Summary:

- Starbucks stock has declined by almost 35% in the last three years, despite growing revenues.

- Recent challenges include declining same-store sales globally, particularly in China, impacting revenue and profitability.

- Starbucks’ fair value price is estimated at $107.52, presenting a potential upside of 43%, making it a good investment opportunity.

leodaphne

Introduction

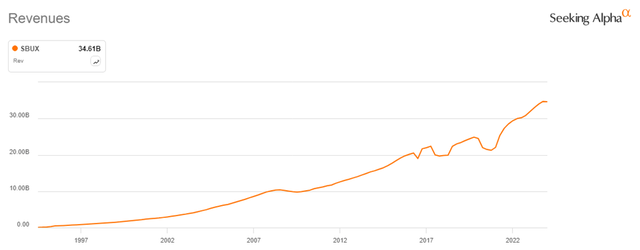

For many years, Starbucks (NASDAQ:SBUX) has been synonymous with coffee and continues to be America’s top choice for coffee on the go. The company has become a staple in society, and for many years, it was as if the company could do no wrong, as reflected in its revenues.

Despite growing revenues, the market has not viewed Starbucks favorably, even in the last three years. The stock is down almost 35%, while the S&P500 (SPY) has returned more than 29%.

Plenty of reasons can explain why that is, which we will also discuss in this article, but there might also be a certain degree of value hidden in this stock. One sign of potential value can also be seen in Starbucks’ current P/E (in TTM), which is currently around the lowest level in the past three years.

The last time Starbucks’ P/E was this low was back in mid-2022, where the stock also traded around the mid-$70s. In hindsight, this was a great time to buy and hold for the next 12 months.

Will that be the case once again this time around? We are going to explore that possibility by reviewing Starbucks’ recent challenges that caused the significant price drop. In addition, we will evaluate Starbucks’ fair value price through our own DCF model.

What has gone wrong

Starbucks has been facing some tough times recently, and their recent troubles definitely came to light with their Q1 and Q2 earnings reports. Back in January 2024, they released their Q1 results, which revealed an earnings per share EPS of $0.90, just shy of the expected $0.92.

They also reported revenue of $9.43B, falling short of the anticipated $9.60B. All this information can be viewed on Starbucks’ earnings page, right here on Seeking Alpha.

Things got even worse with the Q2 earnings report, as Starbucks reported an EPS of $0.68, well below the expected $0.79. Their revenue was $8.56B, missing the forecast of $9.12B, marking a 2% decline in sales compared to the same period the previous year, causing more concern among investors.

Perhaps the most worrying sign was that the decline in same-store sales had a 4% drop, driven by a 6% reduction in cafe traffic.

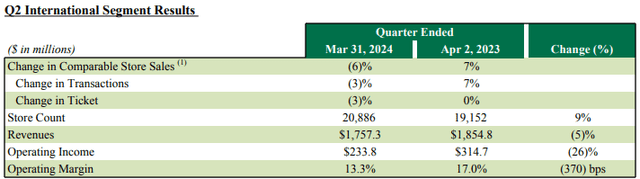

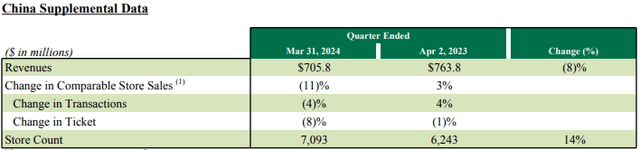

In the U.S., same-store sales decreased by 3%, while international sales fell by 6%. China, a key market for Starbucks, saw an 11% decline due to an 8% drop in the average amount spent per visit. Meanwhile, the average ticket sale dropped by 3% internationally and by a whopping 8% in China – this is, simply put, really bad.

Starbucks’ Q2 earnings report Starbucks’ Q2 earnings report

If you are not familiar with the average ticket size metric, let us explain. To put it simply, the average ticket size, or the average amount of money a customer spends per transaction, is crucial for Starbucks. If one customer buys a coffee for $5 and another spends $10, the average ticket size is $7.50.

