Summary:

- Despite the positive market reaction to Starbucks’ new CEO, I rate SBUX a “Hold” due to ongoing business challenges and skepticism about a quick turnaround.

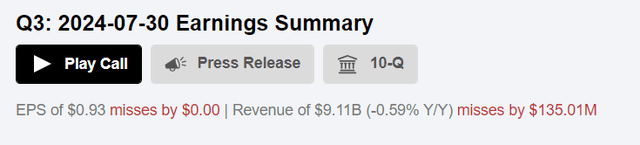

- Recent Q3 results show declining comparable store sales globally, particularly in China, and a drop in EBIT margin and EPS, indicating business deterioration.

- While Starbucks remains financially healthy, observed traffic data suggests it is underperforming compared to peers, casting doubt on medium-term growth prospects.

- Current valuations for SBUX seem too high; even with a premium, the stock’s potential upside appears limited, warranting a “Hold” rating.

JohnFScott

My Thesis

Although the market reacted positively to the recent news of Starbucks (NASDAQ:SBUX) appointing a new CEO, and there’s optimism about resuming business growth and improving margins from many sell-side analysts, I have my doubts about this being a definitive solution for investors. I’m concerned about the current trends in Starbucks’ business and am skeptical that the new CEO will quickly resolve the issues at hand. The excitement generated by the investment banks could put buyers of the recent rally in Starbucks stock in a pretty bad position if the rally proves to be temporary. I rate SBUX a “Hold” for now until I see evidence of the new management’s work.

My Reasoning

As you can see for yourself, the market loved the recent appointment of Brian Niccol to CEO of Starbucks:

According to Seeking Alpha, CFRA upgraded Starbucks to a “Buy” on this news with a target price of $109/share. The research note said that the coffee chain needs strategies such as international franchising and reaching Gen-Z workers, which Niccol helped implement at Chipotle (CMG). Deutsche Bank also upgraded the stock to a “Buy”, calling the hiring of Niccol a “home run” because of his operational, marketing, and innovation strengths. Stifel followed: its note said that the new CEO “is likely to prove to be a good hire as they anticipate improved prioritization and execution from Starbucks.” UBS remained bullish as well, highlighting that Niccol brings a track record of successful “brand positioning and growth,” particularly in “employee focus and cultural strengthening”.

Morgan Stanley blared the headline “Same old same old” when announcing a new SBUX bullish rating. The note said that “every decade Starbucks is compelled to reinvent itself” to keep winning over customers, adding that while replicating the chain’s former successes is daunting, the new CEO is known as a brand builder, which could bring in long-term holders from among the “higher-perspective crowd”, investing patiently to set up Starbucks for future earnings volatility in exchange for long-term growth.

However, all that is just “hope” – today all I see is business deterioration, which should be quite difficult to turn around in theory. Let’s take a look at the recent quarter results (Q3 2024). Starbucks achieved $9.1 billion in revenue in Q3, up 1% YoY and 6% QoQ. But overall comparable store sales declined YoY -3% globally, -2% in North America, and -14% in China, helped by a strong showing in Japan. EBIT margin dropped 70 b.p. to 16.7% and EPS was $0.93, down 6% year-over-year, so the firm actually double-missed the consensus forecasts:

Q3 illustrated SBUX’s challenges in maintaining the momentum of sales growth in key growth markets such as China, even though the results slightly rebounded or improved from last quarter on a consolidated basis.

The big decline in China and softness in the Americas regions (US and Canada) look quite concerning to me. Ongoing shutdowns of Starbucks stores to improve service quality are weighing on retail sales. Global same-store sales growth of 1% last quarter was significantly down from the mid-single-digit gain achieved during the last decade, and a big plunge of 6% in China. On the other hand, some relief was found in Japan, where same-store sales increased 6% in Q2. Either way, the sequential increase of 6% and the YoY increase of 2% over the past five quarters revealed a trending slow recovery in comparable store sales.

Of course, the company remains financially healthy as far as I see it, with a prudent capital allocation policy: aiming to keep its leverage ratio below 3x lease-adjusted EBITDA and 50% dividend payout, they generate enough earnings to fund its growth plan and its $17 billion share-repurchase plan. Recently, SBUX’s diluted share count fell by 14.7 million from the prior-year period to 1.136 billion. However, looking at the observed traffic data recently published by Goldman Sachs analysts (proprietary source), Starbucks appears to be one of the worst-performing restaurant chains compared to other companies, as observed traffic has continued to decline in recent months, according to Placer data:

Goldman Sachs proprietary data [September, 2024], notes added![Goldman Sachs proprietary data [September, 2024], notes added](https://static.seekingalpha.com/uploads/2024/9/23/53838465-172706850387946.png)

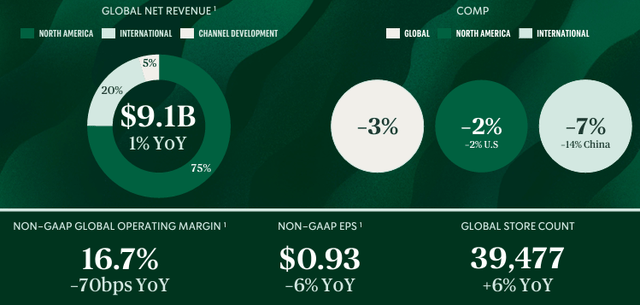

Based on that, I believe the expansion rates SBUX can show in the medium term are likely to be quite low. So it’s hard to believe that SBUX may reignite growth next year as the consensus estimates tell us right now:

According to the past management commentary (for Q3), Starbucks still sees some operational improvements coming down the pipeline in the US with the scaling of Siren Craft systems and improved partner scheduling and inventory management. In addition, they plan to accelerate new store builds and renovations which should support future top-line growth in China, especially in Tier-2 and Tier-3 cities. However, in China, there remains a challenge with consumer spending and intensified competition from local players, which has put a dent in Starbucks’ performance. It has intensified competition with the so-called “Xihuaya” alliance of three large local brands, which have been expanding quickly. It’s a massive end market for SBUX which the company seems to be losing for now.

