Summary:

- Starbucks continues to experience growth and create shareholder value, with revenue expected to climb by 7-10% in 2024.

- The company has been expanding its number of locations, reaching 38,587 stores by the end of Q1 2024.

- Even with significant capital expenditures, Starbucks has maintained strong cash flows and has returned capital to shareholders through share buybacks and dividends.

JohnFScott

If you are a coffee drinker, I can practically guarantee that you are aware of Starbucks (NASDAQ:SBUX). Even if you aren’t a fan of that caffeinated beverage, there is a high probability that you know what is undoubtedly one of the most famous consumer brands on the planet. With a global network of cafes and a market capitalization of $105.48 billion as of this writing, Starbucks is a behemoth. When companies get to a certain size, rapid growth can become a challenge. But no matter how large Starbucks becomes, it seems as though management finds ways to continue that growth trend.

It was with that image of a growth-oriented company in mind that I last wrote a bullish article about Starbucks way back in March 2015. I called the company the coffee king and, citing its rapid international growth and strong brand here at home, I concluded that the firm would make for an attractive prospect for long-term investors. This was in spite of the fact that shares have never been exactly cheap. Since then, things have gone quite well. Shares have seen an upside of 132.7%, including distributions. While that is a bit short of the 148.2% increase seen by the S&P 500 over the same window of time, it’s certainly not a bad return. Today, I look back on the company to see just how far it has come. And while I half expected to see a firm that would experience slowing growth, what I ultimately found is a vibrant enterprise that looks set to continue growing while simultaneously creating tremendous shareholder value. So even though shares have risen materially since I last wrote about the business, I would argue that the ‘buy’ rating I assigned the firm is still appropriate at this time.

Management keeps brewing

At its core, Starbucks has always been and still remains a coffee-oriented business. But it would be a mistake to think of the firm as only that. It has its own tea brands, as well as bottled water and a variety of bakery-oriented goods. While the vast majority of the company’s products are sold through its cafes, it even makes available for customers RTD (ready-to-drink) beverages and other products that can be purchased at many grocery stores across the globe.

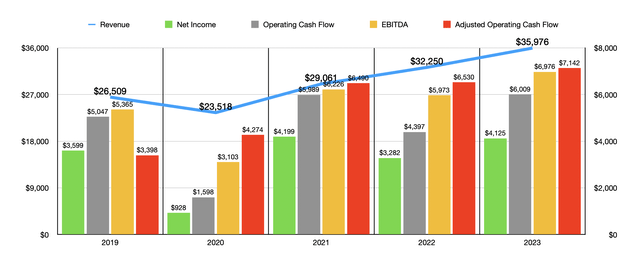

Fundamentally speaking, the history of Starbucks has been really quite solid. Although revenue dropped from $26.51 billion in 2019 to $23.52 billion in 2020, that decline was driven by the pandemic. Since then, it has been a story of unending growth. In 2021, revenue totaled $29.06 billion. And by 2023, sales had increased further to $35.98 billion. What’s really impressive is that, even in 2024 when global economic conditions are varied and questionable, growth is expected to continue. Overall revenue is expected to climb by between 7% and 10%, driven by a 4-6% increase in comparable store sales and the opening of new locations.

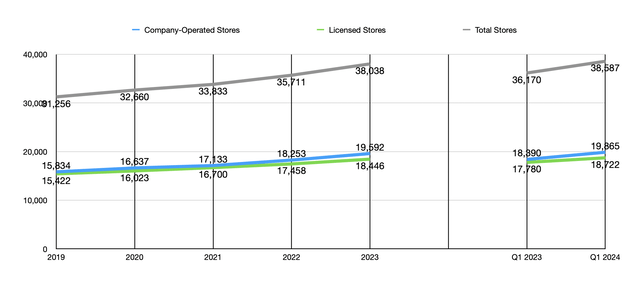

You might think that there can only be so many Starbucks locations on the planet before reaching market saturation. In theory, there is some upper limit. But we certainly haven’t found it as of yet. In 2019, the chain had 15,834 company-operated stores. It also had 15,422 that were under licensing agreements. All combined, that totals 31,256 locations. By the end of 2023, the firm had grown to have 19,592 company-operated stores and 18,446 that were under license. All combined, that’s 38,038 stores. In 2024, that number looks set to continue. By the end of the first quarter, the firm had 38,587 locations. That’s 549 more than it had only three months earlier.

Growth on the top line has, generally speaking, proven bullish when it comes to growth on the bottom line. In the first chart in this article, you can see net profits and various measures of cash flow for the company. Actual net income has been quite volatile. But when you start looking at cash flow data, the situation looks impressive. Operating cash flow, after adjusting for changes in working capital, went from $3.40 billion back in 2019 to $7.14 billion in 2023. Meanwhile, EBITDA has risen from $5.37 billion to $6.98 billion.

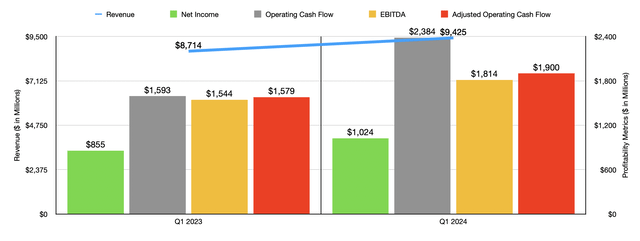

As I mentioned already, management expects growth to continue this year, and we are already seeing evidence of that. Revenue of $9.43 billion in the first quarter of 2024 dwarfed the $8.71 billion generated the same time one year earlier. Net profits jumped from $855 million to $1.02 billion. Operating cash flow has gone from $1.59 billion to $2.38 billion, while the adjusted figure for this has risen from $1.58 billion to $1.90 billion. And lastly, EBITDA for the firm has expanded from $1.54 billion to $1.81 billion. When it comes to 2024 in its entirety, management expects earnings per share to grow by between 15% and 20%. It’s difficult to tell what this means for net profits because we don’t know how many shares the business might buy back. But to see such bottom-line growth anticipated by management is absolutely encouraging.