A decline in this metric means customers are buying fewer items or opting for cheaper ones, which can significantly impact revenue, especially when this pattern repeats across millions of transactions. This indicates that economic challenges, especially in China, are hitting Starbucks’ revenue hard.

In addition to the decline in ticket size, we want to point out the huge YoY decline in operating income seen in the international segment.

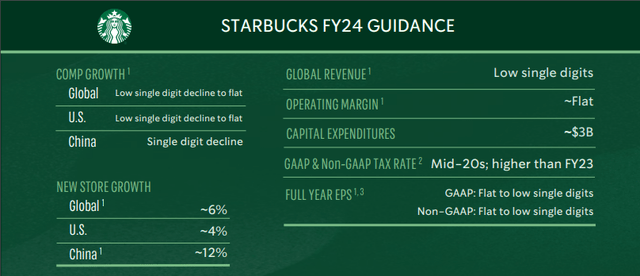

As a consequence of these disappointing results, Starbucks has lowered its expectations for 2024. They now predict low single-digit revenue growth, down from an earlier forecast of 7% to 10%. Similarly, they expect flat to low single-digit growth in same-store sales globally and in the U.S., a downgrade from the previous projection of 4% to 6%.

In China, they anticipate same-store sales to decline, reversing the previous expectation of slight growth. Economic uncertainty is adding to these challenges, with CEO Laxman Narasimhan noting that consumers are becoming more cautious about their spending due to economic conditions, impacting Starbucks’ sales.

Starbucks CEO Narasimhan said, “In this environment, many customers have been more exacting about where and how they choose to spend their money.”

Despite the waning sales, Starbucks’ most dedicated customers have remained loyal, utilizing discounts through the company’s mobile app. However, occasional customers have been purchasing less frequently.

To attract these occasional customers, Starbucks plans to offer a version of its app that allows orders without requiring loyalty membership. Additionally, they are exploring ways to meet overnight demand, with a pilot test doubling business, and plans to build on successful product launches, like its lavender drinks, to pursue a $2B business over the next five years.

This will be key to Starbucks’ success in the long term. In addition, Narasimhan also announced that they now expect supply-chain cost savings of $4B over the next four years, up from the previous forecast of $3B over three years.

Similarly to Starbucks, other companies such as McDonald’s (MCD) and PepsiCo (PEP) have also reported that consumers are cutting back on spending and seeking deals elsewhere. We want to highlight this since it is evidence that what we see at Starbucks concerning customers substituting for other products is not an isolated case—it is seen across the whole industry.

Starbucks is releasing its Q3 earnings for FY2024 on July 30th, and the market is currently expecting a topline result of $9.25B and a bottom line of $0.94 per share. These estimates are very similar to Q1 2024, where Starbucks underdelivered, as we mentioned earlier. This time, we need confident earnings without further lowering their full-year guidance.

We believe the market should react positively if Starbucks simply holds its full-year expectations in line with what it announced during its Q2 earnings. In addition, Starbucks also needs to change its ticket size to stop bleeding and generally start seeing growth once more.

Financial Overview

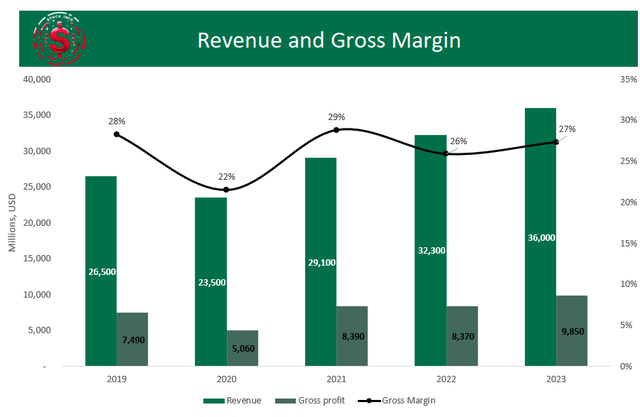

You might be wondering, at this point, if anything significant changed in Starbucks’ financials. Reality is, on the top line, not much has changed in the past five years.

The graph below shows that Starbucks’ revenue has steadily increased from $26.5B in 2019 to $36B in 2023. Despite a dip in 2020 to $23.5B, revenue growth resumed strongly in subsequent years.

