Summary:

- Starbucks stock has plummeted due to slashed guidance, but this presents a buying opportunity as coffee demand remains strong.

- The lowered guidance is not unique to Starbucks and is influenced by external factors such as inflation, higher interest rates, and reactive consumer spending cuts.

- Starbucks is a solid dividend growth stock with a current yield of 3% and a history of increasing dividends for 13 consecutive years. This presents an opportunity to accumulate.

- The slashed guidance was not a result of fundamental shortcomings of SBUX, but rather due to external conditions.

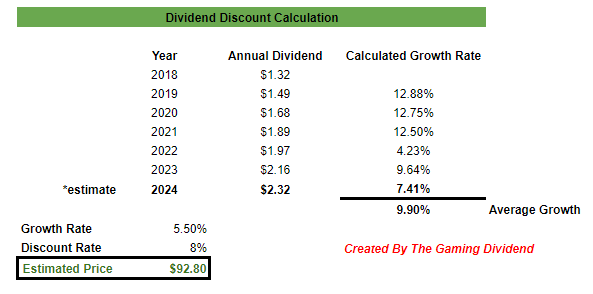

- I calculate an estimated fair value of $92.80 per share, which represents an upside potential of 22.7%.

bedo

Overview

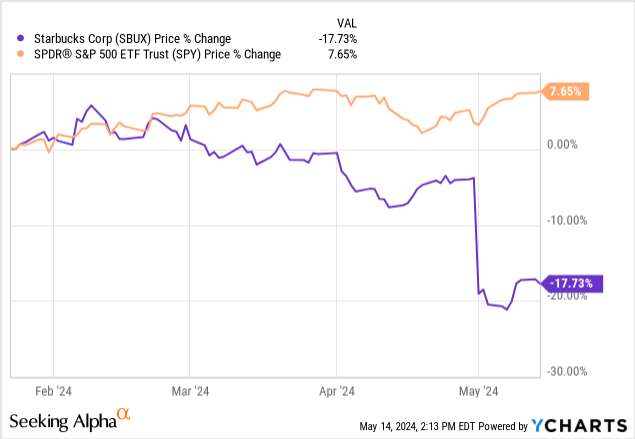

I previously covered Starbucks (NASDAQ:SBUX) (NEOE:SBUX:CA) in January and rated it a buy. However, the guidance outlook was slashed over the last earnings report and the stock has plummeted since then. However, I think this presents an opportunity and the market drastically overreacted to the downside. Even though the short-term noise may have clouded judgement, data reinforces the fact that coffee is still in demand and the cult following of Starbucks will likely be maintained throughout this slump.

I saw that the market reacted a bit dramatically because of a slashed guidance, but this isn’t a problem that’s unique to Starbucks. Inflation remains higher, interest rates are still elevated, and consumers have been cutting back on spending for more than a year now. These external things have already been pre-existing factors on a macro level, so it shouldn’t have come as a surprise that guidance was slashed.

Additionally, SBUX remains a solid dividend growth stock. The dividend yield now sits at 3% and the dividend has been increased for 13 consecutive years. For reference, the average dividend yield typically sat around 2% over the last four-year period, making this a more attractive time to lock in a higher starting dividend yield. While the starting yield isn’t the most appealing, long-term investors should stick around and continue accumulating because the dividend growth has been excellent. In addition, there are a few different indicators that reinforce the idea that SBUX’s fair value sits much higher, so entry here would allow you to capitalize on potentially huge price appreciation when market conditions improve.

Dramatic Guidance Reaction

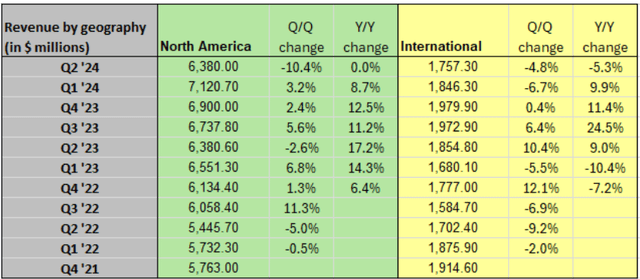

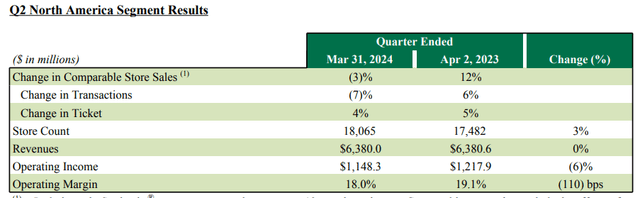

At the end of April, SBUX reported their Q2 earnings which revealed a decrease in revenue by -1.8% year over year, amounting to $8.56B. The lowered revenue was caused by a shift in comparable sales across all operating markets, with the US having the largest impact. Comparable sales were down 4% on a global scale, 3% in North America markets, and 6% internationally. However, revenue remained flat year over year for North America markets while International market revenue decreased by 5.3% year over year.

