Summary:

- SBUX jumped 24%+ the day after I tripled my position in it. While clearly that was part luck, it also stems from consistently following my YARP stock selection process.

- There are plenty of examples of “bad luck” too, but this one event reminds us of the importance of portfolio management and risk assessment, not just “stock picking.”

- I discuss SBUX from several angles: what led me to buy it at first, then add to it, and my outlook and process around what I do with it next.

JohnFScott

If I’ve said it once, I’ve said it a thousand times. Seeking Alpha is fully stocked with fundamental analysts who provide subscribers with outstanding fundamental research on stocks of all shapes and sizes. I am not one of them.

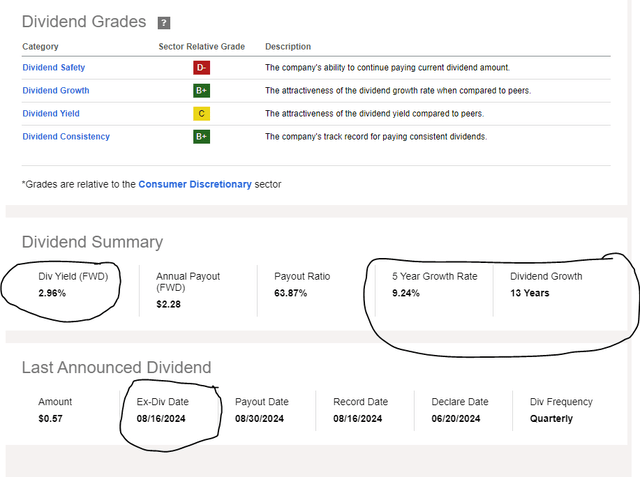

Oh, I do cover Starbucks (NASDAQ:SBUX) and own it personally, as part of my YARP™ (Yield At a Reasonable Price) portfolio I run for my family and some subscribers. However, that entire process relies 90%+ on technical and quantitative analysis. And, on the timing of ex-dividend dates and earnings announcement dates. The end goal is straightforward: earn as much return as I can, including as much dividend income as I can, with low standard deviation. In other words, don’t lose big along the way.

The stock market is not the neighborhood it used to be. As such, I’ve adapted my approach to analyzing stocks, whereby I use Seeking Alpha quant ratings, dividend grades and other outside sources as my “analyst” function. That allows me to be what I was professional for 30+ years: a portfolio manager, technician, and above all else, a risk manager. And the process I developed, while it has its warts like any other, sometimes drops opportunities into my lap.

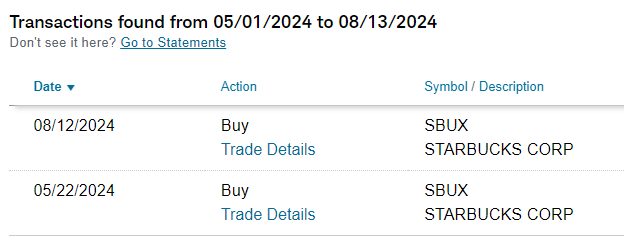

Tripling my position in SBUX on Monday afternoon, only to see it pop more than 24% the following day (trade dates with execution prices underneath shown below), might be the luckiest thing to happen to my portfolio, ever. Or was it? After all, it is hard to be an investor for 30+ years and not have the opposite occur, as it has for me multiple times.

Rob Isbitts/brokerage account (YARP stock portfolio) Rob Isbitts/brokerage account (YARP stock portfolio)

In the case of SBUX, it was simply moving a 1% position to a 3% position in my YARP portfolio, whose process I’ve written about here a few times, and aim to continue to. That includes the stocks I evaluate and decide not to own, as was the case with the last 2 I wrote about. It is just a single stock in a broader portfolio. And frankly, since I tactically float the stock positions between 1% and 5% at any time, once they enter the portfolio, and since SBUX goes ex-dividend this Friday, I could have allowed myself to up it to the full 5% weighting. I still could, but my point is that, since my stock weightings are a direct result of my ongoing technical/quantitative assessment of all 30-40 stocks in the portfolio relative to each other, and to my macro assessment of market conditions, this was a “classic” case of what prompts me to move it to 3%, not keep it at 1% or go straight to 5%, as I did with four other stocks on Monday.

