Summary:

- Starbucks was led astray by former CEO Laxman Narasimhan.

- New CEO Brian Niccol recently outlined his turnaround plan.

- It’s a back to basics approach that puts more emphasis on coffee, the café experience, and customer service.

- Sales in China should also normalize relatively soon.

TonyBaggett

Led by new CEO Brian Niccol, Starbucks Corporation (NASDAQ:SBUX) has laid out a masterfully simple turnaround plan that is likely to succeed. Add in a potential recovery from the company’s Chinese operations, and it combines to make the stock a pretty compelling investment today.

Introduction

Fiscal 2024 has not been a good year for Starbucks.

It started at the end of the first quarter, which ended on December 30th, 2023 and was reported to the market on January 30th. Revenue came in at $9.4B for the quarter, which was a miss of $230M. Non-GAAP EPS was $0.90 per share, a miss of $0.04 versus analyst estimates. These weak results were offset by a gain in same-store sales — that all-important metric was up 5%, although analysts expected same-store sales to increase 6.4%.

Second quarter earnings were far worse. Non-GAAP earnings came in at $0.68 per share, a miss of $0.12 per share compared to analyst consensus estimates of $0.80 per share. Revenue came in at $8.56B, which was a $600M miss versus analyst expectations. Shares tanked on the news, falling from $88 to the low $70s.

Third quarter numbers had pieces of good news and pieces of bad news. Sales continued to slide, including same-store sales falling 3% across the globe. Earnings were in-line with analyst estimates at $0.93 per share, and revenue of $9.1B was only $150M off analyst projections of $9.25B.

The slight improvement wasn’t enough for the CEO to keep his job. In August, the company announced CEO Laxman Narasimhan was stepping down immediately to be replaced by Chipotle CEO Brian Niccol.

Shares rallied sharply on the news, with many investors convinced that Niccol was the right man to turn Starbucks around. After all, Niccol was brought in to turn around Chipotle after it experienced a food safety crisis in 2018. He did that, and then showed his expertise as an operator by leading Chipotle to outstanding results in subsequent years.

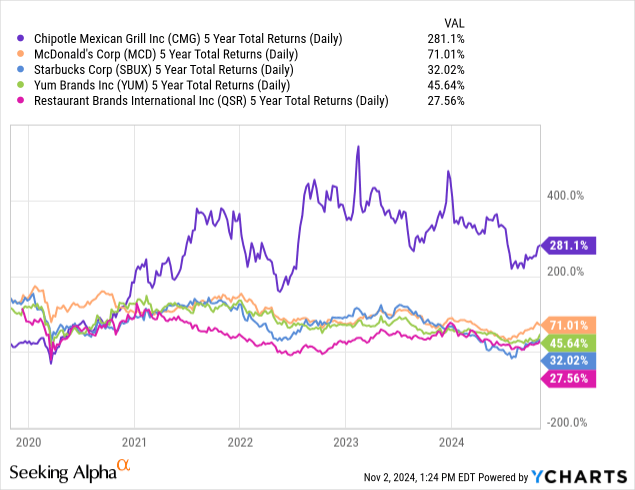

To see the full picture of Niccol’s impact during his years at Chipotle, let’s compare the stock versus various QSR peers over the last five years.

What we see is Chipotle massively outperforming peers, and that’s even after shares fell pretty sharply after Niccol departed. Niccol isn’t the only reason Chipotle outperformed, of course, but considering the reaction from Chipotle’s shares when he announced his departure, it’s safe to say he’s viewed as an effective CEO.

Now that Niccol is in place as Starbucks’ CEO, and he’s had a few months to look things over, he recently came out with what this analyst thinks will prove to be a very effective turnaround plan.

Niccol’s back to basics approach

Investors were anxious to hear with Niccol had to say during his first conference call, which was held on October 30th. He didn’t disappoint.

Niccol outlined his Back to Starbucks plan, with has four main pillars:

- Success begins and ends with its employees.

- Deliver the customer experience needed to win the morning.

- Be the community coffeehouse.

- Re-introduce Starbucks to the world.

Starbucks Q4 Earnings at a Glance

The plan mostly consists of Starbucks going back to its roots. Niccol said, “My experience tells me that when we get back to our core identity and consistently deliver a great experience, our customers will come back. Our problems are fixable. Most of what we need to do is in our control.”

