Summary:

- Starbucks Corporation has appointed Brian Niccol as CEO, replacing Laxman Narasimhan, leading to a potential turnaround in the company.

- Niccol’s experience in the restaurant industry, particularly with digital strategies, may bring positive changes to Starbucks’ operations and revenue growth.

- Niccol’s most important job will be to change the lagging sentiment among customers, especially in the U.S., unify the team, win back store traffic in stores and digitally.

- While the Brian Niccol premium is already priced into the stock, investors should wait for signs of progress before making significant investment decisions.

mikkelwilliam/E+ via Getty Images

Investment Thesis

Starbucks Corporation (NASDAQ:SBUX) has served up the foamiest coffee drink ever overnight by hiring Chipotle’s widely revered CEO, Brian Niccol, away from the fast-casual restaurant giant.

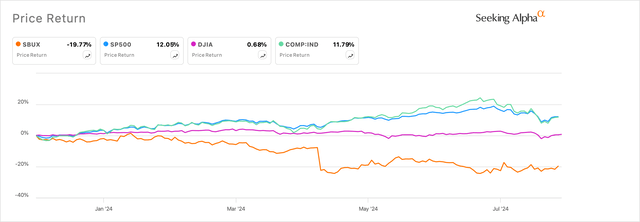

This news comes after months of intense activity at the Seattle, WA-headquartered coffee chain company that saw the removal of now-erstwhile CEO Laxman Narasimhan, installed as CEO just over a year ago. Narasimhan was unable to arrest the decline in sales and sentiment surrounding the coffee chain. With no signs of a turnaround in progress, Starbucks’ stock had been sinking throughout the year.

Exhibit A: Starbucks sinks as the markets deliver returns in FY24 (Seeking Alpha)

What exacerbated Narasimhan’s situation of late was the piling pressure by activist investors along with strong hints of disapproval by former CEO Howard Schultz, who also happens to be Starbucks’ largest shareholder.

While the change in Starbucks’ top leadership is definitely a huge welcome change, I believe the Seattle company’s turnaround will still take 1-2 quarters, giving investors ample opportunity to buy into the stock.

My valuation shows the company’s outlook is already priced in, and I recommend a Hold for now.

Starbucks Revenue Contraction Under Prior Leadership Sparked Concern

There is one thing investors, employees, and the board would agree on when it comes to Starbucks’ leadership: that Laxman Narasimhan was not the best hire for the CEO’s post.

Narasimhan’s previous leadership roles in consumer product companies such as PepsiCo (PEP) and Reckitt Benckiser Group (OTCPK:RBGPF) seemed like an odd set of qualification criteria for him to be the CEO at Starbucks. In addition, social media forum checks show that Narasimhan was not exactly preferred. Glassdoor ratings also indicate a deteriorating sentiment among Starbucks employees, with just 47% of employees approving of Narasimhan as the CEO.

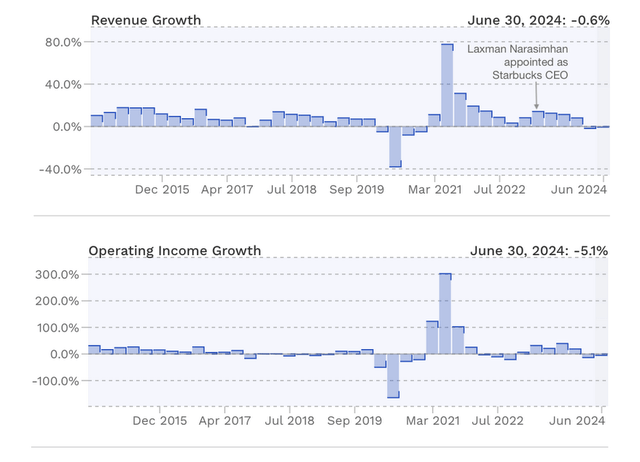

Since Narasimhan was added as the Starbucks CEO, the company’s quarterly performance seemed to go from bad to worse with every quarter that went by. In the most recent Q3 FY24 quarter, Starbucks total sales contracted to $9.1 billion, declining 0.6% y/y. This was the worst revenue performance in the past 10 years of the coffee chain’s operating history if we exclude the demand-supply distortions due to the 2020 pandemic lockdowns.

