Summary:

- Travel and entertainment spending rose sharply, and the outlook for airlines seems favorable.

- The operational problems could be the result of an outdated scheduling system. If these problems persist, consumers may boycott the airline, which could be disastrous for investors.

- Besides the operational problems, the revenue and profit outlook are bright. The company has also resumed its dividend and the stock’s valuation also looks favorable.

- Weighing the rewards against the risks, I think Southwest Airlines stock is worth buying.

Alex Wong/Getty Images News

Introduction

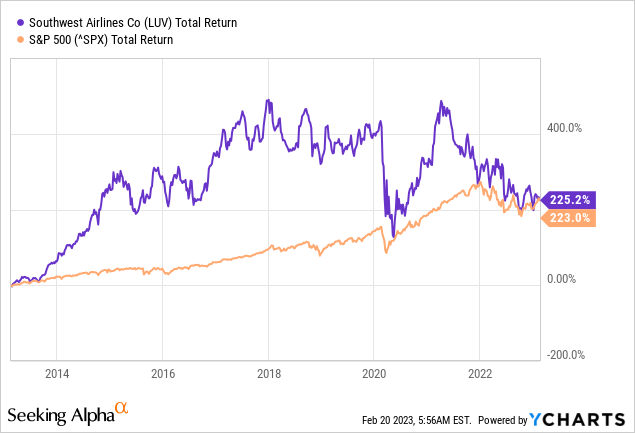

Airline shares can fly high, but they can also land hard. Over the past decade, Southwest Airlines (NYSE:LUV) shares have shown tremendous growth from 2012 to 2018, before stabilizing and taking a nosedive during the corona pandemic. The strong rise in the stock price was due to the sharp increase in revenue, earnings, free cash flow and of course the dividends per share. Now, the stock price is depressed again. This seems a good buying opportunity.

The outlook for airlines appears mixed as Wells Fargo’s CFO Mike Santomassimo said that spending on travel and entertainment rose sharply but he also issued a warning about the U.S. economy.

Southwest Airlines is back on the growth path, but the many cancellations during the December event are worrisome for the airline’s future. These cancellations may be temporary but they pose a risk to investors of Southwest Airlines. With growing revenue and earnings prospects, dividend resumption and a cheap stock valuation, I think this stock is worth buying.

Guidance Is Great, But Operational Problems

Southwest Airlines on Jan. 26 announced its annual results for 2022 and revised its expectations for the first quarter. The company posted a net loss of $220 million for the completed quarter and full-year net income of $723 million excluding special items. Operating income was record high at $6.2 billion for the fourth quarter and $23.8 billion for the full year.

CEO Bob Jordan gave an outlook for the first quarter of 2023:

Based on current revenue and cost trends, we currently expect a first quarter 2023 net loss. However, we are encouraged by current booking trends in March 2023. Our 2023 plan continues to support solid profits with year-over-year margin expansion for full year 2023.

Southwest Airlines had major problems with its operational performance, as more flights than ever were canceled and the number of on-time flights was the lowest in 10 years. Many employees complain that the technology behind the scheduling system is outdated. This poses a major threat to Southwest Airlines as consumers may boycott the airline. Management is addressing the problem well with a detailed review and the formation of the Operations Review Committee. Southwest Airlines will review the priority of technology and other planned investments this year.

Dividends And Share Repurchases

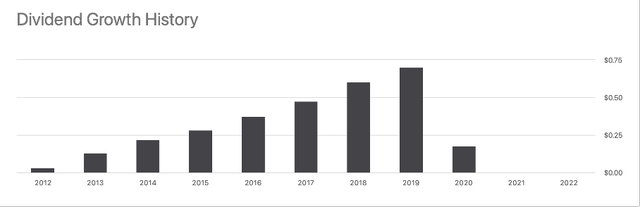

Airlines stocks went down during the corona pandemic, and most cut their dividends and share buybacks. As we see with Southwest Airlines, the dividend was cancelled in 2021 and 2022.

From 2012 to 2019, the dividend per share grew strongly, as we see in the chart below. Looking ahead, the dividend is resumed and the forward dividend rate is $0.18 (dividend yield of 0.51%). Many analysts expect the dividend per share to increase further in the coming years, and the consensus yield for 2025 is 2.35%.

