Summary:

- Starbucks faces significant challenges, including declining revenues, competitive pressures in China, and a weakened value proposition, necessitating a turnaround under new CEO Brian Niccol.

- Niccol, with a stellar track record at Taco Bell and Chipotle, is expected to implement strategic changes but faces a tougher circumstance at Starbucks.

- The company’s growth potential is limited by its already extensive global footprint and competitive market, making significant revenue and EPS growth challenging.

- Despite Niccol’s proven success, SBUX’s current valuation leaves little room for upside, leading to a ‘Hold’ rating until shares become more attractively priced.

garett_mosher

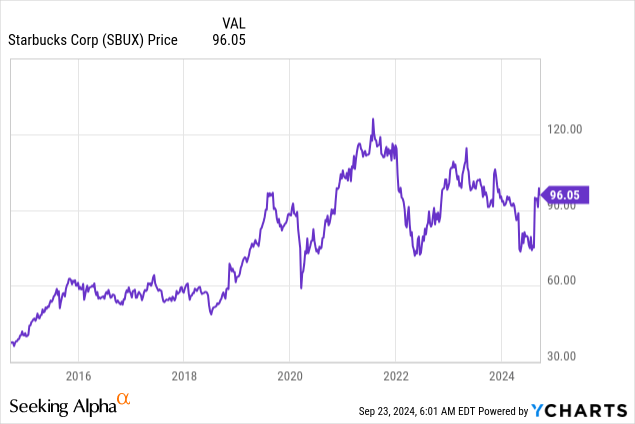

In quite a surprising turn of events, Starbucks (NASDAQ:SBUX) turned from a fast growing and highly profitable global brand to a company in a dire need of a turnaround.

Once again, a CEO who’s not Howard Schultz failed. However, this time, the company didn’t turn to its legendary founder to save the day.

Starbucks recruited Brian Niccol, the former Chipotle (CMG) CEO, arguably the best restaurant operator of today, and someone with an impeccable track record of leading turnarounds.

Niccol is set to take on his biggest challenge yet. Let’s dive in.

Recapping Two And A Half Years Without Howard Schultz

Schultz left the CEO role in April 2022, after successfully leading Starbucks out of the pandemic. In his last quarter, Starbucks was growing revenues at a mid-teens pace, opening around 50 locations per quarter, operating margins were in the ~15% range, and comparable sales were steady in the high-single digits.

His successor, Laxman Narasimhan, was no natural candidate by any means. In my July 2023 Starbucks article, I listed him as a key risk. Laxman came from outside the company, and had no experience in the food service sector. As he entered, he set out extremely aggressive goals for double-digit revenue growth and 15%-20% annual EPS growth. He also targeted significant cost cuts and rapid global expansion, leaning heavily on China, and price increases.

Initially, the market trusted Laxman’s plans and responded in sending Starbucks close to all-time highs. However, by the end of 2023, it became clear the company is heading towards a tough period.

Two Of The Worst Quarters In Starbucks’ History

Early signs of problems surfaced in fiscal Q1’24, when Starbucks reported decent results, but far below the pace of the guidance if provided for the year. Still, they didn’t cut the guidance, but rather said they will be “at the low end” of their target range.

Then, a disastrous second-quarter was a wake-up call for both Starbucks and its investors. Starbucks reported a revenue decline for the first time in its history outside of Covid, driven by a significant decline in China and North America. The third quarter was more of the same.

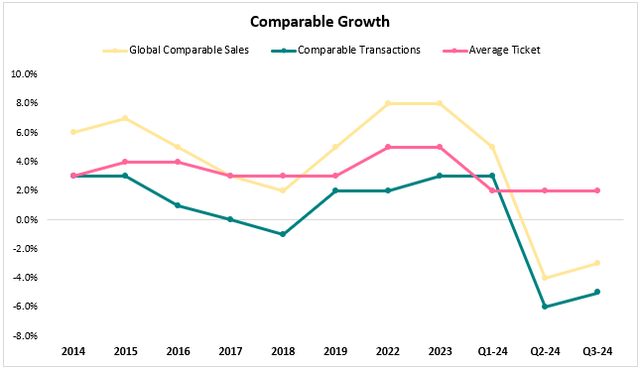

Created by the author using data from Starbucks reports.

