Summary:

- Starbucks Corporation is one of the worst-performing restaurant stocks in 2024, and rightfully so.

- The company had to downgrade its guidance twice in the last two quarters, as comparable sales are declining.

- Starbucks checks none of my boxes when it comes to investing in the sector.

martinrlee

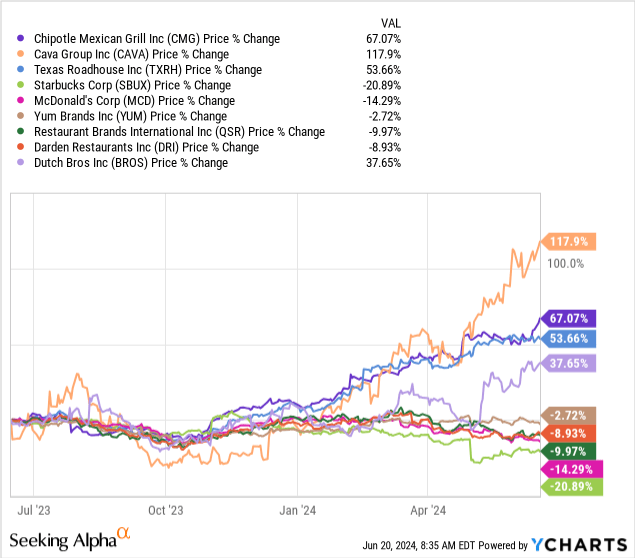

Starbucks Corporation (NASDAQ:SBUX) investors should be frustrated. How can they not be? In a year when the only sector that seems to keep up with semiconductors is food service, the stock is down almost 15% and is now trading 36% below its all-time highs.

Starbucks is still one of the strongest brands in the world, but the company needs a turnaround, on many fronts.

Let’s go over the key factors to monitor in identifying a potential turnaround.

Revisiting The Restaurant Investment Thesis

Back in October 2023, I downgraded Starbucks to Hold. Before I go through the reasons for that downgrade, I think it’s worthy to briefly remind the investment framework in food service companies.

Historically, this is a sector that was perceived as inferior, primarily due to a lack of barriers to entry. However, Peter Lynch and Bill Ackman, two of the most successful investors in history, had huge success with restaurant companies. Over time, investors learned to appreciate the simplicity and the potential of well-run restaurant chains, and it seems like, in the past couple of years, this has been one of the hottest sectors.

While stocks of Chipotle Mexican Grill, Inc. (CMG), CAVA Group, Inc. (CAVA), Dutch Bros Inc. (BROS), and Texas Roadhouse, Inc. (TXRH), are conquering new highs every day, other names like McDonald’s Corporation (MCD), Yum! Brands, Inc. (YUM), Darden Restaurants, Inc. (DRI), Restaurant Brands International Inc. (QSR), and of course, Starbucks, are struggling.

The reasons for the difference in stock performance, are the three pillars that are the foundation of the investment thesis in restaurant chains. I talk about them in all my articles covering the sector, including a deep overview in this Chipotle article.

In short, restaurant chains are a story of footprint expansion, comparable sales, and margin expansion (or stability). If I had to rank, I’d say comps are the most important, followed by margins, and footprint expansion. That said, all three metrics have to be near perfect, for a long time, for a stock to become a success.

Now, I encourage you to guess which companies on the above list are delivering on all three of those metrics, and which aren’t. Here’s a spoiler, Starbucks isn’t.

I downgraded the stock back in October because I saw a new CEO who has no experience whatsoever in running food chains, a huge dependence on China for growth, signs of saturation in key markets, and increased competition.

All that culminated in a truly terrible fiscal Q2 ’24.

Abysmal Q2 ’24 Results

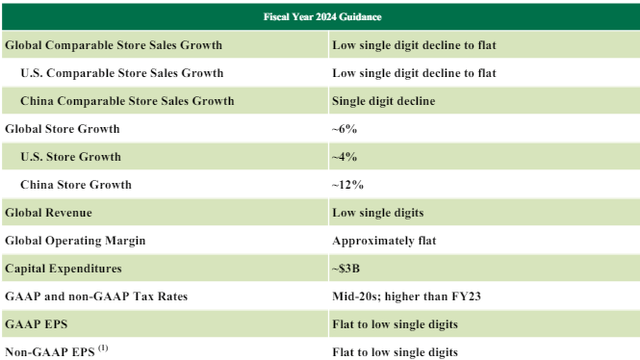

Starbucks began its fiscal 2024 with consensus estimates expecting revenues of $39.6 billion, and EPS of $4.14. This was predicated on the company’s initial guidance, which, at its mid-point, suggested revenues of $39.9 billion and EPS of $4.23. Well, we all know that this is not going to happen.

