Summary:

- Starbucks is experiencing a major post-earnings pullback, with the stock dropping nearly 40% from its high.

- Dutch Brothers, a competitor, is selling at a higher valuation than Starbucks despite being less profitable. I would be more excited about the re-rating of the bigger brand.

- Starbucks is facing challenges in China, with declining same-store comp sales and a lack of foreign influence affecting its business.

- The joint venture with TATA to open 1,000 Starbucks stores in India by 2028 could be the next leg of the growth story.

JohnFScott

A major post earnings pull back

Back in 2023,

I wrote an article surmising that a recessionary environment where the consumer would have to tighten their wallet may benefit inferior products like J.M. Smucker’s(SJM) Folgers brand. I believed Starbucks (NASDAQ: NASDAQ:SBUX) was overpriced for the growth rate the market was expecting which also hinged on a China expansion strategy. Since that article, Starbucks has finally dropped into a buy zone. I still believe I am paying a premium price for the brand name versus a realistic current valuation, but I am willing to pay a little above intrinsic value for a premium brand.

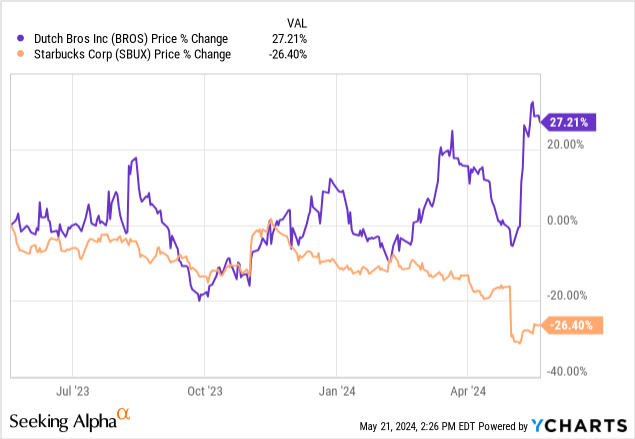

The market has been all too ready to write off Starbucks and crown Dutch Brothers (BROS) the new king of coffee, but Dutch Brothers is selling at a far more ridiculous valuation than Starbucks:

Yes, Dutch Brothers is finally profitable, but paying 90+ X EPS for any coffee firm is expecting a lot of growth. Last I checked their frappes still had chocolate chips and not NVDA chips.

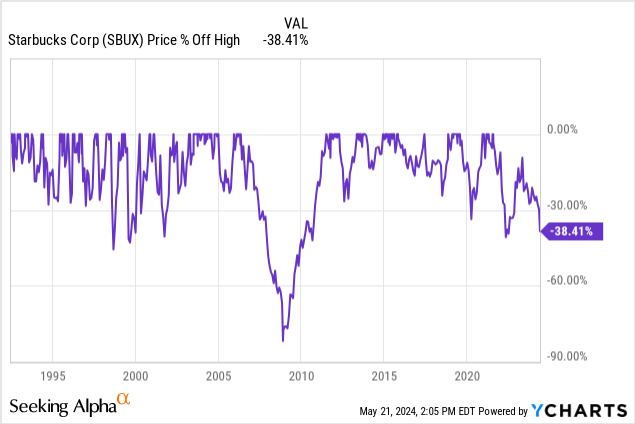

Percent off high

Near -40% off the high, Starbucks is in a bear market within the bull. It’s hard to find blue chip brand names that haven’t moved in tandem with the raging bull since mid 2023, and Starbucks is one of those names.

