Summary:

- Starbucks Corporation shares have been stagnant due to the expected impact on the company due to the slowing Chinese economy.

- This doesn’t seem to be anything new, as China issues have led to presenting opportunities to pick up shares of Starbucks previously.

- Despite the challenges, analysts expect strong growth for Starbucks in the coming years, making the current valuation fairly attractive for long-term investors.

- We’ve been using covered calls on a portion of our position to generate additional income, besides from the growing dividend alone.

garett_mosher

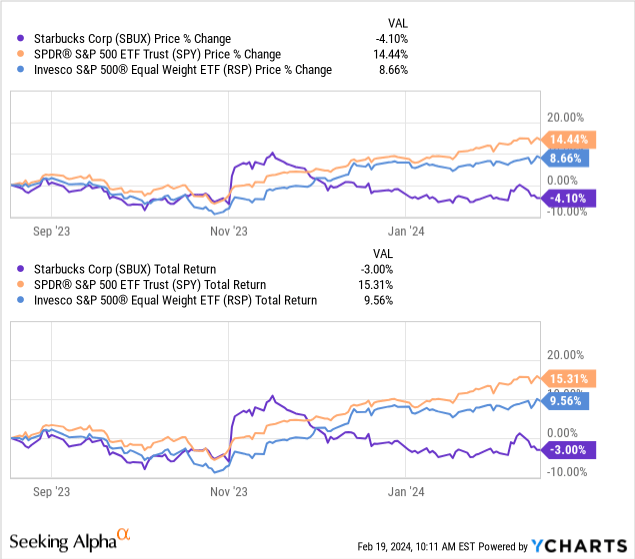

Starbucks Corporation (NASDAQ:SBUX) hasn’t been participating in the upside rebound of the overall broader market indexes over the last four months. Instead, shares of the coffee chain have been moving mostly sideways.

Over the last six months, it’s been even more noticeable in terms of the divergence of SBUX relative to (SPY) and even the Invesco S&P 500 Equal Weight ETF (RSP).

Ycharts

The primary culprit for why investors are probably feeling a bit of déjà vu at this point, is because of China. However, it’s not just a feeling of something we’ve already seen; China has been a weak point in prior years. China is the second home market, as it’s often noted, due to significant expansion and exposure to the country.

Now, the slowing of the Chinese economy is seemingly putting a damper on future expectations for SBUX in terms of growth. Although admittedly still growing, it’s the pace of growth that is expected to slow down.

During the 2020 Covid pandemic, while there were shutdowns around the world and the economy came to a screeching halt, China was even more strict. This then went on to continue while the rest of the world largely started opening. China remained in lockdown through 2022 thanks to the “zero COVID policy,” and that put significant pressure on SBUX as it dampened sales and growth opportunities.

Clearly, human life is more important than the profits of a corporation, but we are specifically talking about what was ailing SBUX’s business in this discussion today.

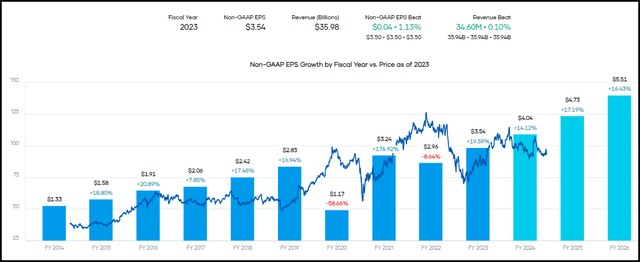

On that front, it did hurt SBUX’s earnings during this period. That’s quite clear to see looking back at the earnings history of this company. 2020 took a massive dive in profitability, and 2022 was also weaker before resuming to record levels of EPS again last year.

SBUX Earnings History and Estimates (Portfolio Insight)

The latest earnings report for SBUX was posted on January 30, and they missed both the top and bottom lines. That’s something that doesn’t necessarily happen so frequently, and with a relatively newer CEO, it probably is something he is hoping not to make a trend. In the last 16 quarters, they’ve met or exceeded analyst expectations 12 times for earnings. The track record for revenue is a bit more mixed, but they still exceeded analysts’ expectations in 10 out of the last 16 quarters.

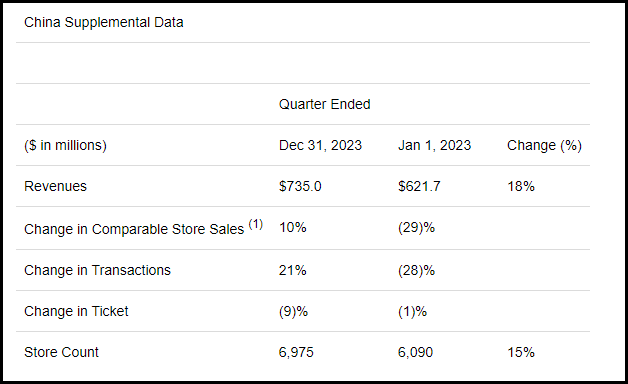

This latest quarter saw 549 net stores open globally, for a total of 38,587 stores. They noted that at the end of Q1, they had 16,466 stores in the U.S. and 6,975 stores in China to provide some color on the type of exposure we are seeing from these two countries alone.

During the call, they noted that China, in this latest quarter, was continuing to see some strong growth with comparable growth of 10% in China.

Our performance in the quarter was fundamentally strong. Our Q1 total company revenue was a record $9.4 billion, up 8% year-over-year. Our global comparable store sales grew 5% year-over-year, supported by a 5% comp growth in North America, driven by 4% ticket growth, and 10% comp growth in China.

