Summary:

- Southwest Airlines reported a non-GAAP EPS of $0.15, beating expectations, but shares fell due to cost pressures and board changes.

- Elliott Management’s board shakeup adds uncertainty. The company aims to improve profitability, but it raises concerns regarding Southwest’s faltering market niche.

- Southwest’s middle-market position faces challenges, including rising costs, competition from new discount entrants like Breeze, and a potential Spirit-Frontier merger.

- Despite Elliott’s potential turnaround efforts, I remain mildly bearish on LUV stock, expecting persistent profit margin issues and potential recession risks.

- I believe Southwest’s best bullish case would be acquiring a regional-focused airline with non-Boeing planes.

Joe Hendrickson/iStock Editorial via Getty Images

Southwest Airlines Q3 Earnings

Southwest Airlines (NYSE:LUV) reported Q3 earnings Thursday morning, with a non-GAAP EPS of $0.15, beating expectations by $0.11. The company also had $6.87B in revenue, rising 5.2% YoY and $80M above expectations. Although Southwest beat estimates, it only outperformed by a small degree, rising slightly initially but opening 2.5% lower. LUV fell 4% lower by mid-morning Thursday.

The primary cause for its higher revenue was a slight improvement in pricing and demand, with some rebooking benefits after customers were traded during the July CrowdStrike (CRWD) outage. Per its new guidance, the company’s revenue per available seat mile will rise 3.5% to 5.5% YoY by Q4. However, it also expects costs per available seat mile to increase 11% to 13% outside of fuel costs, indicating continued labor and maintenance cost pressures. Its available seat miles are also anticipated to fall 4%, likely due to ending its market in many less efficient locations.

It reversed the small early morning gains from when it announced its deal with Elliott Management that keeps CEO Bob Jordan and removes board chairman Gary Kelly. Elliott secured the appointment of six new directors to Southwest’s board, ending the proxy war issue. Elliott’s overarching goal is to refresh the board with independent industry experts to hold management accountable and improve financial performance. Although Elliott’s authority is expanded, this deal does not give it majority control of the now 13-member board.

Fundamentally, this significant change to Southwest’s board significantly increases uncertainty. Although Elliott management has indicated an effort to increase Southwest’s profits, others argue the activist lacks understanding of its businesses. Earlier this year, Elliott suggested that Southwest’s turnaround strategy was filled with too many “long-dated promises“, indicating Elliot may want to see a more rapid improvement in its cost and profitability issues. From an investor standpoint, I tend to agree with Elliott’s view but see that the substantial board shift is a net negative for its valuation because it creates significant uncertainty regarding how it will change. For me, this adds to the problem of…

Southwest’s Growing Identity Crisis

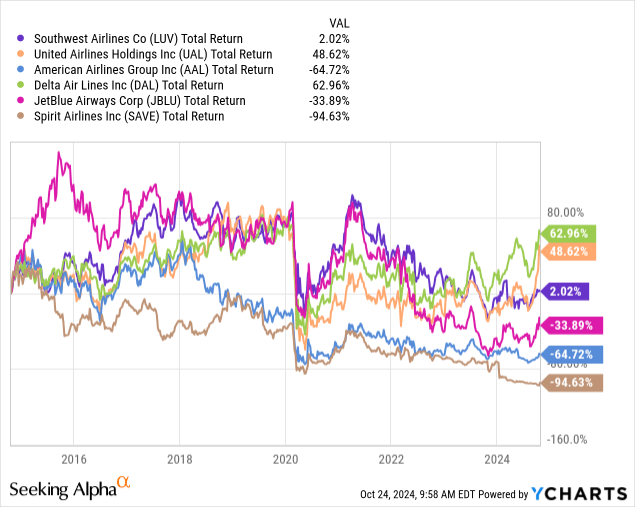

I have had a historically bearish view of LUV. In February, I last covered the company in “Southwest Airlines: Risking Going From One Extreme To The Other.” The stock is down a half-percent since then, effectively unchanged despite a 17.2% return in the S&P 500. Airlines had a difficult start to the year amid the combination of slowing (but high) economic demand and rising costs, leading to lower operating margins. However, the economy’s surprising resilience in the past three months has lifted the market, leading to a 52% rise for United (UAL), 22% for American (AAL), 26% for Delta Air Lines (DAL), and 21% for JetBlue (JBLU). However, Southwest is only up ~13%, better than Spirit’s (SAVE) 9% (SAVE is still down 83% YTD).

For the most part, airlines have been awful investments over the past decade. Between these six, Southwest is in the middle, with a total return of 2% over the past decade:

I believe these six reflect the general trends in the US airline industry. Delta, American, and United are typically higher-cost and quality airlines, while JetBlue and Spirit are usually cheaper. Southwest falls somewhere in the middle, transitioning from the “budget airline” segment but not rising sufficiently to command market power like the “big three.”

