Summary:

- Salesforce has been challenged on planning and executing layoff announcements, risking repercussions from customers and partners who are intertwined in its culture. Confidence is now at risk.

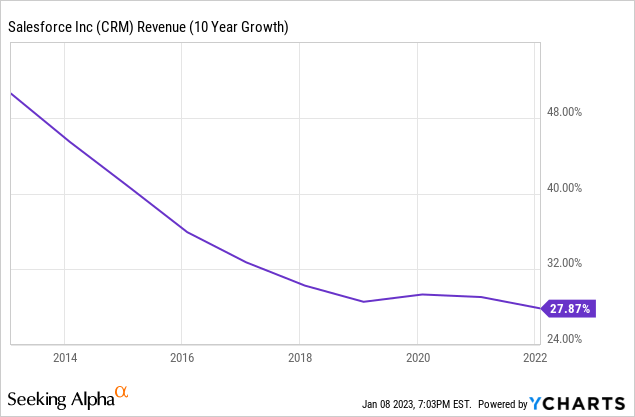

- Salesforce revenue growth has plummeted. It’s now the lowest it has been in a decade.

- Multi-billion dollar acquisitions of Slack and Tableau are failing to yield expected returns.

- Salesforce’s ambitions of growing beyond a CRM vendor, which many investors banked on, continuously fails to pan out.

- Company’s co-CEO and other executives appear to have lost confidence and have left or are leaving.

Salesforcre’s annual user conference Dreamforce at Moscone Convention Center

Sundry Photography/iStock Editorial via Getty Images

Salesforce (NYSE:CRM) produces software and services which some of the world’s largest companies use to manage their relationships with customers. It has been a company that is easy to love for investors and customers alike. It has, up until recently, beat expectations regularly, given back to its community via its 1-1-1- pledge, and helped build the careers of many thousands via its Trailblazer program. Company co-founder and co-CEO (to become sole CEO Feb.1, 2023) Mark Benioff and his team have been done well by investors consistently delivering revenue growth between 22%-37%. But that’s no longer the case and I don’t see that changing, in a meaningful way, for the foreseeable future. My bearish position, as detailed here, is based more on recent events at Salesforce (including laying off 10% of its employees) and failure of strategy execution rather than the numbers alone. They have already been discussed on this site though that author came to a different conclusion.

Loss of confidence among stakeholders

Salesforce CEO Mark Benioff is a well-meaning Wizard of Oz, of sorts, drawing as many as 170,000 attendees (2018) to Salesforce’s Dreamforce conferences in San Francisco, tens of 1000s to its Salesforce World Tour events, and 17 million to its Salesforce Trailblazer community. If you use Salesforce, chances are you know of Benioff, exiting (Jan. 30, 2023) co-CEO Brett Taylor, and at least a few people who work for the company, its customers, or partners. All of this helps make CRM’s product so sticky.

But the downside of “sticky” and a close customer and developer community is that it makes news of mass layoffs, over-hiring, executive exodus’ and misjudgements spread fast among stakeholders all around. They feel betrayed by Benioff’s evangelism around an “Ohana” community whose premise wouldn’t include putting 10,000 employees out on the street.

From a post on Salesforce’s website tiled What is the Salesforce Ohana:

In the late ’90s, our CEO Marc Benioff wanted a break. He decided to take a sabbatical, so he rented a beach house in Hawaii (doesn’t get much more relaxing than that). On the islands, he connected with locals and learned about many of the Hawaiian’s traditions and customs, including the concept of Ohana. In Hawaiian culture, Ohana represents the idea that families — blood-related, adopted, or intentional — are bound together, and that family members are responsible for one another. When he created Salesforce in 1999, he made sure that “Ohana” was in the company’s foundations.

Today, the Salesforce community is a deep-seated support system we nurture inside our company. And, it doesn’t stop at our employees — it extends to our partners, customers, and members of the communities that we call home. We collaborate, take care of one another, have fun together, and work to leave the world a better place.

Many feel betrayed.

