Summary:

- Southwest revenue has grown in recent years, but profits have lagged.

- Fleet upgrade creates base for revenue growth.

- The company’s financial health is the best among the big four airlines.

- Start of dividend payments is a sign of recovery after the Pandemic.

lsannes

Introduction

Airlines suffered significantly during the COVID-19 period, and then the surge in inflation in the United States changed the plans of tourists in 2022. We will find out how things are going with one of the largest airlines Southwest.

Southwest (NYSE:LUV) is one of the four major airlines in the U.S. and operates a low-cost carrier business model. The company ended 2022 with a fleet of 770 Boeing 737 aircraft. More than 95% of the company’s revenue came from domestic flights. Southwest had 121 destinations in 42 states and ten near-international countries. The company was founded in 1967 and is headquartered in Dallas, Texas.

2022 Financial Highlights

The company reported record operating revenues of $5.7 billion, representing a 21.6% growth over the same period last year. The increase was primarily in passenger and other revenues. Revenue passenger miles (RPMs) increased 11.6% q/q and load factor increased 0.6 pts. q/q.

Operating expenses increased 23.6% q/q to $5.9 billion primarily due to a 54% increase in fuel and oil and a 30.2% increase in other operating expenses. As a result, the company reported an operating loss of $284 million and a net loss of $159 million. In the first quarter of 2023, net loss resulted from the negative financial impact of approximately $380 million pre-tax, related to the December 2022 operational disruption. Southwest Airlines canceled approximately 16,700 flights from December 21 to December 31 after winter weather swept across the U.S. Accordingly, the costs associated with the fiasco are temporary and the company will soon return to profitability.

The company ended first quarter 2023 with $11.7 billion in cash and had a net cash position of $3.6 billion. Capital expenditures increased to $1.04 billion, compared to $510 million for the same period last year. Southwest continues to increase capital expenditures, but we will discuss this in more detail below.

The company noted: “Based on current revenue trends and our cost outlook, which includes market wage rate accruals for all open labor contracts, we expect solid profits in second quarter 2023 and continue to expect solid profits and year-over-year growth in both margins and return on invested capital for full year 2023.”

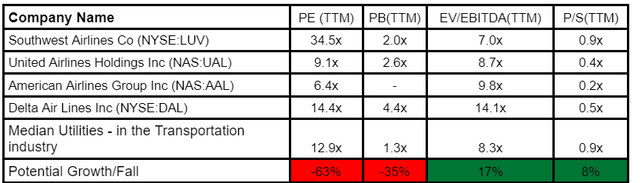

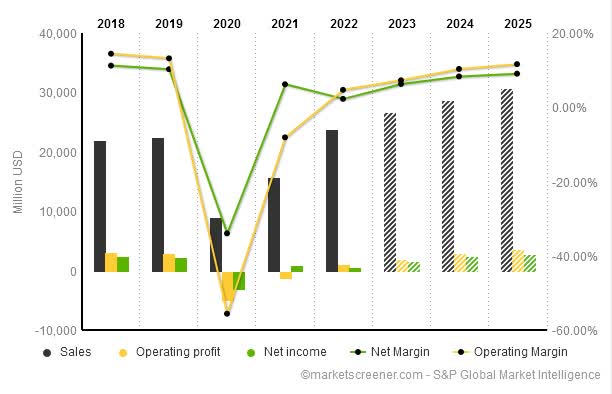

Let’s look at the long-term financial performance of the company. The company suffered greatly due to the COVID-19 pandemic and in 2020 the company’s revenue dropped significantly. At the moment, we see a recovery, and revenue for 2022 year has already exceeded the figures for past years.

