Summary:

- Starbucks, the world’s leading retailer of high-quality, specialty coffee products, is now an $83 billion (by market cap) global coffee titan with slightly more than 38,000 coffeeshop stores across 86 global markets by the end of FY 2023.

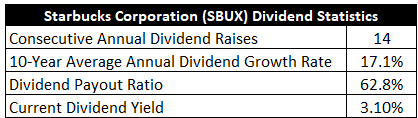

- Starbucks has increased its dividend for 14 consecutive years with a 10-year dividend growth rate of 17.1%.

- Starbucks moved its revenue from $16.4 billion in FY 2014 to $36 billion in FY 2023, a compound annual growth rate of 9.1%.

- It’s worth noting that Starbucks has been prolific at share buybacks, and the outstanding share count has been reduced by approximately 25% over the last decade.

jetcityimage

Starbucks Corp. (NASDAQ:SBUX) is the world’s leading retailer of high-quality, specialty coffee products. Founded in 1971, Starbucks is now an $83 billion (by market cap) global coffee titan that employs approximately 380,000 people. Starbucks finished FY 2023 with slightly more than 38,000 coffeeshop stores across 86 global markets (52% of which are company-owned stores).

The company operates across three segments: North America, 74% of FY 2023 revenue; International, 21%; and Channel Development, 5%. The US is the company’s largest single market, comprising nearly half of the global store footprint. While Starbucks does sell foodservice products and ready-to-serve drinks through its Channel Development segment, the vast majority of the company’s revenue is generated by selling coffee and food products through company-owned and licensed coffeeshop stores across the world.

Starbucks controls one of the world’s most popular and recognizable brands. When one thinks about going to a coffeeshop and/or buying coffee, it’s almost certainly the first brand that comes to mind. This company has built a rare one-two punch, offering both a high-level product and high-level experience.

Many companies have a hard time getting products or experiences right. Doing both… simultaneously? Extremely difficult. And yet, Starbucks has done this. How? Well, it pioneered a variety of specialty coffee beverages which have elevated and popularized the entire coffee scene. And it offers these hand-crafted beverages by trained baristas in coffee shops that are designed to provide a consistent, social, and relaxed experience.

In doing all of this, Starbucks has built a coffeeshop empire across the world. However, it’s also been a bit of a victim of its own success, as this empire has invited envy and given rise to motivated competition in pretty much every market. Still, no company has the scale and brand power of Starbucks, and there’s a huge gap between Starbucks and its closest competition.

Starbucks may not be growing as fast as it used to, but its size and proven success has turned it into a world-class operation. It’s a blue chip option for investors interested in a serviceable long-term investment idea that doesn’t feature the kind of uncertainty that some upstart might have. And despite the slower growth rate, Starbucks has still been putting up great revenue, profit, and dividend growth.

Dividend Growth, Growth Rate, Payout Ratio and Yield

To that last point, Starbucks has increased its dividend for 14 consecutive years. The 10-year dividend growth rate of 17.1% shows how generous Starbucks has been with its dividend raises, although more recent dividend increases have slowed into a high single-digit range. The company has slowed as its matured, which is unsurprising, and idiosyncratic challenges over the last few years have also weighed on growth, but Starbucks is still mostly putting up world-class numbers.

Along with this relatively high rate of dividend growth, the stock offers an attractive 3.1% yield. This yield, which easily beats the market, is 120 basis points higher than its own five-year average, and it’s the highest yield this stock has ever offered in a normal environment (i.e., outside of some kind of general panic that crashes the market).

Starbucks almost never has a 3%+ yield attached to its stock, so this is pretty remarkable. That said, the slowing of the business would justify, and perhaps even require, the market to adjust the stock’s yield higher in order to compensate for the lower growth.

The dividend is covered by a payout ratio of 62.8% – not uncomfortably high, despite the business still not fully firing on all cylinders. Here’s the rub: If Starbucks can come close to its historical growth over the next several years, investors buying now are able to snatch a very appealing yield and get that strong growth. And if the growth doesn’t fully materialize, at least the higher yield is locked in. It could be a very compelling setup, which is why I’m covering this name today.

Revenue and Earnings Growth

As compelling as these dividend metrics may be, though, they’re mostly looking backward. But investors must always be looking ahead, as the capital of today gets risked for the rewards of tomorrow. That’s why I’ll now build out a forward-looking growth trajectory for the business, which will be of use when the time comes to estimate intrinsic value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth. I’ll then reveal a professional prognostication for near-term profit growth. Blending the proven past with a future forecast in this manner should give us the information we need to make a reasonable judgment call on where the business could be going from here.