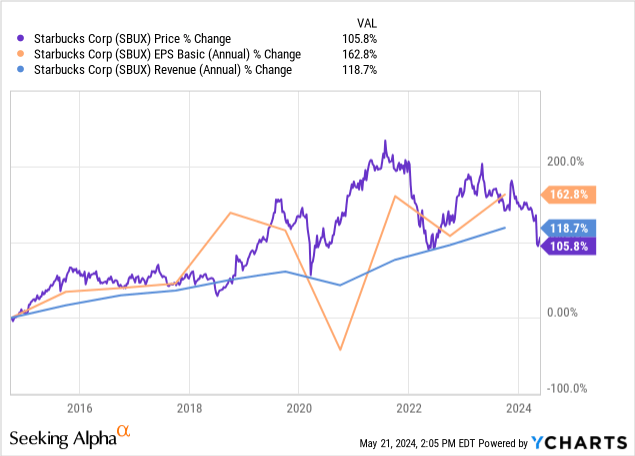

10 year earnings and revenue growth vs share price

As investors, we are now finally able to enter at a point where 10-year share price growth is lower than 10-year revenue and EPS growth. For most of the last 10 years earnings and sales growth rates were below the share price growth rate. This is always my first step in determining whether a stock is at an attractive entry point worthy of further analysis.

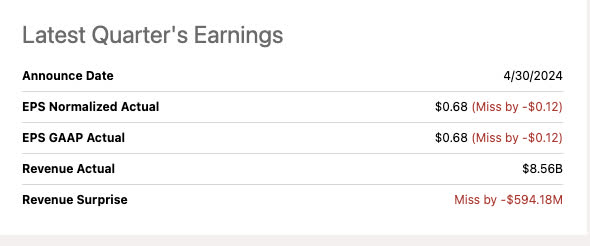

Most recent quarter woes

Seeking Alpha

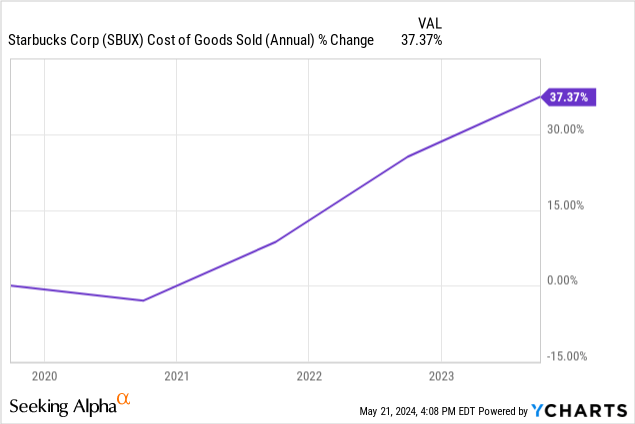

A 15% miss on EPS and a 6.4% miss on revenue. Not great numbers, one of the worst we’ve seen from Starbucks in a while. But with misfortune comes opportunity. The revenue is the more worrisome of the two as inflation is partly to blame for the bottom line.

Coffee prices

tradingeconomics.com/commodity/coffee

Coffee prices would have been a better scapegoat on the most recent earnings call versus weather or defending the throughput and waiting times. The excuses gave Jim Cramer a lot of cannon fodder on CNBC. Starbucks is passing along every dime of inflation they are absorbing and the consumer is starting to balk. Wait times need to be improved. Narasimhan noted they are working on throughput via investment in their “siren craft system“, which cuts down steps for more complex drinks.

While Coffee is not as insanely valued as cocoa currently, it still appears due for a commodity cycle price drop. That could work out some of the bottom-line issues organically.

The flailing China strategy

As noted on the most recent earnings call, same-store comp sales in China are down -11%. CEO Laxman Narasimhan still seemed to double down on the premise that the China team could improve the revenue growth trajectory and did not indicate any alternate strategies.

A lack of foreigners in China

As a former expat who used to spend about half of my life in China for a decade-long period, the exodus of Foreigners during and post-Covid is undoubtedly hurting the business. When I was working in China, Starbucks was a daily affair. At locations I would frequent across Shanghai or other major tier 1 cities, the foreign cohort made up a good portion of the waiting line.