Oh, did I mention that while I was aware that the market was pushing SBUX to get its proverbial behind in gear, and that not one, but two activist investors were breathing down the board’s neck, none of this factored into my decision to up the position. And no, none of this is intended to be a brag. That’s reflected in the title of this article, a quote originally attributed to Lefty Gomez, an all-star pitcher with the New York Yankees back in the 1930s. He had Lou Gehrig and other Hall of Fame hitters to help him be “lucky,” but he was pretty good, too.

In my case, while this is just one of many trades I’ve done and will do this year in the YARP dividend stock portfolio, this example with SBUX is a reminder of what is, to me, the part about investing that too many folks simply skip over. They focus on what to buy and hold, which is important. But they spend much less time thinking about each position as part of a broader portfolio, managing that portfolio, and adjusting “position sizes” as frequently or seldom as fits their own goals. In my case, I don’t trust “the market” with my retirement assets. Instead, I use the market as a tool to get what I want out of those assets. That’s what led me to do what I did with SBUX and have and will do with other stocks, for better or worse, many times over.

But the bottom line is this: it is an investment process, rather than “stock picks,” that drives decisions. And sometimes, it leads to happy outcomes, like this one did.

Where an investment process leads to a “lucky” buy

Let’s go back for a moment to SBUX itself, and the announcement that drove the stock price higher on Tuesday. Two words: Brian Niccol. In what may seem like a blockbuster trade in a major sport (except that one team gets nothing), Mr. Niccol, who until the announcement had been the chairman and CEO of Chipotle Mexican Grill (CMG), and prior to that mastered the turnaround at Yum Brands, became the head person at SBUX starting next month.

This is one of those times (and there are many) where I question whether fundamental analysis is as applicable in modern markets as it was when my career was measured in size like a “tall” coffee at SBUX, versus now when it more like a “Venti” (30 years). For the record, I’m a huge fan of Starbucks, and thank them for helping me survive a recent week in Europe, since iced coffee is hard to find there versus the United States. But I digress.

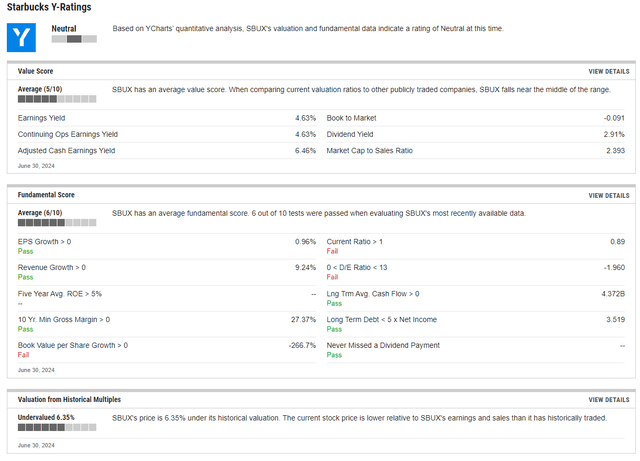

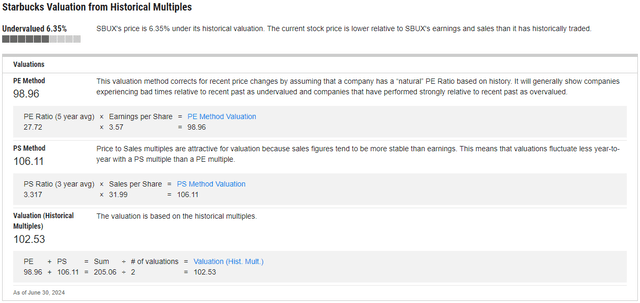

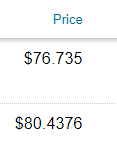

Niccol has had the magic touch, but how do we properly value the impact, before anything has occurred? I don’t think we can. But that’s why I am an ardent chartist. I’ll examine SBUX ratings and grades on Seeking Alpha in a moment, but here is one analysis of the stock’s valuation from a different source, YCharts, which is as of June 30, 2024.

The stock closed around $78 that day, and so according to this one source, it was worth $102 a share. Monday it closed at $77, and by Tuesday’s close, it was at $96, so about 6% shy of that valuation. Here’s an updated graph of that quantitative system’s fair value on historical multiples, versus the actual stock price of SBUX.