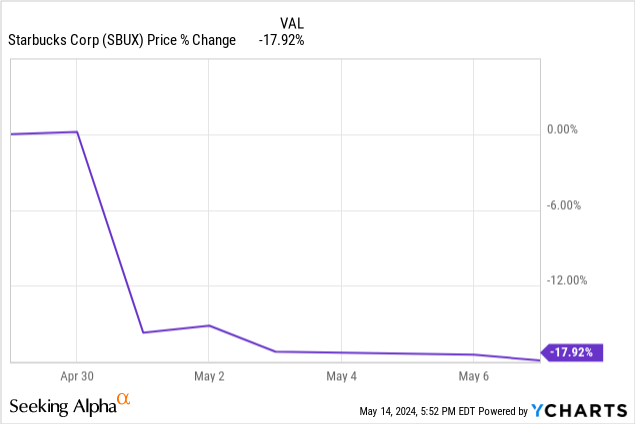

The price reacted to the downside mostly due to the slashed guidance and outlook. Management stated that they now see US comparable sales growth to come in at a low single digit growth rate for the fiscal year, versus the original forecast that stated an expectation of comparable sales between 4% – 6%. In addition, they now see global unit store growth of an estimated 6% compared to the original expectation of a firm 7%. After the news dropped, the price slid by nearly 20% which I believe to be very dramatic.

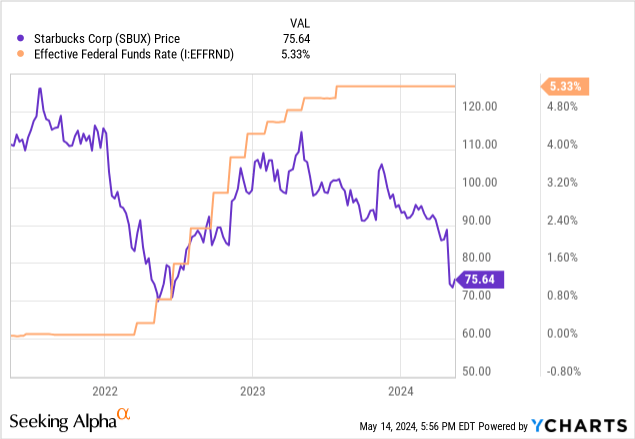

Firstly, this is because SBUX still expects growth to happen. It’s not like they shifted guidance to say they expect to see losses for the next year. In addition, the slight estimation adjusted down to 6% for global unit store growth is actually still impressive in my opinion when considering the unfavorable economic conditions. Interest rates started rapidly rising around the midpoint of 2022 and since then, the price of SBUX lost its upward momentum. The higher interest rate means that borrowing costs are increased, and I would’ve expected this to have a much larger impact on expansion plans.

With higher interest rates still in mind, it comes as no surprise that consumer spending has tightened. A complaint that I often see here in different comment threads for SBUX is that they are losing their appeal because prices are simply too high. However, I remember prices being too high for the last decade. “Too high” is such a subjective thing and I have felt this way for the last ten years but despite this, all of the SBUX locations are always busy during prime working hours without fail.

Prices being high would only mean that people may temporarily delay ordering at SBUX until their own conditions improve because, as we all know, it’s really hard to dial back on small lifestyle changes like this. The same can be said for almost all peer food related companies, whether it’s McDonald’s (MCD), Krispy Kreme (DNUT), or DoorDash (DASH). All of these companies have menu items or business aspects that are outright unreasonably expensive, such as having to pay almost 50% more in cost with DASH to get your food delivered or the fact that a dozen glazed donuts at Krispy Kreme is nearly $20.