Worse than the declining sales was a deterioration in the company’s operating income growth, which contracted 5.1% to $1.5 billion in Q3, as shown in Exhibit B.

Exhibit B: Starbucks’ declining growth rates in revenue and income was not well received (Company sources)

The prior leadership had maintained that they will “continue to target an earnings payout ratio of approximately 50%,” resulting in “a significant portion of our earnings going directly back to our shareholders.”

However, these earnings payouts would not be meaningful enough for shareholders if the company’s growth rates kept deteriorating. That is what Narasimhan and his team had mentioned in the previous Q2 earnings call, where they massively cut FY24 revenue growth to paltry single digits from the previous 7-10% FY24 growth projections.

A change in leadership was the least the Board of Starbucks could do to alleviate the concerns of investors and employees.

What the Brian Niccol Premium Means For Starbucks Shareholders

Today’s change of guard for Starbucks’ CEO leadership comes close on the heels of another activist investor, NYC-based Starboard Value, who had picked up a stake in Starbucks. This is in addition to Elliott Investment Management, which was already launching proxy wars for substantial changes in Starbucks.

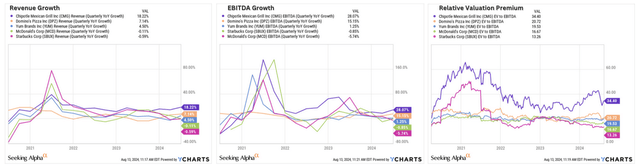

Brian Niccol has a deep history in the restaurant industry, having worked in the QSR format (Quick Service Restaurant), leading Taco Bell, as well as in the Fast Casual restaurant format, most recently leading Chipotle (CMG) and developing a successful brand. Installing Niccol under Starbucks’ leadership will definitely add a premium to the coffee chain, since he has done well to steer Chipotle through these uncertain times.

That being said, there are 3 things that I will be keenly looking for from Niccol during his tenure as Starbucks’ CEO.

First, the pricing & promotion strategy is coupled with coffee drink innovation. Of late, Starbucks management appears to be copying the growth strategies of its competitors by leaning strongly into texture-based coffee drinks and drive-through café formats, mirroring Dutch Bros (BROS). These drinks initially look to be launched in a premium price range under the <$4.5 prices in Dutch Bros menu pricing. In the past, Niccol has been able to effectively use digital marketing to position Chipotle’s prices at the right value. This has immensely helped Chipotle grow its average unit volume, with new targets being $4 million.

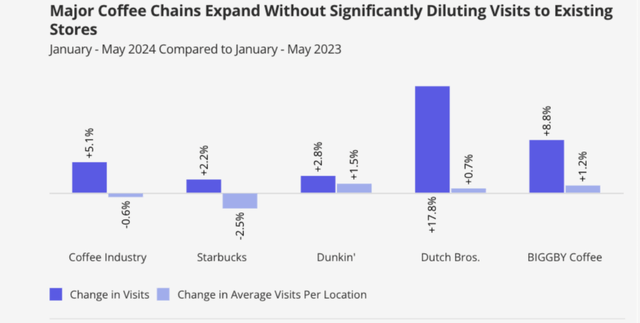

Second, Innovations & Messaging are a natural continuation of point #1. Of late, Starbucks is playing catch-up by jumping into the promotions-led price war, which is very unusual for Starbucks. Its innovations and messaging seem reactionary to competition, and consumers are taking notice. The company’s brand strategy looks fragmented if I look at the fallout from the Middle East region conflict. All of this seems to be weighing heavily on the company’s revenue and store traffic.