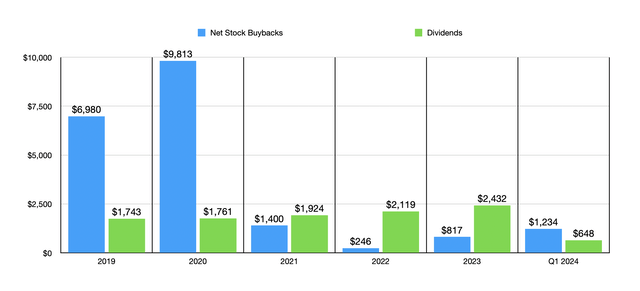

Of course, growth does not come cheap. In order to continue expanding, management allocated $1.8 billion toward capital expenditures in 2022. And in 2023, capital expenditures rose further to $2.3 billion. Given the significant outflows, investors could be forgiven for thinking that the company might not have much additional capital to reward shareholders with. But this is not something to be worried about. From the beginning of 2019 through the end of the first quarter of this year, the firm has allocated $20.49 billion on net share buybacks. This is in addition to $10.63 billion in dividends paid out over the same window of time.

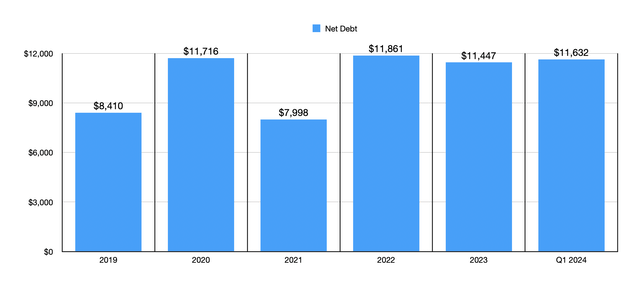

What’s really remarkable is that cash flows are so strong that the company has been able to achieve all of this without any material changes in debt for the most part. If we ignore 2021, where the company did see a plunge in net debt, we can see that from 2020 through the end of the first quarter of this year, overall net debt at the business has remained virtually flat. By the end of the most recent quarter, it totaled $11.63 billion.

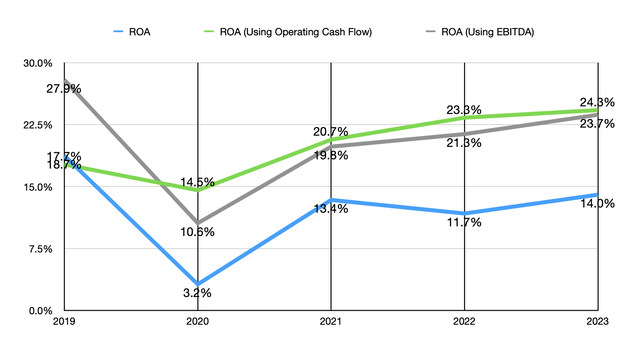

Management’s decision to return capital to shareholders has resulted in such a large outflow of capital that the company has, as a consequence maintained a negative book value of equity. This does make it impossible to test the quality of the business in one respect. But there is another, and that is by looking at profits and cash flows in relation to assets. In the chart below, you can see precisely that. As you can see, the effective return on assets generated by Starbucks has increased over time. This shows that we are dealing with a high-quality business that can and likely will continue to generate strong returns for investors.

Stepping back for a moment and focusing again on growth, what’s really exciting is that the firm does seem to have plenty of upside potential to it. Estimates vary from one source to another. But one source figured that the global coffee market was worth about $127 billion in 2022. From 2023 through 2030, it is expected to grow at a rate of about 4.7% per annum. The global tea market, which Starbucks got into years ago when it acquired Teavana, was estimated to be worth $127.2 billion last year. Between 2024 and 2028, it’s expected to grow at a rate of nearly 8% per annum.

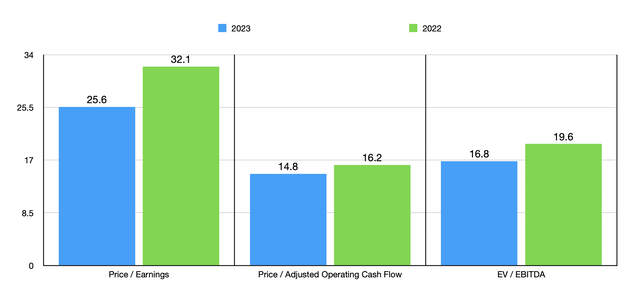

Of course, a high-quality company with growth potential moving forward does not come cheap. But fortunately for investors, it doesn’t come expensive either. In the chart above, you can see how shares are priced using results from 2022 and 2023. What you can see here is that shares never get cheap. But they do get cheaper on a forward basis. And for an industry leader that looks set to continue growing for the foreseeable future, these multiples don’t look unrealistic.

Takeaway

Over the past several years, Starbucks has demonstrated to investors that growth is still possible and important for the firm. Although some of the financial results have been a bit lumpy, the overall trajectory is clear. Debt remains in a fairly narrow range and the profitability metrics we have for the business look positive. If only shares were cheaper, I could take a more bullish stance on the business. But as they stand now, a ‘buy’ rating still is logical at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!