On the positive side, I should note that Starbucks reaffirmed its full-year 2024 guidance, with a belief in its execution and operational excellence. I believe that the company’s growth and expansion in emerging markets, including China, will slow down due to intense competition and weaker consumer spending, which we’ve observed recently. So this reaffirmed guidance will likely set a high bar for Starbucks to achieve, while the optimistic consensus forecasts for 2025 and beyond may also be revised downward as it becomes clear to the market that, aside from hope for a brighter future from the new CEO, there’s no substantial data to suggest a business turnaround in the medium term.

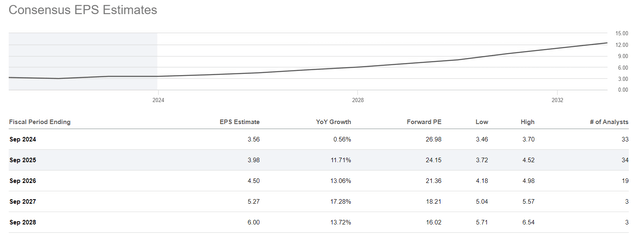

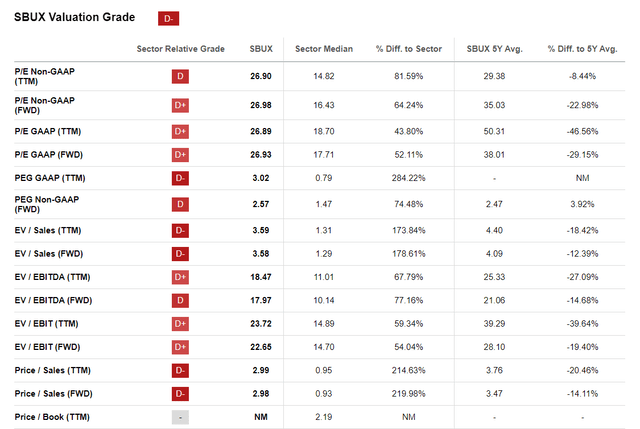

As is often the case with a global brand like Starbucks, the company trades at very high multiples. Even taking into account the projected EPS growth for next year, the forwarding PEG ratio is 2.6x, which is 74.5% above the sector median.

Seeking Alpha, SBUX’s Valuation

A company like Starbucks should indeed be trading at a premium I guess, but given everything happening in the market today, I think the current premium for the company’s stock is too high.

Yum! Brands (YUM) P/E for the next year is close to 23.3x, and I believe SBUX’s multiple shouldn’t differ much – let it be at exactly 24x, continuing the downward trend formed since 2022.

In this case, even if Wall Street is correct with its full-year 2025 earnings estimate of $3.98/share, the fair value per share I calculated would be $95.5, which is only slightly lower than the SBUX stock’s price I’m seeing on my screen right now.

Based on all that, I conclude that SBUX deserves a “Hold” rating until the operational and traffic data prove that the business is indeed turning around.

Your Takeaway

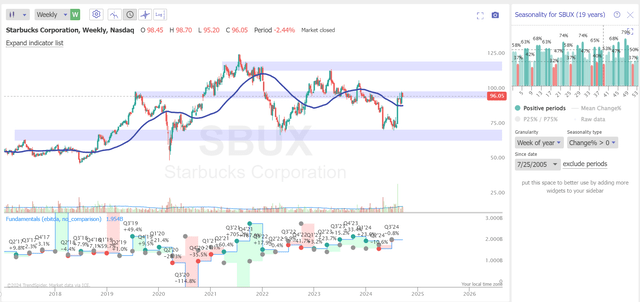

To its credit, Starbucks stock did react strongly in a positive way to the announcement of the new CEO. This coincided with the stock reaching a significant demand zone around $72/share, along with several bullish weeks from a seasonality perspective ahead of us. Therefore, I wouldn’t be surprised if the stock trades even higher, despite hitting a resistance zone just recently. However, when we consider the fundamentals, I think there’s little reason to believe that the current rally is justified from an operational business growth standpoint.

TrendSpider Software, SBUX weekly, Oakoff’s notes

The current recovery seems more like a reflection of hope in the new CEO’s ability to revive demand. But I highly doubt that this can be achieved within the timeframe that Wall Street’s current consensus forecasts suggest.

Even considering the need for a premium in valuing SBUX, the current valuations seem too high to me. There are other equally well-known brands that trade at slightly lower multiples, so if we use their valuations as a benchmark for Starbucks, then the current price appears fair, so the potential for future upside is likely limited.

SBUX is a “Hold” for now.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.