Summary:

- The picks-and-shovels commercial theme is, by now, iconic.

- It doesn’t just apply to gold prospecting… The metaphor also applies to an exotic area like AI.

- AI needs more and better data centers, and Sterling helps to build them.

- Better still, the company is very profitable, and its stock is reasonably valued.

halbergman/E+ via Getty Images

I’m in pain.

My favorite National Football League team, the New York Jets, got pummeled last Monday night by the San Francisco 49ers.

Sports media talking heads have been trying to make me feel better. They point out how the season isn’t over after just one game. And many say the Jets’ problems are fixable.

But misery runs deep in the Jets nation. If you follow football, you’ll understand.

I need something feel-better solution.

Perhaps the dumbest pun in the history of puns can work.

San Francisco 49ers… 49ers, the nickname given to those who joined in the mid-19th century gold rush.

I’m not quite there yet… many of those miners exhausted themselves prospecting for gold only to wind up broke – spiritually, and financially.

But the folks who sold picks and shovels to them flourished!

That encourages me to return to one of my favorite investment themes. I’m referring, of course, to the picks-and-shovels AI angle.

These involve companies that don’t actually do AI or put AI to commercial use. It’s about companies that help build the physical world we need in order to have AI.

I’ve already written about and put “Buy” recommendations on three such companies. I covered Quanta Services, Inc. (PWR) on 6/3/24. I wrote up EMCOR Group, Inc. (EME) on 6/17/24. And I started covering MasTec, Inc. (MTZ) on 8/12/24.

Those recommendations haven’t produced instant riches.

Since publication, PWR fell 3.2% (versus a 5.6% S&P 500 gain). EME returned 1.6% (versus plus 1.2% for the S&P 500). And MTZ’s 3.0% gain trailed the S&P 500’s 4.5% rise.

But in contrast to how I feel about the Jets, I remain excited about the picks and shovels AI theme. I never saw any of these as instant plays. (I may, though, come to regret the 49ers word-association thing. At least I’m retired. So, it’s not as if I’m about to quit a day job to become a stand-up comic.)

In fact, the world’s changed sentiment on AI from admiring hype to pitiful sneers makes me want to add to this collection of buyable stocks.

Today, I want to spotlight Sterling Infrastructure, Inc. (NASDAQ:STRL).

As with the other picks-and-shovels plays I profiled, STRL doesn’t offer as much upside as, say, NVIDIA Corporation (NVDA), the poster child of AI.

But as the ongoing and not nearly completed AI build-out continues, STRL should, like the other picks-and-shovels group, post market-beating returns.

And they’ll do so with far less risk than we get from the NVDAs of the world. (By the way, I still like NVDA et al. But lower risk plays should also be part of even an AI-oriented portfolio.)

STRL makes a distinct contribution to the picks-and-shovels group. It’s an especially strong play on data center construction.

But before getting to STRL specifically, let’s have an AI pep talk.

Don’t Buy into Periodic Episodes of AI Gloom

It seems like yesterday that we gazed starry-eyed at all things AI.

Sure, it has great potential. This link will retrieve an article promising to list “Notable 23 Benefits of AI.” This link is to a May 2, 2023, article I wrote about mentions of AI on Meta Platforms, Inc. (META) earnings call having jumped 188% year-to-year.

And I’ll never forget the belly laughs I got from The Kroger Co. (KR) management’s having said on its 6/15/23 earnings call “[a]s AI advances, we continue to work and constantly evaluate potential use cases….” Folks, Kroger is a supermarket chain!

No wonder NVIDIA Corporation (NVDA) and other leading AI stocks soared from one new high to another.

More recently, the table has turned.

Now, supposedly, AI is overdone, overrated and overhyped. (Click here, here, here, and here.) Hence, the pauses, corrections, and retreats in many big-name AI stocks.

As a prototypical Libra (we see both sides of issues), I cast my lot with those who say “the truth is always in the middle.”

A lot of what we see today from AI ranges from primitive dabbling to minor to unadulterated garbage.

You probably encounter the latter if you try to use AI customer-service bots. I think they’re so bad, that I routinely ignore the prompts and immediately type “agent” to force a chat with a human. (Did you know you could do that? You can!)

ChatGPT-4o is fine as a Google search alternative if and only if you phrase a question that forces the app to consult databases rather than just mimic human conversation… I ask my question and follow with “supply sources.” Ex that, you may be hit with the infamous generative AI hallucinations.