Starbucks moved its revenue from $16.4 billion in FY 2014 to $36 billion in FY 2023. That’s a compound annual growth rate of 9.1%. Very solid. I’m usually looking for mid single-digit (or better) top-line growth from a mature business like this.

Starbucks was already a large and fairly mature business 10 years ago, yet it still managed to put up high single-digit top-line growth. Meanwhile, the company grew its earnings per share from $1.35 to $3.58 over this 10-year period, which is a CAGR of 11.5%.

Is this the highest growth I’ve ever seen? Of course not. But this is very respectable, even slightly impressive, growth out of such a large enterprise. Moreover, I think, in some ways, Starbucks has actually been “underearning” over the last five years. EPS is effectively flat going back to FY 2018.

The pandemic walloped this business, and a recent transition from a founder CEO to an outsider CEO has also introduced questions around vision and leadership. In a different world – one where none of this happened – Starbucks would probably be sporting mid-teens EPS growth, but low-teens growth is still quite nice.

It’s worth noting that Starbucks has been prolific at share buybacks, and the outstanding share count has been reduced by approximately 25% over the last decade. The buyback machine has definitely helped to spur some excess bottom-line growth.

Looking forward, CFRA anticipates that Starbucks will compound its EPS at an annual rate of 16% over the next three years. That would be more in line with the “hypothetical” growth rate I posed above, but Starbucks will need to start operating at 100% in order to do this.

Now, the company’s most recent quarter – Q2 FY 2024 – showed a modest YOY decline in revenue and a 14% decrease in GAAP EPS. So Starbucks is digging itself a hole that’ll it have to get out of.

Inflation, which has pressured pricing on coffee products higher, is starting to bite, likely causing consumers to pull back on discretionary coffeeshop purchases. Anecdotal evidence indicates that store experiences aren’t as enjoyable as before.

Also, competition is more fierce than ever. China, one of the company’s largest and most important markets, has had many economic problems over the last several years. And the company’s new CEO, Laxman Narasimhan, has seemingly been unable to properly communicate a cohesive strategy. Lots of challenges for sure. Still, this is a world-class QSR business with unrivaled brand recognition and loyalty, and the company’s long-term track record is excellent.

Starbucks continues to expand and open new stores (364 new net stores last quarter), meeting rising global demand for coffee. I see nothing about Starbucks that is fundamentally and permanently damaged; to the contrary, Starbucks has an enviable coffeeshop empire (one which is still expanding) that its competitors would love to have (which is why they’re competing in the first place).

If Starbucks can simply get back to basics and focus on providing great products in a great environment with great service, all while also offering a reasonable value proposition to customers, the company will do extremely well. Customers still appear to love Starbucks, as evidenced by the 32.8 million US Starbucks Rewards members (up 6% YOY for the most recent quarter).

Boiling things down, I think a near-term 16% EPS CAGR is a lofty and unrealistic expectation. But Starbucks doesn’t really need to knock it out of the park.

A more pedestrian low double-digit EPS growth rate, more in line with what’s transpired over the last decade, would be enough to power high single-digit (or better) dividend growth over the next few years. With a 3%+ yield, that’s setting up investors for an easy 10%+ annualized total return profile – even on a Starbucks that isn’t at full speed.

However, if Starbucks does something closer to CFRA’s projection, one could be looking at spectacular returns over the next few years, as there’d quite possibly be a lot of upside from multiple expansion on top of the growth and yield. From my perspective, it’s hard to do poorly with an investment in Starbucks, from this starting point, over the next 10 years.

Financial Position

Moving over to the balance sheet, Starbucks has a good financial position. Negative shareholders’ equity means there is no long-term debt/equity ratio. The interest coverage ratio is over 10, which is fine, although I’d prefer to see something a lot higher here. On the other hand, the long-term debt load of ~$15.5 billion is not overly substantial relative to the $80+ billion market cap.

I’m not in love with the balance sheet, but it’s far from the worst out there. Profitability, though, is outstanding. Return on equity was coming in at over 50% before equity went negative, and net margin has averaged 10.6% over the last five years – even after getting dinged during the pandemic.

Starbucks has long generated very high returns on capital, and ROIC has historically been at well over 30%. While it’s not quite as good as it once was, Starbucks remains a world-class enterprise. And the company does benefit from durable competitive advantages, including brand recognition, pricing power, economies of scale, a global distribution network, and a competent omnichannel strategy. Of course, there are risks to consider.

Regulation, litigation, and competition are omnipresent risks in every industry. While I see regulation and litigation as somewhat muted compared to many other business models, the QSR space is notoriously competitive and only becoming more so.

