Summary:

- Southwest Airlines, once a top performer, has struggled post-pandemic but is implementing significant strategic changes to regain profitability and market position.

- Key initiatives include network restructuring, adding redeye flights, and product changes like assigned seating and extra legroom seats to boost revenue.

- Southwest’s strong balance sheet allows for continued dividends and share repurchases, positioning it well for future growth despite recent challenges.

- The market undervalues Southwest’s potential improvements, making it a buy now with expectations to become a strong buy in 2025.

Southwest Airlines Boeing 737 taking off from Los Angeles International Airport Alvin Man

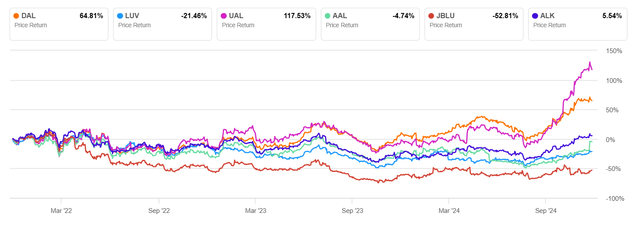

Any investor in the airline industry knows the legacy that Southwest Airlines (NYSE:LUV) built for itself in its first 50 years of service. Until the covid pandemic, Southwest was considered the best-run, most consistently profitable, and often the highest market cap airline in the world. But Southwest’s fortunes have taken a dramatic turn for the worse over the past three years, and one look at its stock chart and analyst recommendations show that a fundamental change has taken place in how the Dallas-based airline is viewed.

big 6 airlines 3 year chart (Seeking Alpha)

The pandemic served as a dividing line in the success or failure of many organizations, and that is certainly no more true that for the U.S. airline industry and many of its companies. Delta Air Lines (DAL) frequently traded places with Southwest in the latter part of the decade of the 2010s as the highest market cap airline in the world, and now DAL is worth twice as much as LUV. United (UAL) has seen significant fruit from its efforts to become a much more profitable and valuable company and is worth 1.5X as much as LUV.

Southwest now finds itself in a pretty large pack of U.S. airlines that have been breakeven at best and money-losing for parts of the past three years. Southwest’s north Texas-based rival, American (AAL), continues to generate low single digit net profit margins, a territory that LUV is occupying more time than not. The ultra-low cost carrier segment of the U.S. industry is in turmoil, highlighted by the chapter 11 filing of Spirit Airlines, and low margins or losses for Frontier (ULCC) and Allegiant (ALGT), joined by low-cost carrier JetBlue (JBLU). Most of the U.S. airline capacity is being flown by carriers that are not consistently generating even 3% net profit margins.

There are common reasons why the two top performers, DAL and UAL and some of their foreign counterparts, are doing as well as they are, and there are also common themes around the underperformance of most of the rest of the U.S. carrier industry. Some carriers like AAL have made high-profile executive reassignments to try to address strategic errors that have weighed down that company while LUV opened 2024 with a sense that it needed to change but moved slowly to address problems that many of its critics, let alone some of its own employees and supporters believed needed to be addressed; the involvement of Elliott Investment Management, L.P., turbocharged change at Southwest, resulting in a truce that gives the low-cost carrier that became a model for dozens of airlines around the world a mere few quarters to begin to see improvements or face an even deeper loss of control than the settlement, which has led to a turnover in the board and senior leadership changes but largely leads Southwest still in a position to control its destiny.

In comparing Southwest’s financial performance to its more profitable U.S. global competitors, Elliott hammered away at the need for Southwest to seek greater revenue opportunities through a more sophisticated business model that was less focused on the product attributes such as open, all alike seating and free checked bags that built Southwest and more focused on the evolving travel market that is increasingly willing to pay good money for more premium travel experiences. In addition, Southwest continues to overcome the enormous reputational damage that came from its weeklong operational meltdown during the Christmas 2022 holiday period.

The good news is that Southwest has announced a large number of strategic changes that will begin to go in effect in 2025 even after a healthy and robust winter 2024-25 holiday travel season that appears to be benefitting all airlines. Let’s look at each of these factors and attempt to gain insight into the benefit each will have for Southwest.