Revenue (The company financial report)

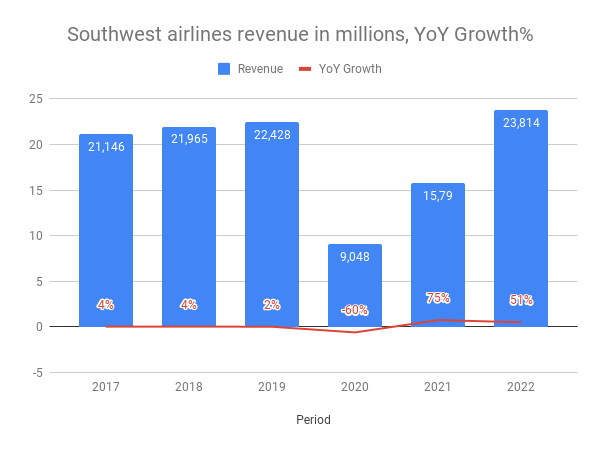

If you look at the net income, we see a less confident recovery, and it began to decline since 2017. This was mainly due to the strong growth of operating expenses relative to operating income. Between 2017 and 2022, the company’s operating expenses increased by 32%, from $2.8 billion to $3.7 billion. The company’s fuel and labor costs are critical for their impact on income.

Income (The company financial report)

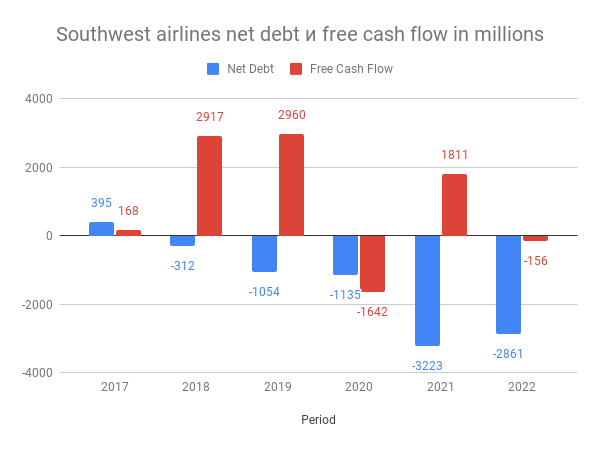

It is worth noting that the company’s net debt is negative, which is important for the stability of the company during a crisis. Free cash flow has come under pressure from rising capital expenditures and has yet to recover to pre-pandemic levels, impacting the dividend and buyback programs.

In 2022, the company significantly increased capital expenditures from $505 million to $3.9 billion, primarily due to growth in new aircraft orders. The Company continues to expect to take delivery of approximately 100 aircraft in 2023. In total, the company expects to take delivery of 632 aircraft by 2031, representing an almost complete fleet renewal.

net debt to cash ratio (The company financial report)

Competition

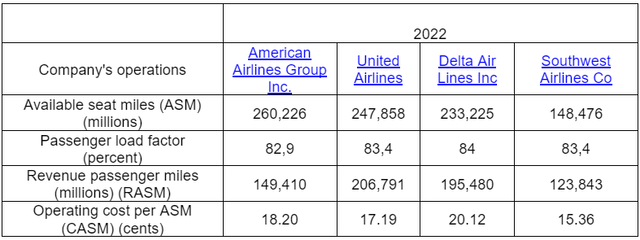

Let’s take the Big 4 U.S. airlines: Delta Air Lines (DAL), Southwest Airlines, American Airlines Group (AAL), United Airlines (UAL). In terms of operating performance, we see American Airlines and United Airlines as having high ASM. The growth potential for these companies is the highest because ASM measures the carrying capacity of an aircraft that can generate revenue. Passenger load factors are almost the same for all companies. In general, it is at a high level despite the increase in ticket prices. Delta Air Lines has the highest RASM; it makes better use of passenger miles. Southwest Airlines has the lowest CASM, while Delta Air Lines has the highest. It is quite difficult to pick a leader.

Business performance (companies reports)

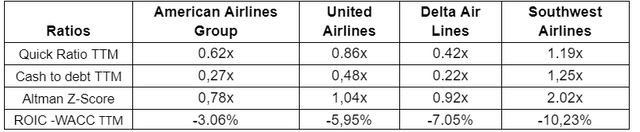

Regarding financial stability indicators, Southwest Airlines appears more stable than its closest competitors. Past history also favors Southwest, as the company has never gone through bankruptcy proceedings, unlike its competitors. Altman Z-Score shows that all companies except Southwest are at risk of bankruptcy in the coming years. The ROIC-WACC indicator also indicates that these airlines are losing value, money is being spent without increasing profit. It is worth noting that Southwest’s negative ROIC-WACC ttm is related to an operational disruption last year, while analogues have been showing a weak value for a long time. At the moment, the financial situation of American Airlines Group and Delta Air Lines looks unsustainable and it appears they will have a longer recovery period.

