Summary:

- Starbucks, despite recent share price increases, remains a buy due to expected industry growth and improved company results under new management.

- The coffee industry is projected to grow at a 6% CAGR over the next 5 years, benefiting Starbucks significantly.

- Starbucks’ strong brand and loyalty program provide a competitive edge, though challenges include competition and labor market pressures.

- Current valuation shows potential for upside, with expected dividend increases and growth under the new CEO’s leadership.

jetcityimage

Investment thesis

Starbucks (NASDAQ:SBUX), the American multinational coffee company, has recently undergone a major change, not only in its share price, but also in its management. The share price of the Brian Niccol-branded company has shot up, but even so, I still think it is worth buying the company’s shares with the current limited upside potential and the expected improvement in the company’s results.

Growing industry

The first thing to look for in a company where we expect growth is how the industry can grow because if the growth prospects of the industry are good, we can expect growth even if the company’s performance is poor. In addition, if the market is not growing, the company can still grow, but it can only grow at the expense of its competitors, because in this case, we are talking about a zero-sum game. Fortunately, Starbucks is in the coffee business, where growth is expected on an annual basis and stable growth is expected for the next few years, which will be a tailwind for the company in the long run. My expectation is that the industry will be able to grow at a compound annual growth rate of at least 6% over the next 5 years. This is supported by Zion Market Research’s research on coffee shop growth. The forecast is for an annual average of 6.83%, which is good news for Starbucks as it means a bigger tailwind in terms of both coffee shop openings and revenue numbers.

Competitive advantages and challenges

Given the trends in the industry, more and more companies have opened cafés or larger companies have expanded their offerings in this area, putting the company under greater competition.

One such challenge I see is the move by McDonald’s (MCD) and Dunkin’ to increasingly try to capture markets in the coffee business. True, they are not operating in the premium segment, which means their coffee prices are cheaper, but they allow for faster service, which may put some pressure on Starbucks’ pricing and could siphon off some of Starbucks’ lower income customers. In addition, there is the British coffee chain Costa, also in the premium segment, which is a bigger competitor in Europe. There is also the Luckin Coffee shop (OTCPK:LKNCY), which is a challenge in China because of its lower pricing. Even the emergence of local specialty coffee shops and Nespresso, which makes coffee capsules, could be a challenge for the company, but I think in the long run it will be the brand that will make the difference between the different coffee shops and coffee chains, where Starbucks is the strongest, not only in my own judgment and experience, but also in the Forbes 100 Most Valuable Brands list, where Starbucks is 37th. Also on that list is McDonald’s, but that’s not for McCafé, it’s for burgers. For this reason, I think we can clearly give this company a wide-moat label.

In addition to the global brand and presence in the world market, what will benefit the company in the long term is the trend towards premiumisation not only in developed but also in developing countries. This translates into an annual increase of roughly 1% towards higher quality in developed countries, while in developing countries it is more than 2%. So I think in the long run the company will be a top performer in this industry.

The strong brand has created a sense of Starbucks, which means high quality and coffee culture, but this has been challenged in recent years by the tight labour market in the western world, which has made it harder for the company to find well-qualified and skilled workers. This, coupled with inflation and a rising wage demand, may put pressure on the company’s margin expansion in the future, which nevertheless has improved from the 5-year average of 18.35% to 19.41%, but efficiency is the key here in my opinion, given the sustainable Starbucks experience.

Starbucks’ loyalty program may be the key to growth, especially in developed countries. As the US market, for example, is already at a more mature stage, which according to the latest report, only here the revenue could only grow by 7%, compared to the same quarter last year, while in the international segment it was 24%, which shows that it is worthwhile to increase the engagement of those who already regularly shop there, for example, with a loyalty program. It’s good news that the Rewards Membership number, which was down more in the Q2 fiscal report, has started to rise again in the Q3 fiscal report. My expectation is that it can increase this number by double digits compared to the same period last year.

The company can even improve efficiencies by improving the digital platform, speeding up ordering and reducing the pressure on employees, which is essential to maintain the quality and experience of Starbucks. By enhancing these, the company can reach its consumers more easily, giving promotions and driving greater engagement. I think this is the next level of revenue growth and maintaining a competitive advantage, so I expect the company, and the new CEO, to place a strong emphasis on this.