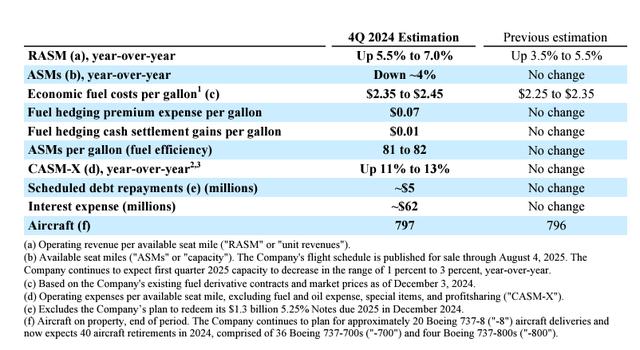

LUV guidance 5 Dec 2024 (southwest.com)

A healthy industry backdrop

First, the industry noted a deterioration in domestic and near-international (largely Latin and Caribbean) yields in the spring and summer of 2024. JetBlue and Spirit, two of the weaker carriers in the industry, announced fairly significant reductions in capacity that amount to 8-10% of each carrier’s capacity in the fall; cumulatively, industry capacity esp. in leisure markets, fell about 2-3% during the fall helping to reduce industry yield erosion during non-holiday periods of the fall. The Thanksgiving holiday season was strong throughout the industry, which has led to improved investor guidance from several airlines. The winter/Christmas/New Year’s holidays are also expected to be strong.

In addition, crude oil prices remain stable and at the low end of what they have been over the past year. Although LUV hedges fuel and is expected to lose more money on its hedges in the current quarter than it gains in benefits from those hedges, fuel prices are expected to remain below year-ago levels not just for the remainder of this quarter but also into at least the early part of 2025.

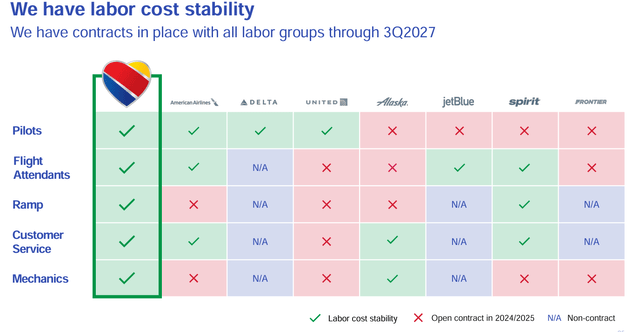

Against a healthy industry capacity background and stable fuel prices, Southwest will benefit from several of its own initiatives and strategies. Primary among the benefits is that LUV is expected to have stable labor costs throughout 2025. The industry has struggled with increasing labor costs since the pandemic, when many airline employees left the industry, requiring large increases to attract new staff. Southwest settled with all of its labor groups earlier in 2024 and paid the retroactive payments that have been common with airline labor contract settlements post-covid. Several competitors, including United with its flight attendants, have yet to settle with all of their labor groups, so LUV will competitively have a more stable labor cost profile in 2025 and beyond than some of LUV’s competitors.

LUV labor stability (Southwest.com)

Network changes

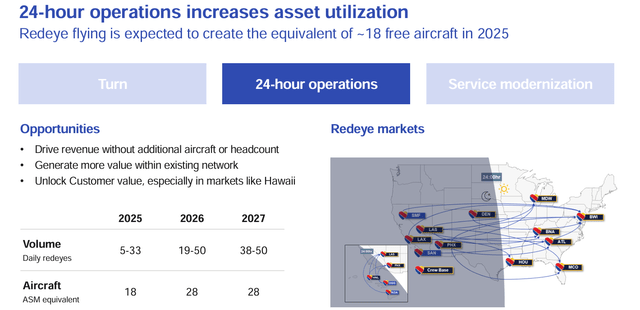

One of the most significant groups of changes that will take place beginning in 2025 is a significant restructuring of its network. Since its inception, Southwest has never operated a redeye flight, or one that leaves before midnight of one day and lands in the early morning hours of the following day. As Southwest’s network has grown from coast to coast, they lost a certain amount of aircraft and network scheduling efficiency that comes by having redeye flights, which nearly every U.S. airline uses. Now that LUV’s network spans from Hawaii to the East Coast, there is currently a very narrow window when it is possible for a person to fly on Southwest from one end of Southwest’s network eastbound to the opposite end, while many competitors have networks that allow that many times per day. While Southwest’s former reservations and operations systems did not support redeye flights and its labor contracts did not permit them, LUV now has the green light to add redeye flights. Beginning in February of 2025, Southwest will begin operating redeye flights, first from its major bases in California to its major bases in the Midwest and Eastern US. Its rollout of redeye flight will be fairly quick, with Hawaii being added in the spring and additional markets added by summer. In the process, Southwest will gain up to a dozen new aircraft worth of flying using its current fleet. In addition, Southwest has struggled with getting airplane deliveries from Boeing, so is now currently facing a shrinking fleet as a certain number of aircraft reach the point where they can no longer be economically maintained in the fleet. Operating redeyes helps to offset the drawdown of Southwest’s fleet that is occurring. Further, Southwest’s fleet involves a larger number of larger 737-800s and MAX 8s which seat 175 seats and which are more economical on longer flights. Instead of making multiple stops back to the east coast as many LUV flights do, use of the larger aircraft will create efficiencies that are maximized by operating the aircraft across two-thirds or more of the continental U.S. It will be possible to leave Southwest’s Hawaii stations at multiple time windows per day and fly through to the east coast as happens routinely on other carriers. Finally, by operating redeyes, Southwest will eliminate a number of late night and early morning short flights which generate lower yields. Although redeye flights are typically not the highest yielding flights in a market, they are usually more economical to operate because there are few fixed and only marginal costs – the airplane would otherwise sit someplace overnight – while late night short-haul flights typically are only valuable for connecting passengers with local passengers in those markets choosing more body-friendly schedules.