The 10% comparable sales came largely from changes in transactions. Ticket change actually dragged the comp sales down by (9%) in China. The comp sales were also going up against last year’s level, which highlighted that more challenging period – or what they noted as the “market lapped prior year mobility restrictions.”

What this tells us is that there were more transactions year-over-year, but consumers were actually spending less per ticket.

SBUX China Supplemental Data (Starbucks)

In North America overall, the change in comparable store sales was 5, with transactions up 1% and change in tickets accounting for the larger 4% increase. International, more specifically, saw comparable store sales climb 7% with a change in transactions up 11%, but a change in tickets down (3%).

As we saw from the historical earnings graph we shared above, there is still expected to be strong growth going forward. Going out over the next five years, analysts expect an average annual EPS growth of 16.41%.

SBUX Earnings Estimates (Seeking Alpha)

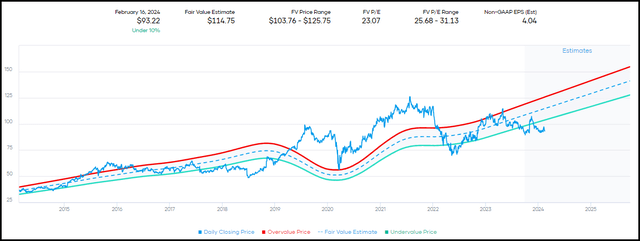

That’s why, even with a weaker China, the latest decline in SBUX share price seems, at least to me, to be rather unwarranted. The forward P/E over this fiscal year comes to 22.93x. On its own, that’s not even rich compared to SBUX’s historical range. The company’s shares have more often traded in the upper 20x range rather than the low 20x multiple.

SBUX Fair Value Estimate (Portfolio Insight)

Then you go out a year or two, which is nothing for most long-term-oriented investors, and we can see the P/E multiple come down even further. So, we are already priced at a cheap valuation to help provide some headroom for missing analysts’ expectations.

Options Writing To Generate More “Income”

Aside from a core position in SBUX in my portfolio, I also have another batch of shares that I’ve taken from writing puts. Since then, over the last couple of years, I’ve been writing covered calls in a way that generates even more “income” aside from the quarterly dividend alone.

The latest covered calls we had written recently expired worthless. This was a trade that we entered on November 29, 2023. This was actually a covered call position that we rolled previously as shares were heading higher. The original calls we wrote were at a $105 strike, and we rolled it up to $110. Given the weak share price we noted above, it inevitably led to the trade expiring worthless.

That meant we netted the entire $1.19 in premium from this trade, and even when we rolled, we closed out the prior position for a small net profit. In that original trade, we brought in $0.75 in premium and closed the trade for $0.29 for a net premium of $0.46.

This now adds another set of trades to what has been a rather lengthy list of covered calls after originally taking assignment of puts back in early 2022. In total, we’ve now collected $10.28 in net option premiums from this name, including the original premium received for writing the puts.

| Ticker | Expiration Date | Upper Strike | Lower Strike | Current Price | Type Sold | Date Initiated | Premium Collected | Date Closed | Closing Cost | Gain/Loss |

| SBUX | 02/16/2024 | $110.00 | – | Expired | Calls | 11/29/2023 | $1.19 | Expired | – | $1.19 |

| SBUX | 12/15/2023 | $105.00 | – | Rolled | Calls | 10/18/2023 | $0.75 | 11/29/2023 | $0.29 | $0.46 |

| SBUX | 08/25/2023 | $110.00 | – | Expired | Calls | 07/17/2023 | $0.69 | Expired | – | $0.69 |

| SBUX | 07/21/2023 | $110.00 | – | Rolled | Calls | 04/17/2023 | $4.93 | 07/17/2023 | $0.04 | $4.89 |

| SBUX | 04/28/2023 | $105.00 | – | Rolled | Calls | 03/27/2023 | $0.86 | 04/17/2023 | $4.00 | -$3.14 |

| SBUX | 03/24/2023 | $111.00 | – | Expired | Calls | 02/15/2023 | $2.16 | Expired | – | $2.16 |

| SBUX | 02/17/2023 | $110.00 | – | Rolled | Calls | 12/12/2022 | $2.46 | 02/15/2023 | $0.24 | $2.22 |

| SBUX | 12/16/2022 | $105.00 | – | Rolled | Calls | 11/04/2022 | $0.51 | 12/12/2022 | $0.53 | -$0.02 |

| SBUX | 03/18/2022 | $105.00 | – | Expired | Calls | 02/07/2022 | $0.58 | Expired | – | $0.58 |

| SBUX | 02/04/2022 | $101.00 | – | Assigned | Puts | 01/07/2022 | $1.25 | Assigned | – | $1.25 |

Along with the options “income” we’ve been able to collect, the shares have paid $4.73 in dividends during this time as well.

Given the share price has been weaker, that means it puts us in a situation where turning around and writing some more covered calls at this time may not be the most appealing choice.

This isn’t something new to this position, and it’s actually what we experienced shortly after taking the assignment of these shares in early 2022. The above table breaking down all of our trades reflects that. We were able to write some covered calls initially, but then it wasn’t until the end of 2022 that we were in a really great position to do so again. I also own SBUX as a core position in my portfolio, so I don’t mind being patient here.

Conclusion

Most consumer staples/packaged food companies are experiencing growth only through price increases as they see volume taking a hit. Seeing transaction growth (plus ticket growth in North America) in a consumer discretionary name such as SBUX, I think, really highlights the power of the Starbucks brand worldwide. People might not be buying their Oreo cookies or cans of Pepsi as frequently, but they are still not passing up their morning coffee. Given this strength, I believe that SBUX is looking attractively valued for a long-term investor around these levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SBUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Interested in more income ideas?

Check out Cash Builder Opportunities, where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investors’ income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.