It became increasingly clear that operating in the highly competitive Chinese market isn’t going to be so easy, and that Starbucks lost its appeal due to aggressive price increases, worsening experience in stores, and diversifying the menu into gimmicky non-core categories.

Then, after several interviews and earning calls that made Schultz, Starbucks’ board, and investors question Laxman’s ability to right the ship, the company took a courageous step and went after the industry’s most regarded CEO, Brian Niccol.

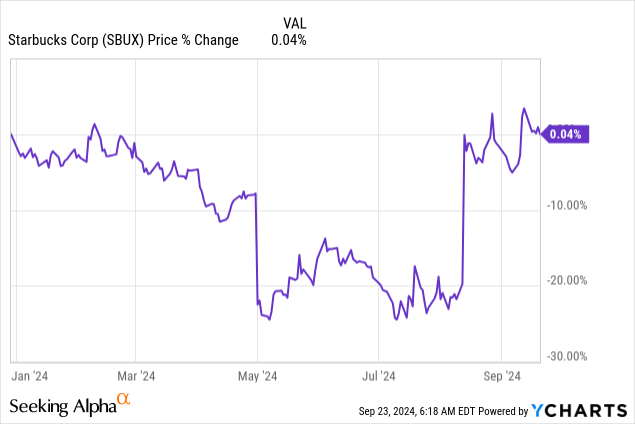

The Market Set An Extremely High Bar For The New CEO

On August 13th, 2024, the day of the announcement, Starbucks’ shares jumped over 20%, erasing the year-to-date losses in a matter of minutes.

Can’t blame investors for being excited. After all, Niccol has one of the best track record in the industry. When he became Taco Bell’s CEO in 2015, it was a low growth division within Yum! Brands (YUM). Under his leadership, comparable sales growth more than doubled and accelerated to high-single-digits, while margins expanded significantly.

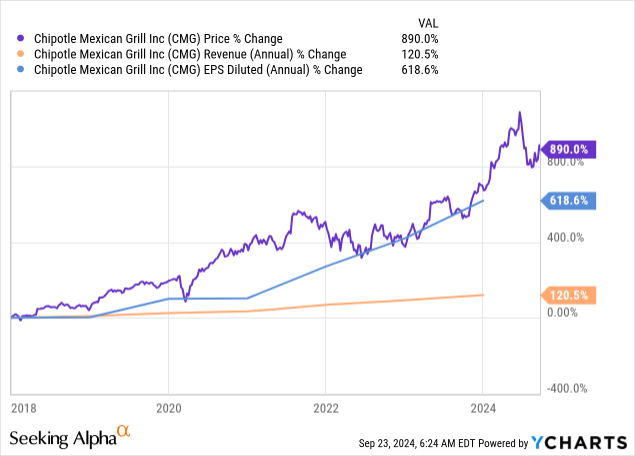

His success in Chipotle requires very little words to describe:

He took Chipotle from a diminished brand after a major health crisis, to being the embodiment of a successful restaurant company. The company became the poster child of how to operate an expansive chain at scale.

Under his leadership, revenues more than doubled, EPS rose more than 7x, and shares grew nearly 10x.

Investors are hoping Niccol will be able to do the same for Starbucks, but I believe that he is taking on the biggest challenge of his career, and caution is advised.

A Very Different Circumstance In Starbucks Vs. Chipotle

Starbucks isn’t going through as severe of a crisis as what Chipotle went through prior to Niccol’s entry. However, the circumstance might be even trickier.

Chipotle suffered from an outlier operational mishap, and although it was one of the most impressive recovery stories for a brand, the company was fundamentally in a great position for a turnaround.

It had a lot of runway for unit growth, had plenty of avenues to innovate the menu and improve operations, and it had no dependency on tough geographies like China.

Starbucks’ case, is much different.

Unit Expansion Opportunity & International Exposure

When Niccol joined, Chipotle had less than 2,500 stores, almost all of them in North America. Mature food chains in the country have more than 7,000 stores, leaving a lot of room for growth via geographic expansion.

