Summary:

- Starbucks faces significant challenges, due to a deteriorated macroeconomic environment and internal struggles.

- Last quarter, the company dropped 15% on earnings, and the stock has been more or less flat since then.

- In this article, I dive deep into the most recent available news and facts to explain what concerns me and what should happen for a turnaround.

TonyBaggett

Why Starbucks is down this year

Earnings season is upon us, and soon it will be Starbucks’ turn (NASDAQ:SBUX). Too soon, some may think, recalling the disaster Q2 was for this widely known company, with its shares dropping over 15% on the day. After that report and the CEO’s interview on CNBC, I simply decided it was time to sell (at a loss) and move on. But this doesn’t mean I am not keeping an eye on the company, as I once had a bull-case on the company that could become once again true if some issues are solved.

For those who don’t remember what happened, let me recall a few data. At the end of its last fiscal year, Starbucks guided for 7%-10% revenue growth in FY 2024, with operating margin expansion and EPS growth above 15%. China, which had been a major concern for some time, was seen recovering its comp sales and growing above 4%. Then, three months later, we were all taken aback. Business was slow and weak, and Starbucks will have a hard time achieving positive revenue growth. Margins won’t expand and EPS are expected to be flat YoY. China will probably decline, as well as the U.S.

Clearly, some issues occurred. Perhaps Starbucks management had not seen these challenges come, but this makes me question the ability to understand the market. Perhaps, the IR department didn’t want to worry investors beforehand, but this makes me question if this is the correct way to build a trustworthy relationship with the shareholders. Mr. Narasimhan, the CEO, said during the last earnings call that part of this disappointing report was due to the consumers who were not fully appreciating Starbucks’ value proposition. Many questioned if a $5 coffee is offering value when coffee shops are popping up all over the place and offering better prices (by the way, Starbucks was funded after Howard Schultz experienced Italian bars, where coffees are now sold for around $1.50).

The earnings release was not enough, since a few days later, Starbucks’ founder and former CEO Howard Schultz – who hand-picked Narasimhan as his successor – openly criticized the company’s fall from grace and asked for a “maniacal focus on customer experience”. This criticism expressed by the Founder towards the current CEO was the final blow that made me decide to exit the position. The situation was too unclear.

Since this report, the stock has been more or less flat, with investors debating whether to jump in and profit from a temporary downfall or if Starbucks’ bull case had truly deteriorated.

Some hope was given when the news came out of Elliot Management taking a sizable stake in Starbucks. As far as I see it, an aggressive activist investor is what the company needs right now to end its internal fights and focus once again on its business. But we still need the new 13F to be released to understand what truly happened.

In any case, the macroeconomic environment doesn’t suggest Starbucks is seeing new tailwinds.

A difficult environment for Starbucks

Let me briefly recall what I have just shared in an earnings preview on McDonald’s.

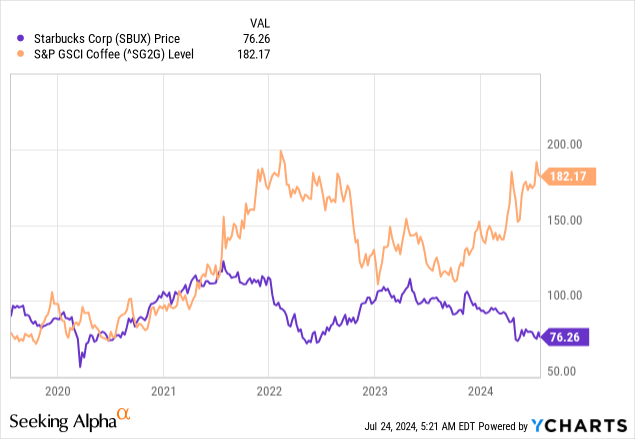

Commodity prices continue to be high, putting new pressure on restaurant margins. In particular, Starbucks is exposed to coffee, and we see that since mid-2021, the stock shows an inverse correlation with the cost of coffee. In late 2023 and early 2024, we also had weather issues in Vietnam, Brazil, and the Ivory Coast, which had a direct impact on coffee.

As a result, facing continuing higher input costs, Starbucks had to raise prices. We have often heard its management repeat that, after all, Starbucks offers a premium product and a premium experience and that customers are well aware of the value they obtain from visiting Starbucks shops.

