Summary:

- Starbucks Corporation’s Q3 earnings show a decline in comparable sales globally, with total transactions down despite higher average ticket prices.

- Operating margins narrowed due to higher expenses, but the CEO and CFO remain optimistic about the company’s action plan for improvement.

- Despite challenges, Starbucks continues to open new stores and maintain a loyal customer base, with a dividend yield of 3.0% providing some support for investors.

- While there are some positives, and the stock appears to be grinding out a base, another misstep would trigger a big leg lower.

Roydee/E+ via Getty Images

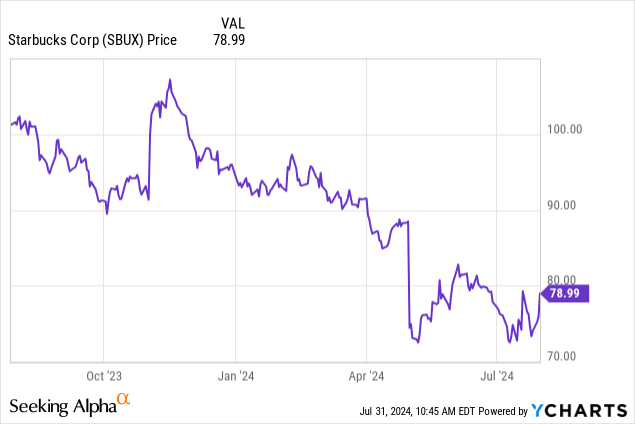

A few months ago, we covered the collapse of Starbucks Corporation (NASDAQ:SBUX) following a horrific second quarter. We had to opine at our service that shares were becoming more of a buy in the low $70s. Now, it looks like the stock is grinding out a base, suggesting a bottom may be in.

Shares are up today after a mixed quarter that come with some new approaches and strategic partnerships, menu moves, and a big effort to re-attract North American customers. Still, approaching with a cautious, but modestly optimistic view is warranted here. While we maintain that consumers are simply exhausted from high prices and are pushing back on the constant price increases, leading to fewer consumer dollars to go around between restaurants, Starbucks is in a bit of a better position today than three months ago. However, it is still seeing weakness in key lines, while comparable sales continue to suffer. Things are better, but we are not in the clear. In this column, we check back in on the stock following the just-reported Q3 earnings.

Starbucks Q3 earnings comparable sales update

Comparable sales are the key metric we watch for with all restaurants. In the just reported fiscal Q4 2024, Starbucks saw another sales decline versus the prior year. The total top-line revenue figure was down 1.1% to $9.1 billion, which missed versus consensus estimates of 1.1%. What about the critically important comparable sales figure? Well, comparable sales for the entire company were down 3.0% globally. This remains a massive negative, even if some degree of decline may have been expected. But a $150 million miss on estimates, which had come down, still suggests that consumers are tightening up, and cutting back on spending their hard-earned cash on expensive coffees and food wares still. Management has taken steps to improve traffic, but it will take time.

Total transactions were down 5% from a year ago, which follows a 6% decline in Q2. This comes despite the average ticket being 2% higher, but a lot of that is from pricing power. With such a volume decline, it is clear consumers are still pushing back. Management has worked hard to regain footing in the critical U.S. market, but in North America, we saw comps down 2% from a year ago. This was because of a 6% decline in transactions, but average tickets were up 3% In the U.S. specifically, comps were down 2%, thanks to a similar 6% decline in volume, but a 4% increase in average.

There was even more pain internationally, driven by ongoing China woes. International comps were off 7%, with 3% fewer transactions, and a 4% decline in the average ticket. China specifically remains a pressure point, where we saw a huge 14% decline in comparable sales. Further, margins remained pressured.

Starbucks Q3 earnings report margins

So we saw lower comparable sales drive a notable revenue miss. Operating margins also narrowed. Global operating margins were down 60 basis points to 16.7%, stemming from higher promotions, higher wages, and higher benefit expenses. On an adjusted basis, margins were down 70 basis points, also hitting 16.7%. One positive is this is up from the sequential Q2’s 12.8%. Breaking it out by region, we saw North American operating margin contract 70 basis points to 21.0%, while internationally, Starbucks experienced a 340 basis point operating margin decline to 15.6%.

While there were these declines, Laxman Narasimhan, Starbucks CEO, stated in the earnings release:

Our three-part action plan is beginning to work and driving operational improvements that we expect to improve financial performance. Our growing culture of focused innovation and relentless execution continues to enhance our capabilities, while helping return the business to sustainable growth.”

Rachel Ruggeri, the CFO, added more color on the track of the plan to dive operational improvement:

“Our efficiency efforts, which are tracking ahead of expectations, partially offset investments associated with the cautious consumer environment. Collectively, our disciplined approach enables us to preserve both balance sheet strength and flexibility, positioning us to successfully navigate through the current macroeconomic environment.”

While there are organic issues with the company, much of the pressure is on a macro basis from a weaker consumer. We are hearing this on many conference calls we participate in for restaurants. Add in the fact that competition in coffee and breakfast foods are everywhere too, but we reiterate that we believe the bottom 20% of consumers are losing the ability to afford eating out. China has its own unique issues that will take several quarters to remedy. But the inability of the consumer to afford life at this point is a huge reason U.S. traffic is down. Worth reminding, but after a few quarters of Student loan repayments having returned, the pinch to consumers has only extended. Simple mathematical fact here, but after years of no repayment, those student loan bills are hitting consumers and immediately drawing money out of the economy.

Starbucks, in our opinion, is a casualty in all of this. That said, Starbucks reported adjusted EPS of $0.93, about in line, but down 7% from $1.00 a year ago.

Action plans and still opening stores

The company has put into place its action plans, which aims to improve efficiency and return traffic to stores. Too soon to see an impact yet, but this is a positive tailwind. We saw some sequential improvements, even if the year-over-year comps are painful. And keep in mind that the company is still opening stores. Starbucks opened 526 net new stores in Q3, and ended Q3 with 39,477 stores. Of these, 52% are company-operated and 48% are licensed stores. 61% of stores are in the U.S. and China. And both regions are under pressure, especially China.

Another good piece of news is that the most loyal of customers are still coming in. The company’s Starbucks Rewards loyalty program, looking at 90-day active members in the U.S., was 33.8 million, up 7% year-over-year, a positive. Further, Starbucks has had 57 consecutive quarters of dividend payouts, and this big retracement has pushed the yield to 3.0%, so you get paid to wait. With that said, valuation is much more reasonable, closer to 21X FWD earnings assuming this year sees essentially no growth.

Our take

While Starbucks Corporation has a lot of work to do, the stock is seemingly grinding out a base here in the $70s, but the pressure is on for the manager to deliver a return to growth. In short, it’s not in the clear, as another surprise quarter on the downside could lead to another wave of selling if earnings estimates come down. We do not see that happening, but investors should be aware of that risk.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for our highest conviction trades?

Start WINNING TODAY! Grow your portfolio by embracing a blended trading and investing approach at our premier service!

We activated our end of July deal! Act now and lock in $250 of savings today. Join Seeking Alpha’s premier service while spots remain at this discounted rate! It’s available to the next 3 subscribers ONLY. Come trade and learn from the best.

Enjoy a money back guarantee if you aren’t satisfied (you will be). Start WINNING today. Get in the game!