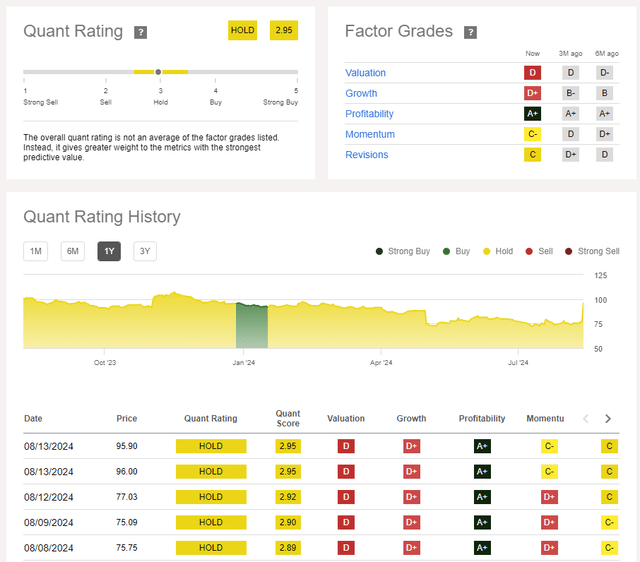

As we see above, it is rare that the market prices a stock around where it is worth. Now, to the Seeking Alpha version of this. I normally just show the Factor Grades box, but given the extreme move in the stock price, I wanted to see some more history in that grading system. Not much changed in the 1-day, 24% leap in price, other than the momentum grade. In other words, from a quant standpoint, there were few, if any clues, that SBUX would be capable of spiking as it did, no matter what the news.

Oh, but wait, we haven’t looked at the price chart yet. Because, as noted earlier, I was not looking for a “homerun” in this or any other stock. But I was looking to convince myself that I could qualify for Friday’s quarterly dividend, owning more shares than I did when I woke up on Monday of this week.

YARP Dividend Ratio analysis for SBUX

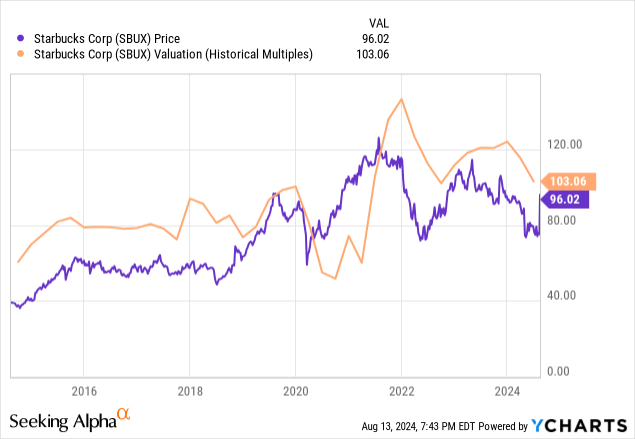

Perhaps most importantly, the reason SBUX caught my attention, apart from the dividend ex-date later this week, is this chart below. As I’ve described in multiple articles for Seeking Alpha this year, my YARP method involves looking at the past 7 years of dividend history for a stock (or ETF) and determining what percentile the current 12-month trailing yield lies in currently.

As you can see above, for SBUX, a 3% yield as about top-of-range historically. Think of it like buying a stock at a 11x trailing P/E ratio when its historical range is 10-20x. When a stock’s yield is near the upper end of its range, AND starting to tick downward, that’s the first clue to me.

In this case, the situation was very fresh, too fresh really. But the stock price was just starting to nudge up enough for me to say, “OK, 3% works, but don’t rush into a 5% weighting just yet.” Well, on a pure YARP ratio basis, SBUX still looks pretty good, but that one-day spike in price had the opposite impact on the yield. Bottom line on this part of my regimen: much of the near-term gains just happened. But the longer we look out, and the more time the management change and continued urging by the active investors, the more clues we’ll get. Again, this is why I firmly believe in first getting the stocks I want into the portfolio “basket” and then being very flexible on how much to own of each one, at any point in time.

As is often the case, price knows!

This is just one of 12 price time frames I use. The very short-term ones are for when I already decided I am buying or selling something, and want to try to get the best execution price I can that day. The longer-term charts (weekly, monthly) are more about whether I even want to consider including a stock in my portfolio, knowing that it might have already run out of gas, long-term.

