Summary:

- This is to follow up my latest “Strong Sell” call where I found Starbucks might be making a big bet on 2025’s green coffee, which may put margins at risk.

- Green coffee prices have reached 47-year high, driven by supply disruptions in Brazil & Vietnam. The forest fire in Caconde looks to extend the supply tightness to 2025.

- Starbucks’ reduced hedging ratio and increased reliance on price-to-be-fixed contracts expose it to market volatility. The unusual trend suggests Starbucks is gambling on lower green coffee prices in 2025.

- Without considering the potential price war with Chinese rivals in the US, Starbucks’ GPM could fall c.3% points if green coffee prices stay at $3/lb throughout 2025.

- Given the challenging margin outlook and expensive valuation of 32x forward P/E, I see little reason to invest in Starbucks. My DCF fair value is only $85, 15% downside from current price. Reiterate Strong Sell.

Pla2na/iStock via Getty Images

Investment Summary

This is a follow-up to our latest “Strong Sell” recommendation on Starbucks (NASDAQ:SBUX) as I believe the recent spike in coffee bean prices will further pressure Starbucks margin in the next couple of quarters, supporting our negative view on the stock. I have flagged the threat to Starbucks on a potential price war with Chinese rivals in the US market in our last article. In this article, in view of the spiking green coffee prices, I have scrutinized Starbucks’ 10Ks in the past decade and I concluded that Starbucks is making a big bet on 2025’s green coffee prices which could put margins and earnings at risk.

As a global coffee chain, Starbucks is a big buyer of green coffee beans, procuring around 3.3% of the world supply on an annual basis. Therefore, fluctuation in bean prices will have a direct impact on Starbucks margins. On 29 Nov, coffee prices hit a 47-year high at $3.35/lb on major supply disruption in key producers, Brazil and Vietnam. In view of the supply disruption, US Department of Agriculture has adjusted down its forecast on Brazil production in 2024/25 by 5% (19 Nov) but what could be worse is that prolonged drought and unexpected rains in Brazil have damaged coffee trees which deepens the concern of further supply cut in 2025.

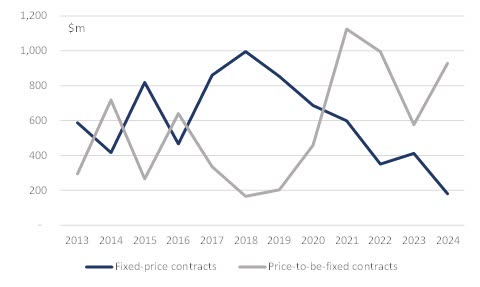

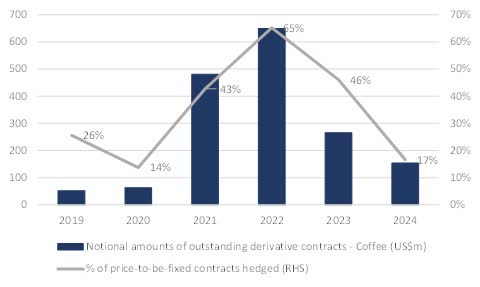

To minimize the impact of green coffee bean prices fluctuation, Starbucks uses derivatives to hedge. However, I have spotted an interesting trend from its 10K where the hedging ratio on “Price-to-be fixed” contracts have significantly reduced to 17% in FY24 with hedged amount coming down to 4-year low of $154m vs $649m (record high) in 2022. This raise concerns that Starbucks’s margins/earnings may be unusually exposed to market swings in the next couple of quarters.

Starbucks is also shifting away from “Fixed price” contracts to “Price-to-be fixed” contracts. Fixed-price contacts have dropped to a record low of $180m in 2024 while price-to-be-fixed contracts were nearing the 2022 level of $929m, the third-highest level since 2013. It seems to me that Starbucks is betting on green coffee prices to go lower in 2025, which likely explains its reduced hedging position and reliance on price-to-be-fixed contracts. While this strategy could pay off if Starbucks’ bet proves correct, what if Starbucks is wrong?