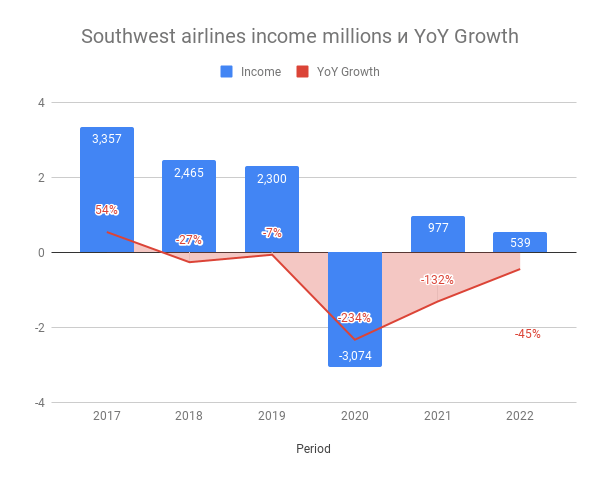

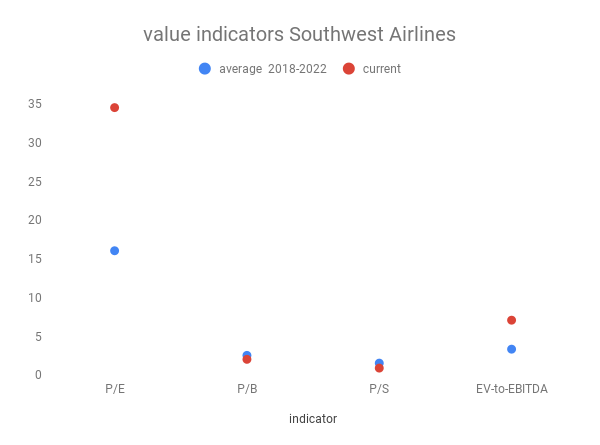

In terms of Southwest’s multipliers, I can say that the company is fairly valued at its current price. The market continues to value Southwest above its peers in terms of P/E ttm and forward P/E, indicating that investors prefer more resilient companies. In addition, the market is expecting a significant decline in airline P/E ratios, which implies an increase in their earnings.

As an additional check, I compared the historical values of Southwest Airlines multipliers, and the result can be called neutral. P/E and EV/EBITDA are above average and P/B and P/S are below average. It’s important to note that I don’t idealize multipliers when making decisions.

value multiples (gurufocus)

Focus on Oil

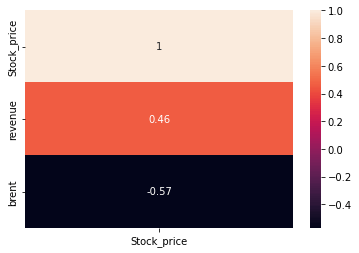

Fuel prices play an important role in an airline’s financial performance, and according to Southwest’s full-year 2020 report accounted for about 30% of all operating expenses. The company also noted the importance of this item, reporting that it has hedged 63% of its fuel in 2022 and 50% in 2023.

But is it that important to investors for whom stock price returns are important? We will analyze historical data and try to find out. The data used were: Southwest Airlines stock price, company revenue, oil price (BZ = F). Data were taken for the period 2009-03 to 2022-12, a total of 165 observations. According to the result, a relationship was found. For revenue, the correlation value is 0.46, and p-value is 4.93e-10, for oil -0.57 with a p-value of 1.76e-15. Since the p-value is less than 0.05, we can conclude that there is a statistically significant correlation. It is worth noting the peculiarity that the price of oil affects the stock price of Southwest Airlines more than the company’s revenues. The correlation is negative between the stock price and oil, with an increase in the price of oil, stocks go down and vice versa.