From sexy to boilerplate

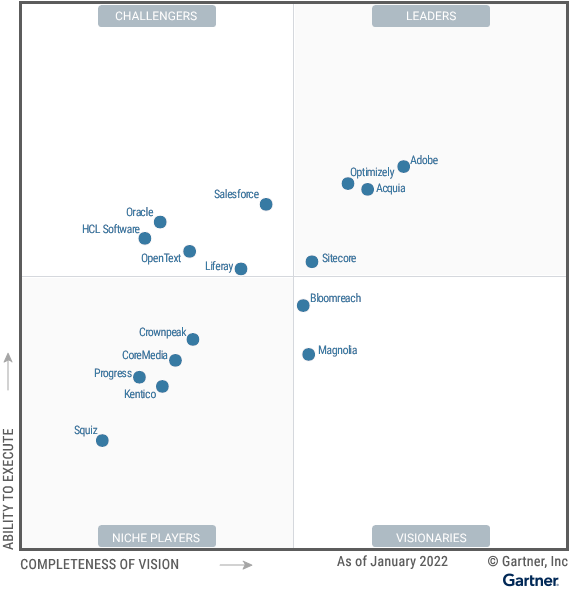

Gartner MQ for Digital Experience Platforms (Adobe)

Moreover Salesforce’s “end of software”/cloud pitch that was sexy a 10-20 years ago is now boilerplate in the industry. Competitors such as Microsoft (MSFT) Dynamics 365, Zoho CRM, Sugar CRM and others have equally and less expensive products, though their market share is tiny in comparison. In the “Digital Experience” category, analysts such as Gartner rate Salesforce’s competitors like Adobe (ADBE) (Adobe Experience Cloud), Optimizely, Acquia, Sitecore and others more highly. If Salesforce’s customers and potential customers get curious, Salesforce could see competition of the kind it hasn’t seen before.

Slowing growth

Salesforce’s slowing revenue growth (Y Charts)

Add to this, CRM’s slowing revenue growth, investors have yet another reason to be concerned.

Smart buy?

But that’s not all. Those who have bought into Benioff’s vision of building “an analytics powerhouse” via its acquisition of Tableau, are likely disillusioned. In 2019, when Salesforce acquired Tableau for $15.7 billion, he called it “the best acquisition ever done in the history of the software industry.” It’s curious if he could still make that argument. Tableau’s revenue growth at Salesforce in Q3 2023 was only 8%, a disappointment given that analytics are hot right now and key to beating the competition.

Moreover, with the departure of Tableau CEO Mark Nelson in late 2022, it was announced that Tableau would now report into Salesforce personnel. The fear is that Tableau will be less of a stand-alone product, which is how most of its customers use it, and more of a tool for Salesforce users.

Where’s the synergy?

Benioff out did himself when Salesforce made an acquisition that was even greater than “the greatest acquisition.” That’s when CRM bought Slack for $27.7 billion. With it he promised that Salesforce would “shape the future of enterprise software.” Consider what Benioff said in the press release announcing Salesforce’s definitive agreement to acquire Slack:

“Stewart (Butterfield) and his team have built one of the most beloved platforms in enterprise software history, with an incredible ecosystem around it. This is a match made in heaven. Together, Salesforce and Slack will shape the future of enterprise software and transform the way everyone works in the all-digital, work-from-anywhere world. I’m thrilled to welcome Slack to the Salesforce Ohana once the transaction closes.”

The Salesforce + Slack match isn’t apparent according to Tim Crawford, the CIO strategic adviser at Los Angeles-based enterprise IT advisory firm AVOA.

“The Slack acquisition by Salesforce has not changed the trajectory of Salesforce up or down,” he told the Wall Street Journal, adding, “CIOs are broadly indifferent to the acquisition.”

Moreover, Slack employees who came to Salesforce via the acquisition are none too happy claiming that there is a culture clash between the companies. Moreover, both Slack founder and CEO Stewart Butterfield and chief product officer Tamar Yehoshua are leaving the company at the end of this month. Business Insider has reported that Slack will lay off 10% of its product and engineering organization. It’s hard to argue that the $27.7 B was well spent.

Another executive exits

One executive exit that hasn’t been mentioned in any detail thus far is that of Salesforce co-CEO and co-Chairman Bret Taylor. He was supposed to become Benioff’s successor and to architect the Salesforce of the future. Customers worldwide will recognize Taylor’s absence and question why someone in his role would leave. In fact, the press already is.

Analysts are curious about how Benioff will lead Salesforce alone. “His (Taylor’s) departure raises questions about why he’s leaving and how operational leadership will be divided and delegated,” Steve Koenig, managing director at SMBC Nikko Securities, told Reuters.

Salesforce stock dropped 7% with the news of Taylor’s resignation, His last day will be Jan. 31.

Why I won’t buy

Given all of this, I don’t see Salesforce as a buy right now, despite the fact that Benioff is reducing spending significantly through layoffs and reduction of real estate holdings. I can’t help but ask what the executives who are leaving Salesforce know that we don’t, how Benioff can justify spending a combined $43 billion for Slack and Tableau and show so little return, never mind other acquisitions like Quip.

Salesforce is on the right track when it comes to reducing spending but ravaging a brand you took two decades to build is an expensive mistake. There are better cloud, CRM, and DXP vendors to invest in if software is where you place your bets.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.