It was also a place we would invite Chinese coworkers and clients for meetings. This undoubtedly led more Chinese natives into Starbucks’ order queues versus domestic operators like Luckin Coffee (OTCPK:LKNCY) as they were influenced by “Western” experts on the coffee brands to consume. The lack of foreign influence has now put price at the center of the equation, an area where Luckin will certainly beat Starbucks.

Boba tea shops are probably a more “go-to” solution for younger Chinese customers. We can now see Starbucks trying its hand at Boba to possibly chase that market down as well. They unfortunately started with the popping fruit pearls rather than the chewy tapioca pearls, already a misstep. It may be convenient to offer a Boba solution in case a member of a visiting party to as Starbucks did not want a coffee, but I highly doubt that anyone in China would think of Starbucks first over a local brand. The U.S. also has many better Boba options in most major cities.

Then you have the 50-70 year old demographic. They are almost exclusively loose tea drinkers that have their own local teas shops. They can grab a domestic porcelain cup of gaiwan tea for less than a couple bucks. Free hot water refills included.

If expats and students studying abroad ever return to China en masse, I think the combination of influence plus consumption by the group would put the growth story back on the right trajectory.

This video was published 9 months back in a popular foreign destination in Shanghai. Although there are more and more foreign commerce-focused events popping up in China now versus 2020-2023, it is still a long way from its former state. Some days I used to walk around certain areas of Shanghai that would be hard to distinguish from New York or Honolulu, where you have a large mix of people from everywhere. Eventually this may return, as long as Chinese relations with the world continue to improve.

A pivot to India?

With CEO Laxman Narasimhan being of Indian origin, the recent partnership with Tata in India to open 1,000 jointly run stores by 2028 would seem to be a smart growth investment. The first time I visited India, I was unable to find a Starbucks nearby in a very densely populated area of New Delhi with several expat-centric hotels. It was completely the reverse of what I found in China where Starbucks was even popping up next to Buddhist temples.

This is a very untapped and undersaturated market in the next area of global economic growth. For those that say bring back Howard Schultz, I think you would be missing out on what Narasimhan could mean to the India growth story that has yet to begin.

The major weakness from my point of view when visiting India pre-covid was the lack of sidewalks. In New Delhi in particular, the lack of sidewalks and walkability hindered many opportunities for customer-facing coffee shops. Most businesses and hotels were walled and gated. Every outing was done with a driver to another walled and gated location. China on the other hand is very walkable and littered with Subway stations which is an excellent environment for customer-facing transactions.

Metro stations in major Indian cities are increasing, I assume sidewalks will come with the added stations. This is a long developing story, but one worth pursuing.

The drive through advantage

Another argument I hear about competition in the U.S. with all the various local barista shops is that there are now many more interesting options than Starbucks. I beg to differ.

A lot of these “hipster” cafes are centered in metro areas and often surrounded by an environment that has now become unsavory in the United States. Homelessness is a major problem and unfortunately, many high-quality restaurants and cafes are bearing the brunt of the problem. Starbucks is still ubiquitous with the drive-through model. Staying in your car and grabbing your cup of joe has never been more appealing in some US cities.

The brand name is still an intangible asset that is yet to be rivaled

At my kid’s school, the children still bring the teachers Starbucks gift cards for teacher appreciation week. Wherever I travel, I still pick up a commemorative Starbucks cup emblazoned with the city I traveled to. I could go on, but Starbucks still has an established and safe brand when gifting someone you don’t know very well with a gift card of appreciation. Like Disney, Amazon, McDonald’s, or Costco, Starbucks is one of those gift cards that you don’t think twice about grabbing.

The brand is established, I just can’t imagine treating Dutch Brothers or Dunkin’ Donuts in the same vein at some point in the future.

