Summary:

- Starbucks faces significant labor risks due to increasing unionization, which could negatively impact margins and overall business performance.

- New CEO Brian Niccol’s past successes at Chipotle and Taco Bell may not translate well to Starbucks due to unique union challenges.

- The stock is currently overvalued with a high forward P/E ratio, not accounting for the labor risks and potential margin declines.

- Despite a favorable Supreme Court ruling, unionization trends are likely to continue, posing ongoing risks to Starbucks’ business model and shareholder value.

Brett_Hondow

Co-Authored By Noah Cox and Brock Heilig.

Investment Thesis

Starbucks (NASDAQ:SBUX) has been under a lot of pressure as the global coffee chain has been trying to buck a slowdown and bring in new management to set up a turnaround. The Seattle-based coffee giant is facing increasingly tough competition, and sales are slowing down. Recently, Starbucks brought in a new CEO (Brian Niccol from Chipotle (CMG)) to help kickstart the overall growth of the iconic coffee chain.

While Niccol has a lot of experience turning around major food chains, the biggest issue Starbucks faces at the moment isn’t even with its business model. Labor risk is becoming a huge problem for the company as more stores unionize.

Starbucks stores have been undergoing a mass wave of unionization during the last two years, with over 500 stores unionized already. The biggest impact of this is that the National Labor Relations Board (NLRB) has become critical of Starbucks and how they operate their stores (more on this later). This is an enormous risk to their business because Starbucks is not in a high-margin business.

Unions are beginning to catch on to the automation trend that is spreading across food prep and manufacturing. To combat this, they’re also demanding in contract negotiations that their workforces and jobs not be automated. Starbucks depends on future automation growth to help fuel reinvestment back into the business. Missing this automation trend is a huge growth drag

To be clear, I think Brian Niccol is a great leader. But all leaders are imperfect and have their faults. For Brian, I don’t see how one of his strengths is unions (Chipotle stores are not unionized anywhere near the same level). Unions bring a unique challenge for Brian, and I don’t think the stock is pricing this in. With this, I think Starbucks shares are a sell. On a P/E basis, they’re expensive, and I think any upside will likely be capped by labor risk.

Background

Starbucks was founded in 1971 by Gordon Bowker, Zev Siegl and Jerry Baldwin. The three men and their vision for a different type of coffee shop was launched from their first location in Seattle, Washington. Throughout the ‘70s, Starbucks performed well, but accelerated in the 1980s.

In 1982, Howard Schultz got connected with the coffee brand and developed a passion for not only coffee, but the inviting, romantic atmosphere that allowed for people to connect and converse with each other over a cup of coffee. Schultz served as Starbucks’ CEO for a total of 23 years.

Over the last three years, as companies across the globe have worked to rebound from the effects of the COVID-19 pandemic, Starbucks has had an increasingly difficult time. Newer and smaller niche coffee shops have sprouted up, resulting in Starbucks losing out on its target audience and losing its spot in many cities as the preferred location for people to show up, connect and converse.

Niccol, though, is supposed to be the answer Starbucks bulls are looking for. The newly named CEO has played a critical role in the turnarounds of Chipotle and Taco Bell, and he has the opportunity to do the same thing with Starbucks.

Niccol spent seven years at Taco Bell, and he joined the company during a time in which sales had stalled significantly. Following his seven-year stint with Taco Bell, Niccol became the CEO of Chipotle, where he helped double revenue, increase profits by almost seven times and increase the stock price of the company by nearly eight times.

The big difference between these turnaround stories and what Niccol is facing today is labor risk. And I think this is a big one.

According to a Reuters article from June, Starbucks had roughly 400 locations throughout the United States that had unionized, which involved more than 10,000 employees. The unionization efforts are clearly picking up steam, though, with the number of unionized locations now topping 500 stores.

Why Unions Are A Unique Problem For Brian Niccol

Unionization is a unique problem for Niccol, and it’s something that he has not had to deal with in the past. As of August, Chipotle had only one unionized store in the entire United States.

Taco Bell, the other restaurant Niccol was CEO of, is also completely incomparable to Starbucks as it relates to a unionized workforce.

This issue is something Niccol has not had to work through in the past, and it could provide him and Starbucks with a unique roadblock in the future.

During his time at Chipotle, one of the things Niccol pushed for the hardest was increased efficiency gains both in portion sizes and ingredient usage to improve margins. I wrote previously about these concerns with Chipotle in the spring before Niccol left the company.

Now with increasing unionization pressure at Starbucks, Niccol faces a key challenge.

The proportion of Starbucks locations that are unionized is still very small, but it’s growing fast. Of the reported 16,482 locations in the United States, only just over 500 are unionized. That is just over 3% of locations that are unionized. But this means the majority of the labor risk from these unionizations is ahead of the coffee chain, not behind it. The probability that workers at these locations push back on the efficiency gains that Niccol will likely go for is fairly high.

