Summary:

- Starbucks Q2 earnings show a surprise sales decline and a significant revenue miss, indicating that consumers are cutting back on spending.

- Comparable sales for the entire company were down 4.0%, with a 6% decline in total transactions.

- Operating margins also narrowed, with international operating margins experiencing a significant decline of 370 basis points.

- The company has a lot of work to do, but now offers a 3.2% yield and valuation has been reset.

Bulgac/E+ via Getty Images

We have been feeling cautious about restaurant stocks the last two months, and have been encouraging profit taking in the space in our public articles, and at our investing group. This has been met with pushback, as no one likes to hear that their stocks should be sold, but thus far this has proven to be correct, with a combination of a weaker market, and signs that consumers are simply exhausted from high prices.

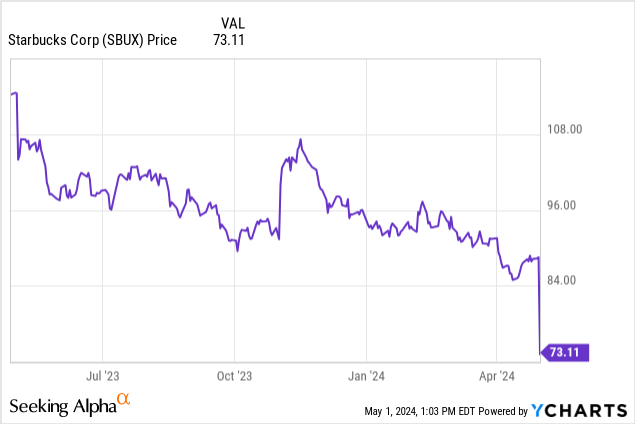

With that said, we got further confirmation from Starbucks Corporation (NASDAQ:SBUX) on this front. A very cautious tone in the just reported earnings and conference call. Here we discuss the Starbucks, and the stock, which is being crippled today, following a one-year trading pattern that saw shares slowly decay.

Starbucks Q2 earnings comparable sales

Anyone who follows our public work or belongs to our investing group knows that in this space, comparable sales are the key metric we watch for restaurants. In the just reported fiscal Q2 2024, Starbucks saw a surprise sales decline versus the prior year. The total top-line revenue figure was down 1.8% to $8.6 billion, which whiffed versus consensus estimates. What about the all-important comparable sales figure? Comparable sales for the entire company were down 4.0%. This is a huge negative, even if some degree of decline may have been expected. But the near $600 million miss on estimates really lends evidence to the fact that consumers are tightening up, and passing on their $7 lattes, at the very least, cutting back. So what is going on?

Here we get more color on what we were seeing, and it is not limited to just one geographic location. Total transactions were down 6% from a year ago. That is a massive shift. This comes despite the average ticket being 2% higher, but a lot of that is from pricing power. Consumers are pushing back. In North America, we saw comps down 3%. This was because of a 7% decline in transactions, but average tickets were up 4%. It was even uglier for comps internationally, driven by ongoing China woes. International comps were off 6%, with 3% fewer transactions, and a surprise 3% decline in the average ticket. What China woes? Just an 11% decline in comparable sales. Ouch. And margins are taking a hit.

Starbucks Q2 earnings operating margin compression

So we saw lower comparable sales drive a significant revenue miss. Operating margins also narrowed. Global operating margins were down 240 basis points to 12.8%, for a multitude of reasons including higher promotions, higher wages, and higher general/admin expenses. On an adjusted basis, margins were down 150 basis points, also hitting 12.8%. Breaking it out by region, we saw North American operating margin contract 110 basis points to 18.0%, while internationally, Starbucks experienced a 370 basis point operating margin decline to 13.3%.

While there were these declines, Laxman Narasimhan, Starbucks CEO, stated in the earnings release:

In a highly challenged environment, this quarter’s results do not reflect the power of our brand, our capabilities or the opportunities ahead….it did not meet our expectations

Rachel Ruggeri, the CFO, added:

While it was a difficult quarter, we learned from our own underperformance and sharpened our focus with a comprehensive roadmap

So, management acknowledged that things were “difficult,” but the call added more clarity. They spoke of the recovery in China being slow, weather patterns, and lower economic outlook in key markets. But they also mentioned “cautious consumer” three times on the call. This jives with our view of the restaurant space. Now make no mistake, while we are largely seeing this pain in the sector, Starbucks has additional traffic issues. The cautious consumer issue, while it is something we have postulated as well, the data has not really supported it.

However, we saw similar conditions in the McDonald’s (MCD) report, for example. Competition is everywhere too, but the reality in our opinion is that it is the bottom 20% of consumers, and yes, they do go to Starbucks, that is losing the ability to afford eating out. We hypothesize this is one of the reasons traffic is down, particularly in North America. There is another risk, and that is that Student loan repayments have only been back about for 6 months, and those bills are hitting consumers hard, instantly sucking money out of the economy. Starbucks, in our opinion, is a casualty of this huge hit to consumers’ purses. Starbucks reported adjusted EPS of just $0.68, a $0.12 miss versus estimates, and falling 14% from last year. It is painful.

Is it all bad news?

It is not all bad news. The company is still opening stores. Starbucks opened 364 net new stores in Q2, and ended Q2 with 38,951 stores. Of these, 52% are company-operated and 48% are licensed stores. 61% of stores are in the U.S. and China. However, 18% of all stores are in China, and it remains a challenge. It is also worth mentioning that there was growth in Latin America and Japan. And China is recovering, albeit slowly, which is a positive. Further, the company is expanding its global footprint. Another good piece of news is that the most loyal of customers are still coming in. The company’s Starbucks Rewards loyalty program, looking at 90-day active members in the U.S., was 32.8 million, up 6% year-over-year, a positive.

Further, Starbucks has had 56 consecutive quarters of dividend payouts, and this big retracement has pushed the yield to 3.1%. Finally, the company did slash its guidance, and did so heavily. This is bad news, obviously, driving today’s massive collapse. Management now expects EPS growth of flat to low single digits from the previous range of 15% to 20%.

With that said, valuation is much more reasonable, closer to 21X FWD earnings assuming no growth. So, value hunters who believe Starbucks will work through this period, may have a hold your nose and buy opportunity.

Our take

This Starbucks Corporation report, coupled with others in the space, lends evidence to our call to take profits in restaurant stocks that we made earlier in 2024. As we look ahead, Starbucks has a lot of work to do. This was a horrible quarter. China’s recovery has been slow, but is ongoing. In the U.S., the high rate and inflation environment is catching up with the consumer. It is tempting to try and buy this company at an attractive price, but we think it is best to wait for confirmation that Starbucks is returning to growth.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Pay yourself dividends with outsized returns

Get more with our playbook to significantly grow your wealth by embracing a blended trading and investing approach at our one-stop shop.

Act now and we will knock off $50 to join our investing group! Get direct access to our fund traders today.

We invite you to try us out, with a money-back guarantee if you are not satisfied (you will be). There’s also a light version of BAD BEAT, with great benefits too. Want an even better price? Send us a message and we will work with your budget!