But this isn’t all there is or will ever be about AI.

Technology evolves.

My first pc was a Timex Sinclair 100. I was a power user. I paid extra for an attachment that would boost memory from 2 KB to an amazing 64 KB. (Yes, that’s really KB, not MB or GB.)

I could go on and on. But I think you get the message.

The best of AI today is analogous to the tiny back-and-white TV screens with which I grew up compared to the best of what we have today. (If you have Amazon Prime, check Jackie Gleason TV Treasures. The young me was wowed by those production values.)

My 7/24/24 Dell article lays out my view of what AI really is. In sum, computers are and will always remain brain-dead. They can only understand “on” or “off” (1 or 0).

The difference between what we’re accustomed to getting from them and the fancy things we expect boils down to much more, much better and much faster programming and processing.

For that to happen, we’ll need much more, better and faster data and logic handling and transmission. And that will require a heck of a lot more and more powerful data centers.

And we won’t go from nothing today to all we need by next year. And the process won’t hit a brick wall even in 2026. Like all tech evolution, it will continue indefinitely as we always find ways to get better. So, all this will keep growing and expanding indefinitely.

And that leads us directly to…

Sterling’s Business Profile

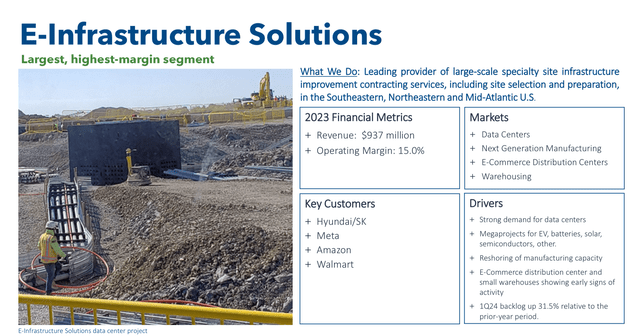

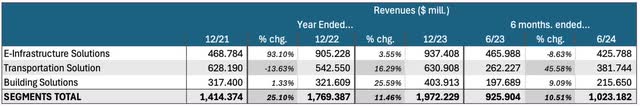

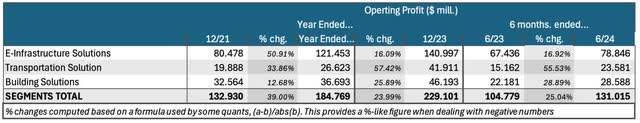

The company organizes itself around three segments.

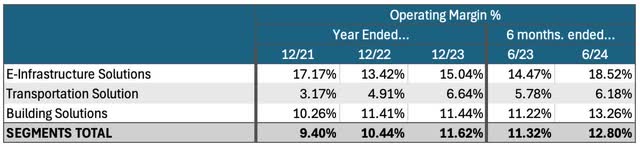

Here are the revenue, operating profit, and operating margin breakdowns.

Analyst Compilation and Calculations based on data from page 64 of latest 10-K and pages 18 of latest 10-Q Analyst Compilation and Calculations based on data from page 64 of latest 10-K and pages 18 of latest 10-Q Analyst Compilation and Calculations based on data from page 64 of latest 10-K and pages 18 of latest 10-Q

As you can see, E-Infrastructure Solutions is the biggest group.

It does construction site selection, preparation, and development.

Notice, in the image above that it isn’t just about data centers. But that’s the company’s strongest business right now.

Notice, too, that we see that sales were actually down in the first half of 2024. That’s because of the group’s ongoing business-mix change.

Small commercial and warehouse work has been weakening. But demand for larger projects is strong and strengthening. The unit’s backlog grew more than 100% in the latest quarter.

Datacenter activity is especially brisk. This category now accounts for over 40% of the unit’s backlog.

It’s expanding geographically too. The slide above refers to STRL’s base as being the Southeast, Northeast and Mid-Atlantic U.S. regions. Now, STRL picked up three large data center projects in the Rocky Mountain region.

In response to an analyst question on the earnings call about growth in project size, C.E.O. Joe Cutillo answered as follows:

Historically, if you thought of Virginia, Dallas was another one, very strong data center markets, but they were one building, small footprints. Those markets are still building. Okay. So when we do a data center in Virginia, it’s not a multi-hundred million dollar job. It’s more like a $40 million job or a $20 million job, depending on the particular one.

