Summary:

- Chinese rivals offering cheap coffee, Luckin and Cotti Coffee, are exploring opportunities in the US market, directly competing against Starbucks for market share.

- Luckin and Cotti Coffee will replicate their long-term price war strategy from China to the US, pressuring Starbucks’ customer traffic and margins.

- Starbucks appears overvalued (32x fwd P/E) as high hope has been built for a business turnaround in both the US and China upon the new CEO appointment.

- Consensus earnings estimates also seem overly optimistic without considering the risk of a price war. I rated Starbucks as a Strong Sell.

LordRunar/iStock Unreleased via Getty Images

Investment Thesis

While Brian Niccol, the new CEO of Starbucks (NASDAQ:SBUX), has been busy fixing the weak operation in the North American market as well as exploring local partners/joint ventures (JVs) in its China business, I believe he has not yet realized a bigger threat is on its way to hit Starbucks’ main operation in the US/Canada where 80%/95% of its revenue/operating profit were generating from. China rivals offering low-price coffee, Luckin Coffee and Cotti Coffee ranking #1 and #3 in store count in China, are both planning to expand in the US market.

I believe this will be a big setback to Brian’s effort in revitalizing the business operations in the US as Luckin and Cotti Coffee will replicate their success in China to the US by expanding through a low-price strategy. To compete with Starbucks, Cotti has been selling its drinks at a price range of $3-4 at its Hawaii and LA stores. Luckin Coffee, as suggested in recent news, plans to sell its drinks at the $2-3 price range, around 50% cheaper than Starbucks which is currently pricing its drinks at $5-6 for a drink. This leads us to believe a price war in the horizon in the US market.

For Starbucks, this is a huge threat. It either joins the price war at the expense of margin or stays premium pricing but sacrificing customer traffic. However, either option drives weaker earnings growth for Starbucks.

Considering valuation, Starbucks is expensive at 32x forward P/E, significantly higher than the sector median of 18x. On earnings, the street is forecasting a 6% yoy decline in EPS in FY25 and a 22% jump in earnings in FY26. I doubt if this is realistic assumptions given the looming price war in the US. Besides that current valuation should have baked in unrealistic expectation on business turnaround in the US and China upon the arrival of the new CEO (25% share price jump on the day of appointment announcement). Therefore, I rate Starbucks as a Strong Sell.

A Quick Look at Starbucks’ Operations in the US and China

US Business is Struggling

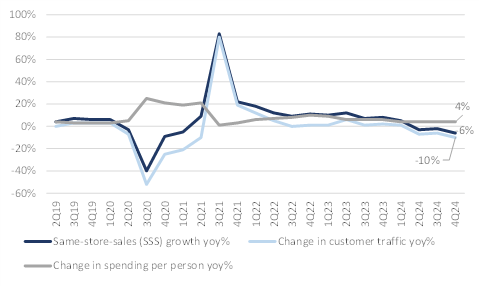

Starbucks is facing challenges in its US business with falling customer traffic. While decelerating economic growth and inflation could be reasons for the weak customer traffic, I believe customer dissatisfaction toward product quality, order accuracy, customer service, and wait times are also factors that keep customers away, especially the non-reward customers who tend to have low stickiness.

Starbucks’s SSS growth, customers traffic and per person spending trend in the US (Starbucks’ quarterly report)

We have found several surveys here showing dissatisfaction toward Starbucks has been rising. The American Customer Satisfaction Index (ACSI) rated 78/100 on Starbucks regarding customer satisfaction in 2021 which is below the industry average of 79 and key local peers like Dunkin and Panera Bread scored 80 and 81, respectively. Another survey conducted by Statista in 2019 suggested that Starbucks received an average complaint of 7.4 per 100 transactions, higher than the industry average of 6.2. In 2020, Hiver, a customer service solution provider, ranked Starbucks as the 6th most-complained brand on social media having over 5,000 complaints records in a month.

Starbucks’ new CEO has rolled out measures to tackle these issues by simplifying the menu, improving service speed, and enhancing staffing levels. However, a meaningful inflection has not yet been seen and I think reputation rebuilding is a lengthy process taking at least a few quarters to years.

