Summary:

- Starbucks’ stock has been under pressure since 2021 as top and bottom line growth has remained elusive.

- With a new shark CEO at the helm, we think a turnaround is in the cards.

- Despite recent financial challenges, Starbucks maintains consistently strong margins, and Niccol’s focus on streamlining operations and the menu could drive top line growth.

- The multiple may appear expensive, but Starbucks’ shares are cheaper than historical averages, and anticipated growth under Niccol makes the current price reasonable.

- We rate SBUX a ‘Buy’.

Hasan Ashari

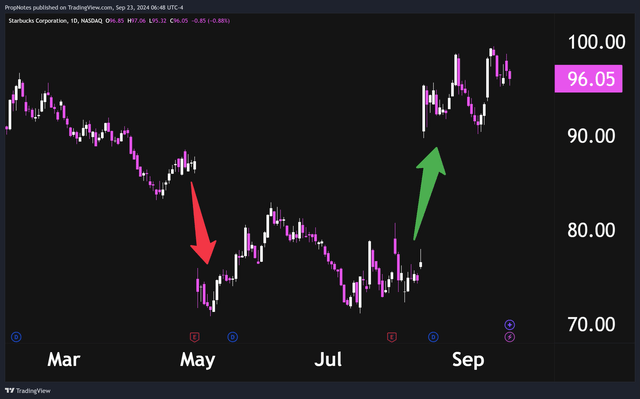

Starbucks (NASDAQ:SBUX) has had an interesting 2024.

Following a disastrous Q2 earnings report that sent shares of the company down more than 15% in early May, the stock was boosted significantly in August with the announcement of Brian Niccol as the new CEO of the storied coffee chain:

Niccol, who previously worked as the CEO of both Taco Bell (YUM) and Chipotle (CMG), is widely viewed by the market as someone who can ‘right the ship’ at SBUX given his success at the other two chains.

For context, up to his hiring, investors had mostly been concerned about the company’s anemic top and bottom-line growth, response to competition, and trouble in China.

While we’re excited about the appointment of Niccol and the steps he’s taken thus far into his tenure, we always thought that the rumors of SBUX’s death had been greatly exaggerated.

Thus, with a new, focused C-Suite, multiple levers for growth, and a dominant global brand, we think paying 17x EV/EBITDA seems like a solid entry point into this powerhouse coffee company.

Today, we’ll touch on our view of SBUX’s financials, the direction we see Niccol taking the company, and why we think the present valuation appears attractive.

Sound good? Let’s dive in.

SBUX’s Financials

While many have been quick to bemoan SBUX’s financial performance over the last few quarters, we’ve largely been sanguine about the company’s results.

Sure, growth has slowed somewhat as of late, but if you look at the company on a longer time horizon, results are largely in line with what we’ve seen historically.