Green coffee bean prices are consolidating around $3.0/lb level after reaching a record high on 29 Nov. If prices remain at $3.0/lb throughout 2025, this would imply another 31% yoy increase in average green coffee bean prices following a 34% yoy increase in 2024. Even without factoring in the potential price war in the US as discussed in a previous article, surging green coffee bean prices could erode margins by c.3% points. Given these challenges, along with Starbucks’ expensive valuation of 32x forward P/E, I see little reason to invest at current levels. Strong Sell.

What Happened to the Coffee Bean Market?

Brazil and Vietnam are two key coffee producing counties, supplying 56% of world’s total in 2023. In 2024, both countries experienced extreme weather conditions.

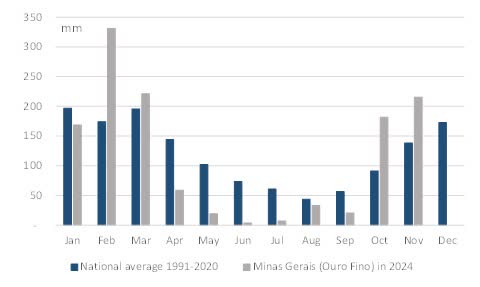

Brazil faced its driest conditions since 1981 with below-average rainfall since Apr 2024. Unexpected rain in Oct/Nov has disrupted coffee flowering and reduced crop yield. The forest fire in Sep 2024, ravaged Caconde (a key area for growing coffee), destroyed around 50 farms or 600 hectares of coffee plantation. The impact on 2024/25 marketing year (MY) should be minimal as harvest season mostly ends in Sep. However, the supply impact will likely be felt in 2025/26 MY given the loss of coffee trees.

Drought in Brazil with rainfall in 2024 below national average in 1991-2020 (Instituto Nacional de Meteorologia)

Vietnam, the second-largest coffee bean producing country, has also been suffering from prolonged droughts in the Central Highlands since 2023 tied to El Niño. High temperature and severe droughts have led to water shortage for plantation, which reduces crop yields and poor bean quality. The drought also delayed the harvest progress, which disrupted bean supply to the world. From trade data, Vietnam’s coffee export dropped 11.6% mom to 45.4kt in Oct 2024. In 10M24, export fell 11.1% yoy to 1.15mt.

Forecasting agencies have been reducing their coffee supply projections. Conab, Brazil’s crop forecasting agency, trimmed its 2023/24 Brazil’s coffee production estimate in Sep by around 7% to 54.8m bags from May’s forecast. Similarly, USDA lowered its projection for Brazil’s green coffee production by 5% to 66.4m bags in 2024/25 in Nov bringing the estimate to 66.4m bags, flattish output from 2023/24.

Besides weather, coffee farms are also facing labour shortage and cost inflation including fertilizer and logistics driving lower profitability. New EU deforestation law imposing stricter compliance requirement on coffee producers will also increase production costs and reduce coffee supply to European market.

Starbucks Appears to be Betting on a Lower Green Coffee Bean Price in 2025

A big jump in price-to-be-fixed contract

When bean prices go higher, it is normal to expect Starbucks to increase “fixed-price” contract to lock in raw material cost. However, Starbucks is doing the other way around. By scrutinizing its 10K over the past decade, I notice a significant decline in the use of fixed-price contract to more than a decade low of $180m in FY24. On the other hand, “price-to-be-fixed” contract has jumped to $929m in FY24, the third highest in the past decade.

Big jump in price-to-be-fixed contract (Starbucks’ 10K)

Hedging ratio also fell to new low since 2021

Starbucks stated in its 10K that it may enter into coffee forward, futures and collar to hedge anticipated cash flow under price-to-be-fixed green coffee contracts. However, the actual amount hedged has decline significantly since 2022 to a recent low of $154m in FY24. This represents only 16.6% of the $929 million in price-to-be-fixed contracts on hand in FY24.

While hedging ratio was similarly low at 14% in FY20, it was more justifiable as green coffee prices were relatively low at $1.1/lb during the COVID-19 pandemic, making it less necessary to hedge aggressively.