Input costs are volatile and rising, especially in terms of labor. Speaking of labor, there’s been growing unionization efforts across stores. The new CEO of Starbucks is an outsider, and his leadership prowess thus far has not been impressive.

Being a global company, Starbucks is exposed to macroeconomic issues and broad economic slowdowns. Inflation has caused the cost of the company’s products to become less affordable to customers, reducing broad demand.

China, one of the company’s key markets, is still suffering from an array of economic challenges, and this market is also difficult for Starbucks to compete in. The balance sheet has weakened over the last decade. Starbucks may also be starting to become a victim of its own success, as its large size (i.e., the law of large numbers) could be hurting relative growth.

There are definitely some risks to seriously consider, but the market positioning and quality of the business should also be considered. Another aspect worth considering is the valuation, which looks appealing after the stock’s recent near-20% drop in price.

Valuation

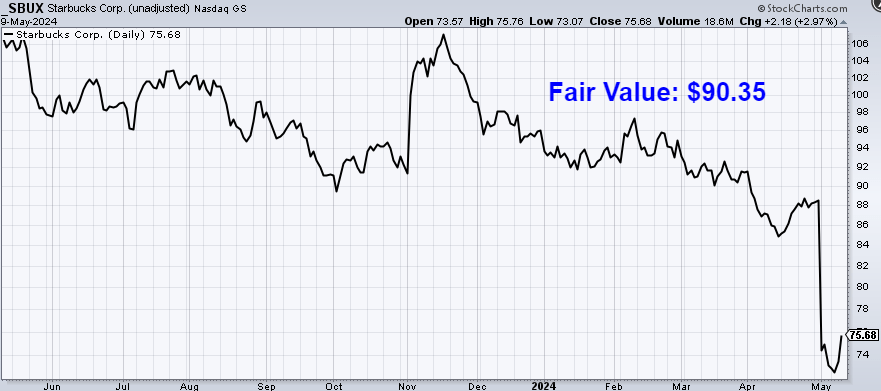

The stock is now trading hands for a P/E ratio of 20.2. Two things about this number. First, since Starbucks is arguably “underearning”, it’s even better than it looks. Second, even with that caveat, it’s still far lower than its own five-year average of 33.9 (although this average is skewed by the pandemic).

The cash flow multiple of 11.3 is nearly half of its own five-year average of 19.9. And the yield, as noted earlier, is significantly higher than its own recent historical average. So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis. I factored in a 10% discount rate and a long-term dividend growth rate of 7.5%. That growth rate is half a percentage point lower than I’ve used in the past for Starbucks. I’ve dialed back the expectations just a skosh, as I do think inflation, a barrage of competition, and the company’s large size conspire to inhibit growth just a bit. Starbucks is still a great business. I just don’t think it’ll grow quite as fast as it used to, but it doesn’t need to – multiple compression has driven up the yield and compensated for that.

The DDM analysis gives me a fair value of $98.04. The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide. The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth. It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks. Even with a more conservative take on the growth and valuation, the recent drop looks overdone to me. But we’ll now compare that valuation with where two professional stock analysis firms have come out at. This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system. 1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value. Morningstar rates SBUX as a 4-star stock, with a fair value estimate of $96.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line. They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold. CFRA rates SBUX as a 3-star “hold”, with a 12-month target price of $77.00.

I came out very close to where Morningstar is at. Averaging the three numbers out gives us a final valuation of $90.35, which would indicate the stock is possibly 19% undervalued.

Bottom line: Starbucks Corp. has built up an enviable coffeeshop empire that, despite some chinks in the armor, continues to churn out fantastic results and high returns on capital. If the company can do the simple things right and provide great products, experiences, and service, shareholders stand to do extremely well over the coming years. With a market-beating yield, double-digit dividend growth, a reasonable payout ratio, almost 15 consecutive years of dividend increases, and the potential that shares are 19% undervalued, long-term dividend growth investors looking for a simple-to-understand QSR investment could have a prime candidate staring right at them.

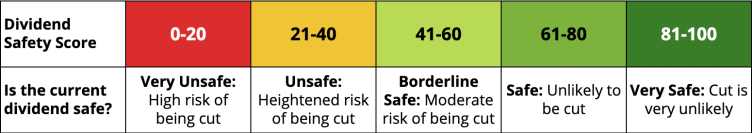

Note from D&I: How safe is SBUX’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 60. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, SBUX’s dividend appears Borderline Safe with a moderate risk of being cut.

Disclosure: I’m long SBUX.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.