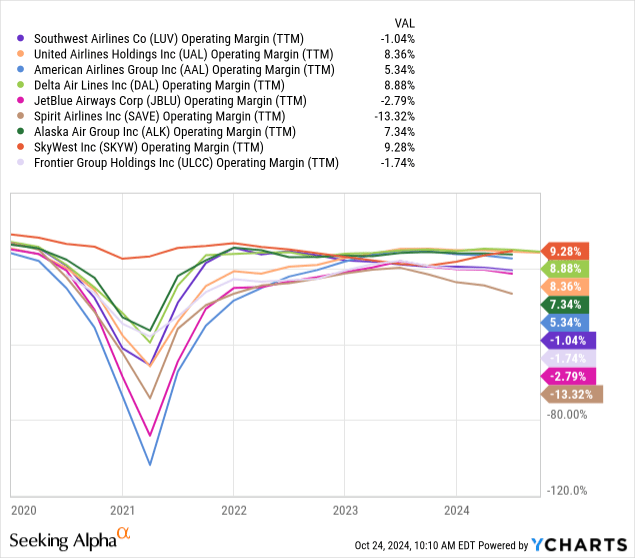

Certainly, airlines’ immense losses during the 2020 lockdowns played a role in their weak performance. That said, airlines face enormous competitive pressures that make profitability difficult without carving a clear niche. On a TTM basis, excluding Q3 performance, Southwest had negative operating margins, reflecting the negative trend of US airlines in general since 2022:

Significant increases in airline labor and maintenance costs primarily cause this trend. Fuel costs were a temporary negative factor in 2022, but if anything, they are a positive factor today as oil and gas are relatively cheap. Demand is not a significant issue, with air travel activity consistently hitting all-time highs. TSA travel checkpoint numbers are currently up ~1.4% YoY, indicating it may be flattening, but it is still well above pre-COVID levels.

Although Elliott may see the discrepancy between travel activity and Southwest’s profits as a significant company-specific issue, it is seen across most of the industry. Delta and SkyWest are among the only ones not seeing margins fall. Delta has a tremendous quality niche benefit, allowing it to charge the most per mile at $0.176. Notably, Southwest is the second highest at $0.1732, above United and American, though it should be just below them if we account for its lack of bag fees. As I’ve discussed, SkyWest’s advantage is its virtual monopoly on regional routes, and it gets direct sales from Big Three firms as a contractor.

Southwest announced changes in September aimed at improving profitability. This includes shifting to assigned seating, potentially giving it added margins from premium seating. The carrier will also allow boarding with upgrades aimed at catering to loyal customers while maintaining its free bag policy. The airline also aims to reduce the time it takes to turn aircraft and will begin to offer redeye flights in key markets in early 2025.

I believe Southwest’s changes continue to make it look more like the “Big Three” as it has continually trended into those markets, first by expanding beyond its region, then shifting away from its focus on “simplification” and middle-class-oriented travel. However, although its pricing strategy looks more similar to those seen in the big three, it lacks lounges, long-haul flying, and many other benefits the larger carriers have. At the same time, it’s losing its hold on the middle-class friendly budget status, particularly as new entrants like Breeze (private, started by JetBlue’s founder David Neeleman) offer even lower-cost flights with a regional focus.

Investors may want to pay attention to Breeze. Being private, it has not had as much attention, but I think its rise is a clear negative headwind for Southwest, JetBlue, and others in the middle price range. Although Breeze lacks consistent profitability, it was not operating in 2020, so it does not have the immense financial debt burden carried by most other airlines after that point. Unlike Southwest, struggling with 737 MAX costs and an aging fleet, Breeze has a young fleet of Airbus A220s, isolating it from Boeing’s (BA) growing list of difficulties, indirectly pushing many airline’s maintenance and capital costs up.

LUV Stock’s Valuation Remains Concerning

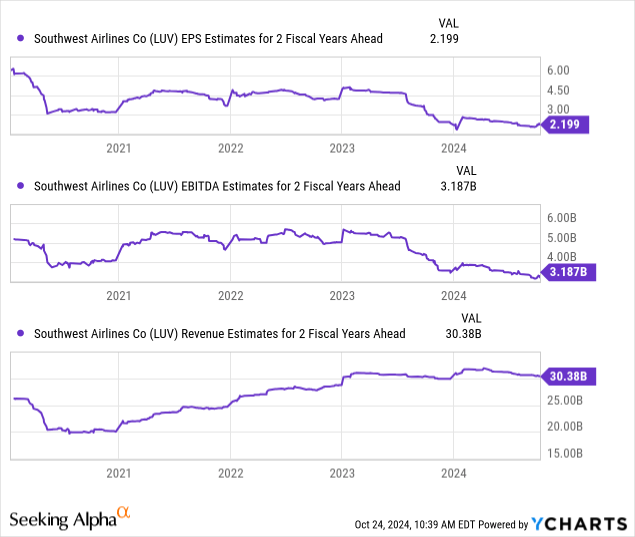

Southwest is expected to see weak EPS at ~$0.59, recovering thereafter. However, its two-year ahead EPS outlook has trended lower throughout most of 2024, with its EBITDA estimate seeing even greater pressure. Southwest’s revenue expectations have also slowed but remain relatively high, indicating analysts are not expecting a recessionary headwind for air travel, but are also not looking for continued growth. See below:

