Summary:

- STRL benefits from infrastructure growth in data centers and aviation, explaining why the stock has well outperformed the wider market over the past few years.

- The same robust demand has been exemplified in its increased contract awards, growing backlog, and expanding profit margins, significantly aided by the multi-year domestic opportunities.

- While these have led to raised consensus forward estimates, we cannot reconcile the growth projections to STRL’s premium valuations, with it notably expensive compared to its peer group.

- While the stock may chart another vertical rally as observed the past few earnings calls, it has also pulled forward most of its upside potential, offering a minimal margin of safety.

- As a mid-cap stock, STRL is also more likely to be volatile, especially due to its small float and growing short interest. We prefer to initiate Hold for now.

by Martin Nancekievill/iStock via Getty Images

STRL Continues To Benefit From The Ongoing Infrastructure Boom

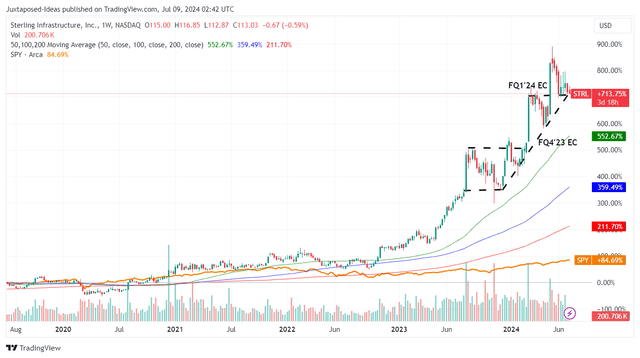

STRL 5Y Stock Price

Sterling Infrastructure, Inc. (NASDAQ:STRL) is a construction company that is currently enjoying robust tailwinds from the booming data center and aviation infrastructure growth, explaining why the stock has well outperformed the wider market over the past few years.

For now, the company operates three key segments, namely:

- E-Infrastructure (manufacturing, data centers, e-commerce distribution centers, warehousing, and power generation).

- Transportation (infrastructure and rehabilitation projects for highways, roads, bridges, airports, ports, rail, and storm drainage systems).

- Building Solutions (residential and commercial concrete foundations for single-family and multi-family homes, parking structures, elevated slabs, other concrete work, and plumbing services for new single-family residential builds).

The same robust demand has already been observed in STRL’s data center contract award of $332M in FQ1’24 (comprising 51.7% of its overall awards), building upon the management’s guidance of “high single to low double-digit revenue growth in the E-Infrastructure segment in 2024.”

At the same time, due to the increased opportunities in multiple data center projects and onshoring of domestic semiconductor manufacturing over the next few years, we can understand why the market is increasingly optimistic about the company’s prospects, as observed in the stock’s uptrend thus far.

Readers must also note that STRL is set to announce their FQ2’24 earnings on August 05, 2024, with the consensus estimating revenues of $566M (+28.5% QoQ/+8.3% YoY) and adj EPS of $1.47 (+47% QoQ/+15.7% YoY).

These numbers do not appear to be overly aggressive as well, since the QoQ jump is likely attributed to the challenging cold weather in January/February 2024 and the projected rebound in project scheduling, with things likely to accelerate from FQ2’24 through FQ4’24.

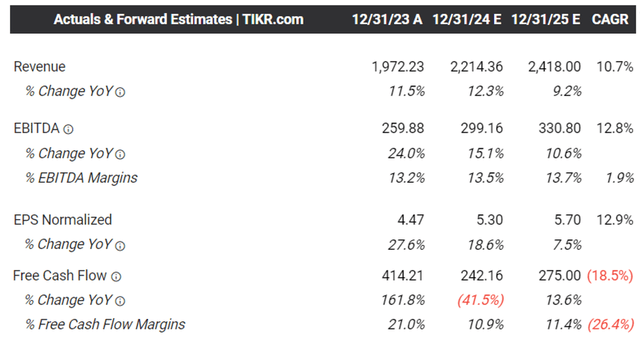

The Consensus Forward Estimates

Furthermore, STRL has guided new pricing and higher gross margins for its new projects across the E-Infrastructure and Transportation segments, underscoring why the management has raised their FY2024 adj EPS guidance from $5.00 (+11.8% YoY) to $5.15 (+15.2% YoY) at the midpoint, sustaining its profitable growth trend.

Perhaps this is why the consensus has felt confident to raise their forward estimates, with the company expected to generate a top/bottom line growth at a CAGR of +10.7%/+12.9% through FY2025.