Starbucks was the only coffee chain to reportedly see a decline in average visits per store location in H1 of 2024 versus H1 of 2023.

Exhibit C: Average visits to Starbucks stores decline in H1 2024 (place.ai)

Third, the Starbucks digital ordering and app experience look pivotal as well. Starbucks is the pioneer of the digital restaurant experience. Per the Q2 FY24 call, a third of all transactions originated from MoP (Mobile Order & Pay). While impressive, I don’t think there is a meaningful impact on revenue, which continued to slide in the recent Q3 quarter, as illustrated in Exhibit B above.

Schultz wrote a detailed LinkedIn post a few months ago where he specifically mentioned that management needs to “reinvent the mobile ordering and payment platform-which Starbucks pioneered-to once again make it the uplifting experience it was designed to be.”

Niccol is no stranger to the digital experience. Under his leadership, Chipotle boasted one of the industry’s best digital successes, with over 40% of Chipotle’s orders coming from digital channels, up from the 10-15% digital channel contributions before the pandemic.

That has also boosted revenues & earnings consistently, and investors seemed happy to pay a premium to own Chipotle’s stock, as seen in Exhibit D. And I expect Niccol to bring that success over to Starbucks.

Exhibit D: Chipotle’s growth rates versus its valuation multiples compared to industry peers (YCharts)

I am not as concerned about Starbucks China’s sales as I am with the decline in sales in the United States. To me, it is more important that Starbucks correct course in the U.S., since those sales account for over 70% of the company’s total sales.

There is no denying that there are still risks that need to be considered. This turnaround cannot happen overnight. But with Brian Niccol in charge, those risks should start to pale when Starbucks starts to perform under his leadership.

Valuation models indicate the Brian Niccol premium is already priced in

With Starbucks’ stock up ~20% at the time of publishing this research note, I believe the premium for Brian Niccol’s arrival looks priced in.

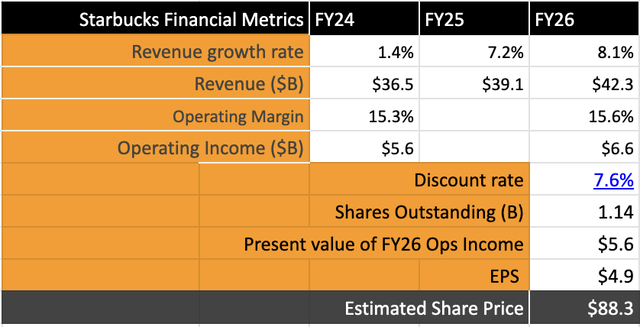

While FY24 now looks like a lost cause, I believe the company should be able to achieve mid-to-high single-digit growth in the next two years through FY26 due to course correction. That implies an end-to-end revenue compounded growth rate of ~4%.

At the same time, I expect a 30-point margin expansion in Starbucks operating margins, implying an ~8.2% compounded growth rate in operating income through FY26. With Niccol now at the helm, there is scope for operating margins to further expand once the digital strategy gets underway, but these kinds of turnarounds will take at least 1-2 quarters.

My valuation model assumes a -1% share dilution rate and a discount rate of 7.6%.

Exhibit E: Starbucks looks priced in after the stock scored big gains due to Brian Niccol’s arrival (Author)

These levels of estimated growth rates would warrant a forward P/E of ~18x, since it compares to the long-term growth rates of the S&P 500. A forward P/E of 18x implies an estimated price of $88-89.

Takeaway

The addition of Brian Niccol as Starbucks CEO is a breath of fresh air for many Starbucks investors. A course correction looks more on the table given the synergies that can be drawn from Brian Niccol’s history as a digitally astute CEO who steered Chipotle through uncertain times to be an industry leader in the restaurant industry.

However, the turnaround at Starbucks will take time, and investors should watch for signs of progress before going all-in on Starbucks.

I recommend staying neutral on Starbucks stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.