However, people still pay for these services on a daily basis, so the “too expensive” argument never really held weight for me. Ultimately, all it takes is for SBUX to throw a couple of budget-friendly drink items on there to get traffic flowing again and counter this argument. If people really were giving up on SBUX then their loyalty program 90-day active member count would not be up 6% year over year to 32.8M.

In addition, similar peers like MCD and DNUT are experiencing lower sales volume as consumers tighten their spending. This is just the part of the cycle we are in and priority is all about efficient capital management and price analysis. This is likely why we see a rise in complaints about the pricing as small incremental price increases are an easy way to offset the lower volumes in stores.

Ultimately, net revenues for the North America segment remained flat at $6.4B while operating income only decreased slightly from $1.2B in Q2 of FY23 to $1.1B in Q2 of FY24. Store count slightly increased to 18,065 locations, and once market conditions improve, we will likely see higher revenues. The international markets suffered the largest impact, with operating income decreasing to $233.8M, down from $314.7M in the prior year. International markets continue to be a weakness as revenues decline due to lower comparable transactions and a lower average ticket.

Growing Market Demand

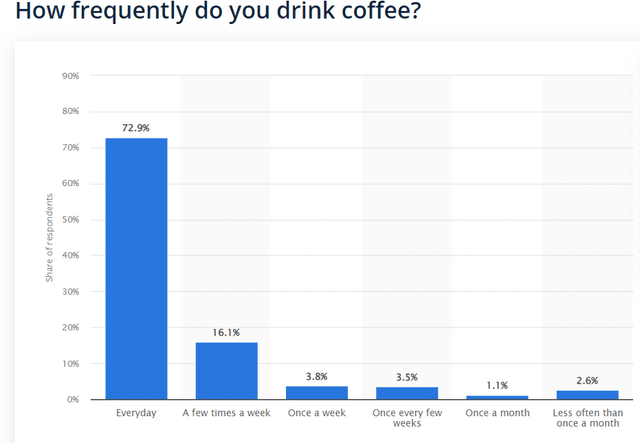

The lack of growth isn’t due to coffee losing its appeal or anything along those lines. Data actually reveals that coffee consumption hit its 20-year high and according to a study conducted by the National Coffee Association, people drink coffee more frequently than they do bottled or tap water. Specialty coffee demand has grown by 64% since 2010 and this is exactly how Starbucks has grown to be as big as it is. Nearly 73% of people actually drink coffee every day.

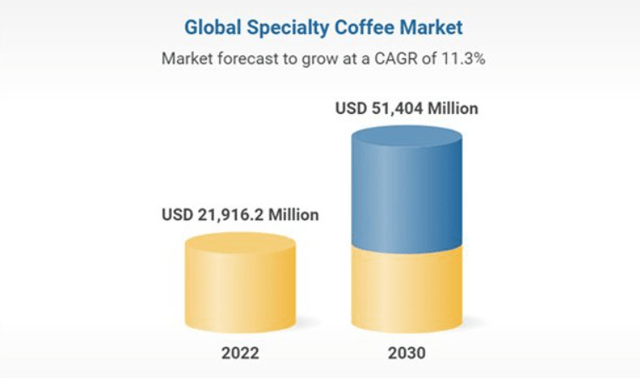

In addition, data compiled by ResearchAndMarkets shows us that the coffee industry is current worth nearly $130B. According to the research, the coffee market is anticipated to grow at an annual growth rate of 6.47% through the end of 2029. This increased demand only presents an opportunity for SBUX to continue expanding their customer base as more people become consumers of coffee.

A large portion of this growth is expected to be fueled by specialty coffees, which is right up Starbuck’s alley. This specialty coffee market has an estimated CAGR of 11.3%. SBUX will likely benefit from this future growth, as I can count about 30 different specialty coffees on their menu at the moment. As needs and interests change over time, SBUX will likely make accommodating adjustments to their menu.

Dividend

As of the latest declared quarterly dividend of $0.57 per share, the current dividend yield sits at 3% following the price drop. Although the starting yield is a bit lower and doesn’t suit the needs of investors that depend on higher yielding income, the low starting yield is totally acceptable for investors looking to accumulate and hold over time so that their yield on cost can rise. Starbucks has done a great job with making the dividend an appealing aspect of the stock.