This is compared to the original estimates of +9.9%/+7.9%, while building upon the robust historical growth at +12.8%/+45.9% between FY2017 and FY2023, respectively.

The raised estimates are not overly aggressive as well, based on STRL’s growing multi-year backlog of $2.35B in FQ1’24 (+13.5% QoQ/+45% YoY), triggering great insights into its intermediate-term prospects, significantly aided by the management’s promising commentary:

There’s really not enough high quality folks out there that can complete these big jobs and these are going to start forming mega teams and we’re already talking to several players on national contracts and long-term agreements related to helping them on their future plans. (Seeking Alpha)

Lastly, the robust financial performance over the past few quarters has contributed to its healthier balance sheet with a net cash situation of $145.23M in FQ1’24, compared to the $130.05M reported in FQ4’23 and -$198.02M in FQ1’23, implying its ability to capitalize on the upcoming infrastructure boom.

STRL’s Expensive Valuations Do Not Offer A Margin Of Safety

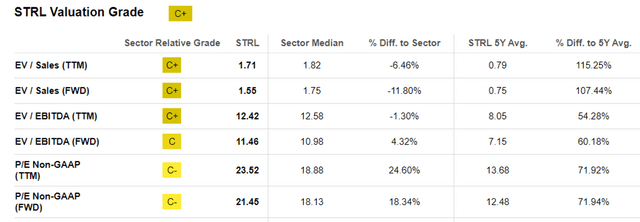

STRL Valuations

The robust long-term prospects are also why the market has drastically upgraded STRL’s FWD EV/EBITDA valuations to 11.46x and FWD P/E valuations to 21.45x, compared to its 5Y mean of 7.15x/12.48x and the sector median of 10.98x/18.13x, respectively.

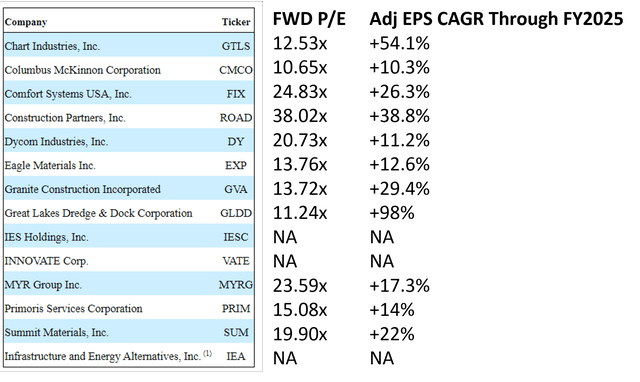

STRL Peer Comparison

Even so, we are not certain if STRL’s current valuations make sense here, especially in comparison to its peer group as disclosed in its recent annual report, with the stock trading at a notable premium in relation to the projected bottom-line expansion through FY2025.

While we concur that its exposure in the data center end market significantly aids its prospects, with the E-Infrastructure Solutions segment currently being its top/bottom line driver at 41.8% (-9.1 points YoY)/64.6% (-9.9 points YoY), respectively, we believe that its premium valuations do not offer interested investors with a margin of safety.

When the generative AI hype and the cyclical data center capex moderates, we may see STRL’s premium valuations eventually return to its historical averages and nearer to its peer group, potentially triggering capital losses.

So, Is STRL Stock A Buy, Sell, Or Hold?

STRL YTD Stock Price

The same optimism has also been observed in the STRL stock prices, with it consistently charting higher highs and higher lows after each earnings call.

The bullish support observed in its stock movement is rather astonishing indeed, with it signaling the market’s and the investors’ conviction surrounding its long-term prospects.

Assuming another double-beat performance in the upcoming FQ2’24 earnings call, we may see the stock chart another vertical rally as observed in the past few earnings calls.

On the other hand, it is undeniable that STRL is trading at an eye-watering premium of +88.8% to our fair value estimates of $60.20, based on its 5Y P/E mean of 12.48x (nearer to its peers) and the LTM adj EPS of $4.83 (+37.6% sequentially).

Based on the consensus FY2025 adj EPS estimates of $5.70, there remains a minimal margin of safety to our 2Y price target of $71.10 as well.

As a mid-cap stock with a market cap of $3.5B, STRL is also more likely to be volatile, especially due to its small float of 31.18M and growing short interest of 4.8% at the time of writing (up from 3.6% at the start of the year and 1.3% a year ago).

As a result of the potential volatility, we prefer to err on the side of caution and initiate a Hold rating here. Do not chase this stock over the cliff.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.