Valuation

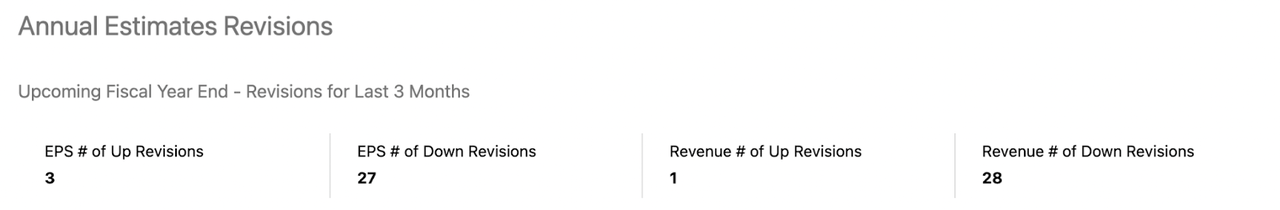

As the coffee chain’s CEO was replaced, Starbucks has seen earnings estimates largely move downward over the last three months as Wall Street analysts begin to price in the fact that a turnaround will likely be painful.

Starbucks Earnings Revisions (Seeking Alpha)

I think with this, the market has also started to price in rising labor costs, which will be a big deal for margins.

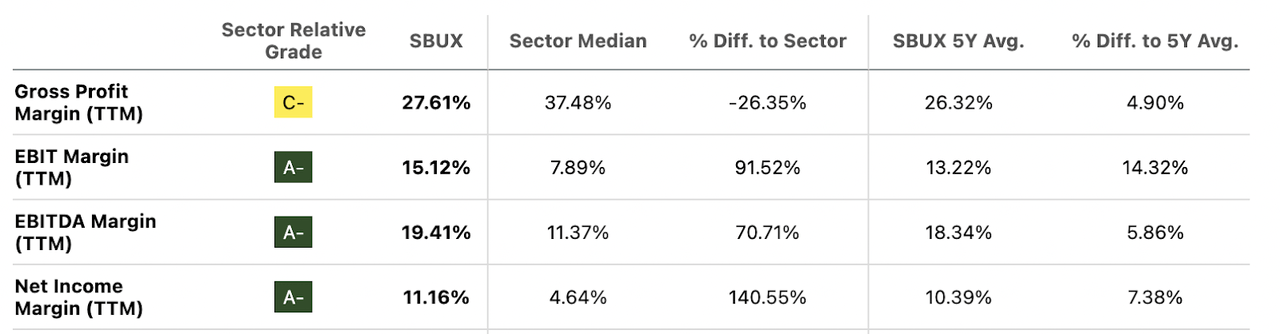

Currently, Starbucks sports a gross profit margin of 27.61%, which is higher than their 5-year average of 26.32%. Their net income margin of 11.16% is also higher than their 5-year average of 10.39% and significantly higher than the sector median of 4.64%.

Starbucks Margins (Seeking Alpha)

In essence, they are likely over earning right now. My fear is that unions driving wages higher will make these metrics revert to the mean. This means lower EPS if revenue does not pick up. And with revenue estimates moving downward, we may not see the lift that’s needed.

Shares currently trade in the mid-20s forward P/E ratio. The forward non-GAAP P/E ratio of 26.72 is significantly higher than the sector median number of 18.58. This doesn’t make sense to me, as I think margins face a real risk. I think the forward P/E should probably be closer to 20 to reflect the labor risks the coffee giant faces. If the P/E moved closer to 20, which would represent 25.14% downside.

Bull Thesis

In my opinion, the biggest bull thesis for Starbucks is that the NLRB was struck down in June by the US Supreme Court for overstepping some of their rulings. The NLRB was trying to take action against Starbucks for firing workers as they sought to unionize. The upside from this ruling is that bulls could argue this is a sign that the unionization drive reached a dead end.

From the June court ruling, the Supreme Court sided with Starbucks, ruling that Starbucks does not have to reinstate its workers while the administrative case continues.

The justices unanimously threw out a lower court’s approval of an injunction sought by the U.S. National Labor Relations Board (NLRB) ordering Starbucks to reinstate the workers while the agency’s in-house administrative case against the Seattle-based company proceeds.

The Reuters article also revealed that the NLRB has received hundreds of complaints accusing Starbucks of “unlawful labor practices such as firing union supporters, spying on workers and closing stores during labor campaigns.”

Starbucks, though, has denied all of these claims. It’s this second line about hundreds of complaints that I find concerning. Because while Starbucks may or may not end up being found guilty for firing workers who attempted to unionize, the coffee chain would be in much bigger trouble if there has been a larger, orchestrated attempt underway to limit unionization. This is illegal in the United States.

I do not think this Supreme Court ruling will be enough to stop the unionization. Most unionization activities by Starbucks employees are fairly lawful and legitimate. In fact, just earlier this month, the Starbucks Worker’s Union (SBWU) signed their 500th store to unionize. I don’t think this trend is going to stop anytime soon. With this, I think this continues to be a real risk to their business model.

Takeaway

The wave of unionization that is impacting Starbucks is unlike frankly anything we have seen at a fast food chain in the US. It’s also a largely new and unique experience for their new CEO, Brian Niccol. Niccol has great experience turning around other fast food companies (Chipotle and Taco Bell), but neither of those two had a strong push to unionize like Starbucks currently is facing.

Unionization will continue to be a major risk to Starbucks business model and will not go away. I think this will push margins down in the near future. Shareholders will likely suffer.

At this point, I just don’t see what the growth drivers are to justify why the stock trades at such a high forward price-to-earnings ratio. On the surface, this higher price to earnings ratio could be justified by the new CEO. But Niccol faces these unique challenges. I believe his management technique is incongruent with what the labor force is set to do at Starbucks.

With this, I am a sell on shares of the coffee giant. If we saw a change in unionization trends at Starbucks, then I may be more likely to change my outlook.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.