Niccol then broke down the plan into various specific tactics.

Firstly, he wants to make it easier for customers to get a cup of coffee. The company wants to deliver a high-quality handcrafted beverage to café customers in four minutes or less. Niccol also pledged the company would “get the café experience right.”

Secondly, the company will bring back its condiment coffee bars. This will happen in all locations by early 2025. Niccol said the condiment coffee bars are “a great customer experience and will help with speed of service.” The company will also evolve store routines to hand-deliver brewed coffee to customers quicker.

Third, Niccol pledged to simplify the menu to “align with our core identity as a coffee company.” The customer will still be offered great choice, but the company will focus on fewer offerings and instead place a greater emphasis on execution.

It immediately made a symbolic move on this front when it announced it would discontinue its divisive olive oil-infused coffee drinks in early November. The olive oil drinks were the brainchild of Starbucks legend Howard Schultz, who discovered the concept during a 2023 trip to Italy. They lasted just under a year on the menu.

Fourth, Niccol pledged a further investment in Siren Equipment and Siren Craft processes, with the intended goal to both improve the in-store experience for both staff and customers, as well as better organizing mobile orders. As Niccol stated and many customers know, mobile orders are wonderful when the restaurant isn’t that busy. But when it’s hopping, mobile orders just add to an already chaotic situation.

Niccol also pledged that Starbucks wouldn’t increase its prices in 2025, while also announcing a stealth price cut. Starting with the holiday launch on November 7th, the company’s stores will no longer charge customers extra for substituting non-dairy milks. This will translate into a 10% price reduction for a lot of different customers.

Fifth, the company will focus on reclaiming its focus on making its cafés feel like the welcoming coffee house that customers remember. The company will reintroduce more personal touches that elevate the café experience. For instance, it will prioritize serving coffee in ceramic mugs for customers who stay in. It will also invest in more comfortable seating.

Finally, Starbucks will focus on coffee again. It will work with everyone from coffee farmers to master roasters to really showcase its premium coffee beverages. Marketing will focus on that, rather than the other drinks that have been emphasized over the last couple of years. The majority of marketing was spent towards Starbucks Rewards customers. This will change, with Niccol placing greater focus on more broad media reach.

On the surface it seems like an ambitious turnaround story, but when we look a little closer it’s really much more simple than that.

Why the turnaround is achievable, and soon

Niccol’s turnaround plan is a lot of words and a lot of proposed action that all really translate into one thing.

Starbucks is going back to its roots.

Niccol came up with this strategy after talking to baristas all across the United States, and many of his ideas were things that baristas brought up to him time and time again. By using this grassroots approach to the turnaround plan, Niccol has made it much more likely that employees will buy in. Further commitment to employees will help here as well, which should help keep unions at bay.

Starbucks bears like to point out that independent coffee shops have surpassed Starbucks because they focused on the café experience. That’s likely true. However, according to Niccol’s experience on the front lines, baristas want to do a better job creating a coffee shop experience. By giving them permission to do exactly that, Niccol may have awakened the proverbial sleeping bear.

The Back to Starbucks plan is also proven. Starbucks became one of the planet’s most successful coffee companies by following a certain set of principles. It then strayed from those principles in an effort to capture more customers. The original plan had a multi-decade track record of working, and it’s highly likely that going back to that plan will be successful.

Yes, Starbucks struggled in 2024. But so did many of its peers. McDonald’s posted negative same-store sales in its most recent quarter. That was the company’s second consecutive quarter of negative comparable sales. Wendy’s posted same-store sales growth of just 0.2% in its most recent quarter. Wingstop missed analyst targets in its most recent quarter.

Most quick service restaurants are also ramping up their value propositions. Several have introduced $5 meal deals. Others have been more aggressive in offering coupons. These aren’t things you do when the sector is hot.

In short, Starbucks has struggled in a consumer market where many of its competitors are feeling similar pain. I’d be more worried if Starbucks was struggling amid a much stronger overall macro environment.

The elephant in the room is China, of course, with results from the world’s most populous country weighing down the rest of the company. Niccol also made it clear that he wants more time to study Starbucks’ China problem before coming up with a plan there.

