Summary:

- Starbucks Corporation facing current headwinds due to weak consumer sentiment and competition, but results should improve as sentiment improves.

- Revenues pulled back in the most recent quarter, but results are forecasted to improve over the next year.

- Share price decline presents a potential buying opportunity for long-term investors as the company is expected to overcome current challenges.

JohnFScott

Article Thesis

Starbucks Corporation (NASDAQ:SBUX) has a strong brand and a successful track record. Recently, its shares got under pressure due to some current growth worries, but as consumer sentiment will improve eventually, so should Starbucks’ results.

Past Coverage

I have covered Starbucks Corporation in the past here on Seeking Alpha, most recently in June 2022. In that article, I argued that it had some advantages compared to its peers Dutch Bros Inc. (BROS), although I noted that Dutch Bros offered a better relative growth performance. With two years having passed since that article has been published, it’s time for an update on Starbucks.

Starbucks: In The News Due To Unionization

Starbucks Corporation has significant employee costs, as do other restaurant companies. After all, Starbucks employs more than 380,000 people, which naturally results in significant wage costs across its tens of thousands of locations.

Unionization has been a theme when it comes to Starbucks for some time, but the company recently got some additional attention as unionization efforts progressed in Ohio. There are around 10,000 unionized employees at around 400 Starbucks stores across the United States, with additional unionized employees in other countries such as Canada.

Like some other employers, Starbucks Corporation is not a fan of unionization, and the company’s former CEO Howard Schulz has even been accused of union-busting.

While increased unionization could result in some cost headwinds for Starbucks, it does not look like the pace of unionization has picked up dramatically in the United States. I thus do not believe that this will be a huge near-term headwind. It is, I believe, more likely that unionization will be a gradual process in parts of the U.S., and Starbucks should ideally be able to offset any related cost headwinds by increasing efficiencies through improving scale while pushing through price increases should also help in keeping its gross margins intact.

Starbucks: Weak Operational Performance In The Recent Past

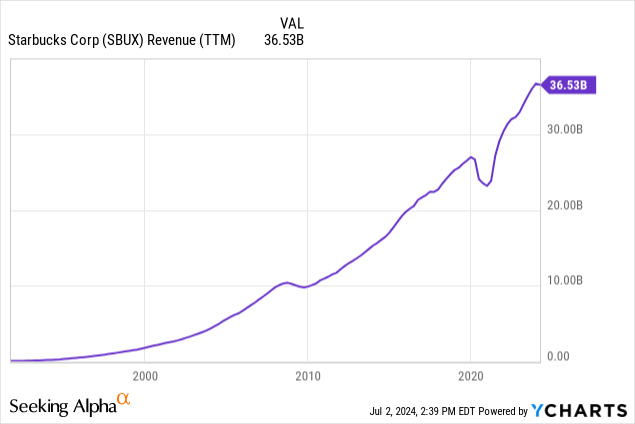

For many years, it seemed like Starbucks couldn’t do anything wrong. The company ran from record results to record results, as we can see in the following chart:

Starbucks Corporation saw its sales decline slightly during the Great Recession, and during the initial phase of the pandemic, when lockdowns and a work from home environment made people forego their coffees at Starbucks. But the company recovered quickly from both of these macro headwinds, and sales hit a record high shortly after the pandemic.

The most recent quarter, however, saw Starbucks Corporation report a rare revenue decline. While sales declined by only 1.8%, that was still a pretty bad result compared to the company’s past growth trajectory, and considering the fact that inflation still isn’t low, the decline was substantially larger in real terms, at around 5% compared to the previous year’s quarter.

This time there was no pandemic to cause this problem, and there was no Great Recession, either. Instead, the sales decline was driven by a combination of weak consumer sentiment and competition.