SBUX made the grade for me a while back in May, as noted by my initial purchase transaction shown above. It got into my YARP stock portfolio at the base level: a 1% position. So I didn’t even qualify for the last dividend on May 16. But I had my sights set on this one, along with several others coming up this week. And as noted earlier, SBUX was the only one of my position increases yesterday that didn’t go to 5%. I raised it from 1% to 3%.

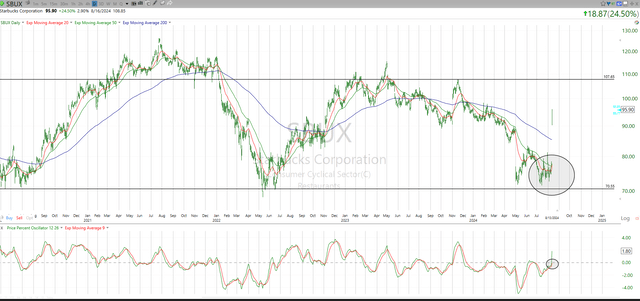

Because while I did see that the stock price was right near the bottom of a long-term range between roughly $70 and $110, and it was approaching the point where its Price Percent Oscillator (PPO) momentum indicator (my favorite such measure, rather than the more popular MACD or RSI), was poised to cross into positive territory (i.e. above 0.00), it was no “slam dunk” (not a Dunkin’ Donuts reference!).

TC2000 (Rob Isbitts/Sungarden Investment Publishing)

I point out all of this technical detail to make the point that I often make, that a stock “rating” is fairly useless to me. SBUX had cleared my filtering/quantitative/business profile phase of stock analysis back in May. I was happy to own it at a 1% position nearly any time. But that’s like making the sport team but having no idea if you will get much playing time.

3 words: process, process, process!

This technical setup was enough for me to go to 3%, but no further. I’m glad I did, of course. But this is all about operating a portfolio with a PROCESS. As noted earlier, SBUX’s historical profitability and sustained dividend growth are attractions to me. However, the safety of the dividend, and the ability for Niccol and his team to do for SBUX what he accomplished at Chipotle (which is the market’s impulse reaction, that he will), is far from a foregone conclusion.

But my YARP stock selection process had to reach this point as of Monday afternoon:

1. Stock is in the portfolio, for reasons noted above

2. It is only a 1% holding, so room to increase to 2%, 3%, 4% or 5%

3. Ex date approaching

4. Stock price stable, and showing hints of moving higher

5. As of Monday, I was down about 4% from cost, so close enough to not feel like I was “chasing” the dividend if I edged up the weighting. YARP is not a “dividend capture strategy” per se.

6. However, when price is your key driver, a flattish chart and approaching ex-dividend date is enough to get me to 3%. But not to 5%.

Conclusions / What’s next?

For more in-depth analysis of the implications of SBUX’s big personnel move…see any one of the many outstanding fellow analysts on Seeking Alpha that cover the stock from a “forward-looking fundamental” standpoint. In other words, anyone who covers the stock here, except for me!

In my case, I’m thrilled with how this turned out, but I’m going right back to the last few months of activity in my YARP stock portfolio to find at least one example of where I followed the process, but the results were not so great. I am sure I’ll find plenty!

As for the upcoming ex-date, the price cushion I just received (thanks, guys!) gives me the luxury (barring a monster pullback in the stock before Thursday afternoon) of upping the position to 5%, essentially swapping some of this windfall profit for dividend income, and going from there. And to be clear, I am still concerned about the ability of SBUX to turn things around.

So with earnings due around November 1, right before the US Presidential Election, I don’t know how much SBUX I’ll own, and when. Or if I will conclude before, then that there is an opportunity to “upgrade” to another name, and relegate SBUX to the sort of “side basket” of stocks I don’t own but keep handy as a “deep bench” to follow.

So, what’s my rating on SBUX? In the parlance of this platform, it’s a hold. But as my regular followers know, that’s just a word to me, a tactical investor just looking to make money over time, consistently, and not lose big along the way.

YARP is my stock selection and rotation process, one I built several years ago and continue to try to enhance every day. More than any point made in this article, I just hope that anyone reading this has or will develop a process they have as much comfort with and confidence in as I do with mine. Sometimes you get lucky, but having a solid, consistent investment process increases the odds that luck will find you.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SBUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.