Starbucks has two issues in China. The first is increased competition, especially from Cotti Coffee. Cotti, emerged from the ashes of 2022’s Luckin Coffee bankruptcy, and has grown significantly in just two years. Luckin Coffee has also resumed its aggressive expansion pace after being recapitalized by its new private equity owner.

Starbucks recently reported negative 14% sales growth in China comparable store sales. That’s bad, but it’s hardly worse than its largest competitor. Luckin reported negative 13.1% same-store sales growth from self-operated stores in its most recent quarter.

The second issue is macro. The Chinese economy is struggling enough that the government has announced an economic stimulus plan. This is likely to include investments in the property sector, lower interest rates, and subsidies to lower-income households.

The current competitive marketplace in China’s coffee market cannot be maintained. A return to sanity combined with an improved local economy should be enough to help sales increase from today’s trough levels.

Valuation

Starbucks shares aren’t cheap today, but earnings growth potential should ensure a much more reasonable valuation when some of the company’s various issues get ironed out.

As it stands today, Starbucks trades at 31x forward earnings projections of $3.18 per share.

But the valuation gets better as we look further down the line. Analysts believe the company’s earnings will continue to improve in both 2026 and 2027. The bottom line is expected to grow to $3.91 per share in 2026, and further increase to $4.39 per share in 2027.

That puts the stock at just 22.5x 2027’s earnings. That’s much more reasonable than first glance.

Starbucks has shown investors before that it can increase earnings in a hurry without a huge increase in sales. In 2017, for instance, the company earned $1.99 per share on sales of just over $20B. A year later, the top line increased to $22.3B, a relatively robust increase of 11.5%. Earnings shot 64% higher in the same period and hit $3.27 per share.

One of the nice parts of the Starbucks business model is it has pretty significant operating leverage when things improve quickly. Investors paying 31x forward earnings are therefore betting on that operating leverage happening sooner, rather than later.

The bottom line

This analyst remains bullish on Starbucks, a stock I’ve owned since the 2018 struggles.

The company was led astray by the wrong CEO who sent it down a misguided path. Its top-notch brand, terrific real estate portfolio, and moat minimized the damage, but it didn’t emerge unscathed. There are serious issues.

Fortunately, the right CEO is now on the job, and he presented the market with a solid turnaround plan. Brian Niccol isn’t out to reinvent the wheel; rather, he simply outlined a strategy that has the company go back to its roots. He’s just rebooting something that worked incredibly well for decades.

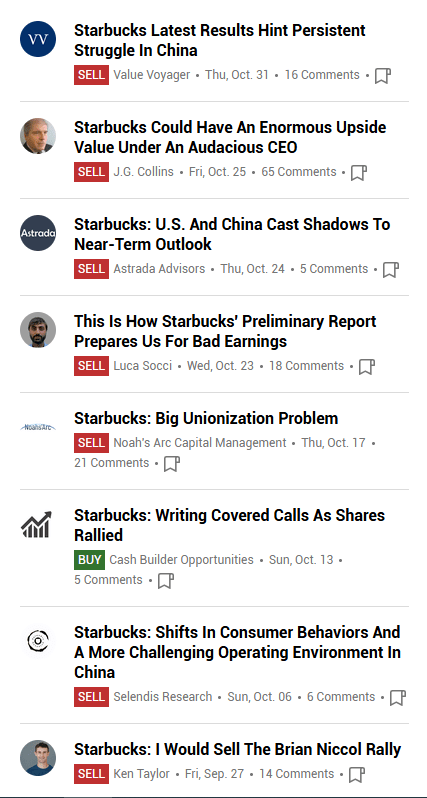

And yet, investor sentiment continues to be extremely negative. Seven of the last eight articles on Seeking Alpha are urging investors to sell.

Seeking Alpha Starbucks stock page

This analyst disagrees. I think a combination of Niccol’s turnaround plan, the normalization of the Chinese market, and a more positive environment for all QSRs in the United States in 2025 will be enough to help the company get through this rough patch.

Starbucks has proven it can be successful as it grew into the behemoth it is today. I’m confident it can get through this rough patch and restore investor confidence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SBUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.