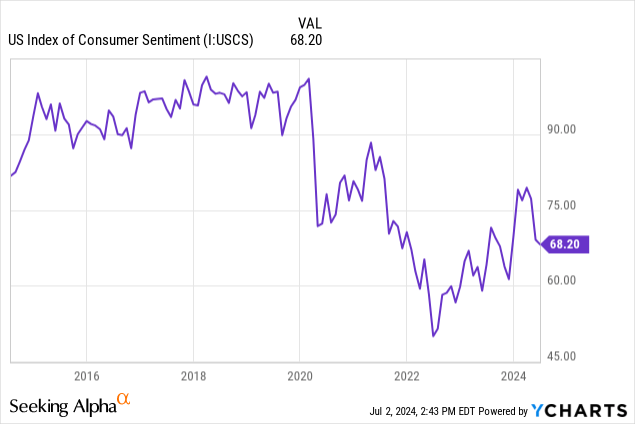

In the above chart, we see that consumer sentiment in the United States is rather low, compared to the average over the last decade. This is largely the result of high inflation that has pressured consumers’ spending power over the last two years. With weak consumer sentiment and daily expenses running high, some consumers have seemingly decided to forego non-necessary purchases such as out-of-home coffees, other drinks, and food items such as those sold by Starbucks.

Competition also plays a role in the recent rather weak sales performance, as the company’s CEO Laxman Narasimhan stated in the most recent earnings call (emphasis by author):

We still see economic volatility in the Middle East, but we remain confident in the region’s long-term growth opportunities. In China, we still see the effects of a slower-than-expected recovery, and we see fierce competition among value players in the market, but we are strengthening our premium position and our team in China continues to execute with terrific rigor and heart as the market shakeout continues and as demand recovers and matures.

Later on in the earnings call, the CEO stated:

So let me start with the competition in China. I think the growth that’s taking place in the mass area of the China business, of the China overall coffee and tea segment, is one where we see just intense price competition.

So growing competition seems to be a China-specific issue for Starbucks right now, which helps explain why the company’s performance in China was weaker compared to the rest of the world. In the United States, Q1 comparable store sales were down 3%, for example, while comparable store sales were down 11% in China over the same time frame.

On one hand, this is good news, as important markets such as the US are better protected from competition — here, Starbucks still seems to have a very strong moat. On the other hand, China is an important growth market for Starbucks, thus pricing issues in China are a headwind for the company. Starbucks’ CEO argued that the competition in China would, sooner or later, make some players leave the market, and Starbucks should be among those remaining once this “shakeout” (the CEO’s words in the most recent earnings call) has ended.

I thus do not believe that the current problems that Starbucks is experiencing will persist over the long run. Once consumer sentiment in markets such as Europe and the US improves, and once the Chinese market has experienced its “shakeout,” comparable store sales should improve again. But it may take some time for this to play out, thus rather weak results for the remainder of the current fiscal year are possible for sure. Analysts expect that Starbucks will report earnings per share decline for the fiscal third quarter and flat earnings per share for the fourth quarter of the current fiscal year, which seems reasonable to me — a gradual improvement over the coming quarters should result in Starbucks getting back on growth track in fiscal 2025.

So while Starbucks isn’t in a great place right now from an operations point of view, the share price slump that the recent results have caused could make for a buying opportunity for someone with a longer-term focus. After all, if earnings are relatively flat this fiscal year, that is not disastrous. And as long as Starbucks gets back to growing its business again in the coming years, there is no long-lasting problem. Analysts are forecasting earnings per share growth of 15%, 13%, and 14%, for fiscal 2025, fiscal 2026, and fiscal 2027, respectively. There is no guarantee that these estimates will be hit, but I believe that there is a solid chance for these estimates to be reasonable. After all, the current issues will hopefully subside soon, and between new store openings, some price increases, and the impact of share repurchases, Starbucks could generate meaningful earnings per share growth over time.

Starbucks: A Buying Opportunity?

