Summary:

- Starbucks’ premium brand image and pricing power face challenges as consumer spending slows, impacting earnings and comparable store sales.

- Q3 FY24 results show a 0.6% YoY revenue decline and a 4.2% drop in operating income, highlighting economic pressures on consumer spending.

- Despite opening 526 new stores, revenue growth remains weak, and the stock appears fairly valued with significant growth expectations already priced in.

- I am uncertain the firm can achieve 7-10% EPS growth amid economic headwinds and consumer spending constraints.

- Rating downgrade from “Buy” to “Hold”.

JohnFScott

Investment Thesis

Starbucks (NASDAQ:SBUX) is the world’s leasing quick-serve coffee chain. The company has curated a premium brand image that has proven highly effective at resonating with consumers across the globe.

As a result, Starbucks continues to enjoy a significant pricing power advantage compared to their competitors.

Nevertheless, the last fiscal year has been a tough one for the company with their latest Q3 results being no different. A slowdown in consumers spending appears to have impacted Starbucks’ earnings. The data suggests that consumers are unable to keep-up with their previous spending habits at the coffee chain with both comparable store sales, transaction volumes and per order tickets declining YoY.

As a result of the earnings slowdown, Starbucks’ current valuation which still incorporates an expectation for CAGR to rest around 10% means shares appear fairly valued at present time.

Therefore, I must downgrade my rating for SBUX to Hold at present time and would not advocate for the hypothetical building or further expansion of a position in the company.

Business Profile & Developments

When it comes to quick-serve chain coffee shops, Starbucks is the undisputed king. Their iconic logo has become ubiquitous on all six inhabited continents with over 38,000 stores spread out over more than 80 different countries.

Since the opening of their first store, Starbucks has focused heavily on creating a premium image for their brand. This has allowed the chain to differentiate themselves from a vastly homogenous range of fast-food restaurant competition by positioning themselves as a more cheap alternative.

This branding has proven to be a powerful tool for Starbucks, with the business now being able to charge around a 20% premium to their competitors when it comes to a basic cup of drip coffee. The coffee shop is also able to charge an even greater premium for their more complex ???made-to-order??? beverages.

By curating a premium brand image which resonates with consumers, Starbucks has managed to curate a truly remarkable degree of pricing power.

The perception among consumers that Starbucks coffee and treats are a more upmarket and higher quality choice compared to the likes of Dunkin??? or Tim Horton???s further plays to the firm???s corner, as consumers are often more willing to pay higher prices for perceived quality improvements.

September 9, 2024 saw Brian Niccol takeover the reigns of the business from departing CEO Laxman Narasimhan, with the board of directors and investors alike hoping that Niccol???s experience at Chipotle can help reinvigorate business at Starbucks.

While it is undeniable that Narasimhan???s turnaround plan seemed to ground to a halt, I am not entirely convinced that enough time was given for the changes he implemented to be translated into quantitative results. Nevertheless, I look forward to seeing what Niccol is able to do with the company, considering his successes at Chipotle.

I wrote an in-depth article on Starbucks back in March titled, ???Starbucks: Earnings Suggest The Stock Could Be A Robust GARP Opportunity???. I strongly suggest you read that deep-dive piece to ensure you get a holistic understanding into the firm???s business model and their economic moat.

Fiscal Analysis ??? Q3 FY24 Update

Starbucks produced a mixed set of Q3 results, with some qualitative operational improvements being offset by slightly worsened business economics.

SBUX Q3 FY24 Earnings Release

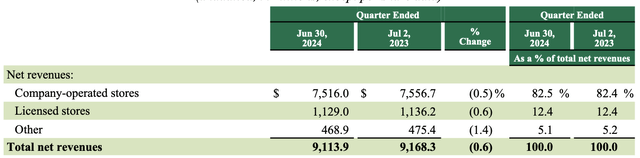

Total net revenues declined 0.6% YoY to $9.11 billion in Q3 as a result of a 3% YoY softening in comparable store sales.

Considering Starbucks??? premium positioning within the quick-serve coffee market, it comes as no surprise to me that consumers have been unable to keep-up spending given the prevailing macroeconomic conditions.