To simplify, Southwest’s cost issues are expected to worsen through 2025 before improving. That said, analysts have revised negatively, meaning cost issues may not be alleviated as soon as expected. Indeed, looking at Boeing’s issues, pilots receiving training at Southwest before leaving for better airlines, and the general rebound in inflation expectations, I see little reason why cost pressures will decrease. Further, with the rise of Breeze, I think Southwest is at increasing risk of seeing lower revenue due to lost customers, particularly as it moves away from its previous core strategy, which may accelerate with Elliott’s new position.

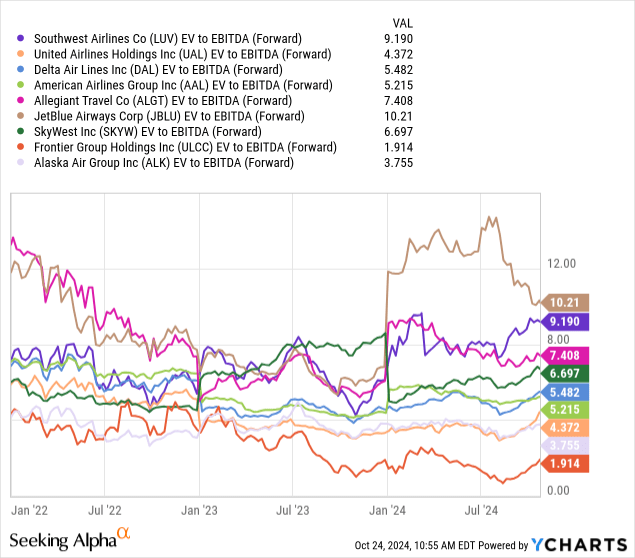

Despite its weakness, Southwest remains relatively expensive compared to its peers on a forward “EV/EBITDA” basis. See below:

Spirit is excluded, given its forward EBITDA is not likely positive. At one extreme, we see Frontier (ULCC) at an extremely low valuation, reflecting its risk of following in Spirit’s direction. JetBlue and Southwest are toward the top, reflecting a high price and their shared profit margin issues, which I feel relate to their “stuck in the middle” market position. Alaska is interesting, having a very low-forward “EV/EBITDA.” I believe Alaska may be an interesting pick, given its merger with Hawaiian.

The Bottom Line

Southwest’s overarching issue may be that it is a middle-class-focused airline in an economy losing its middle class. Consumer bifurcation has accelerated since 2020, where one portion of people see wages continue to rise faster than inflation, and the other sees the opposite. Specifically, that considers recent inflation has hit lower and middle-income people the most. Although bifurcation has been a trend in retail for many years, I think it’s bleeding into airlines, with people opting more for high-cost Delta and others for the most discounted airlines. As a result, those in the middle, such as Southwest, don’t have the dedicated segment they used to. Unfortunately, I expect this trend will only continue, given how long the income bifurcation trend is accelerating.

Unfortunately for Elliott Management, I am not sure Southwest can dramatically change its position. I’d bet the company would be better off looking to go back toward its routes with competitive pricing and a focus on underserved regional markets where it may find pricing power. That is essentially the opposite approach to its outgoing management team, which has tried to expand toward the Big Three markets, resulting in competitive pricing difficulties.

I am mildly bearish on LUV, believing that its profit margin issues will persist longer than analysts currently expect. Further, I think there is significant potential that consumer demand for air travel falter due to recession risks. However, I admit the unemployment trend is not as bearish today as it was months ago. Still, with its pricing not being competitive, I think discount airlines struggling today will see a recessionary benefit, which may alleviate labor cost-growth issues.

I am not so bearish that I would bet against the stock, particularly when Elliott may have better turnaround ideas. In my view, Southwest’s best bullish case is if it can acquire a failing discount airline with non-Boeing planes that are accessible to regional markets. Of course, the FTC’s decision to block the Spirit-Jet Blue merger pours cold water on that potential. Investors may also want to watch the renewed merger talks between the struggling Spirit Airlines and Frontier, as that may fortify the discount airlines’ weakening positions, likely to Southwest’s disadvantage.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.