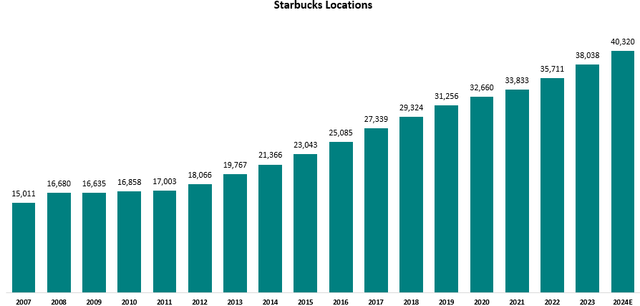

Created by the author using data from Starbucks reports.

On the contrary, Starbucks has around 40,000 locations worldwide, of which 18,198 are in North America, and 7,306 are in China. This is a vastly different opportunity and risk set. There are rumours about divesting the China operations, as the company faces significant competitive pressures.

And in the U.S., it’s tough to imagine how many more stores Starbucks can open. It already seems like stores are cannibalizing each other, as reflected by the same-store numbers, which we’ll discuss in the next section.

Geographic expansion is the easiest and strongest driver for a restaurant’s long-term trajectory, and I don’t see much runway for Starbucks on that front, especially in developed geographies.

Same-Store Numbers Reflect Customer Churn & Bad Value Proposition

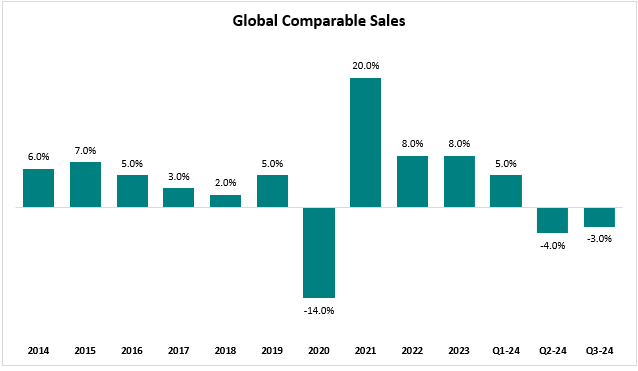

Historically, Starbucks was steady in the low-to-mid single-digit comp growth range, with a good balance between traffic and prices.

Created by the author using data from Starbucks reports.

Since 2022, prices became the main drivers for comp growth, until it became too much and the customer eventually broke. In both the North America and International segments, Starbucks experienced comp declines, and despite record menu prices, margins are still below pre-pandemic levels.

This paints a clear picture – Starbucks can no longer raise prices, and will have to reignite traffic growth. The problem is that the coffee chain became a product seller (rather than an experience provider), and if you’re a product seller, your value proposition needs to be attractive.

At these prices, people prefer to skip their daily Starbucks stop, make coffee at home, or get a snack elsewhere. This is another key difference between Starbucks and Chipotle.

Chipotle has a high mix of customers who come there for their daily lunch near their office, or after their workout. It provides a unique option of a relatively cheap and healthy meal. This makes Chipotle more of a ‘need’ rather than a ‘want’.

Starbucks core offering in coffee and snacks are easily replaceable with at-home or at-office options, which will most likely be much cheaper.

Stubborn Workforce Will Be A Hurdle For Margins & Transformation

Starbucks’ workforce is perceived as a weakness for the company. With a history of unionization clashes, it won’t be that easy to go through big layoffs or major transformation in the operating model.

For example, efficiency could be driven from cutting hours at low-performing stores, or increasing the pressure on throughput (asking employees to do more). Also, it’s possible Starbucks might need to close weak locations, which is another ground for a clash with employees.

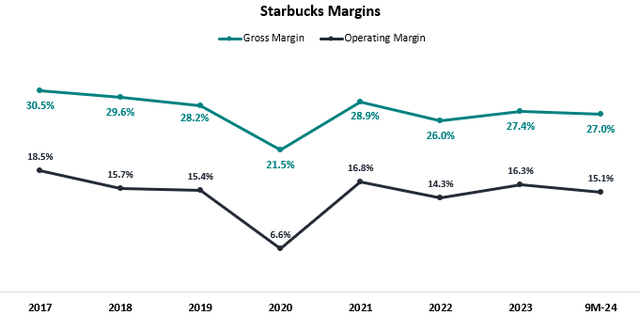

Created by the author using data from Starbucks reports.