Outside of that, the driving factors to this are power and water, which are driving these data centers to go further out to rural areas. And when they get out to rural areas, they find that they can buy larger plots of land and can build data campuses. So instead of a single data center, the stuff we generally are working on has anywhere from three to five data centers on it.

I will tell you, there are some really crazy concepts out there for some really big mega projects that would be 5 to 10 times bigger than any data center we’ve done that we’re paying close attention to that probably won’t happen for another year or so, but the size and scope keep getting bigger.

On the latest earning call, management stated that as “work continues to shift towards large projects, our pipeline of high probability future work is expanded, providing strong visibility into 2025 and 2026.”

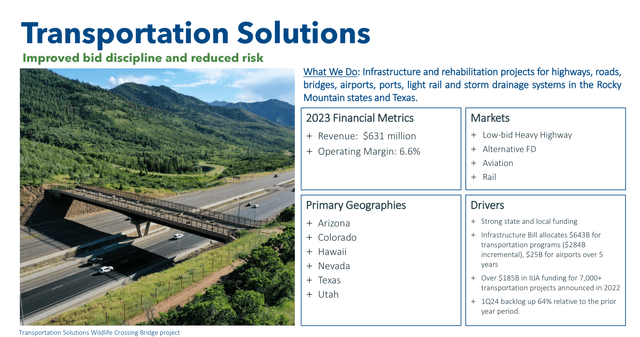

Transportation Solutions, though smaller, is growing briskly.

This involves classic infrastructure improvement. And goodness knows we in the U.S. need plenty of that.

Highway improvement is by far the most visible. If you drive, you undoubtedly sit in construction-related traffic jams. And I assume you hated it.

Actually, STRL, which works on such projects hasn’t been especially enamored with this work either. In its latest 10-K, management explained that “in 2016, our low-bid heavy highway revenue was approximately 79% of our total revenue.”

Since then, STRL has been emphasizing higher-margin projects. By the end of 2023, the low-bid work amounted to just 15% of the business. These include airports and ports.

In the latest quarter, STRL won business for what management told analysts were “multiple large progressive design-built highway projects.” Only a fraction of the expected total work appears in the current backlog.

In the latest quarter, STRL won business for what management told analysts were “multiple large progressive design-built highway projects.” Only a fraction of the expected total work appears in the current backlog.

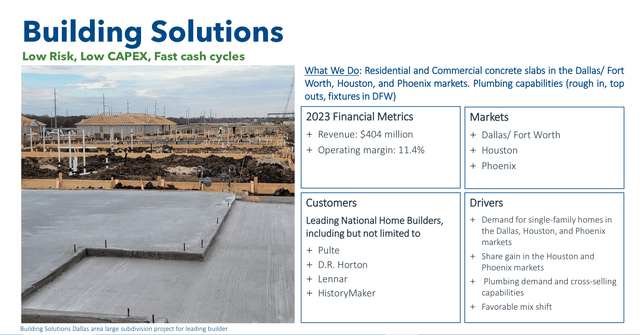

Building Solutions faces a challenging environment, but it’s holding up well.

STRL installs concrete foundational slabs for all kinds of buildings, and plumbing services for residential structures.

As we all know, 2022’s interest rate hikes still pose challenges for building. Residential construction has been especially hard hit by rising sticker problems that make housing unaffordable to many – regardless of the mortgage rate.

But better days lie ahead. We have a tremendous housing shortage. And political will to address this is growing.

What’s more, STRL works mainly in regions in which the population is rising. And it now seems like the next move in interest rates will be downward.

The Company Is on A Roll

As with any diversified business, not all oars are always in the water to the same degree at the same time. But STRL’s biggest oar (E-infrastructure – data centers) is in and rowing briskly. The oars put challenges behind them and now face better futures.

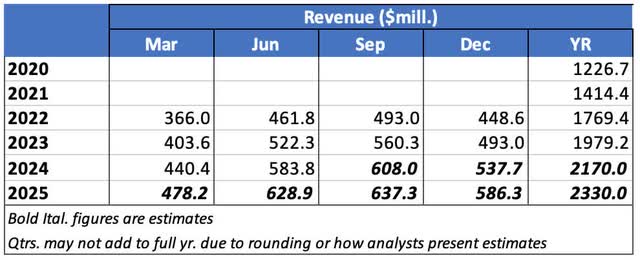

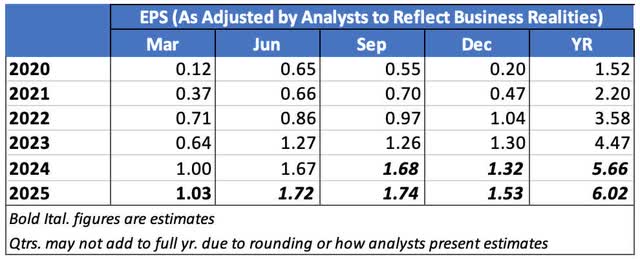

Here are quarterly revenue and EPS trends.