LUV 24 hour ops (Southwest.com)

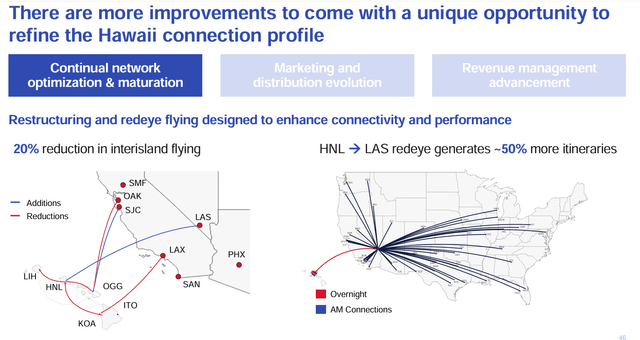

In addition to beginning to operate redeyes, Southwest will trim its intra-Hawaii flying, which Elliott identified as underperforming. Hawaiian Airlines, now a part of Alaska Airlines (ALK), operating the only intra-island service in Hawaii for years. Although there have been local competitors and some mainland-based airlines have extended their flights to Hawaii to other islands, Southwest saw an opportunity in launching its service to Hawaii only a few years ago in adding service between some of the Hawaiian Islands. Southwest expected to receive 737-MAX 7s when it launched its Hawaii service; instead it has had to use MAX 8s which have 25 more seats, so LUV has been unable to fill as many seats on the larger plane. Trimming the schedule will help increase LUV’s loads and reduce its costs. Southwest’s schedule adjustments to/from/within Hawaii, including the addition of redeyes could be one of the largest parts of Southwest’s network adjustments.

LUV Hawaii improvements (Southwest.com)

In addition to Hawaii, Southwest is making adjustments in other markets, particularly in shifting its southeast U.S. focus from Atlanta to Nashville. It is also growing capacity in higher growth markets such as Denver while trimming capacity in some hubs such as Chicago.

Southwest has made few changes to its operations at Dallas Love Field, where the carrier has its headquarters. However, nearly 50 years of air service restrictions on operations in N. Texas end next year, ending decades of feuds primarily between American and Southwest, which have dueling hubs and headquarters in the region. Southwest could expand to DFW airport but could also add service to any of a number of airports in N. Texas which it has not been able to open because of these restrictions.

Product changes

Southwest is making significant changes to its product

Since its inception, Southwest has operated with a first-come first-served seating model that is unique among large U.S. airlines as well as among those around the world. As a result, Southwest’s boarding process is unique in the U.S. as passengers are assigned a unique boarding number which dictates when each passenger can board. Each passenger cannot board earlier than the number they have been assigned and if they board later, they risk getting a lower quality seat – either further back in the aircraft or different from their preference of aisle or window.

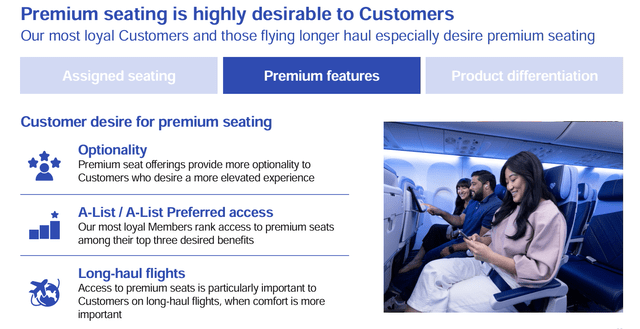

Although it worked well even being unique, Southwest’s boarding system has created a cottage industry of people that work to get a higher boarding priority than they otherwise would have been entitled. Southwest, like nearly all U.S. airlines, allows passengers to board early based on their own request for extra time in boarding which, in the Southwest system, allows someone to get a potentially better seat on the plane. In addition, every other airline in the U.S. that assigns seats puts a monetary value on those seats which are desired the most, and the airline gains revenue from selling those more valuable seats. In addition, nearly every other airline has seats which offer some type of extra space – either in a separate cabin or extra space seats in the same cabin. Southwest’s egalitarian approach to seating has eliminated any possibility of gaining any revenue from those types of seats. Elliott was quite adamant that LUV could be monetizing its seats and generating revenue.

