Summary:

- Starbucks experienced a strong sell-off after missing earnings expectations, but long term, dividend growth investors should consider buying shares.

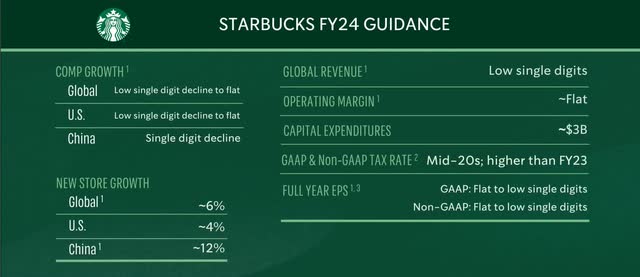

- The company’s guidance was lowered due to challenging economic conditions and slower-than-expected growth in China.

- Despite the challenges, SBUX continues to expand, entering into two new markets. Active Rewards members grew 6% YoY.

- With interest rates remaining higher for longer, this will continue to weigh on consumer financials going forward.

- I have a price target of $92, roughly 23% upside from the current price of $75.

bedo/iStock Editorial via Getty Images

Introduction

With Starbucks (NASDAQ:SBUX) recent earnings not impressing investors or Mr. Market with a miss on both the top and bottom lines, the coffee giant experienced a strong sell-off with the stock down over 18% at the time of writing. The company is a core holding for me and I added additional shares on the recent dip, taking advantage of the recent sale opportunity.

If you loved SBUX at $90 or $80, then you should be buying shares, especially if you’re a long-term investor like myself. In my opinion, SBUX is a buy under $90 a share and a strong buy below $80 where it currently trades. In this article, I discuss the company’s recent earnings, what caused the recent sell-off, and why now is the perfect buying opportunity if you’re a long-term dividend growth investor.

Previous Thesis

During my last article, I rated the stock a buy when they were trading at roughly $95 a share: Starbucks Q1: A Dividend Grower Every Investor Should Own. Fast-forward to today and I still feel the same despite the sharp drop in share price.

In it, I touched on the company’s Q1 earnings that saw EPS of $0.90 and revenue of $9.4 billion, a miss on both compared to analysts’ estimates. Despite this, the stock’s share price actually rose before retracting slightly, unlike the sharp drop after this quarter’s earnings.

I also discussed the company’s targeted 50% payout ratio, which they have been working toward in recent years. I also had a price target of $110 a share for the company, but seeing by their recent earnings, this may be out of the realm of possibility in the medium term. Still, the company remains a great buy for long-term investors, and I discuss later in the article why you should be buying.

Too Enthusiastic

Although the company missed on both the top & bottom line last quarter as well, during Q2 earnings reported on April 30th, things were different. In a challenging economic environment like now, many companies are seeing downward pressures placed on their financials, especially those that rely on loyal customers like Starbucks.

Before management expected growth of 7% to 10% for the full-year, which, I thought, was exceptional considering the challenges many companies have faced. Even for a company of SBUX’s caliber who has a very loyal customer base, achieving this level of growth was a little optimistic, I felt.

Still, I thought the company could achieve at least growth at least on the lower to middle end of that guidance, somewhere in the 7% to 8% range. But during the recent quarter, management slashed guidance, now expecting this to be in the low, single digits.

For those who may not know, missing on earnings is something the market expects, even for larger, globally recognized restaurant stocks like Starbucks and McDonald’s (MCD), who also missed on analysts’ estimates. But slashing guidance is something that typically causes an overreaction, negatively impacting the share price in the process.

Reality Check

Although the coffee behemoth has strong pricing power and has been raising prices to keep up with inflation, it’s apparent that the high-interest rate environment is placing downward pressure on consumer financials. And this has affected SBUX and will likely continue in the near future, with interest remaining at current levels for the 6th straight meeting.

Comparable store sales were down 4% year-over-year and management expects this to be flat vs. the 4-6% range before. Additionally, global store growth is expected to come in at 6% vs. 7% in prior guidance.

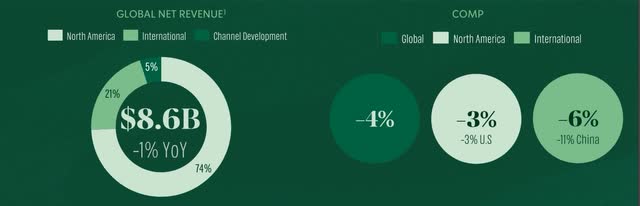

Operating margins narrowed while international margins declined, likely due to slower than expected growth in China. Global operating margins were 12.8% and North America saw negative growth of 3%.

Furthermore, comparable store sales growth was negative 11% in the company’s second-largest market, China. Negative growth and headwinds caused a huge miss on EPS by $0.12, with this coming in at just $0.68 a share. This was more than a 24% decline from the prior quarter.