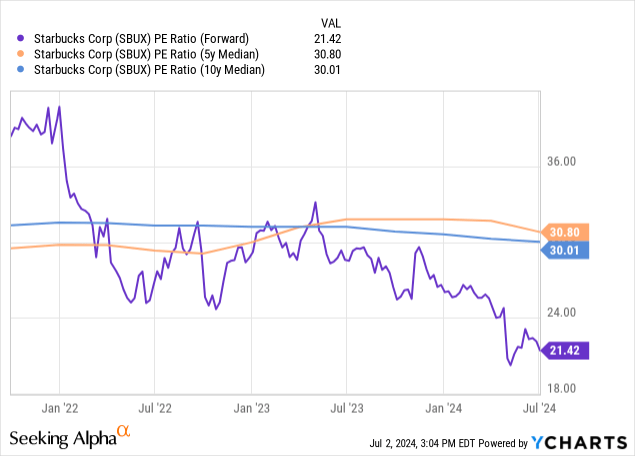

Starbucks Corporation has seen its share price decline significantly over the last year — shares are now down 9% from five years ago and trading around 40% below the all-time high. This would be justified if Starbucks’ current problems would persist forever, but as noted above, I believe that there is a good chance that the company will overcome its current growth slowdown.

As we can see in the above chart, Starbucks Corporation’s share price slump has made its shares pretty inexpensive, at least on a relative basis. Compared to the longer-term median earnings multiples, Starbucks now trades discounted of close to 30%.

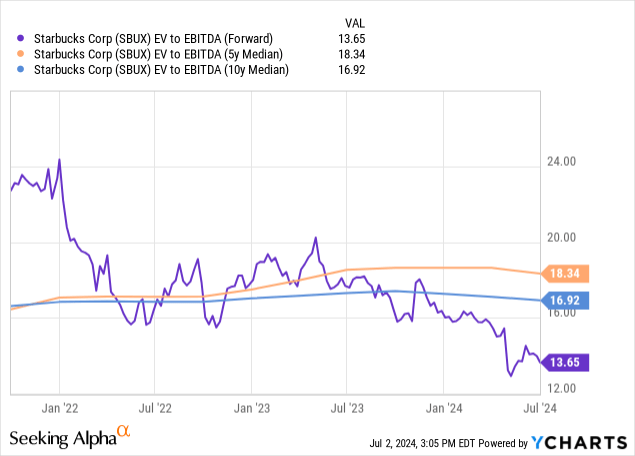

We can also look at the company’s enterprise value to EBITDA multiple, which accounts for changes in debt usage over time:

Similar to what we have seen with the earnings multiple, Starbucks is now trading at a pretty low valuation compared to the historic valuation range. If Starbucks recovers and its share price trades more in line with the historic valuation a year or two from now, shareholders could thus see substantial share price appreciation. Moreover, a 21x earnings multiple does not seem excessive for a long-term compounder like Starbucks.

The fact that the currently rather low valuation makes Starbucks’ share repurchases more efficient and dividend reinvestment more powerful is positive as well.

Takeaway

Starbucks Corporation is currently not in a great spot, but its problems should wane as consumer sentiment will eventually improve and since competition in China is experiencing a shakeout. The share price decline has been severe, and Starbucks is now trading well below the historic valuation range. For someone interested in owning a leading coffee play, Starbucks stock could be quite attractive at the current share price and valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SBUX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

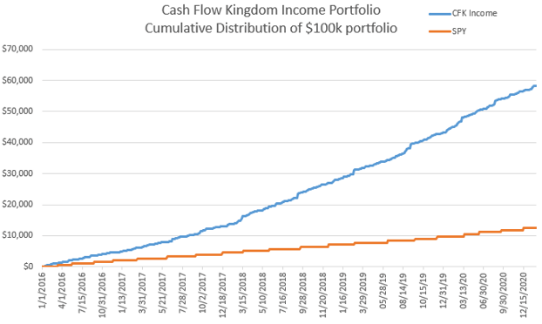

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!