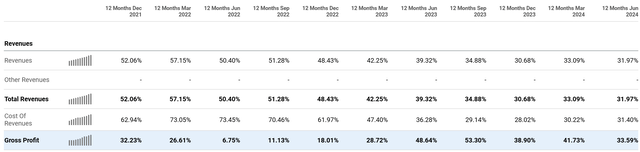

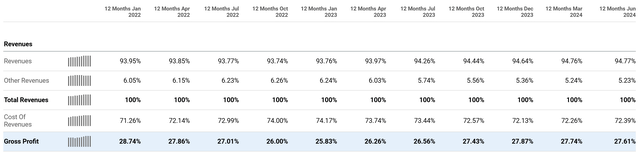

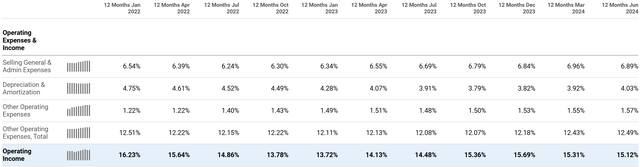

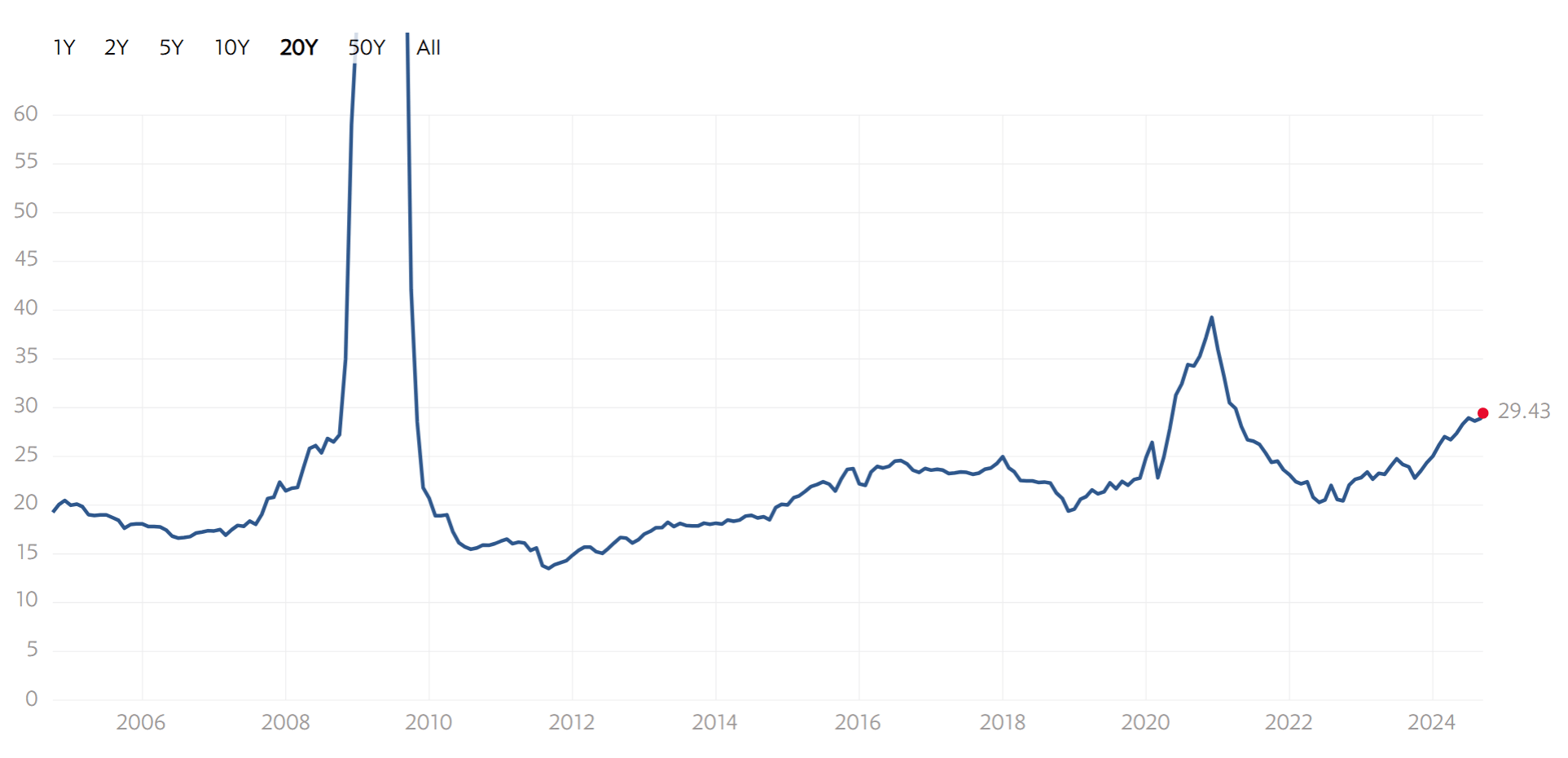

Looking at margins, SBUX has been able to consistently keep gross margins in the upper 20’s range, operating margins in the mid-teens range, and net margins in the 10-14% range:

Gross Margins (Seeking Alpha) Operating Margins (Seeking Alpha) Net Margins (Seeking Alpha)

This is impressive given the level of inflation and input cost swings that we’ve seen, especially in Coffee futures, since coming out of lockdown.

However, even if you zoom out further over the last decade, you’ll see similar stats when it comes to SBUX’s margins and profitability.

This shows, at the very least, competent management from a cost control perspective.

Additionally, it means that a large portion of investor’s issue with SBUX is on the growth side of things.

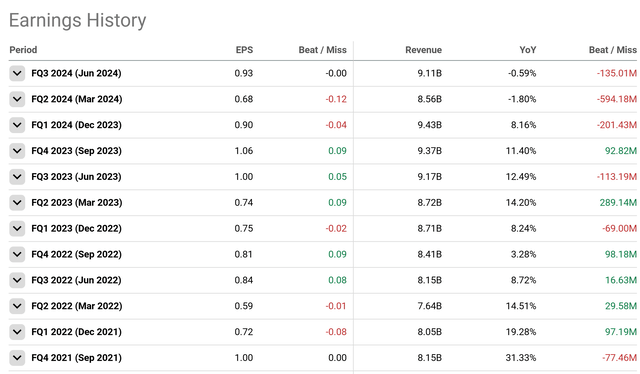

It’s true that top line growth has been weaker in Q2 and Q3, and SBUX did miss on EPS estimates multiple times so far in fiscal 2024:

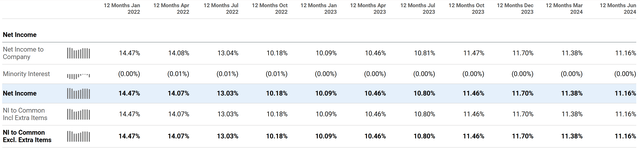

However, one of the important things to note here is that SBUX has been operating in one of the most incredibly challenging environments for restaurants since 2008 or the depths of Covid:

NRA

Global consumers are more stretched financially than they have been in a long time, which means that brands that have the size and scale of SBUX will be impacted, almost no matter what.