New low in hedging ratio on price-to-be-fixed contract (Starbucks’ 10K)

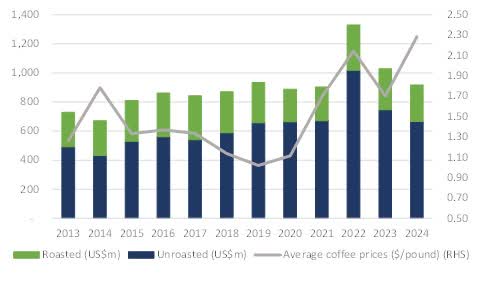

Inventory has fallen to 3-year low in FY24

The combined roasted, and unroasted coffee inventory fell 11% yoy to a 3-year low of $917m in FY24. I agree that lower inventory allows more flexibility for management on procurement if green coffee prices come off. However, if green coffee prices keep going up, Starbucks’ raw material costs will be soaring without proper control, especially given the low hedging ratio.

Coffee bean inventory fell to 3-year low while prices reaching 47-year high (Starbucks’ 10K and www.macrotrends.net)

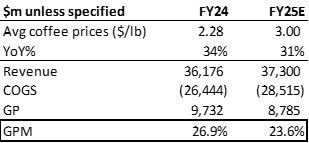

Margins could fall c.3% points assuming green coffee prices stays at current level

After touching a 47-year high in late Nov, green coffee price is consolidating at $3.0/lb level. If it stays at this level throughout 2025, average green coffee price would increase 31% yoy in 2025 following 34% increase in 2024. Taking the consensus revenue estimate of $37.3bn in FY25 and assuming other cost items constant, I estimate Starbucks’ GPM to fall c.3% points to around 24% in FY25 from 27% in FY24.

Starbucks’ GPM could fall 2-3% points if green coffee prices stay at $3/lb throughout 2025 (Analyst’s estimate)

Valuation

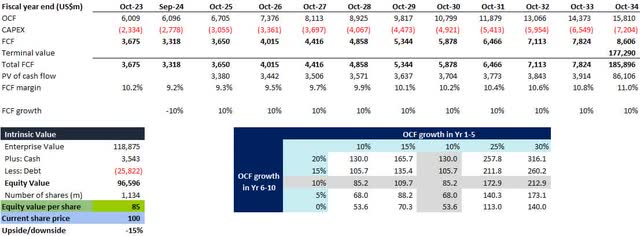

As I have highlighted before, Starbucks earnings have been overestimated by the street, given Chinese rivals are about to expand in the US market employing a low-price strategy. Now, with green coffee prices reaching historical high and likely staying high in 2025 on structural supply tightness amid weather and crops destroyed by forest fire, Starbucks’ margin outlook appears very challenging. Starbucks is trading at 32x forward P/E, a huge premium over the sector median of 18x, warranting a Strong Sell rating.

My DCF model suggests a fair value of $85 for Starbucks by assuming 10% FCF growth from FY25-34E, 3% terminal growth and 8% WACC. 15% below current share price of $100. I believe this set of assumption is very generous as consensus is only looking for 7.9% CAGR on 3-5 Yrs FWD EPS growth. If I take this as a proxy of FCF growth in my model, Starbucks’ fair value would be even lower to $70. Therefore, I believe Starbucks is deeply overvalued.

Starbucks’ DCF based fair value (Analyst’s estimate)

Risk to My Sell Recommendation

Fundamentally, I don’t see much upside risk to the stock, as the operating environment of Starbucks in China and the US are both challenging. However, sentiment wise could improve if Starbucks manages to find a JV partners in China very soon.

Green coffee prices could come down if supply surprises on the upside. This is also what Starbucks is betting on.

Conclusion

While rising green coffee prices will negatively impact Starbucks’ margin, what’s more alarming is the strategy of high proportion of price-to-be-fixed contracts, low hedging ratio and inventory level hoping green coffee price to come off. I foresee a very challenging operating environment for Starbucks in 2025 as it could face a price war in the US market amid the entrance of Chinese rivals and rising green coffee prices at the same time. With the stocks trading expensively at 32x forward P/E, I see little reason to invest in the name. Strong Sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.