Summary:

- Starbucks stock has dropped after disappointing Q2 earnings, but the company has a solid global presence and competitive moat.

- Chinese consumers’ cost-conscious behavior and competition from a local startup are near-term challenges for Starbucks.

- Despite the recent decline in stock price, Starbucks is trading at historically low valuations, making it an attractive investment opportunity.

Guido Mieth

Starbucks (NASDAQ:SBUX) stock has been under pressure after a recent earnings release as investors wake up to the realization that this is not a growth stock. However, the company has a solid global footprint, a Buffett-style competitive moat, and is trading at a more favorable valuation.

An earnings disappointment in a tough market

Starbucks released its second-quarter earnings on 30 April, which led to a sharp decline in the stock price of 16%.

The headline figures said net revenues were down 2% to $8.6 Billion, with earnings per share of $0.68. The company noted that Starbucks Rewards Membership was 32.8 Million, up 6% year-over-year.

Comparable store sales were down -3% which was a disappointment from growth of 12% a year ago. Despite the gloom of comparable sales, revenue for North America was flat from a year ago at $6.380 billion, versus $6.380.6 billion. International revenue came in a $1.757 billion, down from $1.854 billion. It should also be noted that any change in comparable sales only includes stores open for 13 months or longer.

The company opened 364 new stores in Q2, leaving a total of 38,951, where 61% are in the U.S. and China with 16,600 and 7,093 stores respectively.

Overall, I believe these numbers are far from drastic and the decline in the stock price was likely a shaking of the tree from investors positioned heavily for growth.

Cost-conscious Chinese consumers among near-term headwinds

One of the key takeaways for the Q2 results and even previous quarters has been a slow rebound for the Chinese economy. Chinese consumers have been acting more cost-conscious and the situation in the economy has only started to turn around during the first quarter of 2024.

Starbucks is therefore well positioned for a rebound in the Chinese economy. There is a near-term headwind as Starbucks and domestic rival Luckin Coffee have to contend with a price war. A new startup chain, Cotti Coffee, has been offering beverages for only 10 yuan ($1.40). Cotti’s deal was only set to run to the end of May, but the company’s lean model with small stores has also been catching up to Starbucks’ footprint. Seeking Alpha cited Reuters in data that saw the Seattle coffee giant becoming more prominent in online discount channels and store deals.

After letting market pressures control its ailing property market last year, China has finally stepped up with “historic” stimulus measures. The IMF has since raised its growth forecast for China to 5% this year. I believe the headwinds for Starbucks could ease over the coming quarters if consumer confidence bounces back.

Coffee prices are also up around 20% this year, which will add to the near-term headwinds.

Valuation is a reason to be cheerful

I was previously critical of Starbucks’ growth story valuation in my last article on the stock back in April 2022. I felt that the valuation was high at the time and that investors were adding too much weight to the growth potential. The company was starting the transition of its CEO, leading to an investment bank downgrading the stock’s target from $120-90. The stock is largely flat since that article, with a 1% gain at the time of writing.

Having such an aggressive expansion program makes the company prone to the types of economic headwinds noted above.

But Starbucks stock is a company with a Warren Buffett-style competitive “moat” and it would not be a surprise to see value investors circling the stock this year. At a previous Berkshire Hathaway Annual Meeting, Buffet explained his moat idea, saying:

“What we’re trying to find is a business that, for one reason or another — it can be because it’s the low-cost producer in some area, it can be because it has a natural franchise because of surface capabilities, it could be because of its position in the consumers’ mind, it can be because of a technological advantage, or any kind of reason at all, that it has this moat around it.“

Starbucks has a dominant position in consumers’ minds because of the brand and the atmosphere of its coffee houses. Starbucks is to coffee what Netflix is to streaming, or Apple is to the cellphone. Chinese budget brands have been gaining ground in a time of economic stress, but I believe Starbucks will continue to grow in the country as China continues to pivot to a consumer economy.

Gordon Haskett analyst Don Bilson also said that his firm had been taking questions from clients about a potential activist move for Starbucks. As the stock gets cheaper, that could become a reality in my opinion.

Former CEO Howard Schultz said that “any company that misses badly, there must be contrition and a renewed focus on discipline on the core,” adding that mobile ordering and digital payments need reform and that the “stores require a maniacal focus on the customer experience.”

The company is taking steps this week to boost staff morale by getting back to the negotiating table with Union bosses over pay and benefits.

With the recent decline in price, Starbucks is trading near historical lows in price-to-sales, and I believe it is a buy based on those metrics. This is a company that relies on heavy sales volume.

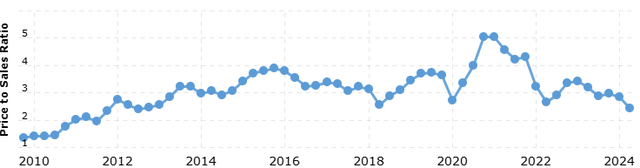

Starbucks Price to Sales Ratio (Macro Trends)

The current P/S ratio of around 2.3X is trailing the lower end of the company’s valuation over the last fourteen years. The year 2010 saw P/S trading at a lower 1.36, but the world was still reeling from the Global Financial Crisis. The company recovered well from the pandemic, but its lofty valuation assumed huge growth, largely driven by China.

The company’s price/earnings ratio is also trading at -57% below the company’s five-year average.

I believe investors should look ahead to China’s longer-term growth story, and I also think that Starbucks’ recent woes were a necessary evil. Changes at the CEO level have not helped the company, there is an issue with strategy and profitability that activists may step in to right.

Other metrics that are cheaper based on Seeking Alpha data are Non-GAAP Forward Price-to-earnings and Enterprise Value/EBITDA, which are both almost 40% lower than the five-year average.

The company is also fairly attractive on profitability metrics with gross profit margins 5% higher than the five-year average, while Return on Total Assets and Cash from Operations are higher by 21.8% and 32.8% respectively.

Starbucks has a dividend yield of 2.94% with an annual dividend of $2.28. Aside from the year of the pandemic, Starbucks has been delivering higher revenue every year since 2016, and I believe that the company will get back on track and is worth buying with the stock currently valued below many of its five-year averages.

Conclusion

Starbucks had a tough quarter for its Q2 earnings and the stock price was hit earlier this month. I feel this is setting up an opportunity for investors to buy into a solid brand name at historically low valuations. Many companies such as Apple (AAPL) and Tesla (TSLA) have been struggling with sales in China, but the long-term story is intact, and these companies were simply suffering from high valuations and aggressive growth projections.

Starbucks may be going through a fire at present, which has included a period of management upheaval. But in my opinion, this is no crisis story and if this stock gets any cheaper due to a correction in the broader market, the valuation would simply be more attractive. The potential for an activist investor to pounce on the stock is very real due to the fragmented recent history of Starbucks’ executive board. Any activist taking a large stake could gain significant power over the company and make adjustments to its strategy. Starbucks is a top global brand with a competitive moat, and the company has been navigating a period where high-interest rates have squeezed domestic and international consumers. China has a big store footprint and consumers have been fearful due to a property crisis and plunging stocks. These issues are starting to change and Starbucks can bounce back strongly.

I will place a buy rating on the stock here but would buy any further lows more aggressively for a potential turnaround plan.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.