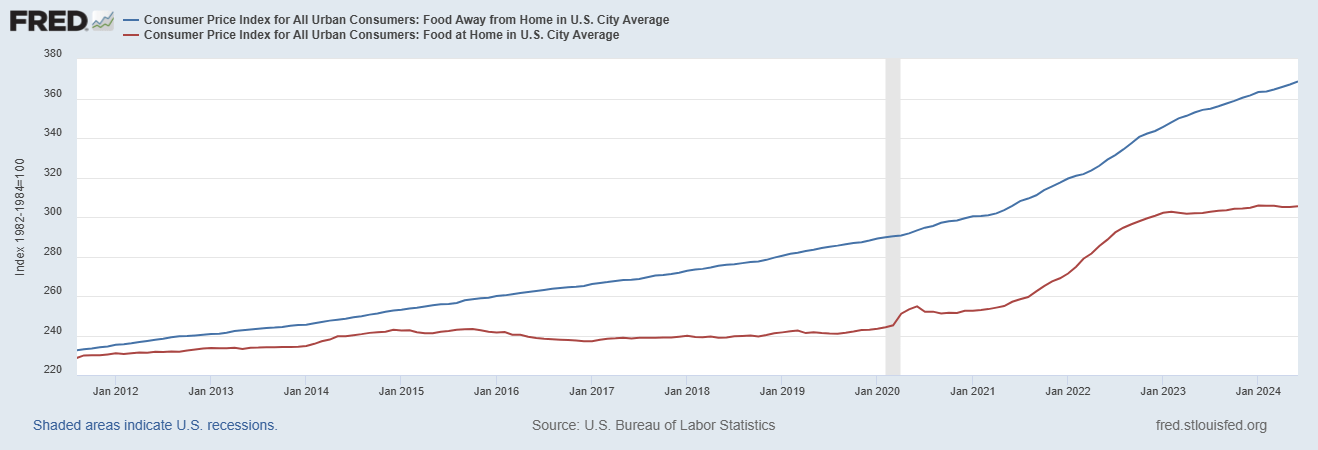

This is part of a more general trend, which is shown below. After the pandemic, food at home increased more rapidly than food away from home, making consumers perceive the convenience of eating at restaurants. But since early 2023, things reversed and while food at home has almost been flat, food away from home has seen a rapid increase in costs as restaurants and food companies tried to catch up and beat inflation.

FRED St. Louis

Things have probably gone too far, and we find all over the place disgruntled consumers and poor investor sentiment. This has proven so true for Starbucks that in its past earnings report, the company had to admit during the last earnings call that its membership program had seen a QoQ decrease in active users, driven by the pullback of “the more occasional members”.

Starbucks announced it would take measures to drive traffic back, and we have seen that in the past few months, more offers and bundles were available.

But just a few weeks ago, when Q3 was already closed, Starbucks’ CFO Rachel Ruggeri took part at the Deutsche Bank Access 2024 Global Consumer Conference and presented a situation that makes me think we won’t see a nice quarterly report in a few days.

Let me walk you through the most concerning words we heard. First of all, the CFO admits Starbucks’ relationship with its customers has deteriorated as there is weaker “awareness of what we have and the perception of value. And it is going to take some time to strengthen those relationships”.

So, a change in consumer perception presents challenges that can’t be overcome in just a few months.

Secondly, Ms. Ruggeri openly informed us that “we expected those headwinds to persist into Q2, but it persisted even further than what we expected”. In other words, Q2 (remember, Starbucks is going to report Q3 now) wasn’t a one-off event, but it is part of a macroeconomic trend that was enhanced by Starbucks’ mistakes in the past year.

Third point. Starbucks’ CFO said that the largest market for the company – the U.S. – is slowing down:

We started to see a more cautious consumer environment in the U.S. And in addition to that — the action plans that we had in place didn’t materialize in the way we had expected. And so from that aspect, it’s going to take us some time to recover.

At least, she was honest in admitting that the action plans didn’t turn out as effective as, at first, they were thought to be. This is another way of saying: don’t expect a turnaround soon. As a result, she repeated quite a few times that “it’s going to take time to fully recover”.

Starbucks’ Q3 Earnings Preview

In the past 3 months, we had 31 down FY24 EPS revisions and no up revision, with analysts now expecting Q3 EPS of $0.93, which is a 7% decrease YoY.

Revenues are still expected to be growing, although by less than 1% YoY. As a result, the market is expecting $9.25 billion as Starbucks’ top line. Usually, Q3 is a weak quarter compared to Q1 and Q4. So, if we factor this in as well, we have an additional reason to be cautious when making our forecast.

Considering Rachel Ruggeri’s words, I personally don’t see any sign hinting that Starbucks was able to grow its revenues. So, given an obvious decrease in traffic and the probable decrease in average tickets due to the ongoing promotions, I expect Starbucks to report $9.1 billion in revenue. This is a -0.7% decrease YoY. Like many, I am inclined to believe Starbucks’ profitability will be lower, with margins being pressured by higher wages and input costs, while consumers have been offered discounts. I would be positively surprised if Starbucks were able to pull off a double-digit net income margin. Personally, I think we won’t see the 11% that is currently the TTM metric. I think a 9% would already be a satisfying result. This means the company could report $820 million in net income.

I am expecting Starbucks to keep its buybacks paused, as the company did in Q2. As a result, the share count should remain the same; 1.13 billion. This gives us a concerning result; EPS could be $0.72, which would bring us back to Q3 2022. Let’s say that Q4 EPS estimates of $1.05 are correct. We would then have FY24 EPS of $3.35, which is $0.22 less than the current estimate and $0.19 less than last year’s EPS. This would lead to a 5.4% EPS decrease. And this is admitting that Q4 will be confirmed. As far as I see it, I think Starbucks will take more time than just a few months to turn things around.

Keep in mind, as a consumer, I have been a fan of Starbucks, and I enjoy sipping its drinks. But, as an investor, I need to detach from this experience and look at the current situation with objectivity. To me, it seems clear that investors won’t see a very profitable company for a few months, and they should not even expect Starbucks to offset the situation by taking on debt to fund new buybacks; the balance sheet is already carrying $14 billion in LT debt. The company’s EBITDA is close to $7 billion, but its FCF is around $4 billion, which has already been fully used to pay $2.5 billion in dividends and fund $1.87 billion in share buybacks over the TTM. The company needs to pause its buybacks to preserve some cash, otherwise it is at risk of being too leveraged.

As a result, I am not buying Starbucks right now, and I confirm my sell rating until the picture improves and Starbucks proves once again that things have turned around.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.