Analyst Compilation based on Data from Seeking Alpha Earnings and Financials Presentations Analyst Compilation based on Data from Seeking Alpha Earnings and Financials Presentations

We see that 2024 is shaping up as a strong year.

2025 growth seems unimpressive. Bear in mind, though, that STRL is a very lightly covered small cap. (Only two analysts account for the published consensus estimates.)

Given the trends and the increasing visibility of bigger jobs, I think the ’25 estimates are likely to turn out too conservative.

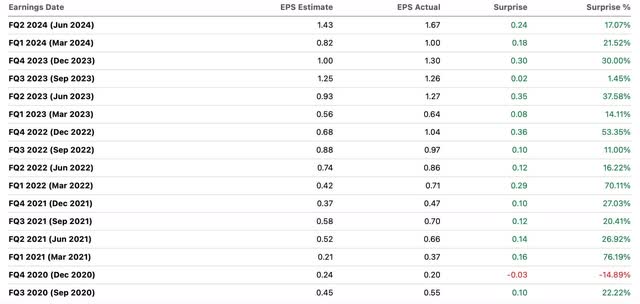

That wouldn’t be unprecedented. Here’s STRL’s history of earnings surprises.

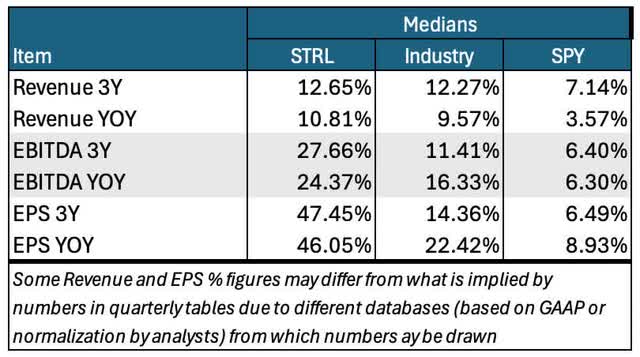

Meanwhile, STRL has a solid track record for having outperformed its Construction and Engineering Industry peers. It’s also been outperforming companies in the SPDR® S&P 500® ETF Trust (SPY) portfolio. (I compare using medians. These aren’t impacted by wild distortions often caused by unusual data items, even in big companies that can dominate weighted averages).

Analyst’s computations and summary from data displayed in Seeking Alpha Portfolios

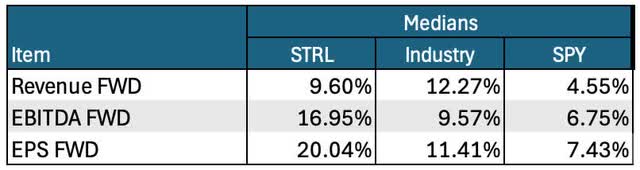

The forward-growth table below reflects the impact of STRL’s ongoing transition from high-volume low-margin work to lower volume higher margin projects. (That shows as below peer revenue growth with above-peer earnings growth).

Analyst’s computations and summary from data displayed in Seeking Alpha Portfolios

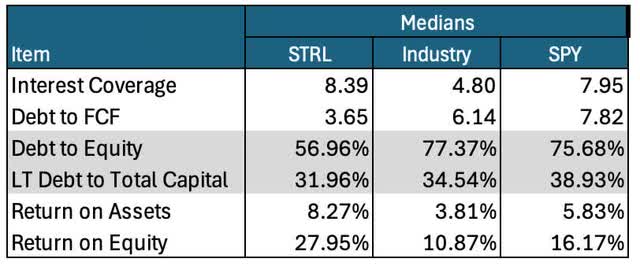

STRL’s core fundamentals are excellent compared to industry and SPY benchmarks.

Analyst’s computations and summary from data displayed in Seeking Alpha Portfolios

Here’s STRL’s approach to capital allocation.