SBUX Q3 FY24 Earnings Release

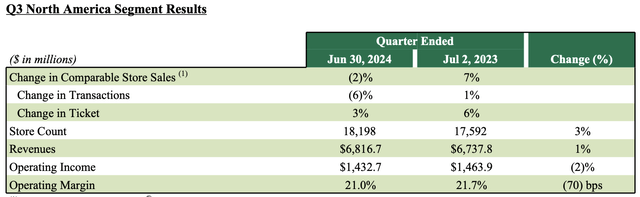

The reality is that consumers across the board have less disposable income at hand than they did twelve months ago. Considering that Starbucks??? average ticket per order increased another 2% YoY in Q3, I believe a significant amount of would-be customers simply cannot afford to frequent their coffee shops as regularly as before.

SBUX Q3 FY24 Earnings Release

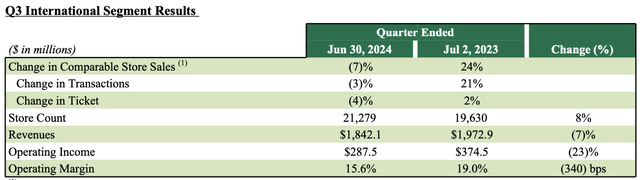

Such an effect appears to be particularly present in international markets, where comparable store sales decline 7% as a result of both a 4% decline in average ticket and 3% decline in comparable transactions.

European consumers tend to be more cautious with spending decisions than their American counterparts, and I suspect their current reluctance to spend will be replicated by U.S. consumers in the coming quarters, ceteris paribus.

Despite the slowdown in revenue growth, Starbucks did open another 526 stores at the end of Q3. These openings align with Starbucks??? overall growth objectives and leaves the company with a total of 39,477 stores.

The reason I mention these store openings is twofold. Firstly, it suggests Starbucks still sees consumer demand for new locations, which is a positive indicator for the health of their brand and image. Secondly, the overall 0.6% decline in revenues becomes slightly more concerning, considering that these new stores should have at least bolstered total revenues even if comparable store sales declined.

SBUX Q3 FY24 Earnings Release

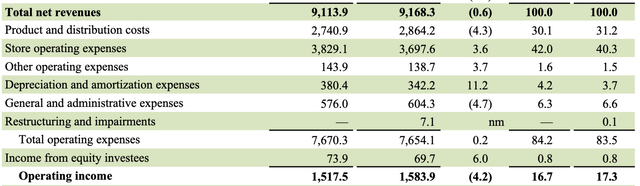

Unsurprisingly, the opening of new stores combined with increased promotional activities to market their products resulted in a significant 3.6% increase in store operating expenses and a 3.7% increase in ???other??? operating expenses which includes marketing costs.

This left total operating income down 4.2% YoY to $1.52 billion with Starbucks??? GAAP operating margin contracting 60bp accordingly to just 16.7%.

While these figures are disappointing, it was positive to see general and administrative expenses decrease 4.7% YoY thanks to ex-CEO Narasimhan???s organisational streamlining activities. Product and distribution costs also decreased 4.3% YoY due to realised improvements in their supply chain.

Using their current effective tax rate of 24.8%, Starbucks??? NOPAT for Q3 was $1.14 billion, down 4.2% YoY from $1.19 billion in Q3 FY23.

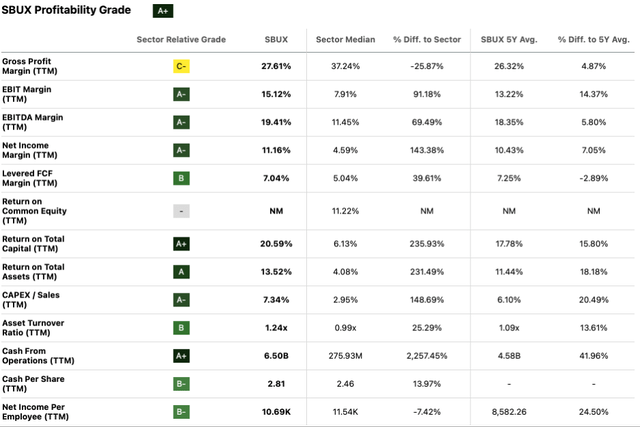

Seeking Alpha | SBUX | Profitability

Seeking Alpha???s quant continues to assign Starbucks an ???A+??? profitability rating thanks to the firm???s still solid operating metrics. I am largely inclined to agree with this rating as despite the recent slowdown in performance, Starbucks remains a massively profitable enterprise that produces significant amounts of cash from operations.