Revenue of $8.6 billion also declined from the prior quarter’s $9.4 billion. Both declined year-over-year as well from $0.74 & $8.72 billion respectively. So, not a good start to the 2nd quarter. A slight decline on a sequential basis is something I don’t worry too much about, but looking out on an annual basis, I do like to see some growth, even if it’s minimal. But as headwinds dissipate, I expect the company to get back to normal operations in the next 6-12 months.

Continued Expansion

In lieu of all the negative talk surrounding the company and them cutting their guidance, they did manage to continue on their path toward growth, opening an additional 364 stores, bringing their total to 38,591. On top of that, the company recently announced their expansion into two new markets, Latin America and the Caribbean, expected by the end of the year.

And this is part of their Triple Shot Reinvention Plan announced last year. The plan is to continue on the path to growth, expanding to 55,000 stores in the next 6 years. Although there are emerging competitors like Dutch Bros (BROS) and Dunkin’ Donuts, according to a recently published article, Starbucks remains a key player and favorite amongst consumers as a preferred meet-up spot.

Furthermore, they remain the #1 choice for away from home coffee for Chinese consumers, according to management during the recent earnings call. Moreover, I touched on this in a prior article on Starbucks, but the coffee giant has a lot of room for growth in India as well as other countries.

Rewards Members Are Still Growing

Considering tighter financial conditions for consumers because of higher for longer interest rates, Starbucks’ Active Rewards members are still growing. Year-over-year, this increased roughly 6% from 30.8 million members to nearly 33 million. And these play a key part in the company’s financials and growth, and as economic conditions become more favorable in the foreseeable future, rewards members will likely see further growth.

Furthermore, the company also tested a pilot program, which is expected to fill the unmet demand gap during store closure hours. During the test, SBUX doubled the business and are aggressively pursuing options to build a $2 billion dollar business in the next several years.

I think this is important as this will likely capture late night workers and employees as they look to have their coffee fix while working. And to get Starbucks delivered to your workplace, or even your home for that first cup of joe will likely resonate well with customers, positively impacting their financials.

Risks To Thesis

Despite my optimism about the company, seeing by their recent quarter, they will continue to face headwinds as long as interest rates remain higher. The Fed kept rates steady for the sixth straight meeting, but was dovish as they anticipate no further raises.

These will continue to weigh on consumer financials and give them less disposable income to buy luxury items like Starbucks products. China will also continue to be a headwind as the country is experiencing a slower than expected recovery.

Valuation

With the sharp drop in share price, this put SBUX’s dividend yield over 3%, higher than the 5-year average of less than 1.95% and the sector median’s 2.0%. For those that follow me, I typically write about stocks I own or would like to own, and I recently purchased additional shares below $80, and I am looking to buy more if it drops below $70. Which I wouldn’t be surprised to see the company hit in the coming weeks with all the negative sentiment and analysts price target declines.

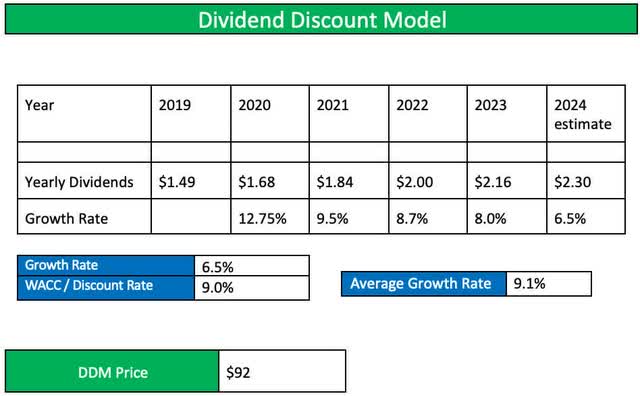

Using the Dividend Discount Model, I have a price target of $92 for the stock, much lower than the $111 I had previously. Still, this gives investors more than 23% upside from the current price. This is slightly lower than Wall Street’s $94.47.

To manage expectations, I used a lower growth rate of 6.5% and WACC of 9%, also lower than the 12% previously. Although the company is known for their high growth, looking at how their dividend growth has slowed the last 5 years, the company could see lower growth, at least for the foreseeable future.

Bottom Line

Despite their miss on the top & bottom lines and lowered guidance, I still consider Starbucks a high-quality, dividend growth company trading at a very good price at the moment. This gives long-term investors an opportunity to pick up shares in a company that normally trades at a high P/E due to its pricing power and globally recognized name.

Sifting through the negative sentiment, the coffee giant continues to expand to grow the business, entering into two new markets, and additional store openings during the quarter. Furthermore, despite tighter financial conditions for consumers, Active Rewards members saw growth of roughly 7% year-over-year. With the sharp drop in price, SBUX is now in strong buy territory, warranting an upgrade from buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SBUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.