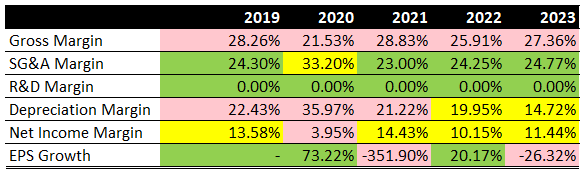

Gross profit followed an upward trend, from $7.49B in 2019 to $9.85B in 2023. Gross margin fluctuated slightly, decreasing from 28% in 2019 to 22% in 2020, stabilizing around 26-29% in the following years.

Overall, Starbucks has managed to maintain profitability and keep the topline profits very stable during a time that has proven difficult for many other companies.

Let’s dig a little deeper into Starbucks’ margins, with the table below summarizing annual margins and EPS growth. The SG&A margin was particularly high in 2020 at 33.20%, which shows increased expenses during the pandemic but normalized to around 24-25% in subsequent years.

Notably, the net income margin has been declining, from 13.58% in 2019 to 11.44% in 2023, which is not necessarily bad. It just isn’t great either.

Their EPS growth has been highly volatile, with significant drops in 2020 and 2023, with 2020 likely resulting from COVID-19 and 2023 being the more worrying year to see EPS growth decline.

Stock Info

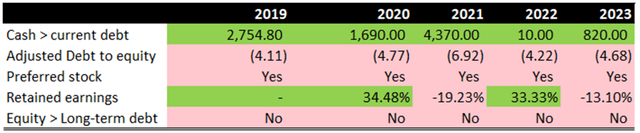

Let’s move on to the balance sheet. In the table below, we have different debt and equity metrics. The amount of cash to current debt significantly decreased from $2.75B in 2019 to just $820M in 2023, which is very worrisome.

Adjusted debt to equity worsened from -4.11 in 2019 to -4.68 in 2023. You may be wondering why this ratio is negative, and simply put, it’s because Starbucks has negative equity, highlighting increasing financial leverage and potential solvency problems for the company.

Retained earnings saw a substantial uptick in 2020 but have since bounced up and down in later years. In addition, Starbucks has had much more long-term debt than equity, which is simply put due to their negative equity. While this is not ideal, it is not necessarily catastrophic as long as it is managed properly by Starbucks’ management.

Their board and officers have a decent history, so we give them the benefit of the doubt here. With that being said, investors should keep a close eye on how Starbucks’ balance sheet evolves in their next earnings.

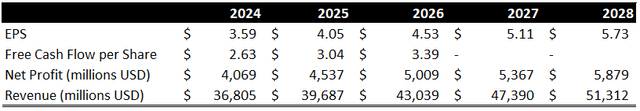

Lastly, the future projections table below outlines Starbucks’ anticipated financial performance from 2024 to 2028. EPS is expected to grow steadily from $3.59 in 2024 to $5.73 in 2028, and free cash flow per share also shows a gradual increase – supporting the notion of improving cash generation capabilities.

Net profit is projected to rise from $4.07B in 2024 to $5.88B in 2028, while revenue is expected to grow from $36.8B to $51.3B over the same period.

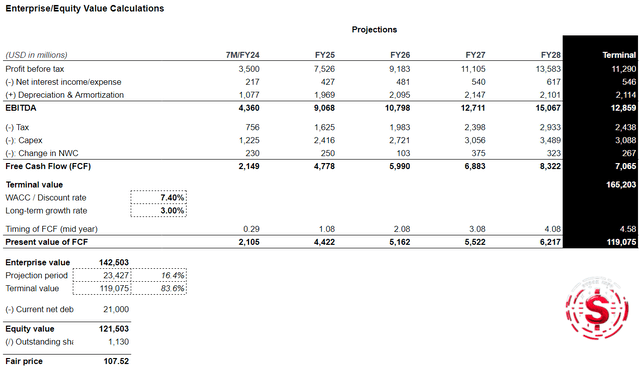

Now that we have been through both the historical and projected financials for Starbucks, let us see what all this implies: the fair value of the stock. The table below outlines Starbucks’ enterprise and equity value calculations. By FY28, we’ve calculated Starbucks EBITDA to $15.1B and free cash flow to $8.3B by the same year.