The dividend has been increased for 13 consecutive years and even though the company hasn’t yet reached aristocrat status, I do believe they have the ability to. The dividend has increased at a CAGR (compound annual growth rate) of 9.78% over the last 5-year period. Zooming out to an even longer time horizon of 10 years, the growth comes in stronger with a rising dividend at a CAGR of 16.69%. These raises were supported by a 5-year average revenue growth of 9.28% and EBITDA growth amounting averaging 11.87% over the same time period.

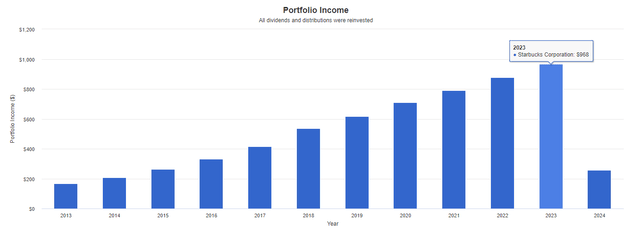

The compounding of the dividend can really be seen when using Portfolio Visualizer to see the dividend income growth laid out over the last decade. This visual assumes an original investment of $10,000 back in 2013. It also assumes that no additional capital was ever deployed, but dividends were reinvested back into SBUX every quarter. In 2013, your dividend income would have only totaled $167 for the year. However, fast forwarding to 2023 shows us an annual dividend income of nearly $1,000 while your original investment would now be valued over $40,000. So for a dividend investor like myself, I plan to keep on accumulating here and build a tax efficient source of dividend income while I wait for the market conditions to improve.

Valuation

SBUX has been given a valuation grade of a D by Seeking Alpha, but I disagree, The current price to earnings ratio sits at 21.06x and while this sits above the sector median of 16.87x, the 5-year average P/E ratio has sat at a very high 38.73x. If anything, this presents a large opportunity for entry while shares are heavily discounted. Long-term investors have the ability to accumulate shares at a post-pandemic low of about $75 per share.

The current average Wall St. price target sits at $90.51 per share, which represents a potential upside of 19.67% from the current level. The highest price target sits at $120 per share, while the lowest is at $77 per share. While the price currently sits below the lowest price target, it seems like even Wall St agrees that there’s a greater probability for shares to move up from here over the long term. In order to reinforce this outlook, I think it would be appropriate to come up with a fair value estimate using a dividend discount model.

I first compiled all of the annual dividend amounts for SBUX dating back to 2018. We can see that since then, the dividend has increased at a CAGR of 9.75%. I used an estimated annual dividend of $2.32 per share for 2024, which would present a year-over-year increase of 7.41%. While this sits below the prior increases, I decided that a conservative outlook would be best since the guidance numbers have been lowered. Therefore, I assume that this year’s dividend increase will also be lighter in nature.

Author Created

Taking the lowered guidance into account, let’s use a conservative growth estimate of 5.5%. In combination with a discount rate of 8%, I get an estimate fair price of $92.80 per share. This would represent a potential upside of 22.7% which closely aligns with Wall St’s average price target upside. When you combine this with a strong dividend growth potential, the opportunity looks highly attractive in my opinion.

Vulnerabilities

We’ve already seen how vulnerable SBUX is to the effects of higher interest rates and higher levels of inflation. As consumer spending slows, there will naturally be less people willing to dish out cash towards a premium coffee. I can honestly say that I’ve personally slowed down my spending in most food related categories and opted to cook more meals in and brew my own coffee. While these decisions aren’t as enjoyable, I imagine that a lot of the population are following the same routine.

If inflation cools down and interest rates let up, we may gradually see an increase in consumer spending towards these luxuries again. This shift in spending may even result in SBUX losing market share as consumers shift towards cheaper competitors like Dunkin. In combination with this, SBUX’s recent price hikes may continue to push consumers away. While I understand that price increases can offset lower sales volume, it can anger consumers and make them feel like they are being taken advantage of. Push the prices too high and you may lose those customers forever.

Takeaway

In conclusion, I believe that the downside price reaction to the slashed guidance was a bit dramatic. The company still ultimately expects growth, and this is backed by the growing demand across the globe for coffee. While Starbucks is currently feeling the ripple effects of a higher interest rate and high inflation, this problem has affected a lot of peer food-based businesses. Consumer spending has tightened but their loyalty program subscriber count has increased, which further cements the fact that there is still demand. Based on my dividend discount model, I estimate a fair value price of $92.80 per share. This potential upside combined with the strong dividend growth makes SBUX a strong Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SBUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.