players like Southwest get punished on the stock market.

While I do believe that LUV shares have a path to $50 or even $60 per share, this may take a few years, as investors will be unwilling to apply a higher multiple unless macroeconomic conditions change.

Until that happens, I continue to believe that investors are better off buying aerospace suppliers. One stock I’ve been buying aggressively is RTX Corp. (RTX), formerly known as Raytheon Technologies. This company owns Collins and Pratt & Whitney, which are major suppliers of a wide variety of commercial aerospace parts like engines and electronics.

I discussed RTX in this article.

As much as I respect Southwest’s qualities, I cannot give it a Buy rating just yet, as I continue to believe in prolonged energy inflation and buying suppliers over airlines.

Needless to say, please feel free to disagree with me.

Takeaway

Southwest Airlines faces a challenging road ahead due to rising oil prices, labor costs, and uncertain travel demand. While the airline industry has its merits, it’s dealing with uncertainties and elevated risks.

Despite recent setbacks, Southwest has demonstrated resilience with strong 2Q23 results and a focus on strategic growth initiatives. However, the recovery in business travel remains sluggish, and macroeconomic challenges remain an issue.

Analyzing the valuation, Southwest’s EBITDA growth outlook is promising, potentially leading to a significant upside in stock price.

Yet, given the current economic landscape, caution is warranted, and a bet against further declines cannot be ruled out. The market is simply not willing to apply higher multiples to airlines. For now, it’s mainly sentiment-driven.

While LUV shares could eventually reach higher levels, it might take time, and investors might find aerospace suppliers like RTX Corp. a safer bet in the face of prolonged energy inflation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.