Valuation

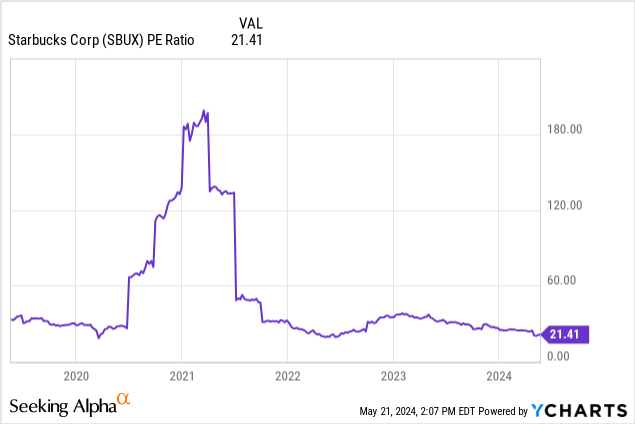

The P/E ratio of Starbucks is near a 5-year low. Still, the forward multiple above 20 would assume immediate growth that is not in the cards as per company guidance.

I previously used an “owner earnings” model to evaluate Starbucks. At the time the 10-year Treasury risk-free rate was still under 4%. Today it stands at 4.47%. The popular Warren Buffett metric is a discount rate that falls somewhere between discounted levered and un-levered free cash flow. Taking net income, adding back depreciation and amortization while backing at CAPEX. It does account for taxes and interest expenses as well as all the operating costs.

Since rate cuts are all but a certainty in the next 12 months, I’ll set the risk-free discount rate at 4%

All numbers courtesy of Seeking Alpha in Billions of USD:

- TTM Net Income: $4,157

- Plus TTM Depreciation and Amortization[$1,524]=$4,157+$1,524=$5,681

- Minus TTM CAPEX: $5,681-$2,586=$3,095

- Equals Owner Earnings= $3,095

- Discounted at 10 year Treasury rate= $77,375

- Divided by shares outstanding=$77,375/1,132= $68.35/share

As we can see, the fair value for owner earnings at current is $68.35. However, considering a future assumption of a return to growth and falling discount rates plus the significant intangible asset that is the Starbucks brand name, I believe this qualifies as a wonderful business at a fair price. It is a premium price, but a tolerable one in my opinion.

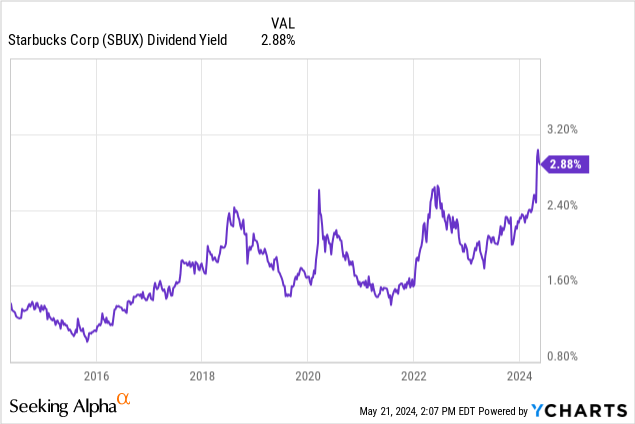

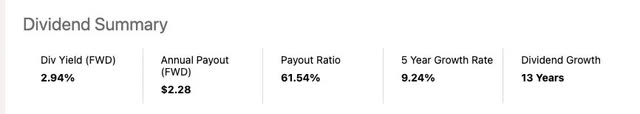

The dividend

The dividend is also becoming a substantial catalyst. Any time a big brand like this crosses the 3% chasm of dividend yield when it is not a normal occurrence, I take notice. While the price has spiked up a bit from when I bought my first shares, the yield is still near a decade high.

Free cash flow per share to dividend per share

Seeking Alpha

The yield is currently growing at 9.24% over a 5 year basis with growth for 13 years. With forward guidance what it is, I would expect this to slow.

Vs. Free cash flow

Seeking Alpha

With TTM free cash flow per share at $3.47, the forward yield of $2.28 is a tad higher payout ratio of free cash flow at 65.7% vs EPS. Tolerable, but again I would not expect a near 10% dividend CAGR for the next couple of years until they figure out the international growth story and inflation subsides.