When customers are tightening their belts, it’s hard to grow top and bottom line results substantially at scale.

Many have compared SBUX against smaller upstart competitors like Dutch Bros (BROS), which is a firm with weaker margins but much stronger growth:

That said, in our view, BROS is not a great comparison because the company’s growth is largely organic, and isn’t yet subject to the global headwinds impacting SBUX.

In other words, slowdown in the consumer can easily be papered over by BROS if they report a high expansion rate within the business. SBUX has largely already saturated the NA market in terms of store footprint, and thus is more exposed to volatility in customer spend on the whole.

Add it up, and the recent weakness, in our view, can be explained mostly by cyclicality and the macro environment. If investors are selling SBUX off on these factors right now, then it stands to reason than as comps in 2025 get easier, investors should bid the stock back up. This appears doubly true as the fed embarks on an easing cycle.

Then, we have the Niccol hire.

In our view, previous management at SBUX was a bit chaotic, and perhaps a bit ineffective. Cost control and margins have been solid, but there hasn’t been a strong vision for the company’s products or brand. Coffeehouses have turned into drive throughs, and the number of menu items has ballooned as management has made data-driven decision after data-driven decision.

Niccol, on the other hand, is a shark. We’ve seen how his attention to detail has driven strong shareholder returns in the past.

Operationalizing a company, streamlining menus, and focusing on consumer preferences seem to be his core competencies, and we think he will do a good job of re-invigorating SBUX’s offerings.

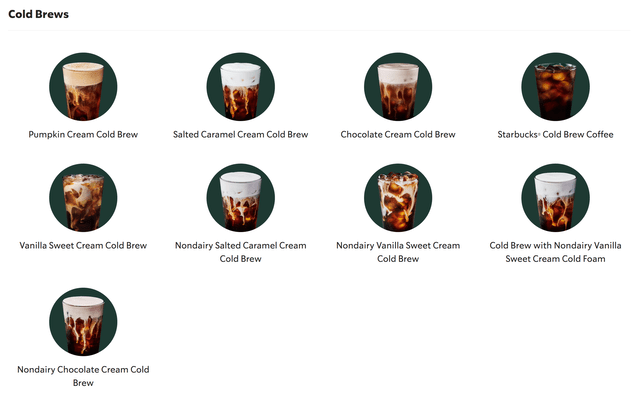

Right now, the menu is a particular point of interest for us, as it seems to be spread a bit thin.

In the cold brew offerings section alone, the company has 9 separate types of cold brew that you can order:

Is this wise?

We think this lack of focus is likely hurting customer service times, operational complexity, and margins. Thus, getting it right is a huge point of leverage for the company.

We expect Niccol to come in and clean this up dramatically, focusing on ‘narrow but deep’, as opposed to the current ‘wide but shallow’ approach.

Fewer items, produced at a higher quality, speed, and efficiency should improve both the consumer experience and margins, but it takes stones to cut customer favorites. We think Niccol will do what’s necessary to find the balance.

Plus, if you’ve read into any of what the new CEO has already done, things seem to be going in the right direction.

His initial moves, towards re-emphasizing SBUX as a ‘third place‘, alongside launching the perennial favorite ‘pumpkin spice’ offerings early show that he’s tapped into consumer preferences.

In turn, we think he’s tapped into the things that will be good for SBUX’s future results.

Add it up, and you’re looking at a company with tremendous brand power and global reach, suffering from historically indecisive management and poor macro conditions.

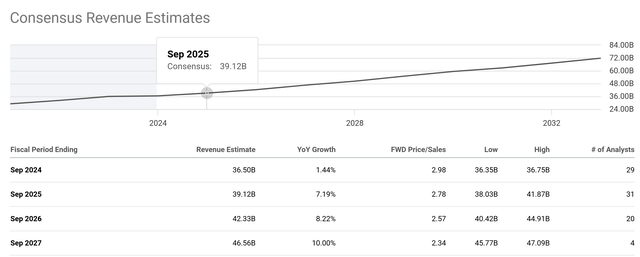

With Niccol coming in, and hopefully a stronger consumer in 2025, we see SBUX results accelerating considerably, maybe to the tune of 15% YoY top line growth by Q4 2025:

Our numbers are a bit ahead of analyst figures, but we’re optimistic about what Niccol can achieve within his first year.