In the last 90 days, there have been 29 downward revisions, following a terrible second-quarter report, in which Starbucks missed revenues by nearly $600 million (~7%), and EPS by $0.12 (~15%).

Starbucks Q2’24 Earnings Glance

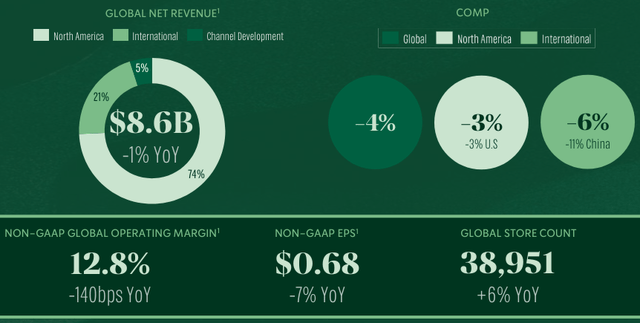

In the quarter, revenues declined by 1.8% to $8.6 billion, the first year-over-year decline after the pandemic. Comparable sales were a negative 4% globally, driven by an 11% decline in China and a 3% decline in the U.S. Remember that we said this was the most important number for Starbucks.

Gross margins declined by 60 bps Y/Y, leading to a gross profit of $2.2 billion, a 4% decline from the prior year period.

Operating margins declined by 240 bps, as operating profit declined by 17% to $1.1 billion. Lastly, net income was $772 million, down 15% Y/Y.

Clearly, this was one of the worst quarters in Starbucks’ history. Even worse than those results was the fact that management did not prepare investors for it, and even they seemed like they were caught surprised, in what led to a viral interview of the CEO on Jim Cramer’s show.

Accordingly, Starbucks had to significantly downgrade its guidance for the year. From revenue growth of 10%-12%, they are now expecting low single digits. From operating margin expansion, they are now expecting it to be “approximately flat.” Most notably, EPS is expected to be flat to low single digits, down from up to 15%-20%.

This is undeniably a materialization of the new CEO risk, but now that the stock is down so much, we have to ignore that and focus on the fundamental prospects.

Same-Store Mess

Following a negative comp quarter, companies must find a way to make customers want to buy more and more frequently. This isn’t rocket science, as customers come if they feel they get good value for their money.

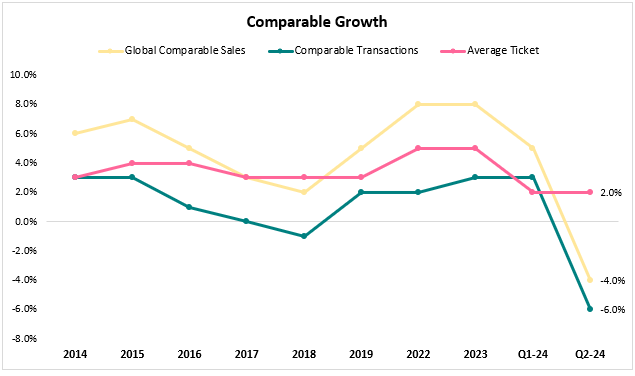

Starbucks has been raising prices for a long time, reaching levels that might be too high according to most customers. This is probably their number one problem, considering average tickets continued to rise by 2% as comp transactions declined by 6%.

Created by the author using data from Starbucks financial reports

When comp sales decline for the first time in years, it raises multiple worries. First, investors have 2%-6% annual growth baked into their expectations. Second, when a company fails to deliver, especially when its competitors are succeeding (Dutch Bros grew comps by 10%), it’s a signal of market share loss. Third, opening new locations becomes less accretive or attractive when existing locations are struggling.

This leads me to the next section.

Geographic Saturation & China Dependency

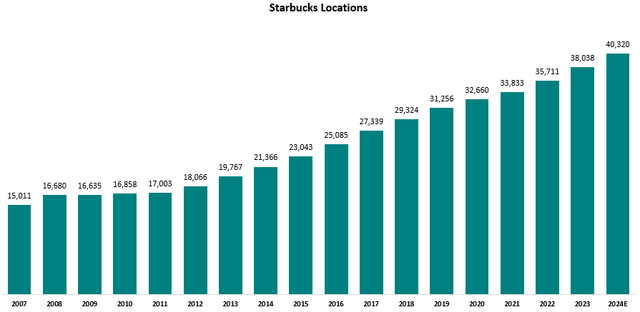

Another potential driver of negative comp is cannibalization. With Starbucks approaching 39,000 locations worldwide, and surpassing 18,000 locations in North America, it might be reaching a point when new locations take away the business of existing stores.