Dividend Growth History (LUV ticker page on Seeking Alpha )

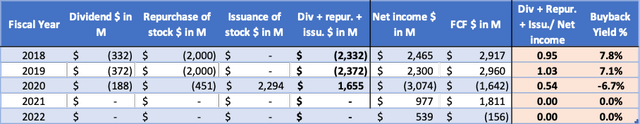

The management of Southwest Airlines returned a lot of cash to shareholders before the corona pandemic. Southwest Airlines returned as much of 95% of net income to shareholders as dividends and share repurchases in 2018. This represented a high buyback yield of 7.8%.

After the corona pandemic in 2021 and beyond, consumers are shifting from working from home to working in the office. They are increasing their travel budgets, as Wells Fargo’s CFO said during Q4 earnings, which is a good outlook for Southwest Airlines.

Southwest Airlines cash flow highlights (SEC and author’s own calculation)

Stock Looks Favorably Valued

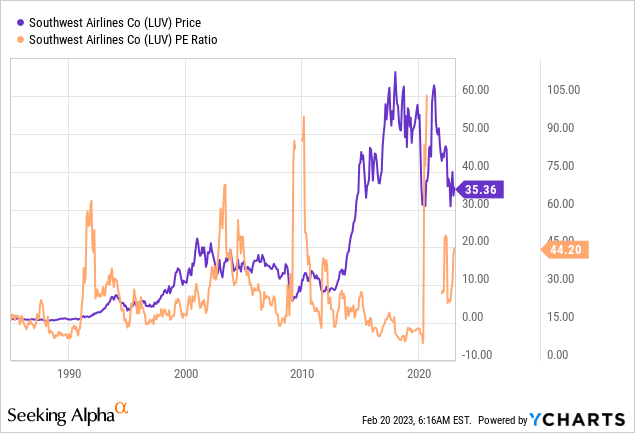

A look at stock valuations yields a remarkable graph of the PE ratio over the past 30 years. We see strong outliers in the years following a financial recession, and if we plot the PE ratio chart with the price chart, we see that a perfect buying opportunity exists when the PE ratio shoots up. Another good buying opportunity occurs right after that. We also see that the PE ratio from 2010 to 2020 is lower than in previous periods. The 3-year average PE ratio for Southwest Airlines is 11.

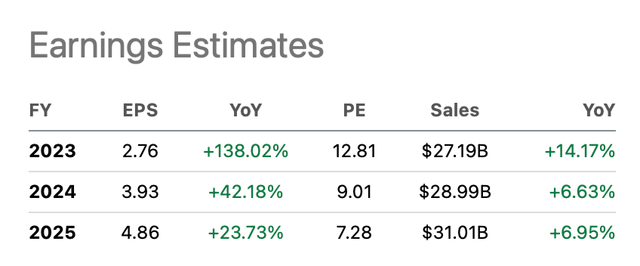

Looking ahead, many analysts have revised the outlook for earnings per share downward, but they still expect a sharp increase in the coming years. The consensus for earnings per share in 2025 is $4.86.

If we multiply this value by the average PE ratio of 11, we arrive at a share price of $53 by the end of 2025 (representing 53% share price growth). The share price seems undervalued at current levels, if the analysts are right in their prediction.

Southwest Airlines earnings estimates (LUV ticker page on Seeking Alpha)

But there are also many risks to the U.S. economy. Inflation is sky-high, making it difficult for low- to middle-income consumers to book air travel. Also, the yield curve is negative, which may indicate that a recession is imminent within now and 1 year. With a beta of 0.8 and high stock volatility, Southwest Airlines is quite risky. The stock offers a great return potential but it comes with high risk.

Conclusion

In Wells Fargo’s earnings report, travel and entertainment spending rose sharply, and the outlook for airlines seems favorable. Southwest Airlines showed rising revenue, but due to operational problems, net income was negative. Those operational problems could be the result of an outdated scheduling system, according to employees. If these problems persist, consumers may boycott the airline, which could be disastrous for investors. Southwest Airlines is addressing the problem and working to improve on all metrics. Besides the operational problems, the revenue and profit outlook are bright. The company has also resumed its dividend and the stock’s valuation also looks favorable. Investors should remember that aviation stocks can fly high, but they can also land hard. Weighing the rewards against the risks, I think the stock is worth buying.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.