Valuation of the company

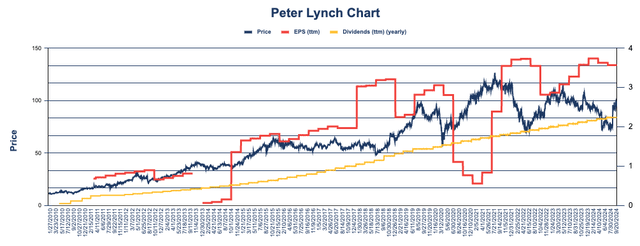

I believe that, in addition to being a high-quality company by brand, the company has the potential for strong growth, both in terms of the industry and the qualities and track record of the new management. The third factor for this is the value proposition in order not to overpay for the company. If we look at the chart below, the Peter Lynch chart shows that the company is no longer undervalued, but even at the current share price level, there is always room for upside even with the current results, not counting the expected improved results for the next quarter.

Peter Lynch chart for Starbucks (Data from Gurufocus.com and this chart is created by the Author)

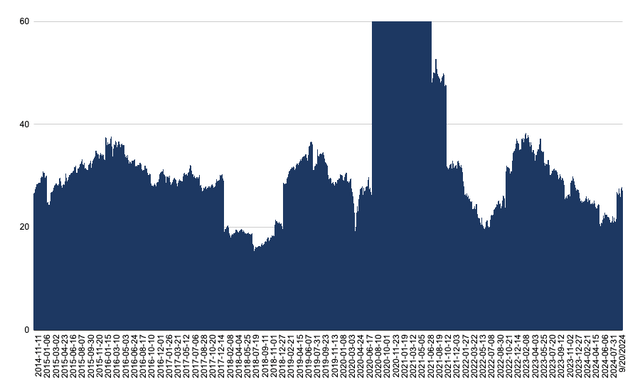

The red line shows the earnings per share for the last four quarters, the blue line shows the share price trend over the last few years and the yellow line shows how much the company has paid out in dividends over the last four quarters. Basically, the chart also shows that it was worth buying the company based on its past pricing when the price chart was closer to the yellow line and less so when it was closer to the red line. This is more naturally fully correlated with the P/E chart below. For better visibility, I made a correction for 2020 and 2021, where the high P/E would have made the chart less visible. At the current price of 96.05, the company has a P/E of 26.9, which is no longer so low thanks to the growth prospects with the new CEO.

P/E chart for Starbucks (Data from Gurufocus.com and this chart is created by the Author)

The current dividend yield is 2.37% per annum, which is positive, however, as we expect the dividend increase announcement and the starting dividend yield to increase soon. My expectation is that the dividend will be at least $2.4 in the next fiscal year, which translates to a starting dividend yield of 2.498% at the current exchange rate. That’s still higher than the average starting dividend yield of the S&P 500 stock index, which is 1.26% currently.

Where it can go wrong

In addition to increasing competition, the economic slowdown in China could set back the company’s growth. In this view, the Chinese market would have been a very important driver of growth over the past one to two quarters had it not slowed. I see this as a critical point in the context of increasing competition. The lack of growth in loyalty programs could also reduce the company’s growth, these will be worth following in the next quarterly report. Pressure could be put on the company’s margins by an increase in the price of core products. This will be an important task for the new CEO to manage. Another issue could be the change in the number of new Starbucks cafes, as this is a key factor for growth, along with the increase in the number of transactions.

Conclusion

Summarizing the key information, I think that Starbucks has a greater competitive advantage over its competitors, which may even grow in the coming years due to the Starbucks experience and loyalty program. Given the industry, the growth of the company is a given. With a new CEO at the helm, I expect efficiency and revenue growth, while maintaining the familiar Starbucks experience. Considering the valuation of the company there is room for upside beyond its current performance, which is not that great at the moment, but considering the company’s prospects, it is worth paying a fair price for this company rather than waiting to see if it gets cheaper.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SBUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.