With margins still below pre-pandemic levels, it’ll be interesting to see how Niccol seeks efficiency without alienating the workforce.

Near-Term Expectations – New Financial Targets & Key Strategic Areas

As is the case in most CEO transitions during a turnaround, Niccol is most likely going to get at least a one-year grace. Meaning that for the next several quarters, results won’t be as important as what the company says about its long-term vision and strategy.

We got a first peek into Niccol’s ideas in his recent letter, titled ‘Back to Starbucks‘. Niccol set out his four key areas in the near term: Empowering baristas; Getting the morning right; Re-establishing Starbucks as a community coffeehouse and; Telling Starbucks’ Story.

My interpretation: Improving the operating model; Perfecting the most important shift of the day (where Starbucks is arguably a ‘need’ and not a ‘want’); Taking back the service provider position instead of the product seller; Launching a new marketing strategy, and block all noise regarding politics.

To me, this is already impressive and shows he has his eyes on the right targets. However, when it comes to investors, the biggest hurdle for Niccol would have to be to reset expectations.

Niccol didn’t set financial goals in his previous companies, but rather relied on metrics like store count or AUV to reflect his long-term targets. In Starbucks, I don’t think this will work, as the company is in a much more mature position.

In my view, Starbucks will set financial targets for 5%-9% revenue growth, and 8%-12% EPS growth, which is more than fine for a company of this size.

There’s a problem, though.

Valuation

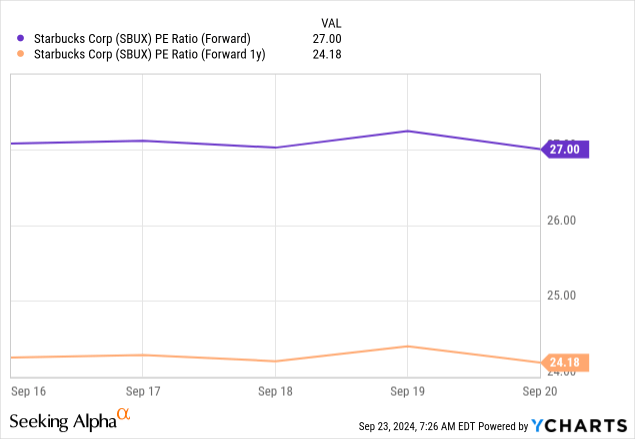

Following the recent news-driven surge, Starbucks is trading at 24 times ’25 EPS estimates. This is close to its pre-pandemic levels, and in line with other mature chains like McDonald’s (MCD) and Domino’s (DPZ).

Also, shares are not that far from all-time highs (~25%), which occurred at a time of peak multiples in the stock market, and when expectations for mid-to-high teens EPS growth were baked into the stock.

Considering the fact it’ll take several quarters for Niccol to have any meaningful effect on results, and that his strategy will most likely include prudent financial targets for the mid term, I don’t see how Starbucks generates market-beating returns from here.

Brian Niccol added nearly $25 billion in market cap for the company, which means he will need to add roughly $1 billion in net income to justify it.

I think he can do it, but the risk/reward right now isn’t attractive. If shares decline closer to a 20x multiple, it’d be where I’d consider buying shares as an attractive point for the optionality of Niccol’s success.

Conclusion

History tells us it’s not smart to bet again Brian Niccol, as he’s one of the most successful CEOs in the food-service industry.

However, I find the Starbucks circumstance much more difficult to turn around compared to Chipotle.

Niccol has his work cut out for him, in what I view as his biggest challenge yet. Starbucks’s footprint expansion opportunity is limited, its value proposition is currently weak, and recent clashes with the company’s workforce suggest it won’t be easy to transform the way things are getting done.

After shares surged nearly 28% on the news, I estimate the current valuation leaves little room for upside. Therefore, I reiterate Starbucks at a ‘Hold’.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.