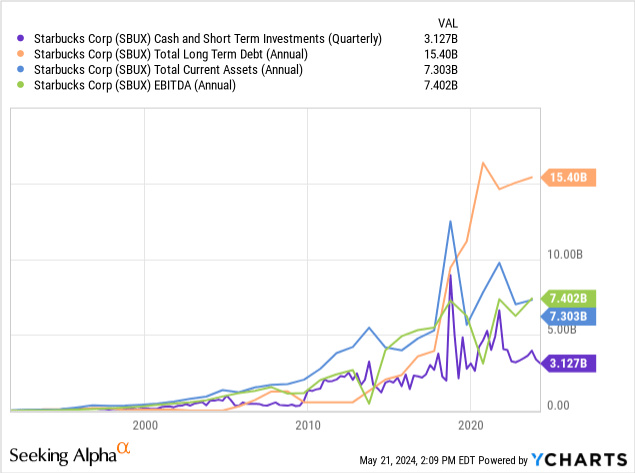

The balance sheet

The balance sheet for Starbucks is not great. The China chasing expansion took off in 2018/19 and you can see LT debt spike up from there. The enterprise value is still only about $20 Billion larger than the market cap, so the market certainly puts a large premium on the brand considering the balance sheet running a negative equity balance since 2019 due to total liabilities exceeding total assets.

Net interest expense is up to $449 million on a TTM basis, which is still tolerably covered by EBITDA at 16.48 X.

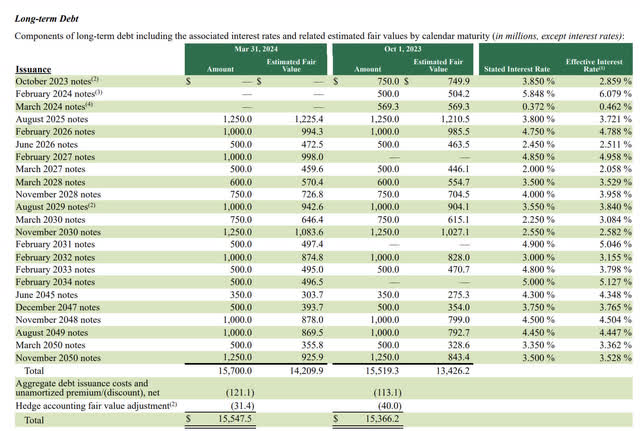

On a brighter note, a lot of this debt was borrowed cheaply. With gross interest expense at $564 million/ $15,580 million LT debt, the effective interest rate is only 3.6%.

Starbucks Most Recent 10Q

2025 and 2026 both have some significant maturities which will increase the overall cost of capital. However, Starbucks did a great job of borrowing nearly half of its current debt with maturities between 2030 and 2050, most with rates in the 3-4% range.

Risks

It’s hard to say how long inflation persists. The cost of beans is certainly affecting the top and bottom lines as passing costs on to consumers is becoming harder. Chasing top-line growth by reducing margins is also not a great idea with the amount of debt the company has. It’s probably best to sit tight and wait for lower inflation before making the next move. A big risk is that the Starbucks growth story stalls out for the next 2-3 years. The multiple could re-rate a couple more times.

Summary

I bought this stock and believe it is a great brand at a fair price. I don’t recommend it for everyone, as I don’t believe growth comes back for another couple of years. For the patient investor, I think you’ll be rewarded in the long run. The company borrowed a lot when debt was cheap to chase growth. That can not be the strategy moving forward with the current cost of capital.

The cheap money did allow Starbucks to expand it’s footprint to every reach of the globe, that is valuable in and of itself. This is something Dutch Brothers or Dunkin’ doesn’t have. Now is the time to reconfigure and wait for brighter days. A buy for the long term “buy and hold” investor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SBUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.