Oil downstream (own estimations)

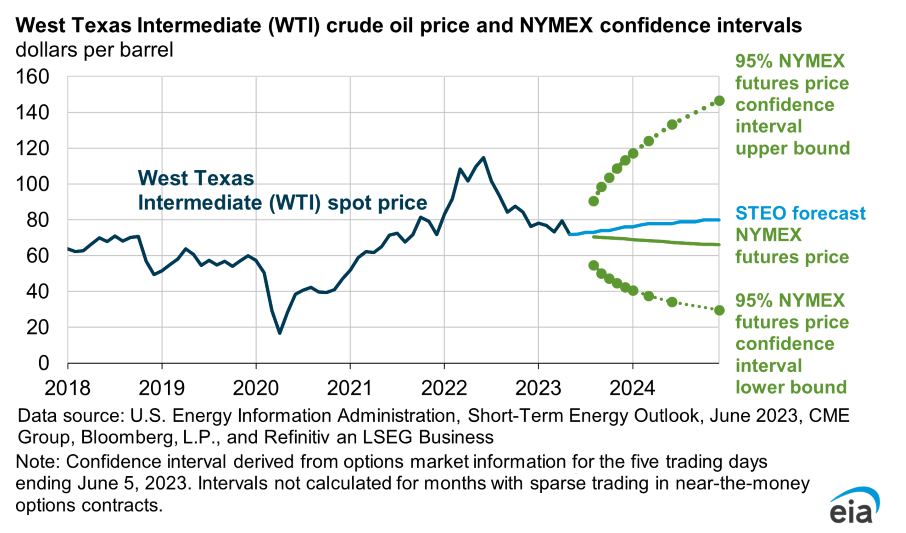

Given this dependence, it is advisable to look at the medium-term outlook for oil prices. According to EIA forecasts, the spot price of Brent crude oil will average $79 per barrel in the second half of 2023 and $84/b in 2024. This could provide a tailwind for Southwest this year and pressure next year.

WTI oil info (evia gov)

Dividends

During the pandemic, the largest air companies, which were under a big blow, suspended dividend payments. Southwest Airlines did not pay dividends in 2021 and 2022. In early 2023, the company paid $0.18 per share and became the first U.S. airline to resume returning to shareholders since the pandemic. If we assume that the size of the dividend will be maintained, then investors can count on $0.72 per share and a dividend yield of 1.95%.

It is also worth noting that the company increased the number of shares outstanding from 590 million in 2020 to 594 million in 2022. For the investor, this is an alarming sign that means a decreasing share in the company’s profits and dividends, but it doesn’t look critical at the moment.

In the pre-pandemic period, the buyback program provided additional return to investors. The average yield (dividend + buyback) for the period 2015-2019 was 6.5%. The company is currently in a phase of recovering indicators, so one should not expect a quick return to previous yields.

About risks

The risk for the company is an increase in the cost of fuel, in the previously mentioned EIA forecast there is a scenario of Brent growth over $100 per barrel. Staff costs at the airline are rising steadily, which is also putting pressure on key indicators. Salaries, wages, and benefits expenses took over 40% in total operating expenses from Southwest in 2022. The company often has delays in deliveries with new aircraft by Boeing, limiting revenue growth.

It’s also worth noting the reputational risks associated with recent customer service issues that cost the company hundreds of millions of dollars.

Conclusion

Southwest Airlines is the leading airline company based on this analysis. The latest report showed the recovery of indicators, the company has sufficient financial stability. The increase and renewal of the company’s fleet can be viewed positively. Fuel prices in 2023 are forecast to be lower than in the previous year, which should have a positive impact on Southwest’s quotes. Based on multiples, however, Southwest Airlines stock is not ideal for purchases at this point. As a dividend story, stocks with a potential yield of 1.6% lose to the non-risky Treasury bond. Accordingly, a possible scenario is the opening of speculative purchase positions in anticipation of a complete recovery of the company’s financial performance, including due to lower fuel prices and new aircraft.

Company financial overview (www.marketscreener.com )

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Liked the article? Bears of Wall Street is happy to announce that you can gain access to the growing library of similar articles with a bearish sentiment by subscribing to the #1 Seeking Alpha marketplace service for short ideas called Best Short Ideas. If you like to enter the world of short selling and learn more about unconventional stock market strategies, then give the service a try and opt for the FREE 14-day trial today! More details here.