SBUX’s Valuation

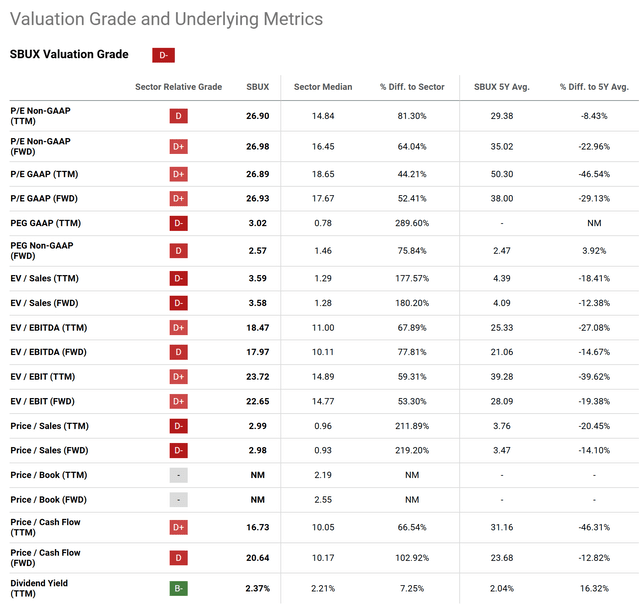

On the valuation front, many have commented that shares look expensive, and by some metrics that is true.

SA’s Quant Ranking system gives SBUX a ‘D-‘ on the valuation front, which isn’t great, obviously:

On P/E especially, SBUX shares seem a bit inflated in price at 26x, especially vs. the sector’s median P/E of 18x. However, SBUX shares are actually cheaper than they have been over the last 5 years. Some of this is likely due to the Covid P/E distortion, but it’s still a fact.

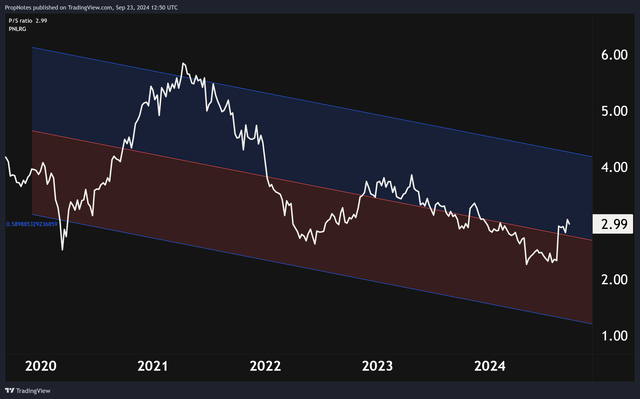

This also underscored by a revenue multiple that’s also ~15% beneath average historical pricing:

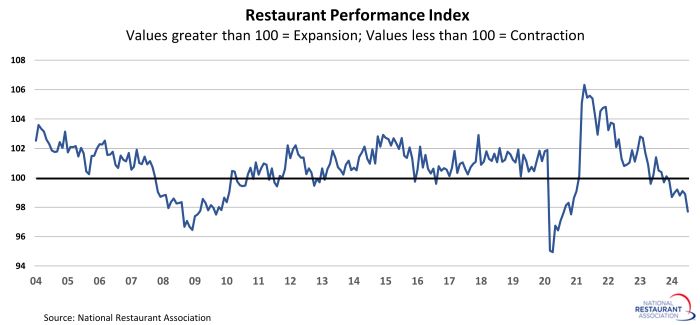

If you look at the S&P 500 as a whole, as well, the market is trading at nearly 30x EPS, which suddenly contextualizes SBUX as looking somewhat reasonable:

Multpl

Finally, if you bake in the re-acceleration in growth that we’re anticipating, then less than 18x FWD EV/EBITDA suddenly seems actually quite reasonable for SBUX shares.

Taken together, you’ve got a company with macro-induced troubles and a new CEO that should have a material impact on growing results over the next year. Trading at a reasonable multiple, shares, on balance, look like a ‘Buy’.

Risks

There are some risks to be aware of here, though.

First off, consumer health may remain poor for the longer term, which would obviously be a negative for SBUX. Less discretionary income for the average consumer means less money to spend on SBUX’s higher margin offerings.

If this happens, then it’s hard to see how top line growth could materialize between now and the end of 2025.

Additionally, SBUX has faced increased competition from Dutch Bros, Dunkin, and other, smaller companies that have their own diverse offerings. If SBUX’s drinks and food appear to be weaker value propositions than the competitions’ going forward, then the company could lose significant share which would, again, put pressure on results.

In either of these cases, weakness should translate into poor results and multiple pressure for investors.

Summary

That said, with a new shark CEO at the helm, a strong global brand, and (hopefully) easing macro conditions, we expect SBUX to inflect into 2025, producing solid top and bottom-line comps.

That should translate into share price gains, that, on balance, make the stock look like a ‘Buy’.

Stay safe out there!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.