Overall, the Q3 results highlight the challenges coffee chains (and particularly more premium offerings such as Starbucks) face during periods of slower economic growth. Given that coffee and treats are not necessities in life, consumers can and do rapidly change spending habits to align with their ultimate levels of disposable income at hand.

I believe that thanks to Starbucks??? enduring brand image, the overall slowdown in comparable same store sales has actually been much less acute than what could have been expected given the struggles among middle-class consumers in the U.S., EU and China.

Furthermore, the truth remains that Starbucks remains a powerful namesake that undoubtedly continues to draw in customers even if they go less often and purchase cheaper product options.

While it could be hypothesised that Starbucks should pursue more discount items on their menu (much like McDonald???s has done to much success), the strategy may end up undermining their premium positioning in the long-run.

Valuation

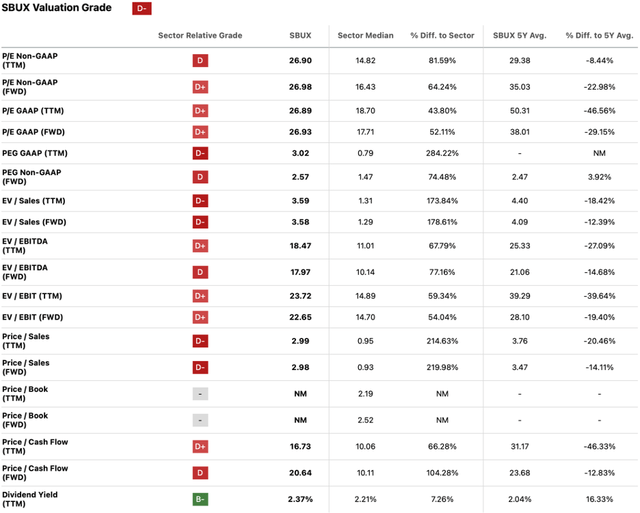

Seeking Alpha | SBUX | Valuation

Seeking Alpha???s Valuation Grade for SBUX stock is now a ???D-??? which is a slight downgrade from the ???D??? rating given when I last wrote about the company.

Indeed, the P/E GAAP TTM remains elevated at 26.89x which, despite being almost 46% down from the stock???s 5Y mean, is still at a level which suggests the anticipation for significant amounts of growth.

This hypothesis is supported by the current P/S TTM ratio of 2.99x which is certainly quite elevated for a consumer discretionary stock and illustrates just how much growth is already baked-in to the current valuation.

Seeking Alpha | SBUX | Advanced Chart

On an absolute basis SBUX stock has significantly underperformed the wider U.S. market as represented by the popular S&P 500 tracking SPY index fund (SPY). The weak performance has primarily arisen due to the lacklustre earnings data being unsupported by what has been a still growth-oriented valuation.

The Value Corner

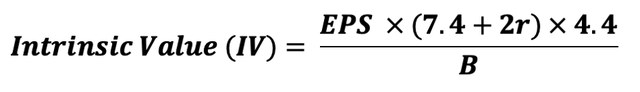

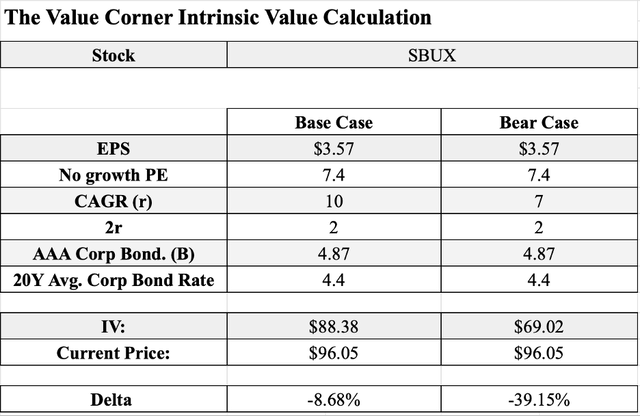

I used my Intrinsic Value formula in order to calculate a quantitative valuation figure to assess the stock???s current price against.