The company has ample latitude to continue to pursue its disciplined add-on acquisition strategy and to repurchase common shares.

Risks

STRL has been doing a good job managing its portfolio of businesses such as to cope with strengths in some areas and weaknesses in others. It’s also managed strategic changes such as shifts to higher margin work.

But there’s an ever-present risk it’ll face too many simultaneous such challenges in the future.

And given the nature of construction projects and the way they’re awarded (often resulting in lumpy tends), timing is an inherent risk. Ditto bad weather (such as what STRL’s building infrastructure group recently experienced in parts of Texas).

So, the risks of earnings and/or guidance disappointment are present. (But I won’t let this keep me awake at night. If you know a company that doesn’t face this, let me know!)

What to do About STRL Stock

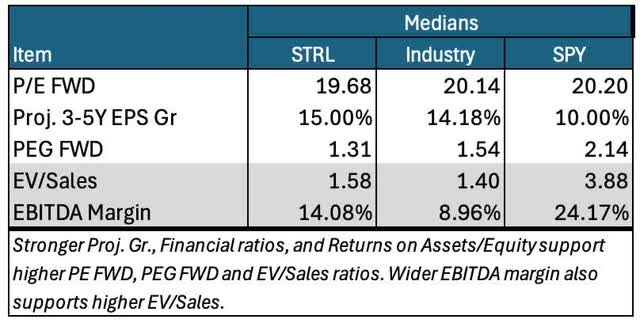

STRL presents a rare opportunity to say “AI” with a straight face and not have to give fancy explanations regarding stock valuation.

Analyst’s computations and summary from data displayed in Seeking Alpha Portfolios

The fancy explanations are fine and valid. I’ve given them often.

Still, it feels good to be able to simply present the valuation numbers and let them speak for themselves.

That’s what comes from backing a picks-and-shovels seller as opposed to the prospector.

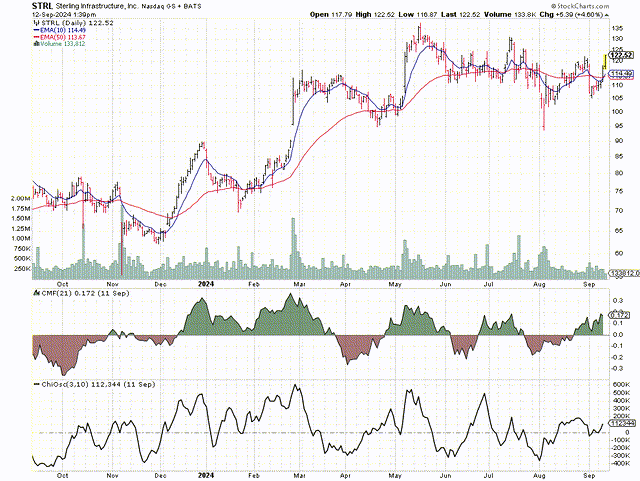

Here’s the price chart.

Strictly speaking, and based on my way of looking at charts, this one is bullish.

The price just crossed above the 10-day and 50-day exponential moving averages (EMAs). And the 10-day just crossed above the 50-day.

The Chaikin Money Flow (CMF) and the Chaikin Oscillator (CO) are both positive.

These indicators measure which party to trade is more motivated. CMF does it for institutional investors. CO does it for the market in general.

Both tell us that buyers are more motivated to trade rather than walk away.

But I have to admit that all of these trends are very mild. They could reverse and keep going back and forth for a while.

So if emphasize technical analysis but want more than a day trade, STRL probably doesn’t work.

But that’s not me.

I’m a fundamentals guy looking to ride secular trends. I use charts to look for cues that I may be missing something important. This chart has no such red flags.

So, I feel good about the secular growth story here.

As I’ve said before, my investment stance depends mainly on whether I think a stock will be better than, in line with, or worse than the market.

Here’s how I apply that to the Seeking Alpha rating system:

- “Strong Buy” means I see the stock as being better than the market, and I’m bullish about the direction of the market.

- “Buy” means I see the stock as being better than the market but am not confident about the market’s near-term direction.

- “Hold” means I see the stock as moving in line with the market.

- “Sell” means I see the stock as being worse than the market but am not confident about the market’s near-term direction.

- “Strong Sell” means I see the stock as being worse than the market, and I’m bearish about the direction of the market.

Based on this scale, I’m rating STRL as a “Buy.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in STRL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.