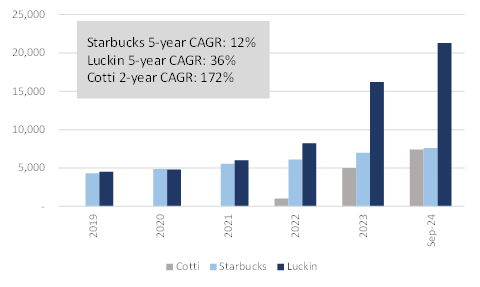

Starbucks is Even More Struggling in China

Starbucks has been facing challenges in China market with revenue declining due to intense competition from local competitors like Cotti Coffee and Luckin Coffee. Chinese rivals penetrate the market not only through self-operated stores but also franchise stores which speeds up the whole penetration process. Instead of profit, Chinese rivals prioritize scale and hence they expand through low-price strategy. As of 30 Sep 2024, Luckin Coffee was the largest coffee chain in China with 21,298 stores, followed by Starbucks 7,596 stores and Cotti Coffee 7,412.

Store count in China (Starbucks’ annual report, Luckin’s annual report and Cotti Coffee website)

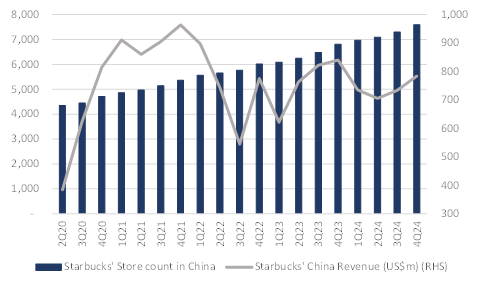

While competition is keen in China, Starbucks continues to add new stores. Just that revenue growth has stalled and It is quite alarming to see Starbucks revenue falling 11%, 14%, and 14% yoy in 2Q, 3Q, and 4Q24 suggesting market share loss to Chinese peers.

Starbucks’ sales in China stalled despite continued network expansion (Starbucks’ quarterly report)

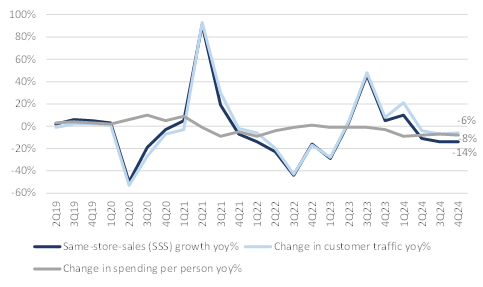

Besides the difference in store expansion strategy, their market positioning is also different. Starbucks’ target customers are white-collars and hence it emphasizes premium quality and quality of life. Therefore, its pricing is also at a premium to peers. Luckin and Cotti Coffee, on the contrary, target young professionals, student, and price-sensitive white-collars who look for products with high value for money. Their low-price strategy has successfully attracted a lot of customer eyeballs, especially under the current slow economy backdrop in China. Despite different target customers, Starbucks is still negatively impacted by Luckin and Cotti’s low-price strategy where Starbucks reported negative same-store-sales growth in customer traffic and spending per person in the last three quarters.

Starbucks’s SSS growth, customers traffic and per person spending trend (Starbucks’ quarterly report)

Recent News on divestment in China Business

Bloomberg reported that Starbucks is considering to sell a stake in its China business. Instead of exiting the China business, I tend to believe Starbucks is hoping to bring in a local JV partner who can help them turning around the China business. With a JV partner, Starbucks can re-accelerate its store expansion in China with less capital and compete against the aggressive expansion plan of Luckin and Cotti Coffee.

This is not the first time a foreign brand has divested shares of its Chinese unit. Yum Brands, the parent company of Yum China operating KFC and Pizza Hut in China, announced a spin-off and separate listing of Yum China in Oct 2015 in view of keen competition and tough operating environment. As part of the deal, Yum Brands sold $460m worth of shares to a Chinese investment firm Primavera Capital and Ant Financial with proceeds being used for store expansion and menu revamp.

Looming Risk of a Price War in the US with Chinese Rivals Entering

I believe the share price jump since Aug 2024 was a reflection of investors’ optimism on Starbucks’ US business given the new CEO appointment. However, I don’t share the optimistic view as I see a looming risk of a price war in the US market as low-price Chinese coffee operators, Luckin and Cotti Coffee, are getting in.