The Value Corner

Using the current share price, the TTM EPS, a realistic ???r??? value of 10% and the current Moody???s Seasoned AAA Corporate Bond Yield ratio of 4.87x, I calculated a base-case IV of $88.38 per share. This suggests what is essentially a fair valuation in shares at present time.

For my bear-case I decreased the CAGR to just 7% to model the negative impact a recessionary environment over the coming year could have on their 5-7 year EPS growth rate. With the lowered CAGR SBUX???s IV drops to just $69.02 suggesting a 39% overvaluation at present time.

These IV models illustrate the current dilemma facing Starbucks??? stock. While the underlying company is producing large amounts of cash from their business, the current stock price is contingent on a significant amount of YoY growth being achieved at the firm.

In absence of this growth, SBUX stock is simply too expensive and trading at a significant overvaluation.

Therefore, the question becomes whether or not Starbucks can return to the 7-10% YoY EPS growth that has defined the company???s financials for much of the past decade.

In the long-term (1-10 years), I do believe Starbucks will continue to be a profitable business thanks to their moaty business operations and global presence. However, in the short-term (1???12 months) I suspect the stock will struggle to have any defined direction of movement and will be susceptible to volatility due to both positive and negative catalysts.

Starbucks Risk Profile

Starbucks still faces two key threats: market cyclicality and intense competition.

As I mentioned earlier, premium priced coffees and treats are not necessity items in the lives of consumers. While the stickiness of these products can be surprisingly high, consumers will ultimately decrease their consumption of these nonessential goods should their disposable income become constrained.

When translated to Starbucks??? business economics, the reality is that during economic downturns, less consumers will be willing and able to frequent their nearest Starbucks and purchase $3-$10 coffees.

As a result (and as is currently evidenced by Starbucks??? lacklustre earnings data), Starbucks should experience cyclicality in their earnings results with their overall performance being largely tied to the health of the U.S., Chinese and European economies.

The firm faces an equally big threat in the form of competition from rivals in the industry. While Starbucks is still a highly sought-after brand, the relatively low barriers to entry combined with the risk of changing consumers tastes and preferences creates some challenges for the company.

In order to compete in the industry, Starbucks must ensure their brand and image remains relevant among consumers. Any deterioration in the public perception of either the brand’s trendiness or quality would result in decreased pricing power for Starbucks, and almost inevitably would be accompanied by an increase in popularity for one of their competitors.

Considering these factors, I believe Starbucks harbours a moderate level of risk which will require continuous mitigation by management in order for the company to prevail.

Summary

In my last article on Starbucks, I rated the company as a ???Buy??? given the significant discount in shares relative to previous prices as well as the overall outlook which appeared more positive for the company.

However, throughout my journey of analysing the Q3 results as well as Starbucks??? positioning in both the current market landscape and within the greater macroeconomic picture, I feel the overall situation has become more convoluted for the coffee chain giant.

While the company remains highly profitable and their brand image is still highly valuable, I suspect consumers simply cannot keep-up with the prices being charged by Starbucks for their products.

This hypothesis is supported by the drop in comparable store sales, transaction volumes and per customer ticket spends.

In terms of my outlook for the company and the potential timing of their turnaround, I asked myself one question: will consumers be more willing and able to purchase Starbucks products at the rates last seen in 2021 within the next 12 months?

Unfortunately, my answer to my own hypothetical question is a firm, maybe. If the company lowers prices slightly and focuses on attracting customers back into stores and if the economy achieves a nice soft-landing, maybe Starbucks will be able to restart their growth.

Then again, it seems highly unlikely that Starbucks will be able to achieve 7-10% EPS growth per annum in the next couple of years, as changes in monetary and socio-economic policies are notoriously slow to result in actual impacts among the spending public.

As a result of the significant uncertainty surrounding Starbucks as a company, I feel compelled to downgrade my earlier rating from a ???Buy??? to a ???Hold??? at the present time.

Analyst???s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. My opinions may change at any time and without notice. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.