LUV premium seating (Southwest.com)

Southwest’s entire seating system will change in 2025, although a specific date has not been established. LUV will begin adding extra legroom seats to its fleet early in 2025 but will not begin monetizing them while the aircraft modification process takes place across its fleet. Later in 2025, Southwest will begin assigning seats and giving the best seats to the passengers that pay the highest fare. Customers that pay the lowest fare may not be given a seat assignment until close to departure and may end up with a middle seat or a seat closer to the rear of the aircraft. With assigned seats, there will be no incentive for someone to preboard to get a better seat. One of the key benefits of assigned seating is that by reducing the number of passengers that preboard including those passengers that ask for a wheelchair to board but manage to walk off the aircraft, Southwest will be able to reduce the amount of time that each aircraft needs on the ground. Reducing turn times will increase aircraft utilization and generate the equivalent of more than a dozen additional aircraft per day.

Southwest will also be enhancing its revenue management processes to increase revenue on full flights. In addition, it will begin cooperating with other airlines including carriers like Icelandair that will operate international flights to Southwest hubs where Southwest will complete the journey. Southwest will add larger overhead bins, improved onboard WiFi and add equipment to charge personal electronic devices, a necessity on longer flights, esp. as Southwest’s average flight length continues to grow.

An Enviable Balance sheet

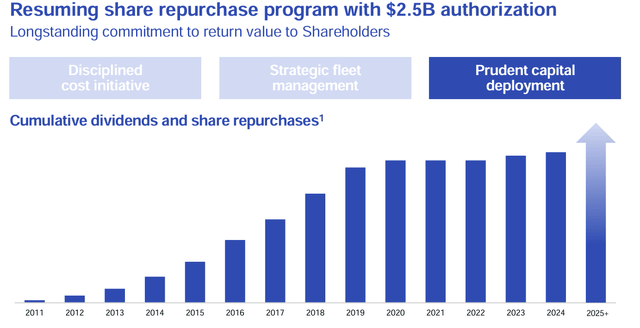

Southwest is one of the few airlines in the world that has had the luxury to endure a couple of years of low profits and still remain at or near the top of the global industry in terms of financial strength. Government aid during the pandemic pushed back some of the restructuring that some companies needed to do but have not done. Southwest is moving forward with a major restructuring of its finances and its operations that will bear fruit. Southwest will continue to pay the richest dividend in the U.S. airline industry and will begin an aggressive share repurchase program.

LUV balance sheet (Southwest.com)

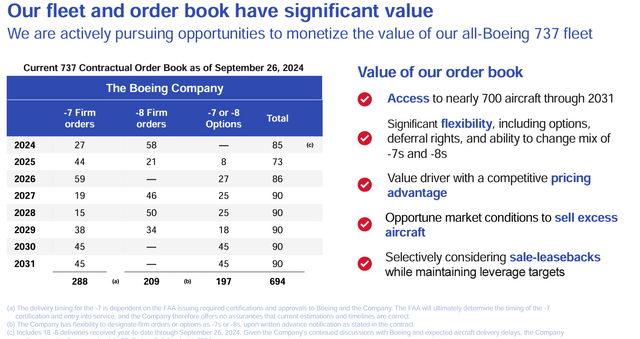

LUV will benefit from its deep pockets and its strong relationship with Boeing that will allow it to operate one of the most modern and fuel-efficient fleets in the world even while selling off many of its older aircraft including many of its 737-800s which are too large and do not have the new generation engines that Southwest wants.

LUV fleet value (Southwest.com) LUV share repurchase and dividends (Southwest.com)

Conclusion

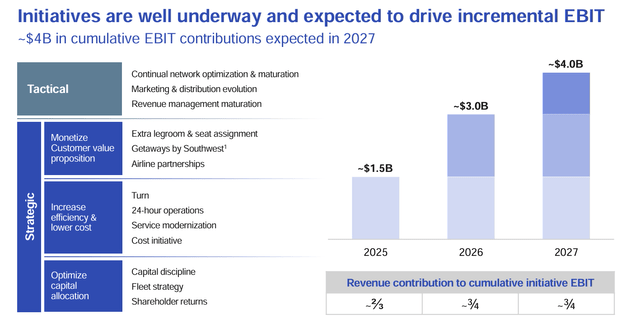

Southwest Airlines has long been one of the best-run companies in the global airline industry. It lost its footing esp. in the post-covid environment but is embarking on one of the most dramatic restructurings that any airline has undertaken. The benefits from LUV’s efforts will reach $4 billion in just a few years and will begin accruing at a fairly rapid rate in 2025.

LUV EBIT improvements (Southwest.com)

I believe the market is not fully valuing the improvements that will come to LUV’s finances and believe it is at least a buy which, I believe, will grow to a strong buy during 2025.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LUV over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.