Luckin Coffee’s CEO, Guo Jinyi, has said during its 3Q24 result call “Luckin Coffee is actively look for opportunities in the US and other markets. We will closely monitor the progress and promptly communicate with the market.” What’s worth highlighting is that Luckin has invested US$120m earlier this year to build a coffee roasting plant (30kt capacity) in Jiangsu Kunshan. This plant is located close to ports in Shanghai, where I believe it is strategically built for export and to support Luckin’s overseas expansion plans.

On pricing, it is reported that Luckin Coffee plans to replicate its success in China by offering low-priced drink at US$2-3, substantially lower than that of $4-6 in Starbucks. Cotti Coffee launched its first store in Hawaii in April 2024 and subsequently Los Angeles and other US cities. Cotti Coffee continued its low-price strategy with Americano priced at $2.99 and other coffees and drinks all priced at $4.29. I think Luckin’s aggressive pricing strategy, even lower than Cotti coffee, will likely ignite a round of price war in the US as it enters the market in 2025.

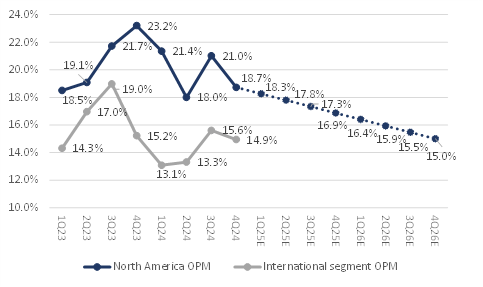

To Starbucks, this would be a very difficult situation. While I don’t expect Starbucks to lower the price of its menu in the US given its premium positioning, it will have to offer more promotional discounts/coupons to retain reward/non-reward customers resulting in low margins and earnings. Starbucks’ operating profit margin in 4Q24 already plummeted to 18.7% in 4Q24 from 23.2% a year earlier. However, it was still the highest vs 14.9% in the rest of the world.

If I assume operating profit margin in the North American market gradually converges to 15% in the next two years and holding other factors such as customer traffic and costs constant, I estimate 11% yoy decline in Starbucks’ operating profit each year in FY25 and FY26. Recall that the market is forecasting Starbucks earnings to decline 6% in FY25 and increase 22% in FY26. In reality, I think the situation could be worse as customer traffic is likely to fall as less-sticky/price-sensitive customers would be attracted to new brands offering discounted coffee.

Starbucks’ OPM in N. America vs International and projections (Starbucks’ quarterly report and Analyst projections)

Valuation

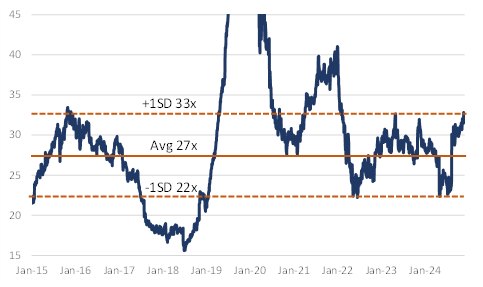

Starbucks appears expensive with a forward P/E ratio of 32.5x, significantly higher than the sector median of 18x. From its own P/E band chart, it has already traded up to 1SD above mean, likely a reflection of investors’ expectation of a business turnaround in the US and China markets. However, I am not as convinced as I believe Starbucks’ US operations will be under tremendous pressure beginning in 2025 as Chinese rivals, Luckin Coffee and Cotti Coffee, kicking off their sales network buildout in the US. Chinese rivals are well-known as low-price competitors and willing to burn cash for market share, Starbucks’ margins will likely fall and drag on overall earnings. Given the looming risk of price war in the US market, I think consensus earnings, down 6% in FY25 and up 22% in FY26, is overly optimistic warranting a Sell rating on Starbucks.

Starbucks’ forward P/E chart (Investing.com and Seeking Alpha consensus earnings estimates)

Conclusion

Despite the new CEO’s effort in trying to turn around the US business, I expect Starbucks to face tremendous pressure on margins, customer traffic, and ticket size when Chinese rivals, Luckin and Cotti Coffee, start launching stores in the US in 2025. Similar to what they did in China, Luckin and Cotti Coffee adopted a long-term price war strategy, and this will be replicated to the US market negatively impacting Starbucks’ profitability in the next couple of years. Starbucks’ valuation is not cheap at 32.5x, big premium over the sector median of 18x. With the rising competition and looming risk of a price war in the US, I believe Starbucks is overvalued. Rated Strong Sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.