The terminal value is calculated using a discount rate (the WACC) of 7.40% and a long-term growth rate of 3.00%. The long-term growth rate is chosen relatively conservatively, but you can see how revenue estimates are expected to grow here. Based on Seeking Alpha’s data, the market expects Starbucks’ revenue to grow between 7-8% yearly.

The selected WACC of 7.40% is calculated using a long-term bond rate of 3.88%-4.38% and an equity market risk premium of 4.60%-5.60% – we use the mean between the two. These inputs, along with the adjusted beta and risk adjustments, determine the cost of equity. We then plug in the cost of debt and the tax rate. It is important to keep in mind these model inputs, since they reflect our estimations and available market data.

Therefore, we believe a 3% long-term growth rate is a fair and not too optimistic input for the model.

This results in a terminal value of $165.2B. When discounted to present value, the enterprise value is $142.5B. After subtracting net debt of $21B, the equity value comes to $121.5B, leading to a fair share price of $107.52.

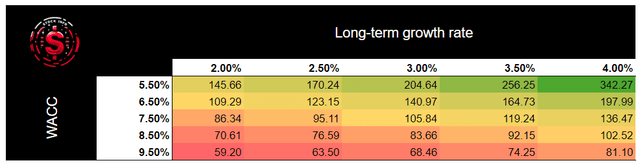

In addition, we have also provided a sensitivity analysis chart demonstrating how different assumptions about the WACC and long-term growth rate affect Starbucks’ fair share price in our model.

The fair share price increases if the cost of capital is lower and the growth rate is higher. Our main point is that the fair value of the stock can be very sensitive to the assumptions we have made in this model.

We try to be conservative when we can while using broader market expectations regarding future earnings. Our fair price calculations use a WACC of 7.40%.

However, if Starbucks’ true WACC is 6.50%, for instance, then we are looking at an almost 100% upside relative to its current price. A potential 100% upside might seem too good to be true, so we believe a fair value of $107.52 is reasonable. This still constitutes an estimated upside of 43%, which is decent.

Risks

As we can see, you should be aware of two types of risks regarding Starbucks and this article.

First, as mentioned towards the end of the last section, our valuation highly depends on our estimation of Starbucks’ WACC, which can differ slightly depending on the assumptions you plug into the model. As seen in the sensitivity matrix above, a single percentage point has significant implications on the model – as goes for our assumptions on long-term growth.

Second, Starbucks faces several key risks affecting its stock price in 2024. One major issue is the decline in same-store sales, which dropped by 4% globally due to a 6% decrease in cafe traffic.

In the U.S., same-store sales fell by 3%, while international sales saw a 6% drop, with China experiencing an 11% decline driven by an 8% reduction in the average ticket size. This trend indicates that economic challenges make consumers more cautious with spending, impacting Starbucks’ revenue and profitability.

Furthermore, Starbucks has lowered its financial projections in 2024, now expecting low single-digit revenue growth instead of the earlier 7% to 10%. This revision includes anticipated declines in same-store sales in key markets like China.

The combination of economic uncertainty and cautious consumer behavior poses significant challenges for Starbucks, putting pressure on its growth and profitability. There is a real possibility that their metrics could keep declining, but management has had a stern eye on this and is on the way to implementing savings across their supply chain to mitigate it.

Conclusion

Starbucks has faced some tough times recently, but there are plenty of reasons to be optimistic about its future. The company has shown resilience with its strong brand, loyal customers, and smart strategies to bounce back. By enhancing its app and offering new products, Starbucks is working hard to win back occasional customers and boost sales.

Despite recent earnings disappointments and challenges in key markets like China, our analysis suggests that Starbucks’ stock has a fair value of $107.62, presenting a promising upside of 43%.

This potential makes it a good time to consider investing in Starbucks. While there are risks, particularly related to economic conditions and consumer spending habits, the potential benefits make Starbucks an appealing investment opportunity.

So, we recommend buying Starbucks stock now to take advantage of this upside.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.