Created by the author using data from Starbucks financial reports

Starbucks almost tripled its footprint worldwide since 2007. Today, it is the second-largest chain in the world behind McDonald’s in terms of a number of locations.

Remember, a chain’s top-line growth algorithm is based on footprint expansion and comp sales. It’s much easier to envision a company with 1,000 locations growing its footprint than it is to assess how much more runway Starbucks has.

Personally, I’ve seen many stores where the barista has nothing to do for several minutes and even hours. Those stores are killing the overall comparable growth, but they also reflect saturation.

This is probably a big reason why the company turns to riskier geographies like China for growth. The problem is that China is unpredictable, there’s immense competition, and even if they were to succeed there, the market assigns a lower multiple on profits generated in China.

The “Third Place” & Identity Issues

I recently listened to a long podcast with Starbucks’ legendary founder and CEO, Howard Schultz. During the podcast, he discusses the core values of Starbucks and refers to his ‘Third Place’ vision.

Simply put, he views Starbucks’ main proposition as being a place that connects people, who want a place they can relax outside their homes and work.

He argues that the increasing reliance on mobile orders led to a deterioration in the guests’ experience.

I have to say, I find it difficult to understand his argument. In the second quarter, 90-day mobile active members declined for the first time in years, reflecting loyal customers leaving the company.

In my view, there’s a clear connection between the company’s bad results and the decline in mobile orders.

It might be true that in its early days, Starbucks was a place of gathering, where enthusiastic coffee lovers came to hang out. However, I don’t really see that barista-customer connection as something that can drive a $90 billion dollar business.

The way I see it, providing a tasty product at a reasonable price is something much more coherent, and it’s a strategy investors can quantify and understand.

Starbucks needs to find the right balance between price, volume, and margins, and it’s not that easy. Until then, I expect the company will continue to struggle.

Valuation & Worries

Starbucks currently checks zero of the three boxes of the restaurant investment thesis. Comp sales are declining, geographic expansion is questionable, and margins are declining.

Add to that the fact the new CEO came out with quite an ambitious, dare I say, arrogant, multi-year strategy. He will most likely have to change it completely, as the company has already taken quite a turn from the path he envisioned.

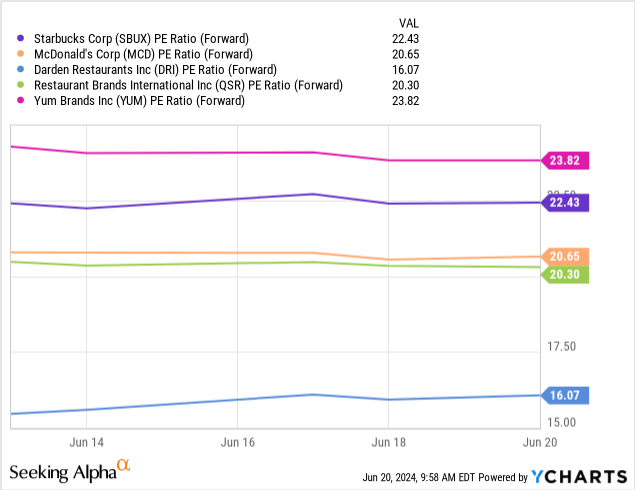

Taking all that into account, Starbucks clearly belongs to the “struggling” basket of restaurant companies.

Within that basket, we can see that Starbucks isn’t trading as low as might be expected considering its long list of problems. At a 22.5x P/E, Starbucks is above McDonald’s and QSR, two prominent names in the sector.

What worries me, even more, is that the market seems to be taking for granted that Starbucks will be able to turn things around rapidly.

Current consensus estimates expect Starbucks to return to mid-teens EPS growth in two quarters, a feat that I don’t think will be so easy.

Conclusion

I’m not looking to buy this dip, at all. I would rate Starbucks Corporation stock a Sell, but I believe that for historical brands like Starbucks, even slightly better-than-terrible results might send the stock higher.

The company has too many issues to count, but the company continues to open new locations at a rapid pace as if nothing is happening.

The current valuation reflects a slowly growing restaurant chain. It does not reflect a chain in dire need of a turnaround.

Therefore, I reiterate Starbucks as a Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.