Summary:

- Starbucks stock has faced headwinds but rallied after good news of Chipotle’s CEO coming on board next month.

- New CEO Brian Niccol’s success at Chipotle suggests the potential for Starbucks to improve and trade significantly higher in the long term.

- Q3 earnings showed improvement, but international challenges remain; A dividend increase is also expected next month.

- Downside risks include an unsuccessful integration of CMG’s CEO and a hard landing, leading to more financially constrained consumers.

- With a new CEO focused on improving operations, SBUX could see a smaller increase from the prior 7.5% in 2023.

Maria Vonotna

Introduction

As an investor, I’ll admit I’m a sucker for a good turnaround story. So far, my record is 1-1. My loss referring to Walgreens (WBA), who continues to face headwinds with the stock trading at its lowest in years. The other one that seems to be going well is Altria (MO) with their NJOY acquisition. The share price is up double-digits in the past year.

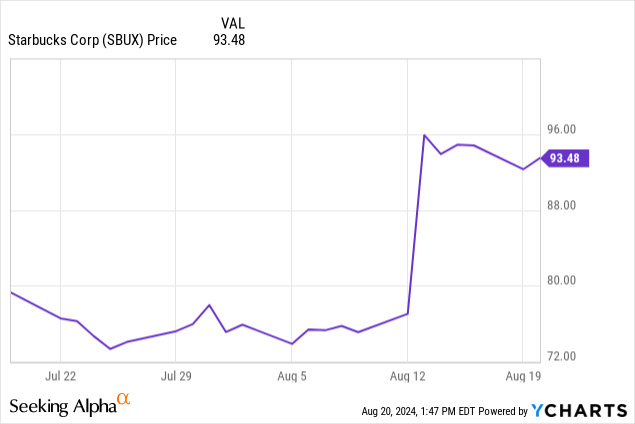

Another stock I am optimistic about is Starbucks (NASDAQ:SBUX) (NEOE:SBUX:CA), one of my largest holdings and one I think will get back to business as usual. Like WBA and MO, SBUX has also faced its fair share of headwinds, dropping to a new 52-week low of $71.55.

However, the stock has rallied since, thanks to some good news received earlier this month. In this article, I discuss the company’s latest earnings, continued headwinds, and why I am optimistic the coffee giant gets back to strong growth over the longer-term.

Previous Buy Rating

I last covered Starbucks in an article you can read here. I discussed the then headwinds that saw the stock sink to a new 52-week low before recovering shortly after as a result of a terrible earnings report. EPS missed analysts’ estimates by $0.12 while revenue also missed.

Comparable store sales saw a decline of 4% year-over-year, which prompted management to slash their guidance for the full-year. This is now expected to be flat vs 4% – 6% prior. But in the past month, their share price has rallied. This caused the price to shoot up double-digits, with the stock now up 24% in comparison to 9.17% for the S&P.

This also caused the stock to blow past my price target of $92, prompting me to downgrade them from a strong buy to a buy. But for reasons I’ll discuss, I believe SBUX still offers great value at the current price.

Why I’m Optimistic

Starbucks recently announced that their former CEO stepped down, only to be replaced by Chipotle’s (CMG) CEO Brian Niccol. Shortly after, the stock rallied from $77 to over $96, blowing past my price target of $92.

In my portfolio, SBUX was the only stock I was in the red, but thanks to the news, I took advantage selling some shares for a profit. They still represent a large percentage and are actually my 2nd largest holding by cost basis behind Agree Realty (ADC).

Many were furious about the interview their now former CEO conducted with Jim Cramer on May 1st. I won’t go too much into it, but it wasn’t a great interview. However, I thought they were a little harsh on him and thought he deserved more time. That time was another 3 months.

In Steps Niccol…

One man will not all of a sudden turn a company around. I agree it will take a lot of work and some time for the company to see progress. But going off what he managed to do for Chipotle from March of 2018 to the end of 2023 is nothing to scoff at and has to be taken into account.

They say men lie, women lie, but numbers don’t. One thing that has made me a successful investor is looking at the facts and not what I want them to be. Doesn’t matter how much I like or dislike the company; I detach myself temperamentally and go from there.

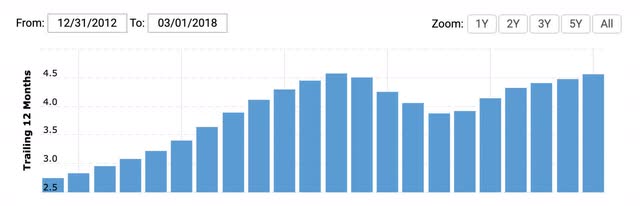

In the chart below is CMG’s revenue growth from the end of 2012 to March before Niccol took over. I used March 1st just because it was the beginning of the month, not the exact day he took over. CMG’s annual revenue grew from $2.372 billion to $4.555 billion according to Macrotrends. This represents a growth rate of 66.72%.

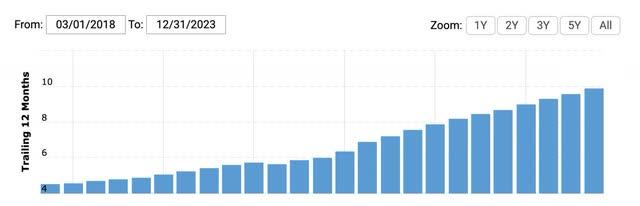

And below you can see from March to the end of 2023 their revenue grew from $4.555 billion to $9.872 billion, a growth rate of 116.7%. Under his leadership, their annual revenue more than doubled.

Here you see their gross and operating margins contracted from the same time frame, going from 27.11% to 16.89% prior to him taking the helm.

From March to the end of 2023, both improved drastically to 26.20% and 15.78%, respectively. Of course, this is not all due to his leadership, but as I stated previously, numbers don’t lie.

And if Chipotle improved under his tutelage, then I’m going to make the assumption that Starbucks can improve as well. I mean, that’s why they hired him, right? Of course, this will take time, but I think SBUX can trade near or higher than the $126 share price they saw back in July 2021 over the long term.

I mean if you traded Larry Bird or Michael Jordan to a different team during their prime years, would the receiving team automatically become better? It’s almost certain, although it’s no guarantee they will win a championship the next year. But their chances certainly be much higher than previous.

Q3 Earnings

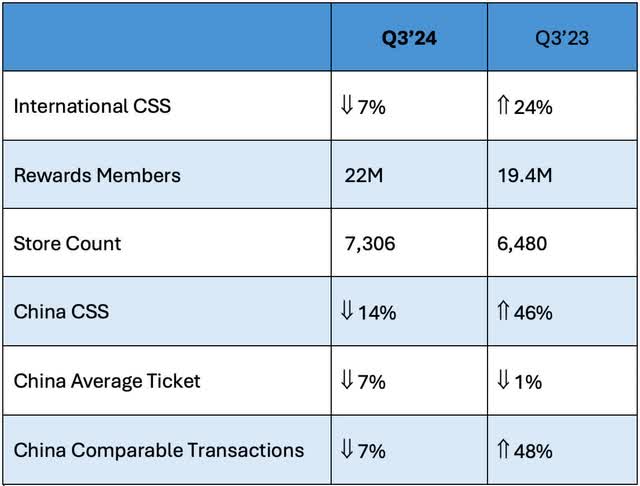

Starbucks reported their Q3 earnings on July 30th with a much better quarter than the previous one they saw. EPS of $0.93 was in-line with analysts’ estimates, while revenue missed slightly, coming in at $9.1 billion. This was much better than the $0.12 miss in Q2, but both were still down year-over-year.

Earnings per share declined roughly 7% from $1.00 while revenue was down slightly from $9.2 billion. This was driven by global comparable store sales being down 3%, driven by negative growth of 2% in the U.S. and 14% in China. And for the full-year management is anticipating single-digit decline.

In the United States, consumers have proven to remain resilient despite high inflation, whereas in China, the consumers have remained cautious. However, this was partially negated by a strong performance in Japan. In the U.S., the average ticket increased 2% while it declined 7% in the second-largest market, China.

Compared to the prior year’s quarter, SBUX’s consumers in China continue to remain cautious as a whole, which has negatively impacted their business. As a consumer discretionary business, I’m not surprised.

With high inflation, consumers are more likely to cut costs for items that are not necessities. Although people love their coffee, when money becomes tight you spend and visit less, resulting in decreased foot traffic. This caused consolidated operating margins to decline 70 basis points from the prior year to 16.7%.

But internationally is where SBUX is challenged the most. I’m not sure what the new CEO will focus on going forward, but I assume it will be a keen focus on the company’s international business. Instead of store count expansion, maybe increasing foot traffic with more attractive deals on the SBUX app? That would be my guess.

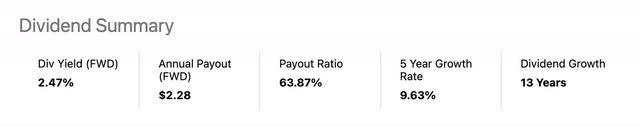

Dividend

Next month, SBUX should be announcing a dividend increase. Last year, they conducted a 7.5% increase to the dividend in September. With a new CEO, this could underwhelm as he hones in on turning things around, and less on dividend growth. As previously stated, the main focus is the company getting back to its normal operations. I do anticipate a $0.02 – $0.04 increase.

Management has stated they are targeting a 50% payout ratio going forward. Currently, this stands at roughly 64%, which is solid. I would like to see this under 60%, something I think the company will focus on going forward.

They have been buying back shares, which is good to see. Their share count decreased from 1.15 billion to 1.135 billion year-over-year. Buybacks and growing cash flows will ensure SBUX’s dividend is well-covered going forward.

Balance Sheet

SBUX’s balance sheet is in good shape, with minimal short-term debt of $23 million and $15.5 billion in long-term debt. This did increase roughly $2 billion on an annualized basis. But SBUX’s cash position of roughly $3.2 billion, investment-grade credit rating of BBB+, and leverage level below 3x puts them in a comfortable position.

This was in comparison to Chipotle, who had cash of $2.5 billion and no debt on its balance sheet. Paying down debt may also be something the new CEO focuses on, along with margin expansion. Peer Dutch Bros (BROS) had $244.3 million in total debt. But in comparison to SBUX’s market cap of $104.6 billion at the time of writing, their long-term debt is nothing that should be of concern going forward.

Valuation

As a result of the stock’s share price rising rapidly to around $93 where it currently trades, this led me to downgrade the stock from a strong buy to a buy. However, over the long term, I think there is still a lot of upside to be had.

If the company can get back to normal operations before high inflation and successfully grow earnings like before and return to their normal valuation of 30x earnings, then long-term investors should see strong upside of 28% over the next 12 months or so.

In 2025 and beyond, earnings are expected to get back to double-digit growth of 12.11% and 13.07% respectively according to FAST Graphs, which, I think, can happen with the company’s moat.

Downside Risks & Conclusion

SBUX’s share price appreciation will be a direct reflection of the new CEO’s success. He’s slated to start next month, and it will take some time for investors to see positive results from this tutelage. Moreover, if he disappoints over the next few quarters, SBUX’s share price will likely fall back into the $70 share price range or potentially lower.

Furthermore, a hard landing will make things more difficult, as consumers will likely remain financially constrained as a result of higher unemployment and higher interest rates. Albeit, I expect them to be lower over the next 12 months.

But I’m optimistic currently, and I am giving the new CEO at least a full year to see how he impacts the company, positively or negatively. But seeing by the success of his leadership at Chipotle doubling revenue and expanding margins, I think the coffee behemoth is in good hands. As a result of the company’s leadership change and long-term upside potential, I continue to rate Starbucks a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SBUX, MO, ADC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.